The Shiji Guest Experience Benchmark Report for Q2 2024 offers a comprehensive look into guest satisfaction trends and review dynamics. This report is crucial for hotel operators and technology vendors aiming to enhance their service quality and customer engagement.

Global trends in guest experience

Rising guest satisfaction levels

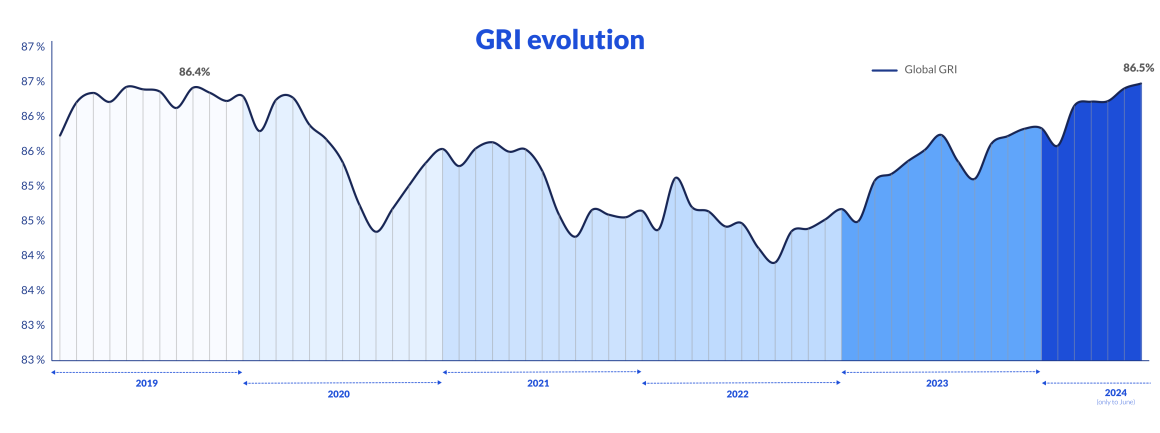

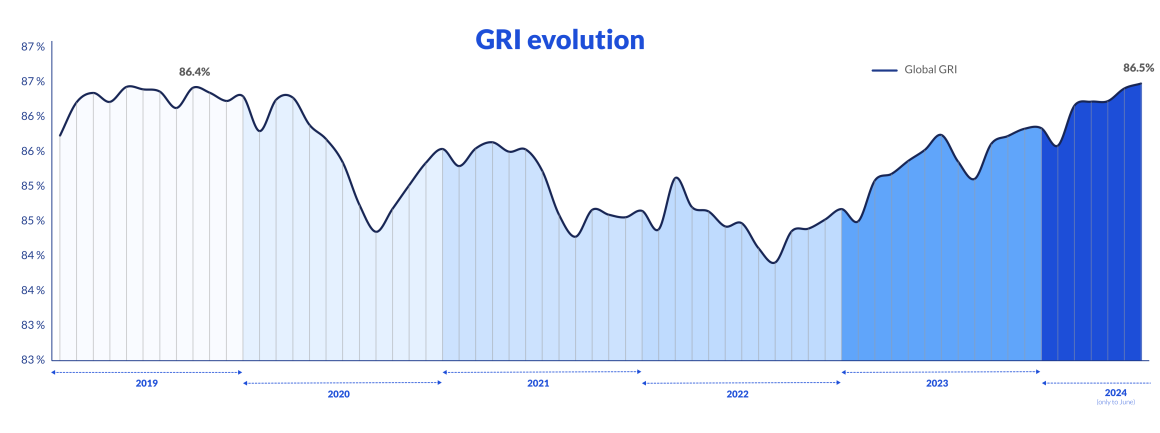

Guest satisfaction has surpassed pre-COVID levels, with a notable increase in the Global Review Index (GRI). In June 2024, 5-star hotels achieved a record GRI of 90.4%, while 4-star hotels reached 86.8%, and 3-star hotels saw an increase to 83.2%.

Decline in review volume

Despite higher satisfaction, there was a slight 2.9% drop in review volume compared to Q2 2023. This trend started in Q1 2024 and continues to influence the overall review dynamics.

Improved response times

Management response times have improved, with positive reviews being addressed in 3.3 days and negative reviews in 4.0 days on average. The overall response rate increased to 66.3%, 3.4 points higher than Q2 2023.

Shifts in review sources

Review volumes on Expedia, Hotels.com, and Agoda surged by over 40% compared to Q2 2023. Conversely, Booking.com and Google saw declines in review volumes and market shares. Agoda now holds a 4.8% market share, almost 2 points more than in 2023. Expedia’s market share grew by 2.7 points, Trip.com also saw a 9% increase in review volume, while Ctrip only grew by 1.9 points.

