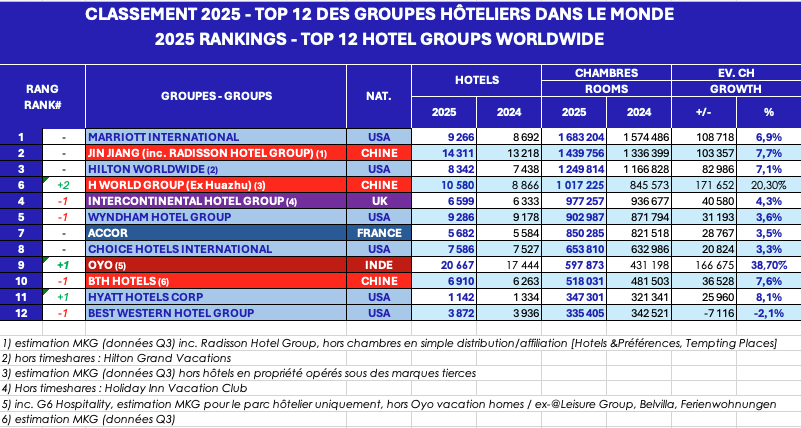

EXCLUSIVE – The global hotel group ranking published by MKG Consulting highlights significant progress made by the industry’s major players. The race for numerical growth remains as fierce as ever, pursued through organic expansion, acquisitions, and strategic partnerships.

Source MKG Consulting – Mai 2025Source: MKG Consulting – May 2025

The development pipelines are overflowing with projects for the next five years, with the clear objective of signing the highest number of deals with increasingly sought-after property owners, especially by asset-light brands.

Today’s leading groups aim to swiftly fill territorial gaps in their global footprint, balancing the risk of downturns across different continents. Certain regions have become focal points for development teams, such as India, Saudi Arabia, Southeast Asia, and Africa—raising the specter of future overcapacity that will need careful regulation.

A parallel objective is to offer owners a comprehensive brand portfolio, covering all segments, with a strong focus on lifestyle and extended stay offerings.

In the current market environment, upscale brands are drawing the most interest from investors—and consequently, the highest priority from franchisors.

A condensed review of a year of development among hospitality giants:

1. Marriott International – The Unchallenged Leader

In 2024, Marriott achieved major milestones in development, financial performance, and brand expansion, further cementing its position as the world’s leading hotel group. Active in 144 countries and territories, Marriott added over 123,000 gross rooms in 2024 and bolstered its pipeline, which will ultimately add one-third to its current inventory.

International markets, where 55% of upcoming projects are located (especially luxury brands), drove strong results—international RevPAR rose 7.2%, pushing global RevPAR up by 4.3%.

Notable strategic moves included:

- Entry into the affordable economy segment through the acquisition of Hoteles City Express, launching City Express by Marriott (150+ properties already, with a 45-project pipeline).

- Launch of StudioRes, a mid-priced extended stay brand (20-night minimum), aimed at healthcare, university, and industrial zones, with an 1,800-property potential in North America.

- Partnership with Sonder, adding over 10,000 units in serviced apartments.

- Accelerated development of branded luxury residences (now 142 globally), a high-margin business line.

2. Jin Jiang – International Divisions Take the Lead

Jin Jiang International operates through three pillars:

- Its own brands in China (approx. 90% of its portfolio) including Jinjiang Inn, 7 Days Inn, and Vienna Hotels.

- Two international subsidiaries: Radisson Hotel Group (excluding Radisson Americas, now part of Choice Hotels) and Louvre Hotels Group, including Sarovar in India.

Due to limited transparency in its domestic market, Jin Jiang is focusing on diversifying its portfolio through:

- A partnership with Ascott Ltd to develop Quest and Tulip Lodj (a Louvre brand) aparthotels in China.

- A three-phase transformation plan for Louvre Hotels Group (2023–2027), led by Federico Gonzalez:

- Redefine fundamentals (2023–2025)

- Foster organic growth (2026–2027)

- Pursue acquisitions (from 2028 onward)

Louvre will invest €400 million in renovations and deploy a support platform for franchisees.

Radisson Blu and Radisson Collection will lead expansion in Europe, India (200+ hotels), and China, with plans to enter Latin America.

3. Hilton Worldwide – Expanding Across All Segments and Regions

In 2024, Hilton pursued a balanced strategy of organic and external growth, adding 100,000 rooms and expanding its pipeline to over 3,500 hotels.

Key moves:

- Acquisitions of NoMad and Graduate Hotels, enhancing its lifestyle portfolio.

