Full-year 2023 results for 10 publicly traded online travel companies: Booking, Expedia, Airbnb, Trip.com, eDreams Odigeo, Despegar, MakeMyTrip, lastminute.com, TripAdvisor, Trivago

2023 results

1. Revenues

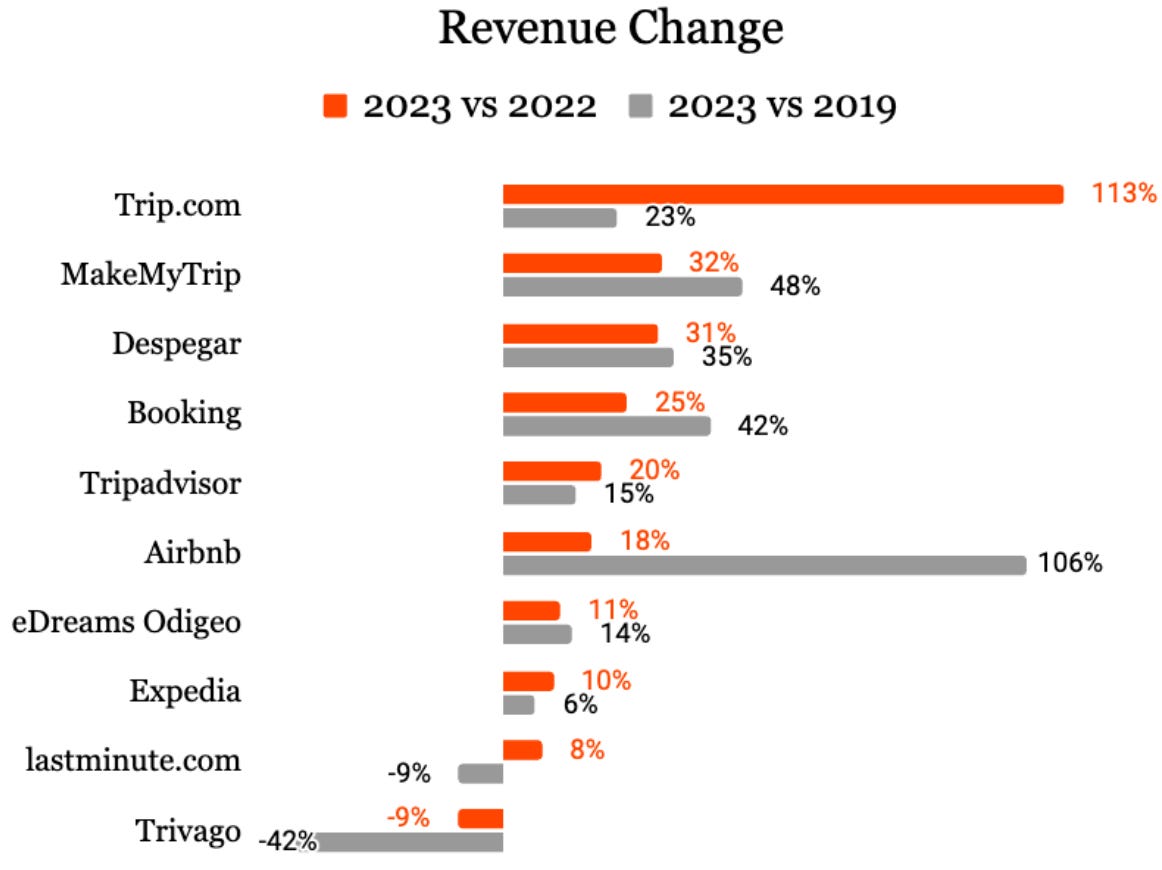

With the exception of Trivago, all companies increased their revenues from 2022 to 2023. Year-on-year revenue ranged from -42% (Trivago) to +113% (Trip.com). Compared to 2019, only lastminute.com and Trivago had revenues below pre-COVID. Airbnb doubled its revenues in 2023 compared to 2019.

Trip.com saw the largest increase in its share of the total revenues of the ten online travel companies in this report, going from 6.7% in 2022 to 11.4% in 2023, while Expedia’s share decreased from 26.4% to 23.3% and Airbnb slightly fell from 19% to 17.9%. Booking.com remained at 38.7%. The remaining six competitors (Tripadvisor, Trivago, eDreams Odigeo, Despegar, MakeMyTrip, and lastminute.com) saw their overall share of total revenues decrease from 9.3% to 8.8% in 2023.

When we look at the universe of the “Other” 6 players, the two metasearches (Tripadvisor and Trivago) decreased their share while Despegar saw a significant increase from 2020 to 2021.

When we look at the universe of the “Other” 6 players, Tripadvisor, Despegar, and MakeMyTrip grew their share, while the rest saw a decrease, particularly Trivago, which went from 13.7% of the revenue share of these six players in 2022 to 10.8% in 2023.

2. Marketing

All companies increased their marketing costs in 2023, with the exception of eDreams (0%) and lastminute.com (-2%). Trip.com more than doubled (+111%) its marketing, which led to a similar increase (+113%) in revenues, as we saw previously.

The marketing over revenues ratio can point to the relative efficiency of marketing spend. The higher the ratio, the more marketing pressure the company requires to drive sales, although we also need to take into account the nature of the product. Travel companies slashed all non-essential marketing investments in 2020.

At 71%, eDreams Odigeo still has the highest marketing/revenue ratio, but it is lower than its 80% in 2022. Lastminute.com also decreased its ratio from 44% in 2022 to 40% in 2023. Airbnb and MakeMyTrip have the lowest marketing/revenues ratios, signaling a strong brand and a lower reliance on performance marketing.

3. EBITDA

All travel companies had improved EBITDA from 2022 to 2023.