Regional Insights

Asia-Pacific: Leading the way

The Asia-Pacific region continues to excel, with the highest GRI of 88.1% in Q2 2024. Despite a plateau in 5-star hotel performance, the region shows substantial improvement in review response rates, now at 66.6%. Agoda’s market share in the region has increased to 14.5%, 1.2 points higher than in Q2 2023.

Europe: Mixed performance

Europe experienced a 5.2% drop in review volume due to fewer Booking.com and Google reviews, which declined by 12.0% and 9.6%, respectively, in our sample. However, review volumes on Expedia (+27.8%), Hotels.com (+36.4%), Agoda (+91.2%), and HolidayCheck (+17.3%) grew significantly. Response times improved, with positive reviews addressed in 3.8 days and negative reviews in 4.5 days. Both 3 and 5-star hotels saw a drop in the value index, with -0.6 and -0.2 points, respectively.

Latin America: Steady improvement

Latin America saw a slight GRI increase (+0.7 points) and better response times, though review volumes declined by 9.3%. 3-star hotels showed notable improvement in GRI (+1.1 points) but had lower response rates at 52.2%, compared to 67.6% and 67.3% for 4 and 5-star hotels, respectively. The Service index dropped for 4 and 5-star hotels by -0.2 and -0.7 points.

Africa: Positive trends with challenges

Africa showed strong GRI growth across all hotel categories; however, the quality of Service index declined for 3 and 4-star hotels by -1.1 and -0.4 points; on the contrary, it kept growing by 0.2 points for the second consecutive quarter for the 5-star, to 92.3%. Response times improved significantly, positioning the region among the best globally, with responses to positive reviews in 3.1 days and negative reviews in 4.5 days. Google’s index in the region is the highest at 87.3%, while Booking.com is at the bottom with 83.0%.

Middle East: Strong performance

5-star hotels in the Middle East achieved a GRI of 90.7%, making them the second-best performer after the Asia-Pacific 5-star hotels (with 91.1%), with review response rates improving across all categories. The region continues to maintain fast response times for reviews, with positive reviews in 3.6 days and negative reviews in 4.0 days. The review response percentage grew in every category, ranging from 86.1% for 5-star hotels to 76.0% for 4-star hotels.

North America: Modest gains

North America experienced slight GRI increases across all star categories. Response times improved, with positive reviews addressed in 3.3 days and negative reviews in 3.8 days. However, value for money remains a concern, particularly for 4 and 5-star hotels, with indices of 81.6% and 82.8%, respectively, lower than the European market.

Actionable strategies for hotel operators

Enhance guest satisfaction monitoring.

Track GRI and other satisfaction metrics regularly to identify areas for improvement. Implement feedback loops to address issues promptly.

Improve review response rates.

Aim to respond to all respondable reviews within 3 days, prioritising the negative reviews to offset their negative impact as soon as possible. As automation becomes more prevalent in our industry, this process will likely be automated to ensure consistency.

Diversify review sources.

Encourage guests to leave reviews on various platforms. The diversification can help standardise the property’s ratings across different review sources, improving guests’ perceptions of consistent service quality, accommodation, and value for money.

Diversification can help homogenise the property’s rating across different review sources, increasing bookers’ perception of consistency in quality of service, accommodation, and value for money.

Focus on service quality.

Invest in staff training and service enhancements, particularly in regions and hotel categories that are showing declines in service indices.

Leverage technology.

Utilise technology solutions to enhance guest experience management. Tools for real-time feedback collection and analysis can provide actionable insights.

Monitor regional trends.

Stay informed about regional performance trends. Adapt strategies to align with regional strengths and address weaknesses.

Takeaways

- Guest satisfaction levels have surpassed pre-COVID benchmarks.

- Review volumes are declining, emphasising the need for diversified review strategies.

- Improved response times indicate a positive trend in customer engagement.

- Regional performance varies, necessitating tailored approaches.

- Actionable strategies include enhancing satisfaction monitoring, improving response rates, and leveraging technology.

Conclusion

The Q2 2024 Shiji Guest Experience Benchmark Report highlights significant trends and shifts in guest satisfaction and review dynamics. By understanding these trends and implementing targeted strategies, hotel operators can enhance their service quality and guest engagement.

It also shows that alongside the reduction in review volume, the GRI of our sample is growing in every region, finally surpassing the pre-COVID in June 2024. The volume of semantic mentions does not follow this growth, with Latin America and Asia dropping just slightly.

There are also differences in the star categories, with the 5-star hotels’ GRI growth pace being almost half of the 4-star’s and the 3-star growing again the quickest. The review market share continues its slow process of rebalancing, with review sources such as Expedia and Hotels.com, Ctrip and Trip.com gaining a bigger slice. This is likely to the detriment not just of the big players (Booking.com, Google, and Tripadvisor) but also of the smaller sources. The latter lost 1,5% in market share cumulatively over Q2 2023 and now cumulatively holds just 4.0% of the total volume of reviews posted every quarter.