The human element is reshaping tech leadership, with personal brands outperforming corporate messaging and tech CEOs leading from the front,. Travel executives though, are falling behind this trend (with one notable exception). In other news, AGC Partners shared with me an early version of their 2024 travel M&A and valuation report, and I’m highlighting some key findings in this edition.

Thanks to Propellic for sponsoring this edition of the newsletter:

Still planning your 2025 travel marketing strategy? Check out Propellic’s Five Key Principles for Effective Travel Marketing:

1. Prioritize bookings as the ultimate measure of success.

2. Target the right traveler segments for better engagement.

3. Align campaigns with each stage of traveler intent.

4. Build resilience with diversified, integrated channels.

5. Optimize performance-driven creative to boost conversions.If you’re looking to refine your approach and drive real results, this is worth a read.

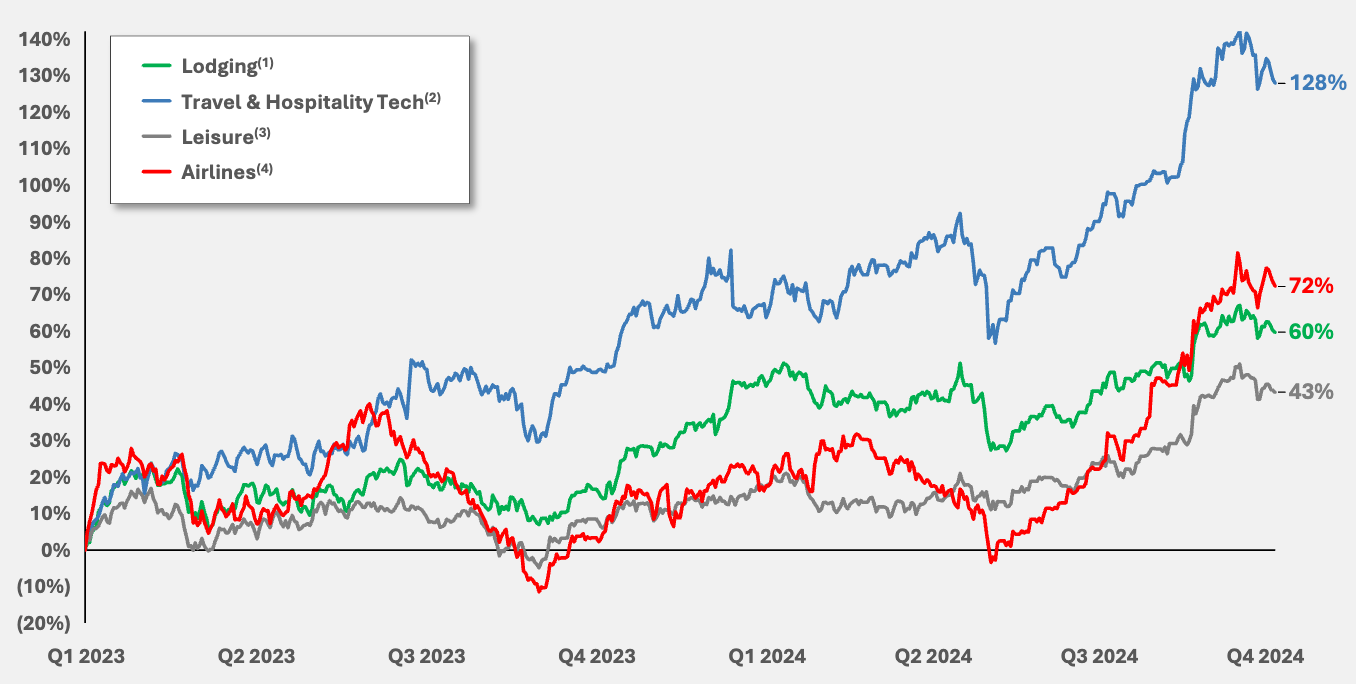

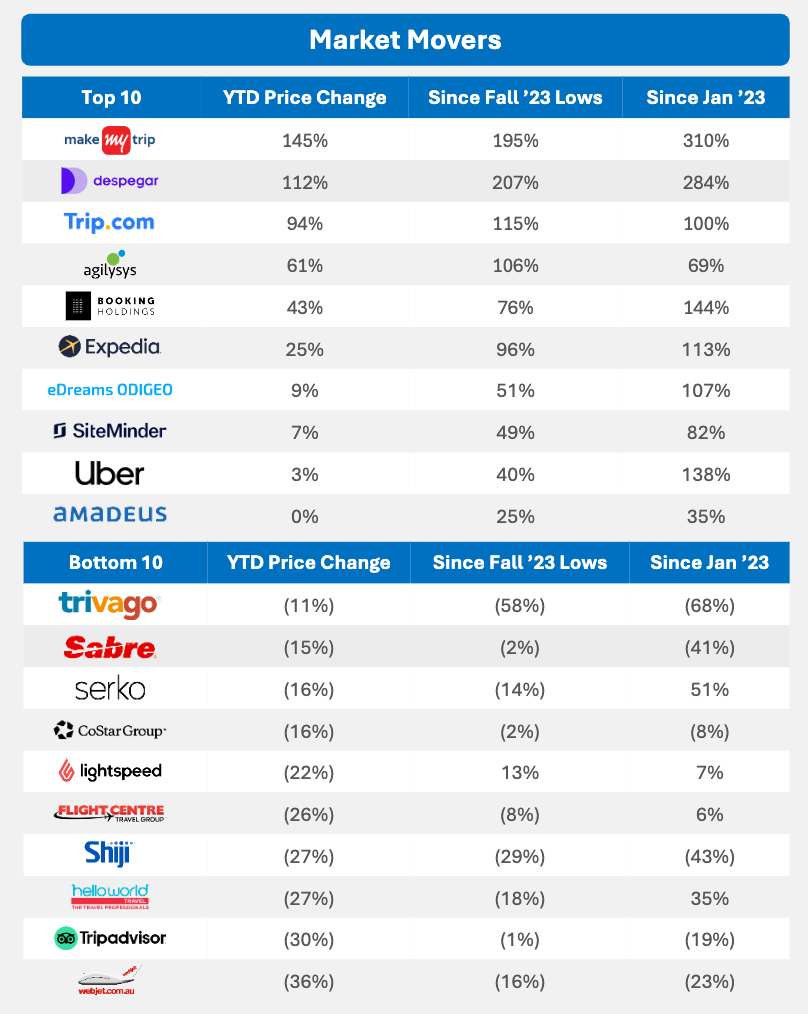

1. Travel Tech is firing on all cylinders

Since 2023, travel and hospitality tech shares have risen significantly, with OTAs and transactional businesses leading the way as investors bet on continued strong travel demand.

(This and the next few stories are based on the recently updated AGC Partners Travel & Hospitality Tech Market Report.)

