A few of today’s stories focus on how travel search is changing with AI, highlighting how this could dramatically and immediately impact how consumers discover and connect with travel operators, potentially bringing a new power balance to the industry. I hope you enjoy it, and please don’t forget to participate in today’s poll at the end of the newsletter 🙏.

Thanks to Propellic for sponsoring this newsletter. This sponsorship is particularly well-timed, given this issue’s focus on the shifting dynamics of travel search.

Travel marketing has evolved rapidly post-pandemic, but travel companies haven’t kept up. Wasted budgets, marketing that doesn’t align with traveler intent, over-reliance on a single channel, and reporting on vanity metrics – it’s a mess. Here’s the deal: it doesn’t need to be that way. Explore travel industry-leading travel SEO & Paid Media consulting with Propellic. Schedule a free performance marketing audit today.

0. The most clicked link in the previous newsletter

The most clicked link in Travel Tech Essentialist #142 was Morgan Stanley’s Generative AI vacation planning article (I am not including the link to the article because in #1 below, I am including a link to the more detailed report).

1. The Winners in AI Travel

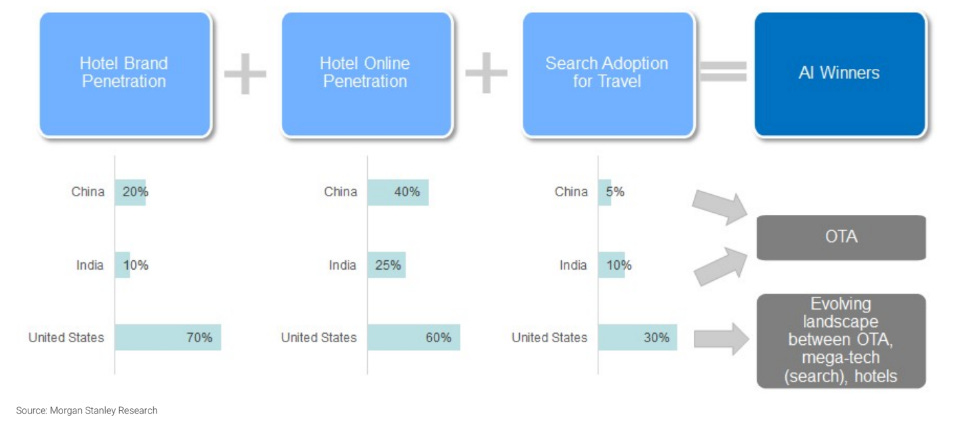

Morgan Stanley’s recent report –Generating your AI Itinerary– highlights how OTAs in China and India, specifically Trip.com and MakeMyTrip, will likely evolve as clear winners in the AI era. Some of the reasons:

-

Branded hotel penetration in China is 40%, and in India, it is 6%, versus over 70% in the US. This offers significant opportunities for OTAs.

-

Online booking penetration is below 40% in China and 25% in India, compared to over 60% in the US and Europe, which indicates substantial room for online growth.

-

OTAs in China and India dominate as one-stop travel platforms, unlike the search engine-dominated markets in the West.

-

Early adoption of travel-specific large language models provides these OTAs a competitive edge.

-

In the US and Europe, Google and large OTAs will benefit from AI, but the OTAs’ reliance on paid traffic from Google creates both AI ‘”top of funnel” risk and opportunities.

2. AI’s Impact in Travel Search

Mario Gavira, VP of Growth and Brand at Kiwi.com and a former colleague at eDreams Odigeo, explores the impact of AI in travel search in two recent articles.

In Search Marketing for Travel in the Age of AI, Mario examines how AI will likely reshape the travel industry dynamics and how the emergence of a new breed of AI-first applications reimagines how we browse and find information. Microsoft’s AI-powered Bing and OpenAI’s ChatGPT have gained modest search market share, but as we have seen in the past, disruptive innovations may not reveal their full potential immediately.

In his second article – Preparing travel for the future of AI Search – Mario identifies three key areas where the travel industry should focus to stay competitive:

-

From SEO to GEO (Generative Experience Optimization). The shift towards AI-driven search responses will transform SEO, emphasizing relevance in AI-generated answers rather than traditional link rankings.

-

From blue links to multimodal ads. Advertisers may see less control over ad placements in AI-powered search responses, similar to what happens with Gmail ads.

-

From Ads to Product Reviews: With AI increasingly incorporating reviews and opinions into its responses, there’s a growing need for cross-functional coordination among search, social media, and customer experience teams.