- Strategic partnership with Small Luxury Hotels of the World to add 400+ boutique hotels.

- Tie-up with AutoCamp, enabling outdoor stays for Hilton Honors members in iconic U.S. natural settings.

- Market debuts in Paraguay, Laos, and Bonaire.

- Reached 1,000 hotels in Asia-Pacific and aims to double its lifestyle portfolio to 700 hotels.

Hilton Honors surpassed 210 million members, a key driver of guest loyalty and brand trial across segments.

[Continued in next message due to length…] [Continuation – Translation of MKG Consulting’s 2025 Global Hotel Group Rankings]4. H World – A “Great Leap Forward”

Formerly known as Huazhu, H World recorded the most dramatic growth in 2024. Its hotel portfolio comprises:

- 11,000+ hotels under the Huazhu umbrella, including 557 owned/leased and over 10,500 franchised or managed (nearly 1 million rooms),

- Plus 122 hotels (26,000 rooms) under Deutsche Hospitality (formerly Steigenberger), with 76 leased and 46 franchised/managed.

The group added nearly 170,000 rooms in 2024 and plans to open approx. 2,300 hotels in 2025, while closing around 600.

CEO Jin Hui highlighted:

- The milestone of 10,000 hotels was reached,

- China remains the growth engine, supported by an 81% average occupancy despite slight RevPAR decline,

- International growth is led by Deutsche Hospitality (+5.9% RevPAR), under Oliver Bonke’s leadership, tasked with:

- Introducing European brands like Steigenberger and IntercityHotel to Chinese consumers,

- Expanding those same brands globally,

- Cautiously approaching the promotion of Chinese brands abroad.

5. IHG – Beyond the spearhead Holiday Inn

Under CEO Elie Maalouf’s first full year, IHG advanced its geographic and brand reach, with:

- Many brand debuts in new countries,

- Focused growth in China, India, Japan, Saudi Arabia, and Germany (via long-term deal with NOVUM Hospitality),

- Expansion of lifestyle (e.g., Garner) and extended stay brands (e.g., Candlewood Suites).

Pipeline activity:

- 714 properties signed in 2024,

- Americas: 16,832 rooms opened; 26,552 signed,

- EMEAA: 23,620 opened; 50,275 signed,

- Greater China: 18,665 opened; 29,415 signed.

Holiday Inn still leads (44% of pipeline), but Luxury & Lifestyle brands now make up 21% of future projects, aiming to exceed their current 14% share of inventory.

External growth:

- IHG acquired its 20th brand, Ruby Hotels, in Feb 2025, a strong European player in the “lean luxury” space, which will expand to the Americas and Asia.

6. Wyndham – Accelerating International Growth

Still the world’s largest hotel franchisor with 25 brands (mostly select-service), Wyndham’s portfolio is 90% U.S.-based, serving primarily leisure road-trip travelers (70% of clientele).

2024 trends:

- U.S. portfolio grew by +7%,

- International growth reached +4%,

- 58% of rooms in the pipeline are now international,

- 78% of the pipeline involves new builds (not conversions), and 35% of projects are already underway.

CEO Geoff Ballotti emphasized:

- Focus on high FeePAR markets,

- Expansion in branded residences and aparthotels, tapping into ancillary revenue streams,

- Confidence in the asset-light model and the group’s appeal to developers.

Notably, over 2,200 U.S. infrastructure projects (worth nearly $250 billion) are near Wyndham hotels, supporting a 6% RevPAR uplift in Q4 2024.

7. Accor – Record Year, Africa in the Spotlight

Accor achieved its first-ever gross margin above €1 billion in 2024, outperforming expectations. CEO Sébastien Bazin attributes this to:

- Ambition, discipline, and high standards,

- Efficient structure with two autonomous divisions: Premium, Midscale & Economy (PM&E) and Luxury & Lifestyle (L&L).

2024 highlights:

- 293 hotel openings, adding over 50,000 rooms (+3.5% net growth),

- Strong performance in a volatile global environment, supported by geographic and segment diversification.

Bazin’s vision:

- “We failed in America, but we won’t miss the rest of the world.”

- Strategic focus: Southeast Asia, China, India, Middle East, Africa,

- Accor operates in 100 countries and continues its long-term bet on Africa (25-year horizon),

- Committed to co-investing with hotel developers.

8. Choice Hotels – Extended-Stay Focus

In 2024, Choice opened 400+ hotels, up 21% YoY, driven by its 22-brand portfolio covering all market segments. Still heavily North American (3% domestic growth), the group pivoted to:

- Extended stay segment (+10% YoY),

- 515th extended stay hotel opened by year-end 2024,

- Pipeline includes 43,000+ rooms.

