8 out of 10 NA beverage drinkers also drink alcohol (Source: Nielsen IQ research report) meaning that they have a taste reference point. “NA wines on my menu are crisp, clean, and don’t mess with your palate or interfere with the meal by being too sugary,” Joseba Madina, owner of Catalan restaurant Gaig restaurant (which features on the Michelin Guide) shares that his regulars are surprised and impressed with the NA wines at his restaurant. He serves Noughty’s sparkling, white and red wine.

The Market Has Changed.

The alcohol-free market is expanding at an annual rate of 20%, while the broader alcohol industry experienced its slowest growth last year at just 0.3%. The global no- and low-alcohol sector is projected to reach US$36.6 billion by 2030, with alcohol-free beer dominating the category, holding over 60% of the market share.

The non-alcoholic wine segment, currently valued at US$52 million (Source: NielsenIQ research report), is growing at 23% year on year. Brands such as French Bloom and the UK’s Noughty, founded by Amanda Thomson—a wine expert with a Cordon Bleu diploma and extensive industry experience—are at the forefront of this expansion. Noughty offers six premium non-alcoholic wines, which are now featured on Michelin-starred menus worldwide.

Many well-known chefs are Noughty fans including Andrew Pern and Oscar Lorenzzi.

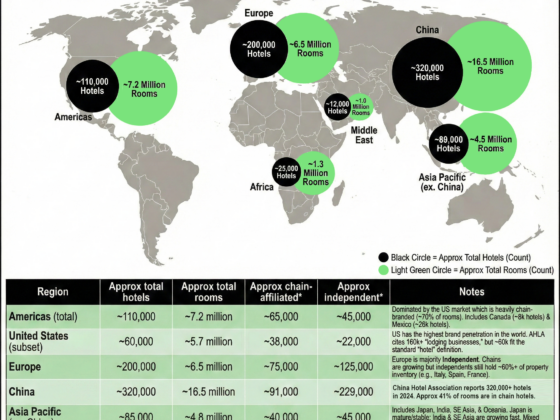

NA sparkling wines are most favoured while “red wines are hardest to re-create without alcohol because they lack full-body appeal once you remove the alcohol,” Emma from Free Spirit shares. Europe and the UK have historically been the largest NA markets, but the US is seeing a surge in nondrinkers and flexi-drinkers and is Noughty’s largest market.

Asia and Singapore are smaller NA markets, but Joseba of Gaig says he has seen a shift since 2021 and there is currently a much higher demand for NA drink options. Interestingly, NA wines are popular at business lunches.

The Consumer Has Changed.

There are many reasons why people choose to avoid alcohol—whether they are driving, pregnant or nursing, have medical or religious restrictions, are recovering from addiction, or simply looking to cut down. The rise of ‘flexi-drinking’ mirrors the growing popularity of flexitarian diets, with more consumers prioritising health and moderating alcohol intake.

In the UK, 55% of drinkers are actively reducing their alcohol consumption, a figure that continues to rise, particularly among Gen Z. One in three UK adults aged 18-24 abstains from alcohol entirely. Globally, 57% of consumers participated in Dry January and/or Sober October in 2023. Health concerns are also driving this shift. The upcoming 2025 US Surgeon General’s Advisory identifies alcohol consumption as a leading preventable cause of cancer, responsible for nearly 100,000 cases and approximately 20,000 deaths annually in the United States. In response, healthcare professionals are increasingly calling for mandatory health warnings on alcoholic beverages.

“Our consumers are a mix of abstainers, substituters, blenders, and triallers,” explains Amanda of Noughty. NA wine contains less than half the calories of regular wine. Noughty’s best-selling sparkling Chardonnay is just 14 calories a glass.

The Margins Have Changed.

Alcohol-free wine options are likely to be most effective when integrated into wine lists. Gaig offers Noughty’s wines by the glass as well as creating their own NA sangria.

“NA wines do well at events because when you pour a nice NA sparkling into a flute, no one feels excluded,” Joseba of Gaig shares. But when it comes to non-alcoholic options, Michelin-star restaurants tend to prefer cocktails and beers over NA wine. Chefs and mixologists lean toward creating culinary based NA drinks in-house. New York’s Eleven Madison Park even sells its zero-proof vermouth.

Many restaurants are hesitant to stock non-alcoholic (NA) wines due to high rents, limited storage space, and the challenge of ensuring opened bottles are consumed before spoilage—particularly when demand is still relatively low. However, this landscape is shifting. Ultimately, it falls to sommeliers and staff to recognise evolving consumer preferences and proactively recommend NA wines to the right guests at the right moment.

While bottled water offers strong profit margins, NA wines present an even greater financial opportunity. Amanda Thomson, founder of Noughty, is prioritising placement on ‘by the glass’ lists, believing that significant revenue is being overlooked.