The rich get richer and the poor get poorer. It’s a bit reductive to employ the aphorism to describe the current state of the hotel industry, sure, but it’s not far off.

Lodging companies, to a man, made it clear that there is a slow down in performance at the lower ends of the hotel market, as travelers pull back some of their travel spend. Chris Nassetta, president and CEO of Hilton, crystallized it during his company’s second-quarter earnings call, stating, “Checking accounts were full of money coming out of COVID. Well, they’ve spent all that money and now they’re borrowing more. They have less disposable income and capacity to do [things], including travel.”

The divergence with those who have more and those who have less was made further clear by Nassetta. At the upper end, he said people still have “pretty fat bank accounts.”

His travel conclusion: “It’s just soft.”

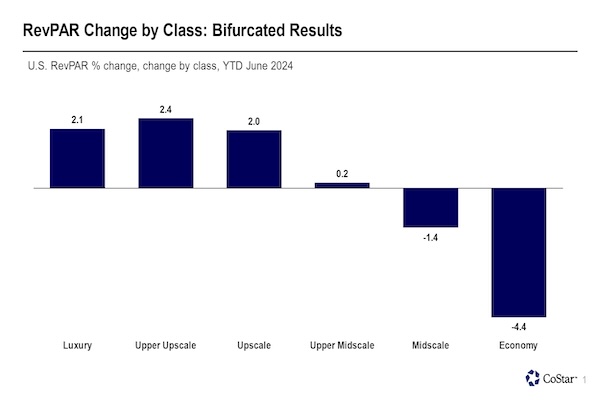

Others who study the vacillations within the hotel industry are seeing data that backs up Nassetta’s divergence claim. “We’re using this term bifurcation to encapsulate what’s going on in the U.S. hotel industry today,” said Jan Freitag, national director, hospitality market analytics, CoStar Group. “The luxury and upper-upscale-type properties are seeing robust growth versus the economy-type properties seeing a deceleration in demand and RevPAR.”

According to CoStar data, luxury RevPAR year-to-date June 2024 is up 2.1% while economy RevPAR year-to-date June 2024 is down 4.4%.

Geoff Ballotti, president and CEO of Wyndham Hotels & Resorts, whose brands, such as Days Inn and Super8, skew heavy in the economy segment, remains rosy despite the less-than-auspicious numbers. “We believe that the current RevPAR environment is transitory in nature despite the occasional downturn,” he said during his company’s Q2 earnings call with analysts, adding that since 2000, and through four lodging cycles, U.S. RevPAR for the select-service segments has grown at a 2.6% compounded annual gross rate.

But demand has been slowing in the economy segment for some time now. In June, CoStar projected RevPAR growth of 2% for 2024 and 2.6% for 2025 across all chain scales, but in the midscale and economy segments, it forecasted negative RevPAR growth of -1.2% and -3%, respectively.

“This idea of the lower-end consumer thinking long and hard about the trip and maybe not taking the trip is concerning if you’re on the economy side, because we’ve been seeing demand deceleration for quite a while now,” Freitag said. Performance within the travel industry is heavily predicated on the whims of the overall economy. Persistent inflation has resulted in higher grocery prices, higher rents, higher insurance, which, as Freitag pointed out, “eats into the non-discretionary budget and travel is clearly discretionary.”

Sky-high credit-card debt is another culprit that is keeping travel down. Overall credit card debt in the U.S. now sits at $1.14 trillion, according to a recent Household Debt and Credit report from the Federal Reserve Bank of New York’s Center for Microeconomic Data.

The upper-end consumer, despite the occasional blip, still feels generally good about their position, allowing it to not cut into their travel plans. Home owners are still benefitting from higher housing prices and a stock market where the S&P 500 is up 15.3% this year through June. Meanwhile, TSA checkpoint travel numbers are at record levels having bested 2019 levels.

A strong dollar is enticing U.S. travelers to go abroad, which, conversely, means they aren’t spending money on hotels domestically. “I’m not sure when that’s going to fully reverse,” Freitag said, adding that it “looked like Americans had taken over Paris” during the just-wrapped Olympic Games.

Something most hotels are benefitting from is the solid return of group business. Marriott International President and CEO Tony Capuano made that clear on his company’s Q2 earnings call. The segment comprised 24% of worldwide room nights in the second quarter for Marriott and “remains the strongest customer segment,” Capuano said.

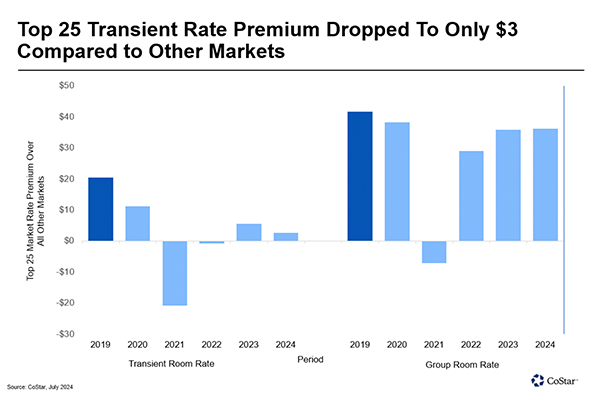

This was further elucidated in recent CoStar data that showed that group business in the top 25 U.S. markets had basically fully recovered from 2019 levels. It’s on the transient side that there is shortfall. Rooms sold in the top 25 markets typically achieve a higher average daily rate than rooms sold outside these large markets. Prior to the onset of the pandemic, full-service hotels in the largest markets, according to CoStar, registered a $20 transient ADR premium and a $42 group ADR premium compared to all other markets. These rates naturally dropped during the pandemic and the recovery has been uneven.

CoStar pointed out that over the course of the last few years, group has largely recovered its ADR premium to $36 through June. It’s a different story for the transient ADR premium: After two consecutive years when other markets showed a transient premium over the top 25 markets, the current premium of $3 is far off pre-pandemic levels. The current year’s premium is a contraction from the $6 achieved a year ago. CoStar further noted the significance of the collapse of the top 25 transient rate premium since transient demand has grown 1% from 2019. This contrasts with all other markets where transient demand grew by 11%.

“Clearly, you can make two arguments here,” Freitag said. “On the one hand, you could say that hoteliers in those markets are not as aggressive in their room-rate pricing and are building demand and occupancy, which then allows them to have more spend out of the room. On the other hand, it could be that transient travelers, especially on the leisure side, are still choosing other locations outside of the top 25 markets.”

One element that is aiding hotels up and down the chain scales and a harbinger of stronger pricing power is the dearth of new hotel supply. A normal per annum new supply rate is around 2%; it’s around 0.6% currently, a result of higher interest rates and the attendant higher cost of capital that is keeping new, ground-up construction at bay.

That could change, but will take multiple quarters of absorption. Lodging Econometrics noted there are 6,095 projects with 713,151 rooms in the pipeline as of Q2, a new all-time high that represents a 9% YOY increase in projects and an 8% YOY increase in rooms compared to Q2 2023 totals. How many of these projects actually get to the finish line and open remains to be seen.