During the pandemic, residential and commercial property prices in the central business districts (CBDs) of large metropolitan areas (MSAs) declined while prices generally increased in suburban areas. Many businesses located in CBDs that were dependent on residents, commuters and tourists either ceased operations or relocated to the suburbs, often within the same MSA.

Despite the reports of business closures and relocations away from the centers of large U.S. cities, hard empirical evidence is scarce regarding CBD business conditions before and after the office occupancy weakness caused by work-from-home policies and an increase in frequency of headlines about retail crimes.

Hotels, restaurants, bars and retail stores comprise most of the current downtown business activity. For hotels, the CBD submarket has long been the most important MSA lodging submarket, due to strong demand from business travel and tourism in these areas. The pressures on both these demand segments since 2020 have likely affected CBD hotel performance more negatively than suburban hotels.

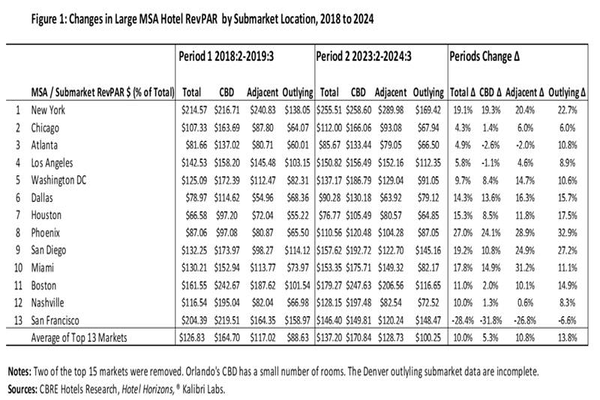

Data from CBRE Hotels Research and Kalibri Labs allowed for a comparative analysis of hotel financial performance before and after the pandemic in CBD submarkets, adjacent submarkets and outlying submarkets of large MSAs. The findings indicate that CBD submarket RevPAR weakened relative to non-central city submarkets in more than one-half of the MSAs studied, likely due to relocations of economic activity.

The study divided the past six years into two periods: pre-pandemic (Q2 2018–Q3 2019) and post-pandemic (Q2 2023–Q3 2024). The three years between 2020 and 2022 were intentionally left out to avoid capturing temporary hotel closures during that time. The RevPAR averages of quarterly data during the two periods are utilized to account for seasonal variation.

The average number of hotel rooms across the sample of 13 MSAs is well-balanced among the three submarket location types at about 30% each. However, in some MSAs, the percentage of all hotels in the CBD submarket exceeds 50% (New York, Chicago, Miami and San Francisco) while in others, this is less than 20% (Atlanta, Los Angeles, Dallas, Houston and Phoenix).

Inflation, which rose more than 20% between 2018 and 2024, influenced nominal RevPAR changes across the board, but suburban markets have shown a clear edge.

Figure 1 presents findings from comparing submarket RevPAR performance in the 13 MSAs from Period 1 to Period 2.

The following observations come from an examination of the far-right section of the figure:

- The average submarket RevPAR changes for 13 MSAs are CBD = 5.3%, Adjacent = 10.8% and Outlying = 13.8%.

- All MSAs except San Francisco experienced RevPAR growth across all or most submarkets (recall these are nominal dollars after several years of rapid inflation).

- In Dallas, New York and Phoenix, RevPAR growth was comparable in all three submarkets.

- In Atlanta, Los Angeles and San Francisco, CBD submarket RevPAR change was negative.

- In five of the 13 MSAs (Boston, Chicago, Houston, San Diego and Washington, D.C.), the CBD submarket RevPAR grew, but by considerably less than adjacent and outlying submarkets.

- In two MSAs, Miami and Nashville, the CBD submarket outperformed either the adjacent or outlying submarket.

These findings point to a shift in economic activity and traveler preferences, reshaping demand in favor of suburban markets. The hotel markets in large American cities were not spared from the geographic adjustments of businesses and households during the pandemic period. RevPAR in the CBD submarket remained the highest in absolute terms but underperformed relative to adjacent and outlying submarkets. In most MSAs studied, the CBD submarket RevPAR was negative or slightly positive, while the other submarkets experienced substantial growth.

Whether these trends continue throughout this decade depends on several factors, including the policies of CBD businesses limiting remote work becoming more widespread and effective measures taken to ensure safe working, living and tourism environments. The only question left is how—and when—the CBD comeback will unfold?

This piece was contributed by Jack Corgel, Ph.D., CBRE consultant.

This article is part of a series of research reports called Hotel Currents.

Acknowledgement: Hogan McDade, who provided assistance in the preparation of this article.