2. Flight to high-quality cash flow and growth

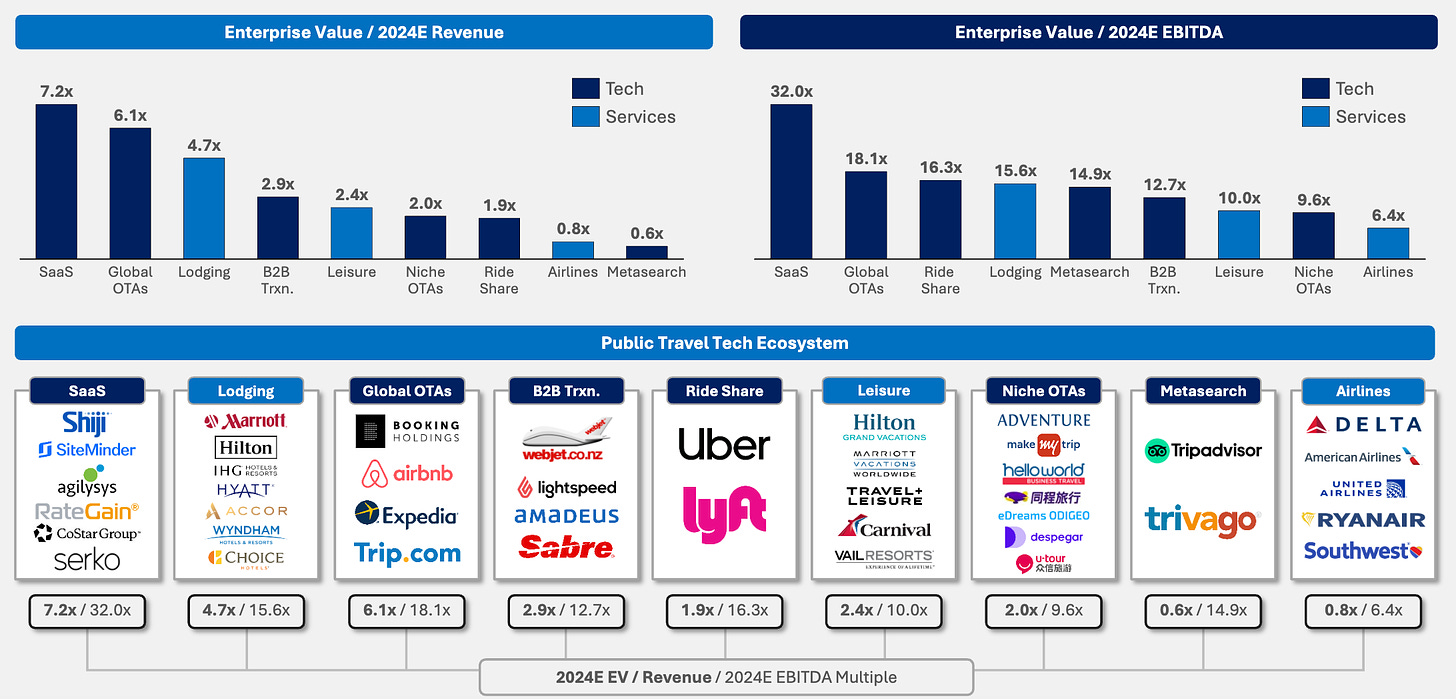

Public market investors are laser-focused on high-quality cash flow and growth.

For detailed multiples and financials on 45 travel companies across travel sectors (SaaS, global OTAs, metasearches, regional OTAs, B2B transactional, lodging, airlines, and corporate travel) refer to pages 25-27 of the AGC Partners report.

