Some of the stories in this edition explore how passion and identity influence travel. Branded hotels and “passion travel” create more personalized experiences that align with guests’ lifestyles and values. These trends reflect the growing influence of the creator economy, where personal brands and travel are increasingly connected.

Thank you to Propellic for sponsoring this newsletter.

Cookie monsters rejoice! Unless you’ve been off the grid on a much-needed vacation, you’ve probably heard that Google will not end support for third-party cookies on its Chrome browser until 2025. This delay allows travel marketers to continue effectively funneling travelers from inspiration to booking as they navigate the web (for now).

Learn about Google’s announcement and what it means for travel marketing from our strategic partner, Propellic, in this article written by Brennen Bliss, Propellic’s founder and CEO.

0. The most clicked link in the previous newsletter

The most clicked link in Travel Tech Essentialist #151 was Growth.Design’s 5-minute story on Hopper’s booking flow.

1. The rise of branded hotels

Once upon a time, branded hotels were the playgrounds of five-star luxury. Armani’s hotels in Dubai and Milan and Bulgari’s chic properties in Bali and London were the beginning. But now, branded hotels are popping up in more accessible price ranges, working with fast-growing consumer brands. And honestly, it makes perfect sense. Think about it: Would you rather crash at a no-name four-star hotel or a Patagonia or Nike Hotel? — David Kijlstra

Branded hotels are evolving. While luxury brands like Louis Vuitton continue the trend with new properties in Paris, there are more accessible brands from other industries like Maisons Du Monde, Hello Kitty, FILA (in collaboration with Hyatt), ELLE, Muji, and IKEA entering the hotel market. The Wim Hof Hotel, created by the ‘Ice Man’ himself, is a prime example of how even a personal brand can evolve into a hospitality offering.

As David Kijlstra highlights, hospitality offers great potential for brands with large followings. He suggests cycling-themed hotels from brands like Rapha or MAAP or car-branded hotels that immerse guests in the brand’s world. As hotels look to target niche markets, these partnerships provide a unique way to stand out and strengthen brand loyalty by aligning with guests’ values, hobbies, and lifestyles.

