Call them the closer.

Blackstone on Friday announced the final close of its most recent real estate debt fund, Blackstone Real Estate Debt Strategies V (BREDS V), which has approximately $8 billion of total capital commitments.

As The Wall Street Journal cited, the $8-billion raise matched the record for this type of investment vehicle, and could be a signal, the article argued, of “another sign of a property-market rebound.”

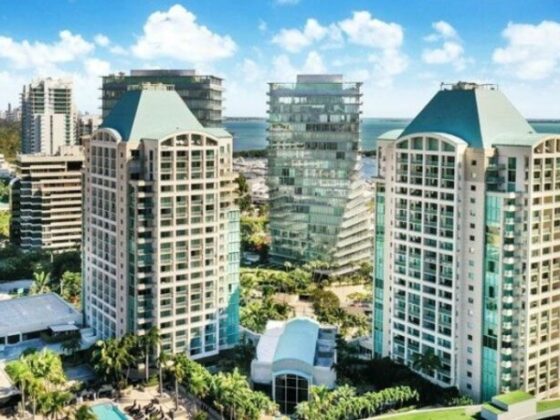

But which types of properties? Hotels have traditionally hung out on the end of the risk spectrum, providing tasty returns but because nightly rates reset often, unlike offices with their longer-term leases, they are also vulnerable to a panoply of external forces. In an up market, it’s boom times; in a down market, owners can get killed. Hotels also include income streams beyond rooms, such as from F&B, which are revenue generators but also have large associated costs. One thing is certain, a debt fund of this capacity is not a wager by Blackstone but an admission that commercial real estate investment is back in vogue after limp post-pandemic years that saw transactions dwindle, especially among hotel assets.

“The fact that Blackstone is placing this kind of bet speaks huge volumes about perceived upside of commercial real estate, and obviously hotels are within that equation,” said Dan Lesser, founder and CEO of New York-based LWHA, a hotel asset management company.

Private-equity backed pools of capital came to the fore around the time of the Great Financial Crisis of 2008 when traditional bank lenders pulled back. They are back now but opened themselves to competition from the likes of private debt funds, which, as Michael Bellisario, managing director, senior research analyst, hotels, global brands and real estate at Baird Equity Research, pointed out can take on more risk than traditional balance sheet lenders that want a high-quality sponsor, high-quality piece of real estate and a higher debt yield. “Typically, you’ll see assets that are transitional, low-cash flowing and/or in need of CapEx that will be financed by debt funds,” he said.

It’s similar to what Tim Johnson, global head of Blackstone Real Estate Debt Strategies, told The Journal, stating that Blackstone crafted the fund’s strategy to not necessarily help but take advantage of current market conditions that have been onerous on many existing borrowers and lenders of commercial real estate. The fund, reportedly, is “buying loans from banks and insurance companies that want to reduce the size of their real-estate debt portfolios.” It’s also getting involved in properties where the debt is maturing and existing lenders don’t want to refinance since the property is worth less and was financed at a lower interest rate.

“That’s not a loan a bank wants to refinance dollar for dollar,” Johnson told The Journal. “Someone has to step in and fill that gap.” He added in a press release: “We could not be more enthusiastic about the opportunities ahead.”

Though all asset classes took it on the chin during the pandemic, offices still have a black eye, with many companies rejiggering their policies of working at the office versus working from home. Though those policies may be shifting back in favor of a more normal, traditional work week, much office real estate can now be categorized as either irrelevant or value depreciated. “I don’t ever recall a time where hotels as an investment asset class were considered more desirable than office,” Lesser said. (Blackstone’s recent buy of a midtown Manhattan office building could buck this trend, seen as a sign that the worst of the office crisis may be over.)

Investing in real estate has been a slog since interest rates began to rise in 2022. Since commercial real estate is a highly leveraged endeavor, when debt costs more to borrow, property values can be worth less. “Interest rates today are elevated compared to where they were just a couple years ago. However, if you look at interest rates today on a long-term basis, they are really not that high. So there’s an enormous amount of capital out there, debt and equity,” Lesser said.