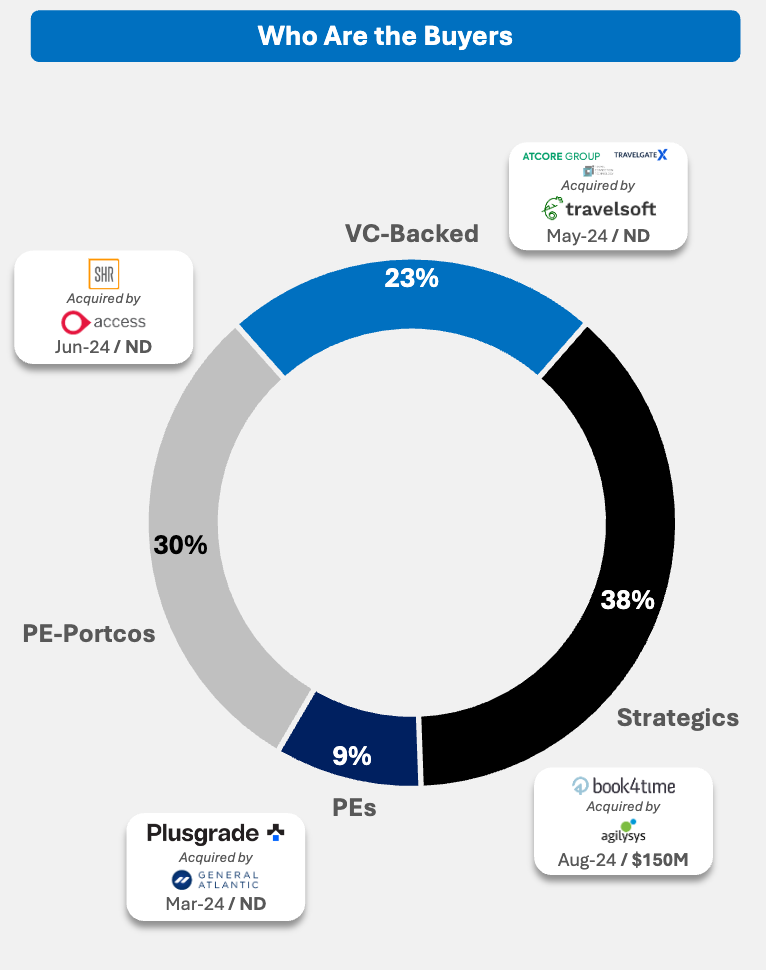

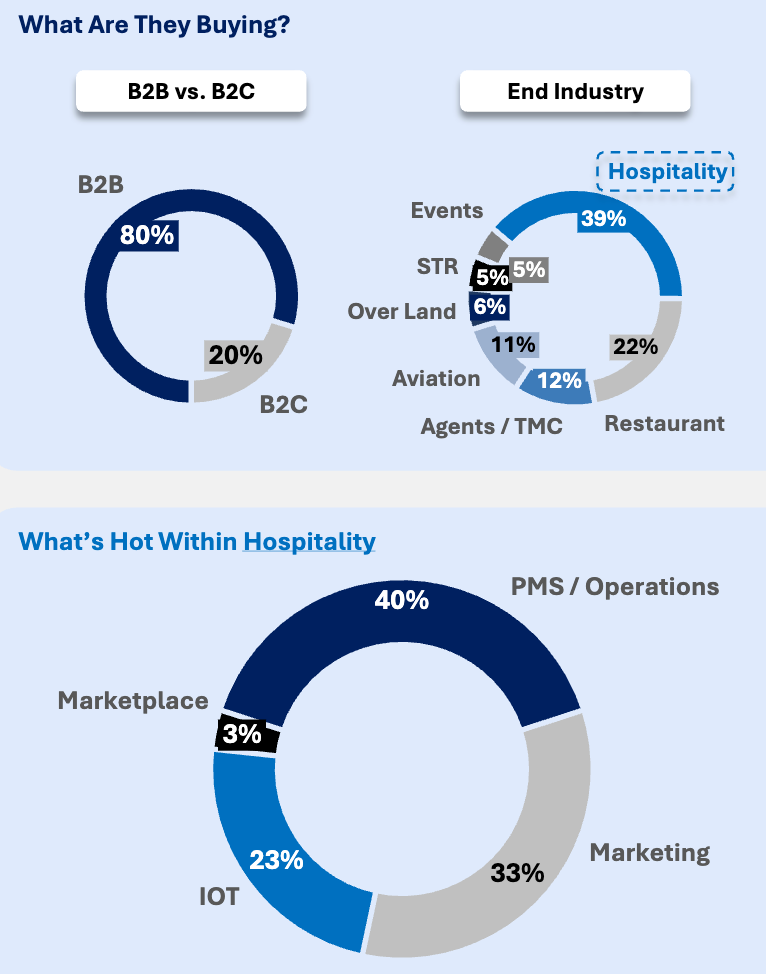

3. B2B and Hospitality are the hottest M&A targets

Hospitality commanded 39% of the Travel M&A market in 2024, with PMS/Operations as the hottest segment within hospitality, followed by Marketing.

