PART 2 – EMEA

In part 1 of the Pulse of the Industry Global edition, we already took a deep dive into the metrics that TrustYou analyzed for the hospitality industry for Q1 and Q2 2024. Now, let’s take a closer look at the latest EMEA hospitality statistics Q1 and Q2 2024 and industry insights.

Throughout the past year, the hospitality industry in the EMEA region has witnessed several trends and faced unique challenges that have shaped its landscape. Let’s delve into the recent developments and insights from the industry, reflecting on the past and looking forward to what 2025 might bring.

Trends in the EMEA Hospitality Sector

Implementation of Customer Data Platforms (CDPs)

Customer Data Platforms have emerged as a key tool for driving success in hotels, aiding in personalized guest experiences and targeted marketing strategies. The integration of CDPs has been pivotal in enhancing customer engagement and loyalty, setting a trend for data-driven decision-making in the industry. Read more on how a CDP drives success for hotels in this blog post.

Growth in Predictive Market Intelligence

Hotels are increasingly turning to predictive market intelligence to fine-tune their revenue strategies. By incorporating forward-looking search data into their technology infrastructure, properties are revolutionizing their approach to demand forecasting and pricing strategies, ultimately improving their revenue management practices.

This strategic shift allows hotels to gain a competitive edge by proactively responding to market trends and shaping their offerings to align with evolving consumer preferences, effectively maximizing revenue potential across various segments and distribution channels. Leveraging predictive market intelligence enables hotels to make data-driven decisions that drive business growth and enhance overall guest satisfaction, creating a win-win scenario for both hoteliers and guests.

Renewed Investor Confidence in European Markets

Renewed investor confidence in the European markets, particularly in London, is on the upswing, according to the London Market Pulse Report by HVS. London’s strong influence as a financial center and its position as a hub for technology and innovation make it a key destination for international visitors, contributing to its status as a leading market in terms of hospitality and hotel investment.

With key performance indicators like average rate, occupancy, and RevPAR showing improvement, coupled with a strong pipeline of hotel projects and significant transaction activity, London’s hospitality industry is poised for growth, attracting both investors and travelers alike.

Tourism is up in EMEA

Recent data from Cushman & Wakefield revealed that European hotel transactions reached a five-year high in the first half of 2024, with transaction volumes exceeding €11.6 billion. This surge in deal volumes reflects a resurgence in investor confidence and activity within the market.

The UK, Spain, and France emerged as the most dynamic markets, representing €7.8 billion in transactions, which constituted over two-thirds of the total European market and reflected a 62% increase compared to H1 2023. London led in transaction volume among cities, followed by Paris, Dublin, Barcelona, and Rome. Projections indicate that transaction volumes are expected to surpass €20 billion in 2024, fueled by the uptick in debt liquidity and robust performance in the hotel sector.

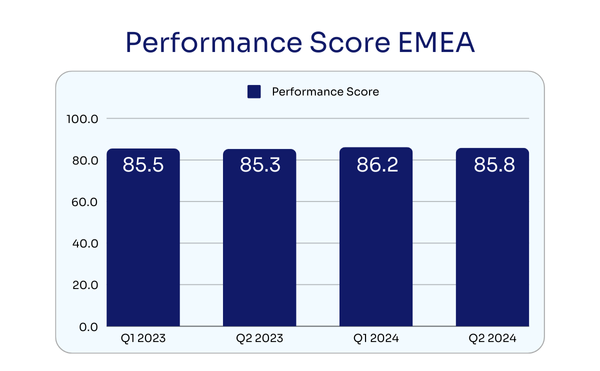

This correlates well with the latest EMEA hospitality statistics Q1 and Q2 2024 and how a hotel’s performance is perceived by guests and that the overall experiences are very positive in EMEA. TrustYou’s Performance Score Analysis for the EMEA region shows that in Q1 2024 the performance score was at 86.2, in Q2 slightly lower with 85.8 out of a hundred.

This was a slight improvement compared to the same period in 2023 (Q1: 85.5, Q2: 85.3). Looking at the global average for 2024 (Q1 2024: 81.7, Q2 2024: 81.5) the EMEA region reaches a much higher score which shows the level of professionalism, service quality and guest experience delivered to meet the high standards of travelers within EMEA.

Loyalty Programs Are Mandatory

AI plays a crucial role in transforming traditional loyalty programs within the hospitality industry. By leveraging AI-driven solutions, hotels can analyze extensive guest data to personalize experiences, predict guest preferences, and enhance service delivery, ultimately fostering enduring guest connections. This shift towards more personalized and engaging loyalty programs sets new benchmarks in guest engagement and retention.

In EMEA, the adoption of AI-powered loyalty programs is expected to revolutionize guest interactions, improve guest satisfaction, and build long-term loyalty by delivering tailored experiences that resonate on a personal level. By embracing these advanced technologies, hotels in the EMEA region can differentiate themselves in a competitive market landscape and create unique and memorable experiences for their guests, ultimately leading to increased brand loyalty and repeat visits.

