What is a chargeback?

Let’s start with the basics. Other than a word that strikes fear into the heart of all those in e-commerce, a chargeback is a transaction reversal that’s initiated by a customer’s bank after the cardholder disagrees with a charge on their card. It’s different from a refund because a refund is usually initiated by the service provider, rather than the bank.

For the cardholder, a chargeback is protection against dishonest merchants and unauthorized charges. For a business, it’s an unwanted, often surprising threat to revenue.

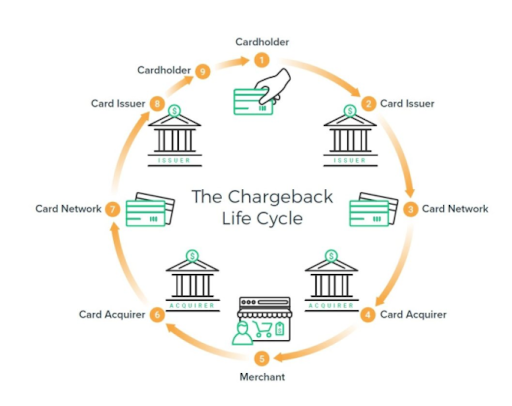

Who’s involved in the chargeback cycle?

It’s not only the cardholder, the bank and the service provider who are involved in the chargeback process. These are all the parties who play a part:

- The cardholder

- The card issuer

- The card network (Visa, Mastercard, Amex)

- The acquirer, payment gateway (Adyen, Stripe)

- The merchant – service provider

What can cause a chargeback?

Chargebacks are initiated by a cardholder who, for whatever reason, doesn’t agree with a transaction on their card. The cardholder should communicate the reason to their bank and then this reason is translated into one of their predefined ‘reason codes’. Typically, the reasons fall into four different categories: fraud-related, service-related, processing errors and authorization issues.

There are 151 chargeback reason codes across the four major card networks. Adyen and Stripe payment gateways summarized all these reason codes into eight categories for simplicity:

So, what are the main reasons for chargebacks in the hospitality industry?

- The customer doesn’t recognize the charge on their account

- The customer wants to avoid paying for accommodation or service because they weren’t satisfied with the service provided

- The customer has forgotten that they made a particular purchase

- There may be another household member who made the purchase with their card and they don’t recognize the transaction

- The customer doesn’t agree with paying for the cancellation/no show fee

- Fraudulent use of the card – stolen cards or testing card limits

Fraud-related chargebacks

Most of the chargebacks that come through a merchant are under the “Fraudulent” reason code, but according to the latest research, only 29% of these are actual fraud. The remaining 71% of these losses are counted as “friendly fraud” – the cardholder simply doesn’t recall the transaction and just needs some clarification.

This frequently happens when a cardholder claims that their card has been stolen or used in an unauthorized manner, or if they have been a victim of identity theft. It may be that the cardholder doesn’t recognize or remember making the purchase. This often happens when the legal entity is different than the entity where the person made the purchase.

Service or product-related chargebacks

Service-related chargebacks can happen when a customer is dissatisfied with the service or product, or there is a failure to provide promised service. For example, it may happen when the room condition isn’t up to par, or there are issues with hygiene or cleanliness or if the room was misrepresented in the description.

Processing errors

Processing errors could be anything from technical issues to duplicate charges, system glitches to refunds not being processed correctly or mistakes during the authorization process.

Authorization issues

This brings us to the next point, which is authorization charges. This can happen when additional charges for services or amenities aren’t authorized by the guest, or when the hotel places a hold on the guest’s credit card for incidentals, which the guest disputes.

Why are chargebacks important?

Chargebacks are important because they not only have an impact on your hotel but also on guests and their perception of your hotel.

Consumer protection

As a hotel, it’s important to protect your guests from fraud and ensure quality in your services to create a bond of trust. By protecting your guests’ payments and giving them a way to recover funds from fraudulent or unauthorized transactions, you are also proving to them that their safety matters, which shows that their business matters too.

Accountability

The possibility of chargebacks gives guests the assurance that if a charge is incorrect, it will be rectified, which leads to improved brand perception and helps avoid a bad reputation. This also promotes business integrity, with hotels closely checking charges at the end of a guest’s stay to avoid chargebacks.

Regulatory compliance

As a business, it’s important that your hotel adheres to the rules and regulations of payment networks in order to continue offering payment by credit card. It is also a consumer right to have the opportunity to request a refund should the charges be incorrect.

Mitigating financial loss

Because no hotel wants to experience financial loss due to chargebacks, this also improves hotels’ accountability and encourages them to implement fraud protection measures, which can help reduce the risk of financial loss due to fraud or human error.

Responding to chargebacks

Once you understand the reason code associated with a chargeback, you can understand the root cause of the dispute and submit a response that includes the appropriate compelling evidence that gives you a higher chance to win the case. For example, let’s say a guest is charged a no-show fee and they raise a chargeback request with their bank. The reason code will tell you it’s for a no show, and you’ll be able to provide evidence that the guest didn’t arrive and that they were made aware in advance of the fees for not showing up for their reservation.