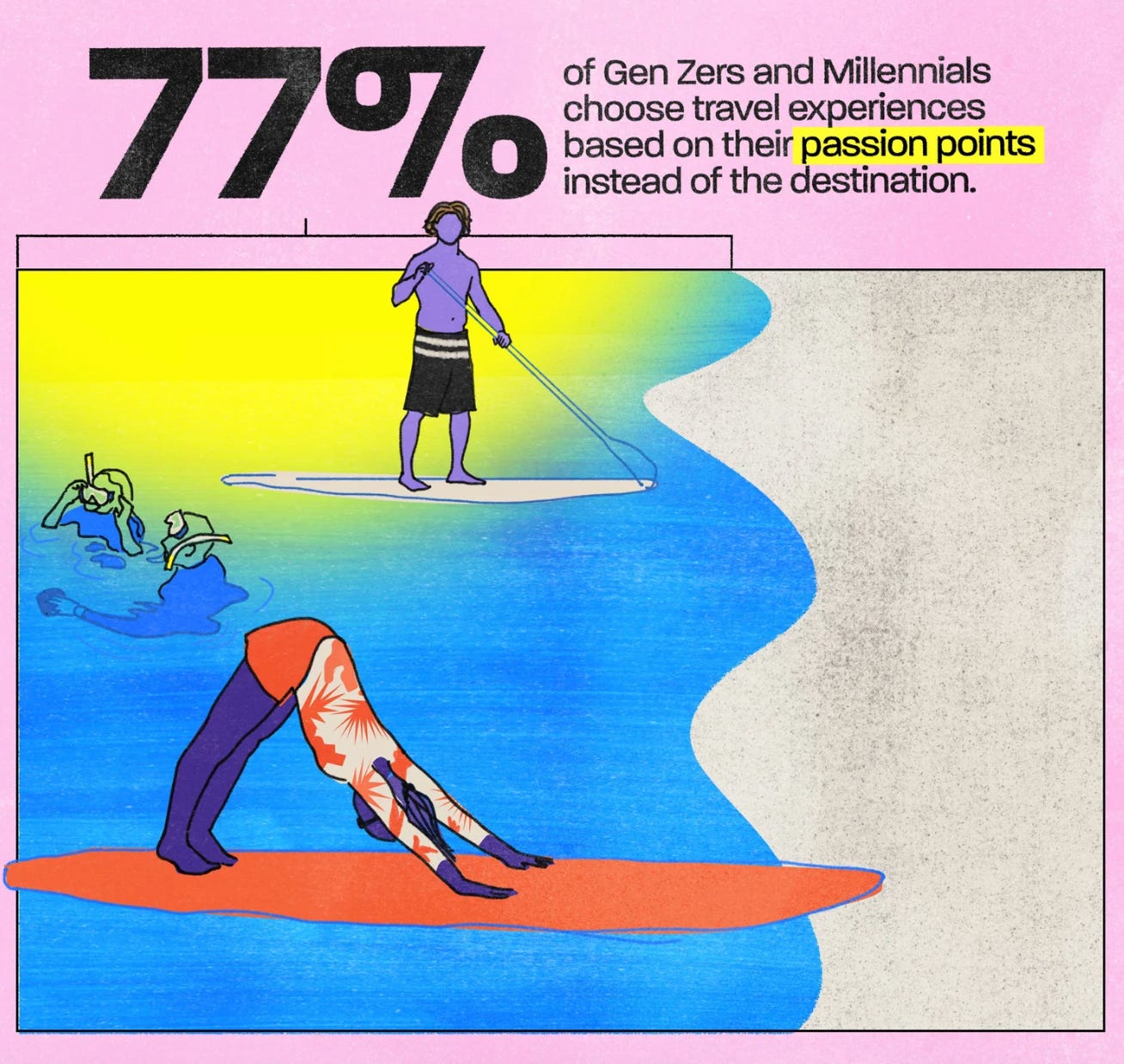

2. Passion travel

A Thrillist survey of 2000 adults shows that for Gen Z and Millennials, travel is a core part of their identity. 72% say traveling is core to their identity and part of how they express themselves. These travelers prioritize unique, off-the-beaten-path destinations, with 84% seeking such experiences. Travel is a financial priority for 89% of Gen Z and 87% of Millennials, who are willing to spend more to get exactly what they want. ‘Passion travel’ is the future, with 77% choosing trips based on their personal interests. Of the travelers surveyed who plan to book a flight in the next year, 63% say they will plan and purchase activities before buying a plane ticket. Read + Thrillist.

3. Reviving Selina

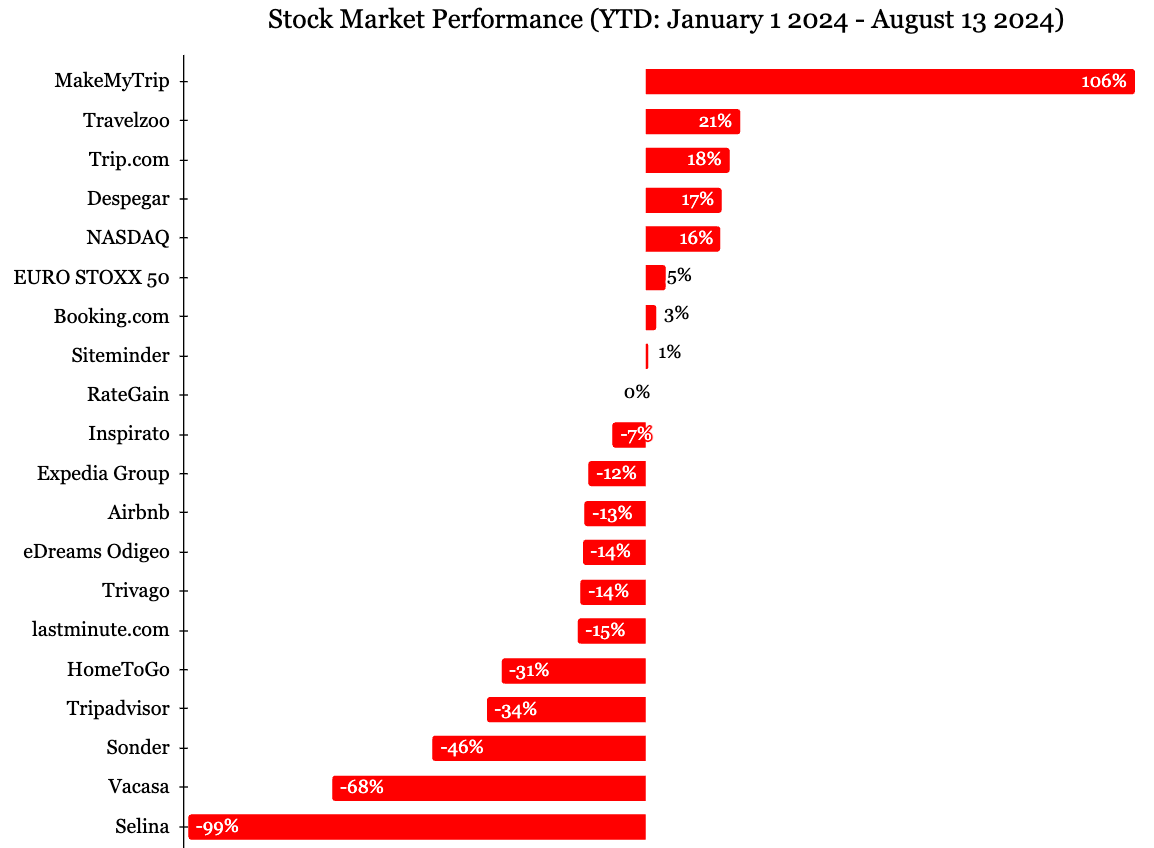

Selina had a market cap of $1.2 billion when it was listed on the Nasdaq in 2022, but it is now worth $547,000 after losing 99% of its value.