3. Perplexity and AI-Powered Travel Search

Brightedge wrote a guide on Perplexity (a leading AI-driven search engine) with strategies to improve visibility on traditional and AI-first search engines. It highlights the importance of identifying platforms prioritized by Perplexity and Google’s Search Generative Experience (SGE) and offers tips on optimizing content for these platforms.

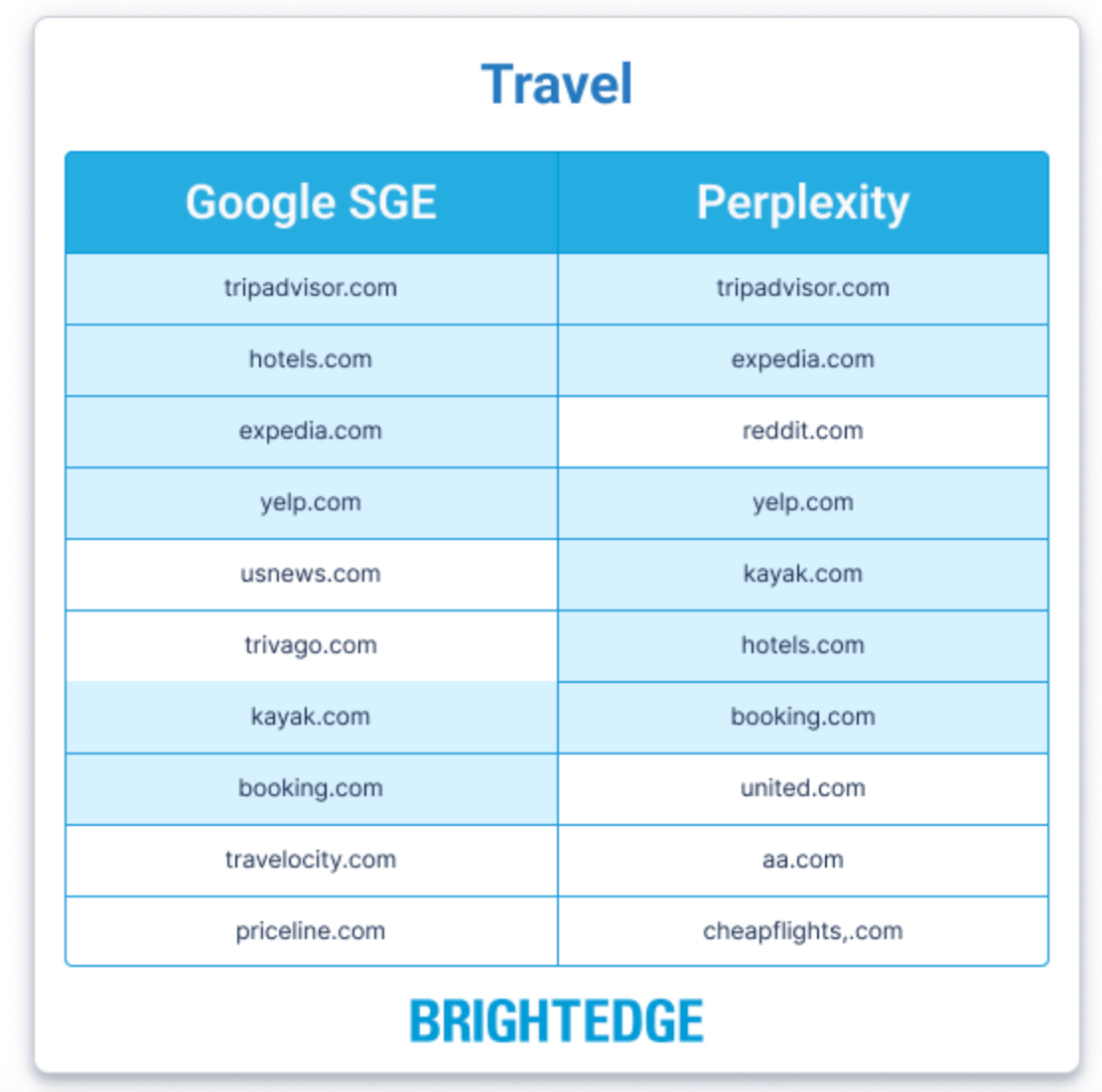

Of particular relevance to the travel industry, the report shows that AI-driven search is significantly influenced by key transactional domains, highlighting the transactional focus of AI search strategies in travel. Of the top 10 domains used by Google SGE to answer travel queries, there are 5 OTAs and 3 metasearch. Of the top 10 domains referenced by Perplexity, there are 4 OTAs, 2 metasearch, and two suppliers (airlines). Six domains overlap: Tripadvisor, Hotels.com, Expedia, Yelp, Kayak, and Booking (by the nature of the domains, these were US-originated queries).