Knowing chargeback codes can help businesses to understand how to avoid them in the future, as well as what needs to be improved from process perspective – and how you can do it.

The basic evidence that we need to help you respond to chargebacks is described in our guide on how to respond to a chargeback.

How to dispute a hotel chargeback

During the chargeback dispute process the cardholder and the merchant try to prove that the other is wrong by providing proof. As the merchant, you have every chance to win the dispute if you do your homework right and provide the relevant evidence to challenge the claim.

Please note that the issuing bank or acquirer may charge a dispute process fee. This fee is returned to you if the case was won and stays with issuing bank or acquirer if the case is lost.

Let’s take a look at how chargebacks are handled, step-by-step.

1. The cardholder contacts their bank

The cardholder alerts their issuing bank and lets them know that there is a specific transaction that they want to dispute.

2. The issuing bank reviews the claim

The issuing bank reviews the supporting documents and the cardholder’s explanation for why they think that transaction is not legitimate. The bank then decides whether to reject the cardholder’s supporting evidence if the evidence provided is weak or unreliable or accept the dispute and forward it to the acquirer via the card network.

3. The acquirer receives the chargeback

If the issuing bank decides that the chargeback claim is valid, it sends an inquiry to the acquirer and withdraws the disputed amount from them.

4. Merchant receives the chargeback

The next step is that the acquirer sends a claim to the merchant or service provider. From here, the merchant has two options:

If the merchant, after reviewing the case, believes that the chargeback is unreasonable, then it’s their responsibility to provide compelling evidence to the acquirer and issuing bank.

5. Acquirer receives the evidence

The acquirer is the first party to receive the merchant’s evidence. If they decide that the evidence is good enough, they will pass it to the issuing bank.

6. The issuing bank receives supporting evidence

After checking the evidence provided by the merchant, the issuer has two choices:

-

Accept that the merchant made a rightful charge and ask the cardholder to drop their claim and return the disputed amount back to the merchant

-

Accept that the cardholder is right and close the case in the cardholders’ favor

7. Arbitration

For more complex cases, evidence can sometimes go to the Arbitration stage where card networks decide who deserves to win. The decision of the card network is final and cannot be challenged.

How long does it take for a chargeback to be processed?

In short, it usually takes a while for chargeback disputes to be resolved. It largely depends on the card networks, and each network has slightly different rules and timeframes.

Usually, a cardholder can initiate a chargeback within 120 days from the date of the transaction. After providing evidence for the issuing bank to review, it takes between 60-75 days to receive their decision. The decision of the bank is final and cannot be contested directly with them.

How to avoid chargebacks

It’s all very well understanding how chargebacks work, but you’re probably asking yourself: what can I do to protect myself from unfair chargebacks in the first place?

The bad news is that some number of chargebacks are unavoidable, if only because people don’t like parting with their money. Not only that, but it’s often easier (and less confrontational) for a customer to reach out to their bank and claim a chargeback than it is to contact the property directly to discuss a refund.

Nevertheless, there are still things you can proactively do to lower the likelihood of getting chargebacks.

Use the clear payment descriptor in Mews

When a cardholder looks at their bank statement, they should immediately recognize the purchase they made. Avoid using parent company names and shorthand that only makes sense to you.

Example: Your property name is “Madison Belle Hotel” and your business name is Belle Holding. In this case, the descriptor should be “MadisonBelle” not “BelleHolding” as it might be confusing for the cardholder.

Make sure your payment and refund policies are clearly presented to the customer – and that you can prove it

In case the customer argues with your rate polices or anything else for which they may have been charged, your best defense is to show that the customer accepted the terms and conditions of the rate on the website and received a confirmation email with clearly stated terms and conditions.

Example: A guest doesn’t want to pay for the no-show/cancellation fee, claiming to the issuing bank that the policies weren’t disclosed. Make sure all the channels you sell rooms from have clearly stated cancellation and refund policies and that the customer always receives a confirmation email summarizing these terms.

Communicate with the customer

Credit cards are usually kept on file and then charged retroactively for additional services or charges, and as the customer may have already left the hotel at this point, they won’t know why or for what they’ve been charged.

Example: A guest left the hotel and was charged for minibar items and damages in the room. If the card has been charged without talking to the customer first, it will most likely result in a chargeback from the cardholder’s side.

Conclusion

So, there you have it. Hopefully, you’ll only receive chargebacks once in a blue moon (ideally never), and all the information here has helped you understand the chargeback process and minimize cases.

If you’re a Mews property and you have any questions, you can always reach out to the Mews support team. For more tips, please check out our guide on how to prevent fraudulent chargebacks within the Mews platform.

Do you have a modern hotel payments solution?

The best hospitality clouds have integrated payment solutions that work to minimize the likelihood of receiving chargebacks in the first place. This is part of a wider conversation about how hospitality payments need to catch up with other industries, and you can find out more in our special guide, We Need to Talk about Payments.