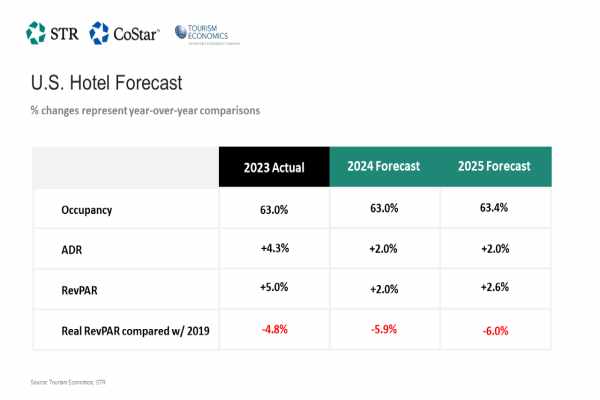

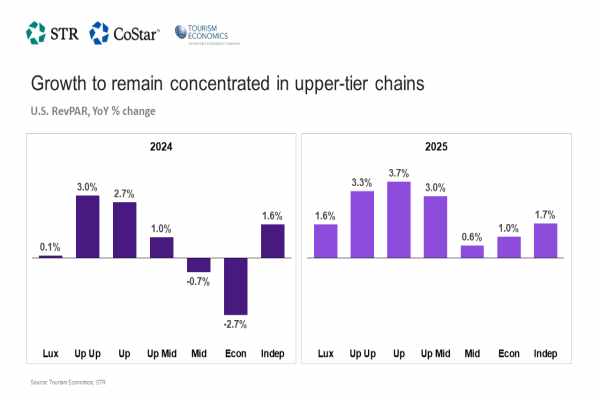

STR and Tourism Economics (TE) have made slight alterations to the 2024-25 U.S. hotel forecast.

For 2024, although RevPAR was kept steady at +2% YOY, projected lifts in ADR were downgraded 0.1 percentage points. Occupancy was upgraded 0.2 percentage points, after the its June forecast projected a YOY decline in the metric.

Occupancy growth projection for 2025 has also been raised (by +0.2 percentage points), while the prediction for ADR and RevPAR gains have been maintained at +2% and +2.6%, respectively.

Midscale and economy hotels have been feeling the impact of a reduced volume of lower-income travelers, whereas high-income households continue to travel but domestic levels are limited due to an increase in outbound travel, said Amanda Hite, STR president.

“The stronger dollar continues to pressure international inbound demand, especially as the cost-of-living crisis continues in Europe and airlift rebuilds across Asia Pacific.”

Economic growth is anticipated to be slower in 2025. However, strong household balance sheets, a gradual upswing expected in business investment and moderating inflation, a more favorable context for the growth of travel is likely, said Director of Industry Studies at TE Aran Ryan.

Further gains in international inbound travel, as well as in business and group travel, will also help support lodging demand growth in 2025, Ryan added.

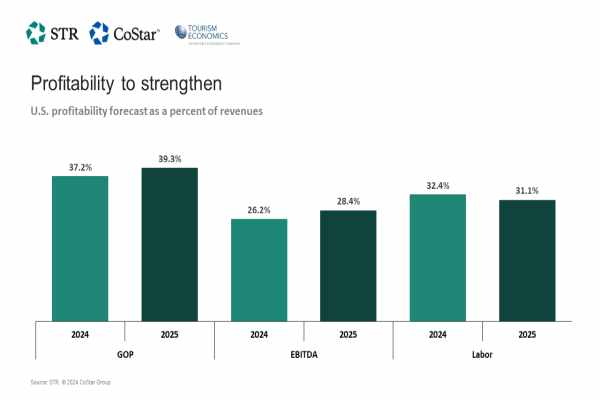

Annual GOP and EBITDA margins are anticipated to see a slight improvement YOY, STR said. Next year, higher growth is likely across both metrics due to reduced labor costs, which will see a marginal dip for most of the chain scales.

“Upper midscale chains are still expected to maintain the lowest labor costs this year, with 2025 levels forecasted to come in $168 lower than luxury chains,” Hite said.

In its June forecast, STR and TE made significant downward adjustments to the forecast, which reflected lower-than-expected performance observed until then. For 2024, projected increases in ADR and RevPAR were downgraded 1 percentage points and 2.1 percentage points, respectively. The occupancy growth projection remained the same for 2025, but ADR and RevPAR were downgraded to -0.8 percentage points and -0.9 percentage points, respectively. The hike in cost of living had been impacting lower-to-middle income families and their ability to travel, lowering the demand for hotels in the lower price category, STR said.