4. Who’s buying?

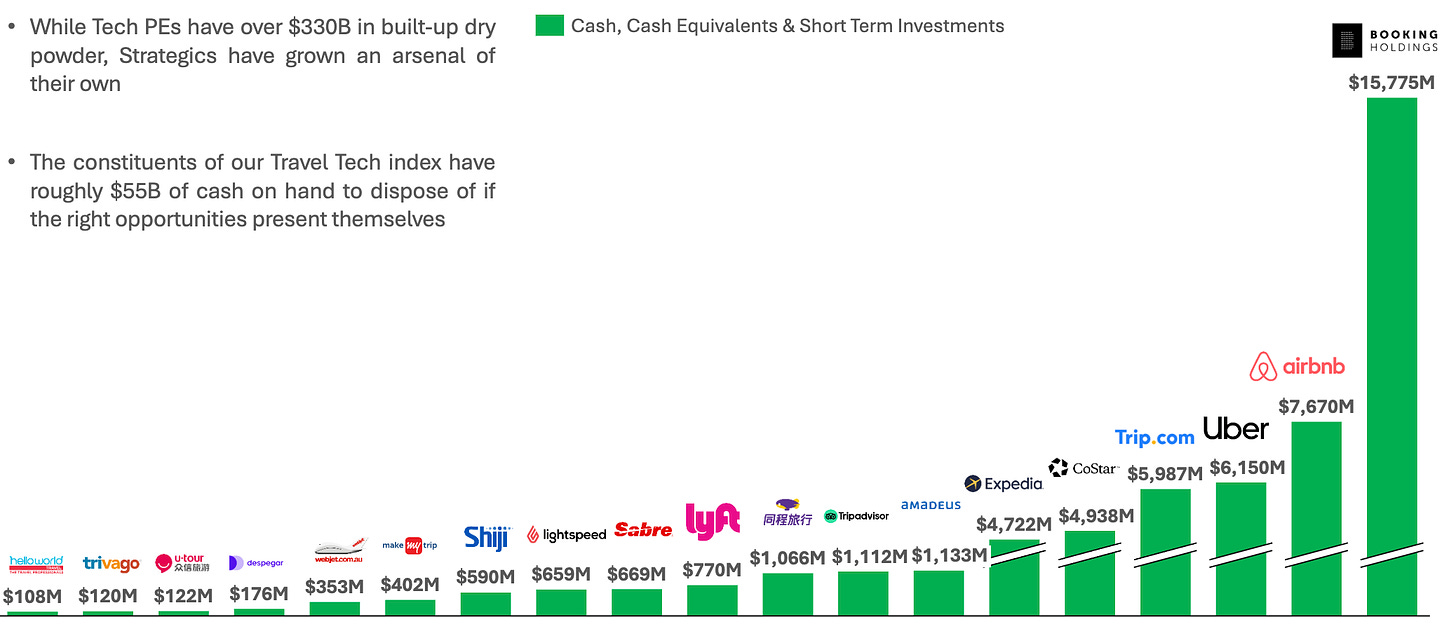

Many publicly traded travel companies hold over a billion dollars in cash, yet they have completed only 58 deals since COVID, with strategic buyers making up just 38% of 2024 acquisitions.

The AGC Partners report lists the 30 most active buyers, including strategic players like HomeToGo, Holidu, and Amex, and VC firms such as Highgate, Thayer Ventures, and Andreessen Horowitz. For full details, see pages 23-24 of the report.