Their analysis shows a strong transactional orientation in AI search strategies within the travel sector, with significant emphasis on Online Travel Agencies (OTAs) and metasearch engines. According to the report, among the top 10 domains utilized by Google SGE for travel queries, 5 are OTAs and 3 are metasearch. Perplexity’s top 10 includes 4 OTAs, 2 metasearch, and 2 suppliers (airlines). Six of these domains—TripAdvisor, Hotels.com, Expedia, Yelp, Kayak, and Booking.com—appear on both lists. By the nature of the domains, these were US-originated queries.

For better travel SEO and digital marketing, Brightedge recommends to:

-

Ensure your offerings are prominently listed and optimized on these key platforms to enhance visibility and reach.

-

Streamline your booking process to be smooth and user-friendly, reflecting the importance that AI-driven search engines seem to place on the booking process.

-

Develop detailed content that includes destination guides, travel tips, and reviews to match the detailed and rich information style favored by these platforms.

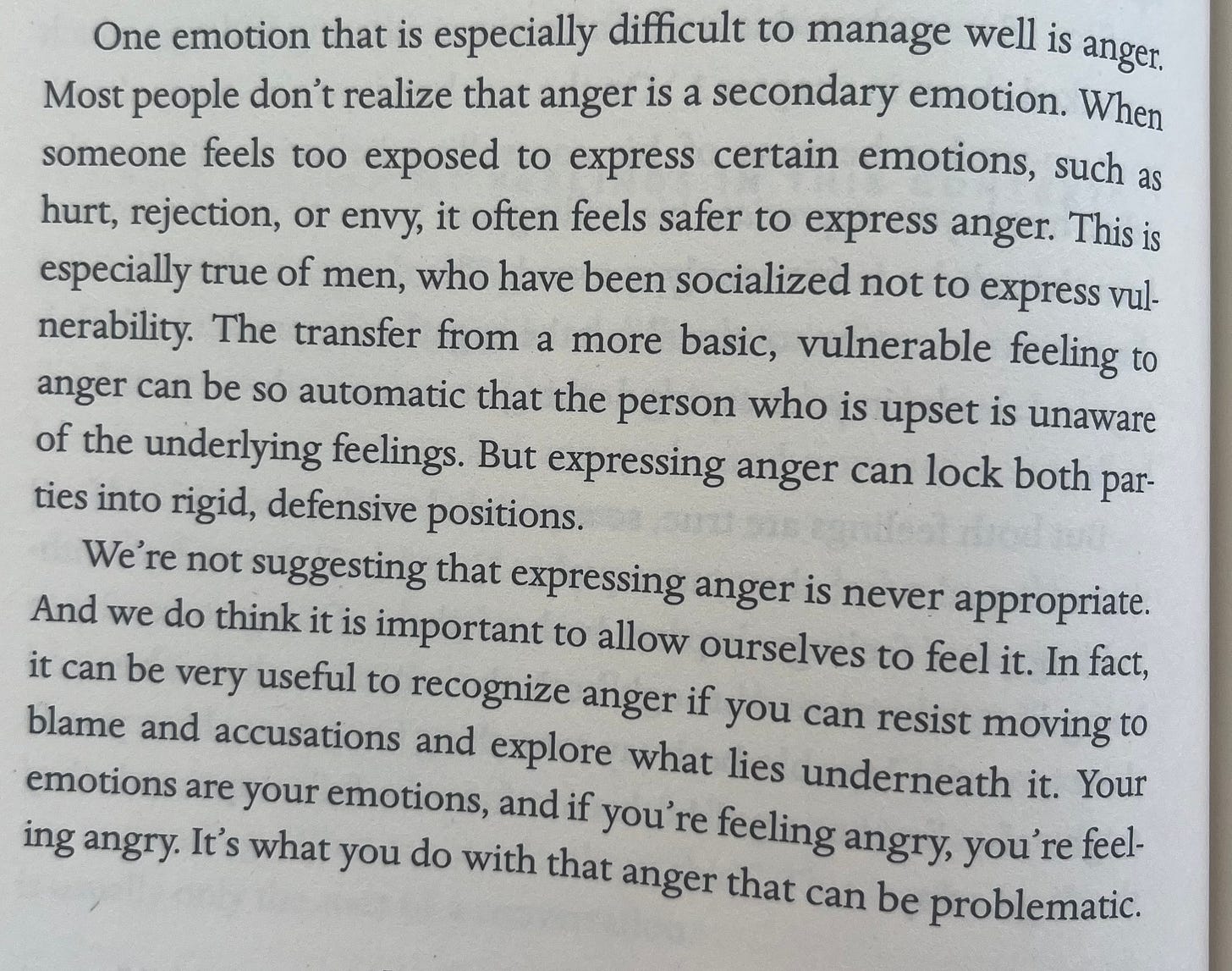

4. Anger is a secondary emotion

Carole Robin taught one of Stanford Business School’s most popular classes, Interpersonal Dynamics, for over twenty years. She then co-founded Leaders In Tech to bring the principles and process of her class to executives in Silicon Valley. On a recent podcast, she discussed emotional responses in leadership, highlighting how anger is a secondary emotion that lies underneath primary feelings like fear, hurt or pain. It is possible to address or resolve primary emotions but not secondary ones. Sharing these primary feelings in a work environment could be perceived as risky and unconventional, but this kind of leadership can foster more genuine connections and have a ripple effect across teams.

