Like all capital market rates, hotel cap rates and mortgage interest rates rose hundreds of basis points in the wake of the pandemic to levels not seen in years. During periods of systematic increases in rates and elevated investment uncertainty, spreads between capital market rates provide useful information not found in rate levels. Specifically, they isolate risk premiums, which guide investors in committing capital to different types of investments.

Hotel rate spreads compressed during 2023 and first-quarter 2024. Both hotel cap rate and mortgage interest rate spreads to 10-year Treasuries and other assets of similar risk returned to near or below first-quarter 2019 levels. These market indicators signal to investors that relative pricing of hotels has normalized.

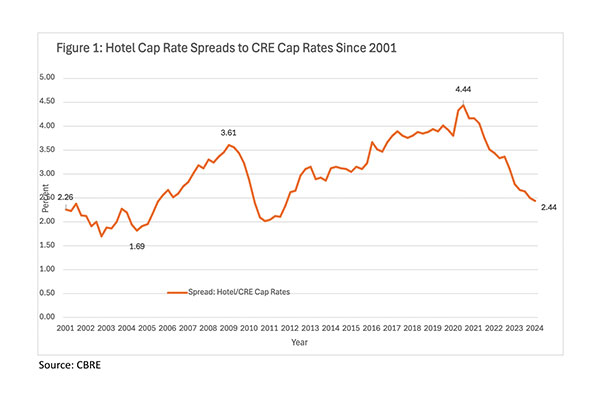

Hotel Cap Rate Spreads

A recent CBRE report presents data confirming that hotel cap rates consistently track higher than those of other CRE property types (i.e., industrial, multifamily, office and retail) through time. In addition, all CRE cap rates are shown to be highly correlated; however, correlations of hotel cap rates with those of other CRE break down during periods of distress.

Data from CBRE Hotels Research and Econometric Advisors allow for an examination of spreads between hotels and other CRE cap rates since 2001 (see Figure 1). The widening of hotel cap rate spreads is apparent during the two periods of financial distress this century—the financial crisis during 2008-2009 and the COVID pandemic during 2020-2021. Since 2022, spreads tightened to the level recorded in 2019 (i.e., just under 4.00%). During Q1 2024 the spread was 2.44% or about 50 basis points below the series long run average. The trend implies further tightening.

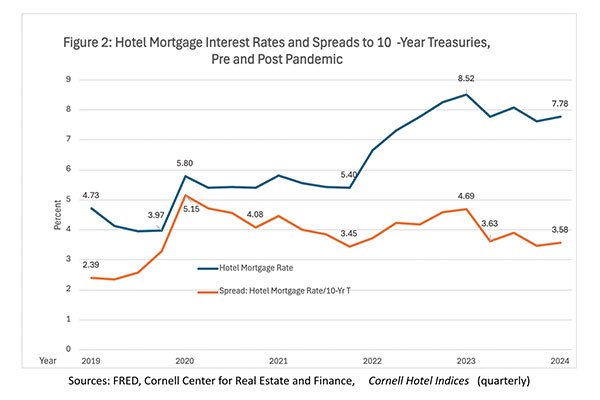

Hotel Mortgage Rate Spreads

A critical link exists between mortgage interest rates, sales volume and property prices. As mortgage rates increase, sales volume declines putting downward pressure on prices. Figure 2 shows that within a few years hotel mortgage interest rates doubled, which had a meaningful negative impact on hotel transactions and property prices. Since 2019, 10-year Treasury rates grew proportionally with hotel mortgage rates leaving the spread to Treasuries close to the Q4 2019 level, as shown in the figure. Despite downward pressures on hotel property prices from rising mortgage rates, the increase in these rates moderated and the relative risk of hotel lending indicated by the spread returned to within approximately 100 basis points to pre-pandemic levels.

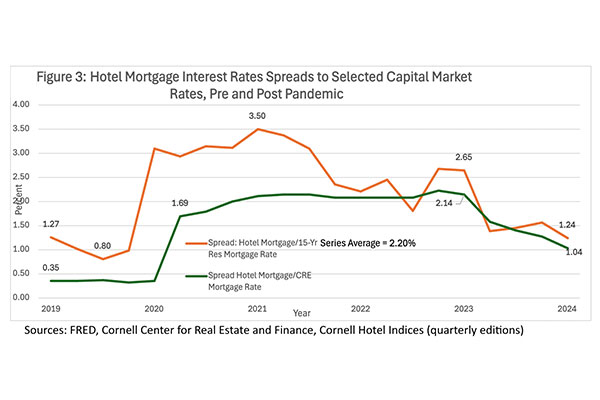

Hotel mortgage interest rate spreads to risk assets rates have come well off their highs in 2021 and 2022. As shown in Figure 3, the spread of hotel mortgage rates to rates on 15-year residential mortgages moved down from 350 basis points to 124 basis points in Q1 2024. Prior to the pandemic, the spread was hovering around 100 basis points. Similarly, the spread between hotel mortgage rates and other CRE mortgage rates at 104 basis points is within 70 basis points of pre-pandemic spreads.

Key Takeaways

- The spread between hotel and commercial real estate (x hotels) cap rates expanded to 4.44% in 2020 then compressed to 2.44% by Q1 2024. The long-run average since 2001 equals 2.98% indicating a normalization of hotel investment risk.

- Hotel mortgage interest rates nearly doubled from 2019 to 2023 and remain above the series average. Yet the spread between hotel and commercial real estate mortgage rates in Q1 2024 at 1.04% is trending close to the .35% in Q1 1019.

- Similarly, the spread between hotel mortgage rates and 15-year residential mortgage rates declined from a peak of 3.50% in Q1 2021 to 1.24% in Q1 2024. The series low was .80% in Q3 2021.

- Current capital market spreads indicate that the risk premiums associated with hotel property investment have returned to within a normal range.

_____________________________________________________________________________________

[1] Figure 1 shows hotel cap rate spreads rising from 2011 until the pandemic. The rise was due to hotel cap rate increasing while other CRE cap rates were declining during the period. It is hypothesized in the CBRE report that the increase was due to the perceived risk of competition from the rapid growth of paid accommodation inventory from short-term rental companies, such as Airbnb.

[2] See Cornell Center for Real Estate and Finance, Cornell Hotel Indices (quarterly).

This piece was contributed by Jack Corgel, Ph.D., CBRE consultant.

Acknowledgement: Hogan Mcdade, who provided assistance in the preparation of this article.