5. People are the new brands

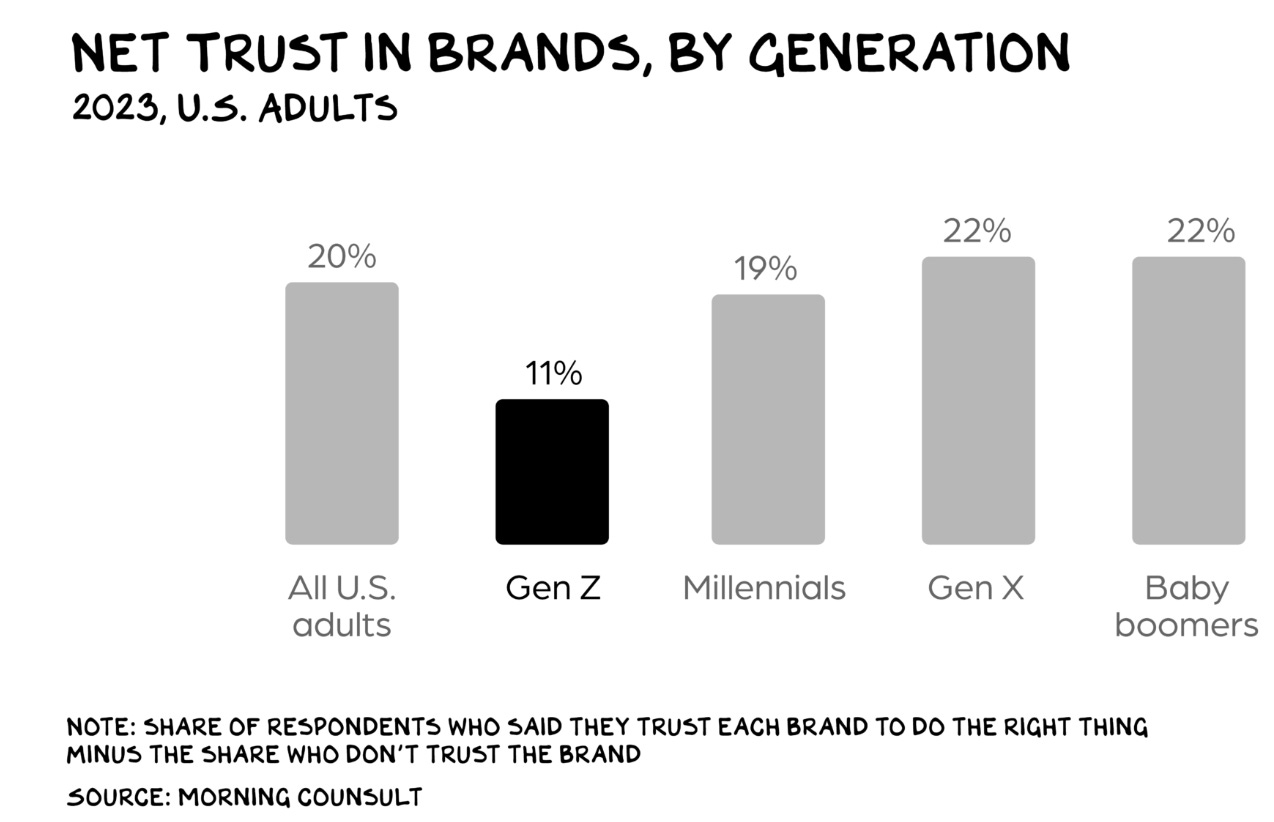

Ed Elson from Prof G Markets highlights a pivotal shift in consumer behavior: we crave human connection over corporate messaging. With Gen Z spending 109 days yearly on screens and 12% of Americans reporting zero close friends (up from 3% in 1990), we’re seeing the rise of ‘parasocial’ relationships. Content creators like MrBeast got more than 1 billion hours of viewing time last year, more than any of the top shows on Netflix, while Joe Rogan’s podcast draws 3x more viewers than CNN and MSNBC’s primetime combined.

From Elon Musk pioneering zero-ad Tesla marketing to Mark Zuckerberg’s MMA journey, tech leaders are becoming their companies’ faces because audiences trust people, not logos. Read +.

When we reflect on the winners and losers in 2024, we will bucket them into two categories: those who capitalized on loneliness and those who didn’t. We’ll realize that, in this society of lonely people, we find a lot more to love in a person than a brand.

