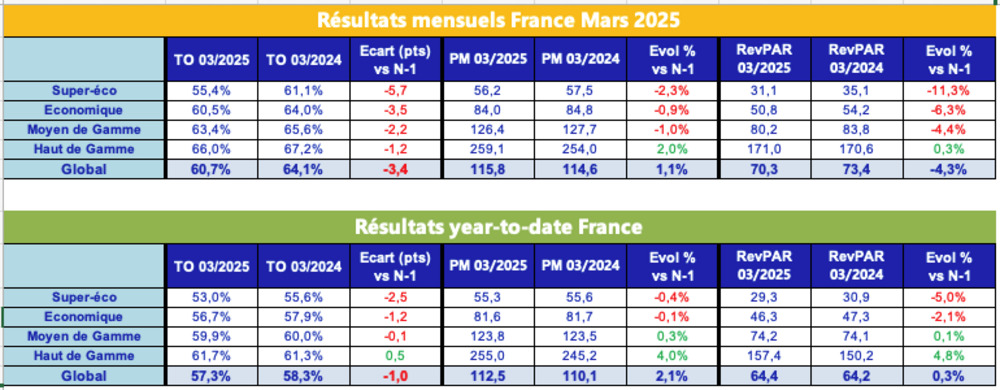

While the first few weeks of March saw a significant increase in visitor numbers, the last week of the month lacked the surge in numbers that would have sustained the improvement in the indicators.

As usual, the capital is not experiencing the same phenomenon, benefiting from a continuing strong influx of international customers, with American visitors leading the way.

The sluggish economic and social climate in France continues to have a major impact on the budget and economy hotel sectors, which are mainly dependent on domestic customers and the activity of industrial and construction companies. These segments in particular are suffering from a sharp fall in occupancy, while the higher categories are faring better.

The transfer of hotel nights to alternative forms of commercial accommodation, mainly short-term rentals, is noticeable year after year, and is reflected in double-digit growth in bookings on platforms used by private individuals.

Occupancy rates are generally quite high for the start of the year, and Fashion Week had its boosting effect on the upscale segment at the beginning of the month, to the great benefit of the Parisian upscale hotel industry, which again gained a few tenths of a occupation rate point and pushed its average daily rate a little higher.

All the regions are down, with one exception

But this is the only segment that is up, while the other categories, and above all almost all the other regional cities, are down to a greater or lesser extent, with the sole exception of Rennes in Brittany.

With the exception of Paris, which enjoys a privileged location, the Île-de-France region is seriously struggling as a result of a two-fold decline in occupancy and average daily rate in the budget categories, with double-digit plunges in RevPAR.

None of the regions managed to do better than…