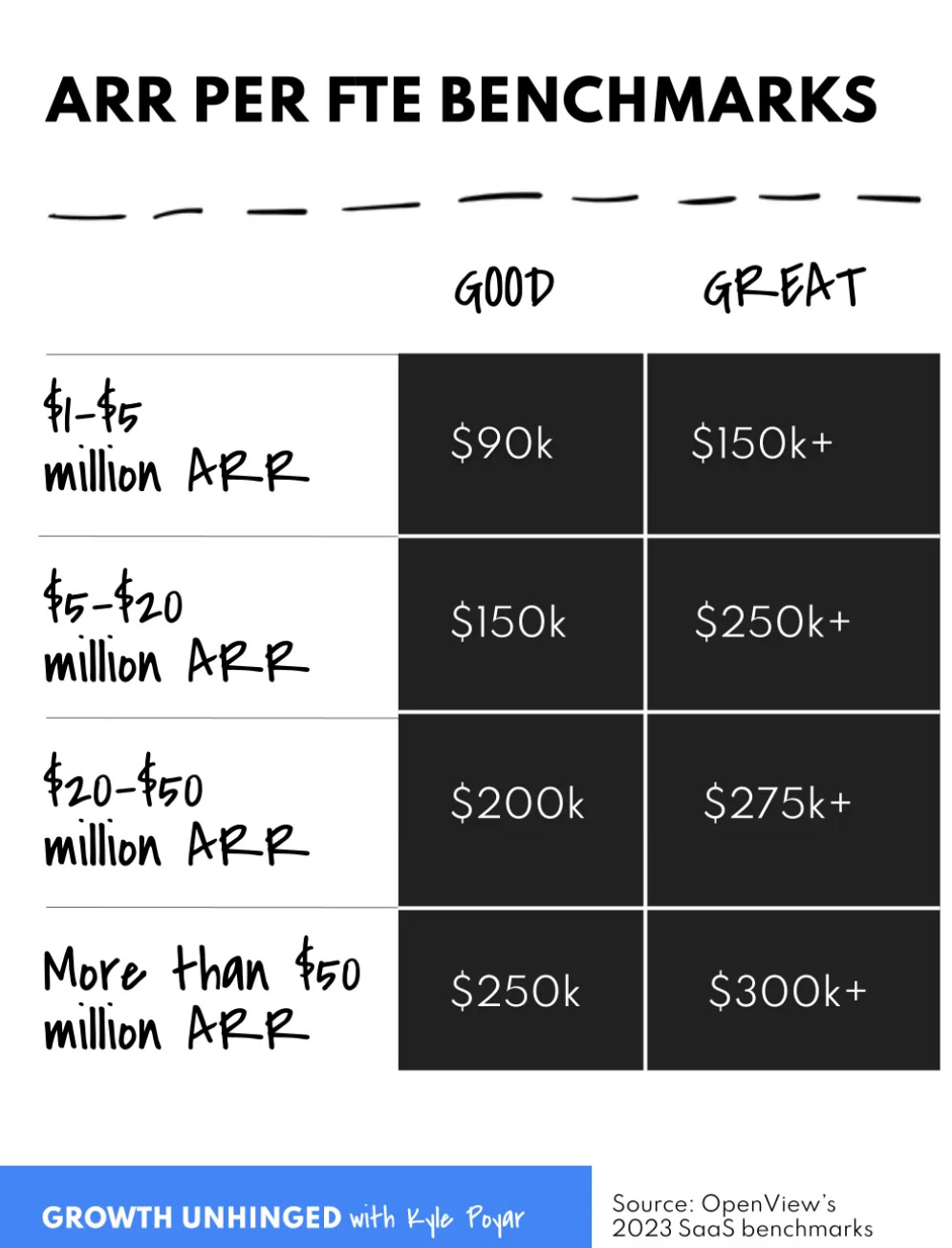

5. ARR per FTE

In Your guide to ARR per employee, Kyle Poyar (Operating Partner at OpenView and editor of the newsletter Growth Unhinged) writes about a straightforward metric for SaaS startups, ARR per full-time employee, that is becoming increasingly significant as companies try to do more with fewer resources. He breaks down what constitutes “good” ARR per FTE across different revenue levels, using data from over 700 private SaaS companies. He also advises against early optimization for this metric, as it could detract from necessary growth investments. He also suggests comparing ARR per FTE within appropriate peer sets, considering factors like scale, growth rate, and geography.

6. From 1 to 80 million in 5 days

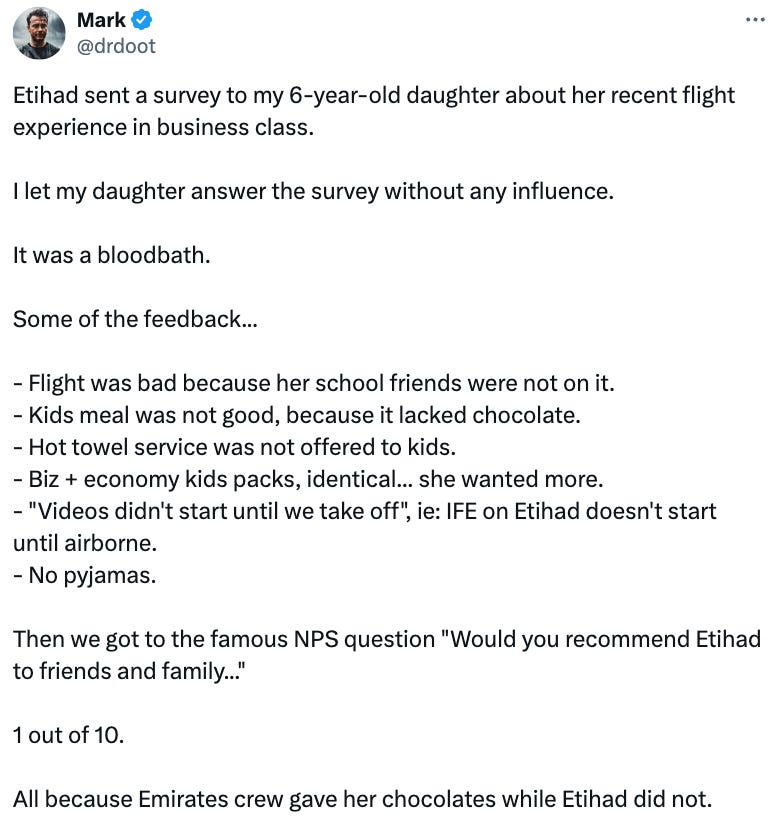

On April 10th, Mark Ross-Smith, founder of Loyalty Status Co, shared a flight experience with his 6-year-old daughter.

5 days later, he gave an update:

For all the sophisticated talk about AI and personalization in the airline industry, getting the basics right starts with knowing who’s on board. For example, if an airline loyalty professional is flying with his 6-year-old daughter, you better make sure that she has a memorable flight experience.

7. Start out the right way

In Start Out the Right Way, Michael Wolfe (Co-founder and CPO of Gladly) discusses the few things you can do in the early days of your startup to ensure a successful start.

-

Work with a lawyer specializing in early-stage startups to help you understand the decisions you need to make

-

Treat the co-founder relationship like a marriage, which requires deep prior understanding and commitment. Trial periods and regular check-ins can prevent “founder divorce.”