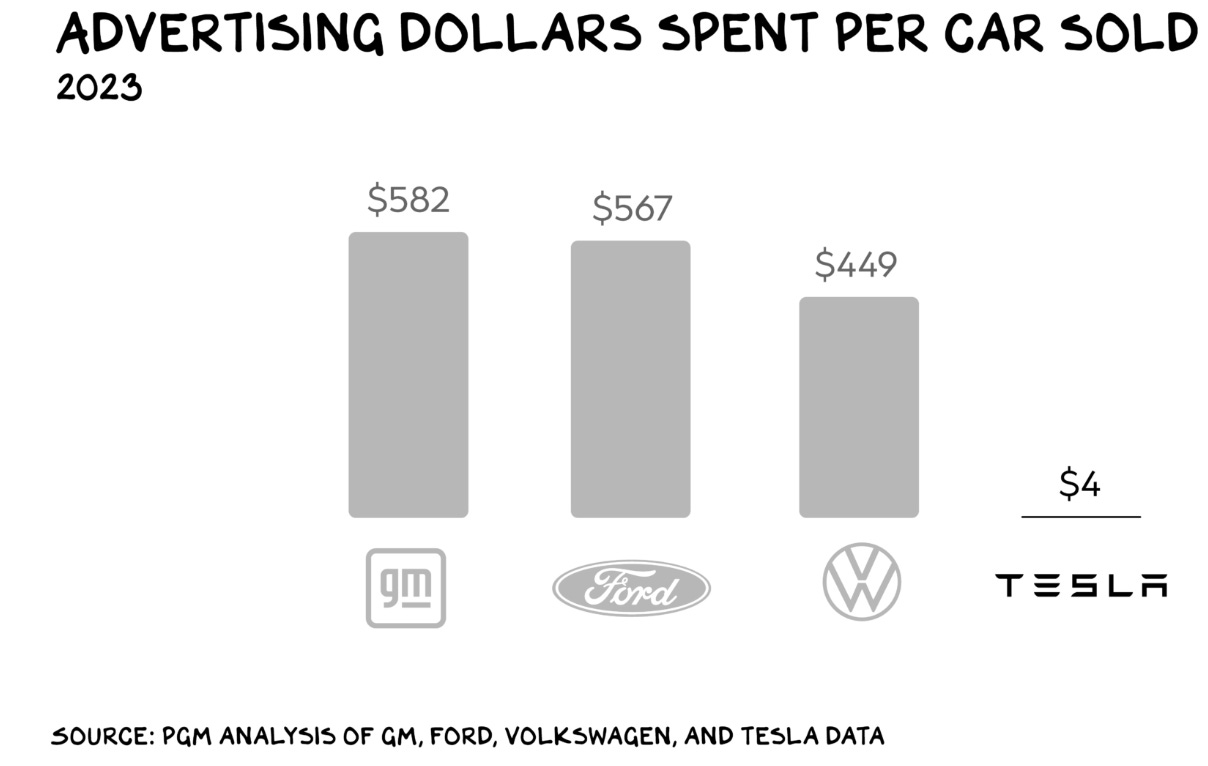

The corporate world has started to wake up to the power of the person, but the movement was started years ago by Elon Musk. From the beginning, Musk knew he was Tesla’s greatest commercial. This is why the company never ran ads…People wonder how Tesla commands a valuation premium 10x greater than its peers while spending only four ad dollars per vehicle sold. The answer is Elon Musk. — Ed Elson

6. Tech leaders go personal

I read an interesting post by Omri Barak about how personal branding is reshaping tech communication. Major tech announcements are increasingly coming directly from CEOs’ personal social accounts rather than corporate channels. For example, Microsoft’s Satya Nadella showcased GitHub updates on LinkedIn (wearing a hoodie); Instagram’s Adam Mosseri introduced Movie Gen to his 2.8M Instagram followers; OpenAI’s Sam Altman also shared 12 announcements in just two weeks via his personal Twitter account.

Other tech leaders have followed suit, with Mark Zuckerberg evolving from his signature gray t-shirts to sharing MMA training and Meta updates on his personal platforms.

The playbook for entrepreneurs and founders is clear: if you’re not personally connecting with your audience, you’re missing out. As tech leaders have shown, your face can be your company’s most powerful brand.

7. Travel CEOs are missing out

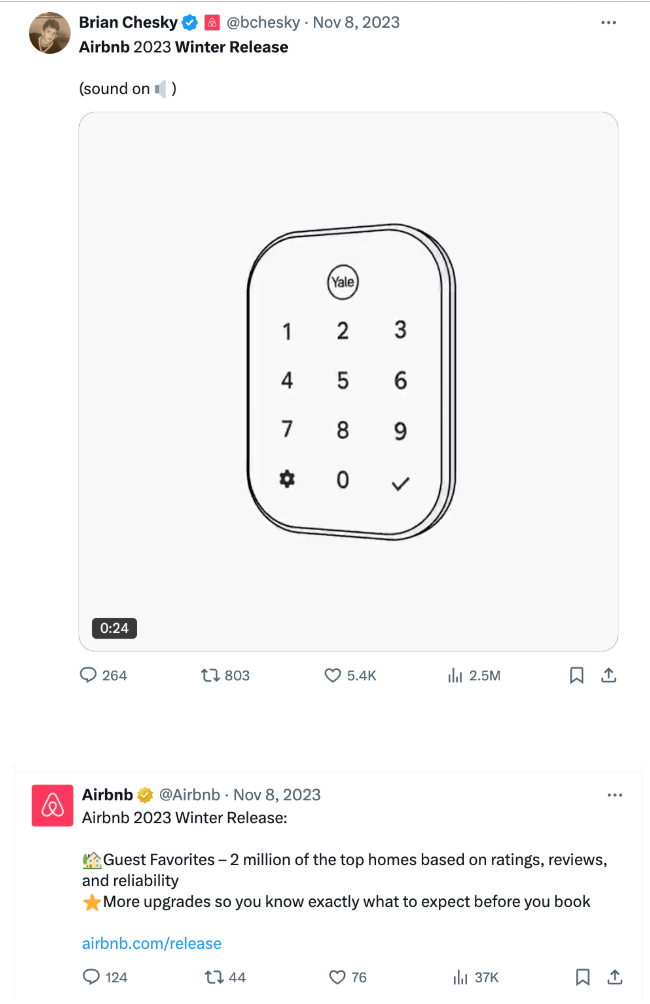

While tech leaders are leveraging their personal brands, most publicly traded travel industry CEOs remain notably absent from social media. The exception is Airbnb’s Brian Chesky, whose active presence on Twitter (630k followers) and Instagram (116k followers) has proven highly effective, with his personal posts about Airbnb generating millions of impressions compared to tens of thousands on the Airbnb corporate accounts.