International expansion:

- +4% net growth,

- Upscale portfolio up 45% YoY, with a 25,000-room pipeline.

Strategic deal:

- Partnership with Westgate Resorts, adding 21 luxury properties to the U.S. portfolio.

CEO Patrick Pacious summed up:

“Four brand relaunches, expanded partnerships, record loyalty program growth, and new revenue sources. 2025 will be about scaling and accelerating.”

9. OYO Rooms – Targeting the American West

OYO’s trajectory remains highly volatile. Still awaiting the right moment for an IPO, the group is reengaging aggressively in the budget and economy segments. Backed by SoftBank, OYO surprised the market by acquiring G6 Hospitality for $525 million from Blackstone Real Estate, bringing Motel 6 and Studio 6 into its portfolio and reinforcing its North American growth strategy.

Key highlights:

- 1,500 Motel 6 hotels in the U.S. and Canada,

- Plans to open 150+ new properties under Motel 6 and Studio 6 by 2025,

- Returned to profitability in FY2023–2024 (ending March 2024), but revenue declined by 15%—prompting a push to regain volume.

Led by founder Ritesh Agarwal and International President Gautam Swaroop, OYO appears to have regained momentum and stability, though questions remain about its long-term sustainability. Notably, Agarwal’s personal debt issues could potentially affect his control over the company.

10. BG Homeinns – Moving Upmarket

Dominant in the Chinese economy segment, BTG Homeinns operates several key brands:

- Economy: Home Inn, Motel 168, Shindon, Ykinns, Fairyland Hotel,

- Midscale: Yitel, BTG-Nanyuan (targeting business travelers),

- Upscale: BTG-Jianguo, BTG-Jinglun.

Amid a challenging Chinese economic landscape (especially in real estate), BTG is:

- Expanding in tier-2 and tier-3 cities,

- Boosting profitability in midscale brands,

- Investing in digitalization to improve operational efficiency and customer experience.

Strategic moves:

- Launch of 100 upscale PuYin hotels over five years in provincial capitals, targeting business districts,

- In August 2024, formed a joint venture with NIP Group, a digital entertainment and e-sports giant, to develop e-sports-themed hotels in major cities (deal runs through 2031),

- Early 2025: launched NUO International Hotel Management Co., to oversee its luxury brand expansion (e.g., NUO, Ahn Luh, Jianguo Hotel, Kempinski).

11. Hyatt – Holding the Industry’s Largest Pipeline

Pushed out of the Top 10 by faster-growing Asian players, Hyatt aims to reclaim its position through robust expansion. As of 2024:

- Pipeline exceeds 138,000 rooms (+9% YoY),

- Gross margin topped $1 billion despite flat revenue.

Strategic expansion:

- ~8% growth in total properties,

- In China: 140 new hotels planned over 4 years, half under UrCove (midscale),

- In India and Southwest Asia: 21 deals signed in 2024, 7 hotels opening in 2025.

M&A activity:

- Acquired Standard International, adding 21 lifestyle hotels and 30+ projects (The Standard, Bunkhouse Hotels, The Manner),

- Acquired Playa Hotels & Resorts (~$2.6 billion), reinforcing Hyatt’s all-inclusive strategy (Hyatt Ziva, Hyatt Zilara).

Flagship brand Hyatt Centric grew significantly in 2024, with new locations in Cairo, Shanghai, San José, and Santo Domingo. Hyatt plans to add 35+ Hyatt Centric hotels globally by 2028 (50% portfolio growth).

12. BWH Hotels – Diversifying Boldly

In 2024, BWH Hotels (Best Western brands, WorldHotels, SureStay) undertook strategic diversification and expansion:

Key achievements:

- Signed nearly 300 new hotels globally,

- Focus areas: India, Vietnam, Middle East, and Africa,

- Target: +850 hotels in 5 years (+20% portfolio growth from ~4,300 hotels today).

Innovative moves:

- Entered glamping with Zion Wildflower Resort near Zion National Park,

- Launched WorldHotels Residences, starting with Noble Crystal Tay Ho in Hanoi,

- Expanded Aiden by Best Western to 130+ locations (existing and planned),

- Rolled out HOME by Best Western in Miami, Atlanta, and Orlando, targeting flexible extended stays.

This comprehensive review confirms the intensified competition, geographic diversification, and segment specialization shaping the future of global hotel development. The industry’s dominant groups are firmly focused on lifestyle, extended stay, and emerging markets—backed by aggressive pipelines and a sharpened asset-light mindset.