-

Diversity and complementarity in skills among founders covers more operational ground and reduce overlap that can lead to conflict.

-

Transparent discussions about each founder’s view on exit strategies, commitment, and breaking points help align expectations.

-

Having a stock vesting plan for founders and key employees avoids the issue of “dead equity” if someone leaves early.

-

Deciding who the CEO will be can prevent paralysis by indecision. Shared leadership sounds ideal but often leads to a lack of clear direction.

8. What makes for successful consumer founders?

Early-stage investor Meera Clark (Redpoint Ventures) wrote about the traits of successful consumer founders by analyzing over 100 US headquartered unicorns. Some conclusions:

-

Most successful startups were not solo ventures; they were built by teams averaging 2.2 cofounders, and the composition of these founding teams often evolved after the business was established.

-

The most successful founders typically had 7-9 years of professional experience before launching their ventures, a balance between being new to the industry and having deep industry knowledge.

-

Despite the rise of remote work, the majority of successful consumer startups are still headquartered in cultural hubs, benefiting from deep insights into cultural shifts and access to top talent.

-

47% of unicorns had a cofounder from either Stanford or an Ivy League school. Previous Big Tech experience was less predictive of success, especially outside the Consumer Apps category.

-

Over half of the companies had at least one former founder on the cofounding team, highlighting the value of persistence and prior entrepreneurial experience.

-

Less than 40% of successful consumer startups had technical cofounders from the start.

9. Why luxury brands are expanding into hospitality

Luxury brands like Armani, Bulgari, and Tiffany & Co. are expanding beyond traditional retail by opening luxury hotels and dining establishments, offering an immersive brand experience. This strategic move meets the demand for luxury experiences by the next generation of luxury consumers who value experiences over material goods. Read + The European

[Luxury brands] are transforming their marketing tactics from “story telling” to “story living”, as they have realized the potential in integrating hospitality into their core business model for a more holistic and multi-sensorial experience. — The European

10. Wizz Air’s new retail shopping platform

Luxury retail brands are expanding into hospitality, and ultra-low-cost airlines are expanding into retailing. Wizz Air, a European ultra-low-cost carrier, launched WIZZ SHOP&FLY, a personalized online shopping platform that employs AI to offer recommendations. These suggestions are based on passengers’ data and destinations, featuring a variety of fashion, beauty, and retail products delivered directly to customers’ homes. The airline partnered with the online shopping startup InterLnkd, which utilizes customer booking data to create a customized shopping experience. Read + Simple Flying.

Ultra-low-cost airlines are entering retail but not ultra-high-luxury retail; Bulgari, Armani, and Tiffany can relax 🙂

PS. Community Poll

The poll in the previous newsletter asked about “tarpit ideas” (seemingly easy and promising startup ideas that have consistently led many founders to failure) in travel. ‘Fixing the broken travel planning’ took first place with 40% of the votes, followed by ‘The all-in-one travel Super App’ with 26%. Full results here.

Today’s poll touches on how AI could reshape future leaders in travel. Booking.com currently dominates the market. Who do you think will lead in transaction volume in 10 years?

Are you fundraising?

If you are a startup looking to raise a round (from pre-seed to Series D), I can help (for free). Travel Investor Network is a private platform where I recommend innovative travel startups to investors and innovators. If you’re interested, please start by completing this form.

Travel Tech Essentialist Job Board

Explore the 1280 open positions on Travel Tech Essentialist’s curated Job Board and stay ahead of the curve by subscribing to job alerts. Some of the jobs on the board:

-

Expedia | Senior Director – Business Planning & Revenue Management | SF, NYC, Dallas, Seattle… | $307,500 – $430,500 with potential to increase pay up to $492,000

-

WeTravel | Product Marketing Manager | Amsterdam

-

TravelPerk | Content Marketing Executive | Barcelona

-

Booking.com | Senior Research Manager | Amsterdam

-

The Hotels Network | Market Manager Australia / New Zealand | Barcelona

→ Join the Talent Network. Hiring companies sometimes ask me to help them find the best talent. If you want me to have you on my radar to introduce you to the right opportunities, join the new Talent Network (it takes 3 minutes).

→ If you’re contemplating a career move, simply curious, or an HR professional seeking job insights, subscribe to my Travel Tech Jobs newsletter.

If you like Travel Tech Essentialist, please consider sharing it with your friends or colleagues. If you’re not yet subscribed, you can do so here:

And, as always, thanks for trusting me with your inbox.

Mauricio Prieto