Peter Fabor believes the brand can be saved with a few radical changes. Here’s his plan:

-

Prioritize guest experience: Close or outsource non-lodging services and categorize locations for specific guest types.

-

Eliminate non-core locations: Focus on beach, nature, and lifestyle locations; close US city sites and downsize in Israel, concentrating on Central/South America and Portugal.

-

Get rid of proprietary tech: Use existing hotel software like Mews or Apaleo for better, faster, and cheaper automation and revenue management.

-

Revenue management: Shift from direct bookings to a strategy centered on GOPPAR, and build partnerships for niche markets like company offsites and weddings.

-

Go remote-first: Transition to a remote-first company with a leadership team focused on hospitality and unit economics.

4. Fintech + Travel

Fintech companies are increasingly integrating into the travel industry, driven by partnerships, acquisitions, and new offerings that enhance the travel experience. Here are a few developments recently highlighted in a PhocusWire article:

-

Revolut introduced free payment cards via vending machines at major European airports, reinforcing its strategy to accompany customers everywhere.

-

SMCC and Hopper partnered to launch a travel loyalty portal in Japan, following Hopper’s similar collaboration with Nubank in Brazil.

-

Klarna expanded its partnerships with Expedia and Cathay Pacific, resulting in a doubling of airline sales and a six-fold increase in travel agency partnerships from April 2022 to March 2023 compared to the same period the following year.

-

JP Morgan Chase acquired Frosch, Valerie Wilson Travel, and cxLoyalty to target affluent consumers, achieving $10 billion in booked travel volume in 2023.

-

Capital One revamped its travel portal, powered by Hopper, and acquired digital concierge Velocity Black.

5. Hopper expands its B2B business to power banks and credit cards

Hopper is accelerating the growth of its Hopper Technology Solutions (HTS) platform to create ‘a new space in travel’ through partnerships with banks and credit cards worldwide. According to co-founder Dakota Smith, HTS now accounts for 66% of Hopper’s total revenue and is the primary driver of international income as the company shifts focus from its consumer app to B2B solutions. With partnerships already established in the US, Brazil, Australia, Japan, and South Korea, Hopper has identified up to 30 additional target markets, including Mexico, Canada, and countries across Asia, Europe, and the Middle East, for further expansion. Read + WiT

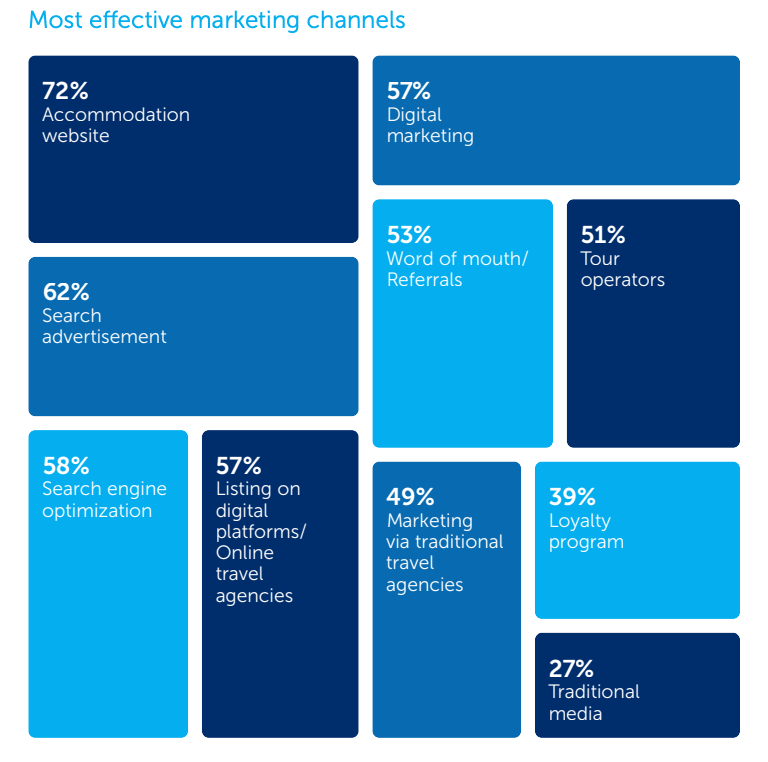

6. The role of digital platforms in US accommodations

The inaugural US Accommodation Barometer, published by Booking.com and Statista, shows a strong outlook for American hotels, with two-thirds of businesses reporting positive sentiment and a strong interest in investment. Some of the results of their survey include:

-

66% of independent lodgings using OTAs agree or strongly agree that they them compete with chain-affiliated hotels.