Chesky’s success signals that a strong executive social media presence can complement and amplify a company’s marketing efforts, potentially leading to increased brand awareness and customer loyalty. Travel CEOs have a clear opportunity to amplify their brand by building an authentic presence on social media.

8. The DMA plays favorites

According to Simone Puorto, the EU’s Digital Markets Act (DMA) is creating an unexpected imbalance in travel distribution. Google’s strict compliance has led to the removal of key features like hotel maps and flight information, resulting in a 30% drop in direct booking clicks for hotels. Meanwhile, Simone notes that Booking.com has implemented only surface-level changes while maintaining practices that limit hoteliers’ independence.

Google’s recent tests in Germany, Belgium, and Estonia showed removing hotel features led to a 10%+ traffic drop for European hotels and increased user frustration, while barely impacting OTA traffic. This appears to be a case of regulatory capture; regulations supposedly meant to create fair competition have instead strengthened OTAs’ position while making it harder for hotels to reach customers directly.

The outcome may not be entirely accidental. Booking.com, headquartered in Amsterdam, represents one of Europe’s few major tech successes. With strong lobbying presence in Brussels and alignment with EU interests in building European tech champions to counter US dominance, the DMA’s uneven impact on Google versus Booking.com might reflect political priorities more than competitive concerns.

9. Turkey’s hair tourism: a case study in service specialization

Turkey has quietly become the global capital of hair transplants, capturing a significant slice of a growing $1.9B medical tourism market. Over 500 clinics in Istanbul alone combine medical expertise with luxury hospitality, offering procedures at $3-4K compared to $10K+ in Beverly Hills or Manhattan.

The success formula combines several elements: skilled doctors, competitive pricing (8x more clinics per capita than the US), and smart packaging – procedures often include stays at high-end hotels and concierge service. The results are impressive: 1.1 million medical tourists visited Turkey in Q3 2024 alone.

This demonstrates how countries can dominate specific service niches by building ecosystems that combine technical expertise, cost advantage, and premium customer experience. It also reminds us that consumers will travel far for the right combination of quality and value, even for elective procedures. Read +.

10. Travel Tech Essentialist Job Board

In the last 12 months of the Travel Tech Job Board…

Top 5 searches by location

– Remote

– Barcelona

– London

– Amsterdam

– New York

Top 5 jobs applied for

– Travel Collection | Country General Manager

– Flyr | Product Manager

– Propellic | Director of Business Development

– WeTravel | Account Executive

– Xeni | Content Writer

Top 5 job functions

– Sales & Business Development

– Marketing & Communications

– Product

– Operations

– Engineering

→ Explore all 1,025 open travel tech roles on the Travel Tech Essentialist Job Board now.

-

Oversee | Revenue Operations Manager | Krakow, Poland

-

Flight Centre Travel Group | Scott Dunn – Senior Vice President, Luxury Travel | New York, NY | $220,000 – $240,000

-

Travel Collection | Head of Business Development | Remote | $110,000 – $130,000

-

Expedia | Director, Expedia Brand Analytics | Austin; Seattle | $224,000 – $358,500

-

AirHelp | Senior Data Analyst | Warsaw, Poland

📩 For monthly updates on the latest roles, subscribe to the Travel Tech Jobs newsletter

💼 Employers: If you want to list your jobs here, complete this quick form

2025 Travel Tech Essentialist Newsletter Sponsorship Opportunities

Reach a focused audience of travel tech professionals by sponsoring the Travel Tech Essentialist newsletter. If you’re interested, please complete this form to learn more.

Are you fundraising?

If you are a startup looking to raise a round (from pre-seed to Series D), I can help (for free). Travel Investor Network is a private platform where I recommend innovative travel startups to investors and innovators. If you’re interested, please start by completing this form.

If you like Travel Tech Essentialist, please consider sharing it with your friends or colleagues. If you’re not yet subscribed, join us here:

And, as always, thanks for trusting me with your inbox.

Mauricio Prieto