Challenges Faced by the Industry

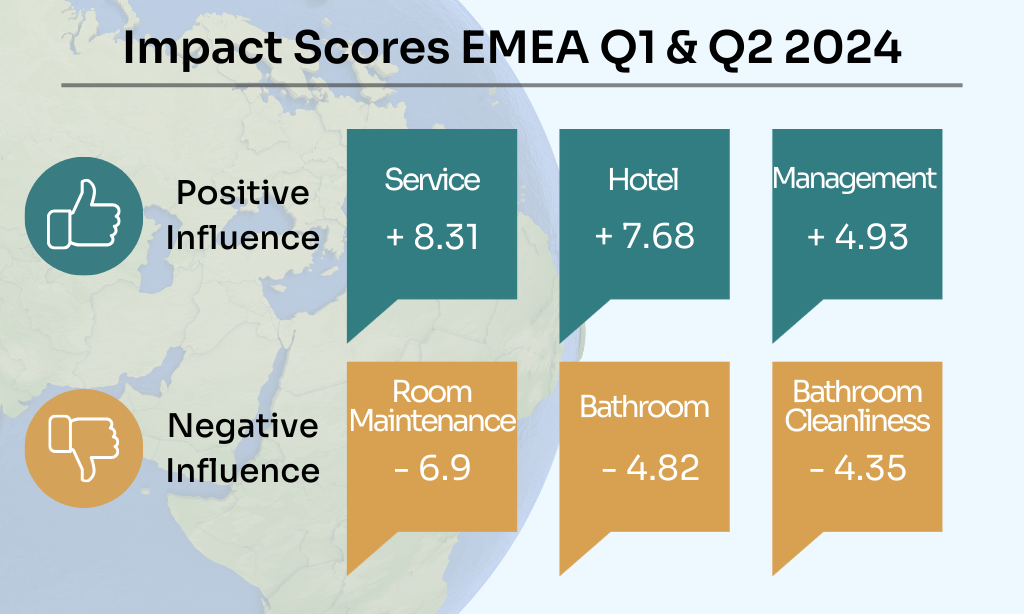

Guest room demand hit an all-time high in 2024 according to EHL. However, meeting this demand presents real difficulties. From talent shortages and evolving guest expectations to supply chain disruptions, this industry simply cannot afford to sit still. This trend is reflected in the latest EMEA hospitality statistics Q1 and Q2 2024 and Impact Score analysis.

The category “Room Maintenance” has the largest negative impact on a hotel’s performance with -6.9 points, followed by “Bathroom” with -4.82 points and “Bathroom Cleanliness” -4.35 points. Hotels should therefore invest particularly in these areas to assure high quality and guest satisfaction during the entire stay. On the positive side, a great level of “Service” is what impacts hotels in EMEA mostly positively with +8.31 points. Investing in high-quality rooms and continuous cleanliness efforts as well as keeping the service level extra high is the way forward for hotels to succeed in a highly competitive environment.

Reliance on Third-Party Booking Platforms

One of the ongoing challenges for hotels in EMEA is the reliance on third-party booking platforms, as recently confirmed in the Hotrec Hotel Distribution Study 2024. The study highlights the growing influence of OTAs, with a particularly noteworthy 10% average market share gain over the past decade. Direct bookings are decreasing, demonstrating a heavy reliance on OTAs for distribution and bookings, particularly for smaller hotels.

The study also emphasizes the dominance of Booking Holdings in the OTA market, with a 71% share, and the increasing use of internet booking engines by hotels as digitalization becomes more prominent. Furthermore, the study underscores several operational and pricing challenges faced by hotels due to OTAs, and the need for fair digital rules to rebalance the relationship between OTAs and hoteliers. Take a look at our blog to find out more about what a Customer Data Platform can do to minimize the reliance on third-party booking platforms.

Accommodating Disabilities in Hotels

Addressing the needs of guests with disabilities remains a non-negotiable aspect for hotels in the EMEA region. The European Accessibility Act (EAA) is a crucial EU directive that mandates accessibility requirements for various products and services, impacting hoteliers significantly. Set to be fully enforced by 2025, the EAA aims to enhance the accessibility of products and services for individuals with disabilities, aligning with the principles of the United Nations Convention on the Rights of Persons with Disabilities.

For hoteliers, compliance with the EAA entails addressing digital offerings like websites, mobile apps, self-service terminals, and payment systems to meet accessibility standards. Embracing accessibility not only enhances the guest experience but also highlights a commitment to inclusivity and social responsibility, ultimately benefiting hoteliers by catering to a wider customer base and demonstrating compliance with evolving accessibility needs.

What to Expect in 2025

As we look ahead to 2025, the hospitality industry in EMEA is poised for further evolution and growth. Anticipated trends include continued advancements in technology, a focus on sustainability to adopt eco-friendly practices and address environmental concerns to meet evolving consumer preferences and industry standards.

The Amex GBT Hotel Monitor 2025 analysis indicates a shift in hotel priorities towards personalization, wellness, and enhanced service delivery to cater to changing traveler expectations. Additionally, the report highlights the repercussions of labor shortages in the hospitality industry, leading to increased costs for hotels, with significant talent crunches being faced globally. There is a surge in global hotel construction, particularly in luxury and upper-upscale segments, contributing to a rise in room supply that may impact pricing strategies. The report emphasizes the importance of sustainability in the hospitality sector, with the need for hotels to adopt eco-friendly practices and address environmental concerns to meet evolving consumer preferences and industry standards.