-

77% of properties report increased bookings by listing on online travel agencies.

-

The vast majority of US lodgings leverage OTAs to drive bookings: 56% are listed on two or more platforms, 31% use a single platform, and only 13% do not utilize these platforms at all.

-

The survey shows that 72% of U.S. lodgings find their own website to be the most effective marketing channel, while only 27% see traditional media as effective. Online Travel Agencies are also valued, with 57% endorsing their effectiveness.

7. Anders Mogensen’s summer travel reflection: from slow travel to slowing down

Anders Mogensen is a serial entrepreneur turned investor, leading Founderment, an early-stage VC firm based in Denmark. He wrote an insightful post on the growing trend of “Slow Travel” as he experienced it in his recent summer family vacation. He discovered the joys of unplugging during a slow boat cruise on the Mekong River in Laos and is happy to see companies like Byway tapping into this trend. From slow travel to slowing down, Anders is excited about platforms like Raus and Landfolk, which offer unique boutique escapes for those looking to disconnect. He also notes the resurgence of personalized travel services among younger generations seeking tailored experiences. Anders also highlights how innovative partnerships are reshaping the travel industry. Companies increasingly focus on building direct customer relationships and offering more integrated, valuable experiences through these collaborations. He analyzes five key partnerships that exemplify this trend. Read +.

8. Gen AI is moving from thought to action

In Why Agents Are the Next Frontier of Generative AI, McKinsey highlights how Gen AI is evolving into AI-enabled ‘agents’ acting as virtual coworkers that use foundation models to execute complex, multistep workflows such as planning and booking a complex personalized travel itinerary. By using everyday language, an engineer could describe a new software feature to a programmer agent, which would then code, test, iterate, and deploy the tool it helped create.

9. YTD performance for travel stocks

10. Fundraising and announcements

-

FLYR raised $225 million in Series D and $70 million in debt, bringing total funding to over $500 million. The round, which valued FLYR at $900 million, was led by WestCap with participation from BlackRock, Streamlined Ventures, and Abu Dhabi Investment Authority.

-

Landfolk raised a €10.3 million Series A round. The Danish startup was founded in 2021 by a group of co-founders who all previously worked together at Airbnb., It has 3000 handpicked premium holiday homes and has expanded from Denmark into Norway, Germany, and Sweden.

-

Wizz Air, Europe’s seventh-largest airline, has launched Europe’s first all-you-can-fly subscription, offering unlimited flights across its network. In partnership with subscription specialist Caravelo, the program costs €499 annually (rising to €599 soon) and allows subscribers to book flights within 72 hours of departure.

2025 Travel Tech Essentialist Newsletter Sponsorship Opportunities

I’m opening up newsletter sponsorship opportunities for 2025. If you’re interested in reaching a focused audience of travel tech professionals, please fill out this form. These spots usually sell out months in advance, so I recommend acting soon if you’re interested.

Are you fundraising?

If you are a startup looking to raise a round (from pre-seed to Series D), I can help (for free). Travel Investor Network is a private platform where I recommend innovative travel startups to investors and innovators. If you’re interested, please start by completing this form.

Travel Tech Essentialist Job Board

Explore the 1370 open positions on Travel Tech Essentialist’s curated Job Board and stay ahead of the curve by subscribing to job alerts. Here’s a taste of the jobs on the board:

-

Fora | Senior Product Designer | New York | $160,000 – $180,000 + equity

-

Stay22 | Product Marketing Manager | Montreal

-

The Hotels Network | Senior SaaS Business/Data Analyst | Barcelona

-

Fora | Senior AI Engineer | New York | $150,000 – $185,000 + equity

→ Join the Talent Network. Hiring companies sometimes ask me to help them find the best talent. If you want me to have you on my radar to introduce you to the right opportunities, join the new Talent Network (it takes 3 minutes).

→ If you’re contemplating a career move, simply curious, or an HR professional seeking job insights, subscribe to my Travel Tech Jobs newsletter.

If you like Travel Tech Essentialist, please consider sharing it with your friends or colleagues. If you’re not yet subscribed, you can do so here:

And, as always, thanks for trusting me with your inbox.

Mauricio Prieto