Global hotel transaction volume reached $24.5 billion in the first half of 2025, down 17.5% compared to the same time period a year ago and more than 30% down versus 2019. That’s according to new data from JLL Research Hotels & Hospitality in its

“State of the Lodging Industry H1 2025.”

There were 600 total transactions in the half, 16.7% less than in H1 2024. Of the deals that did come to fruition, 20 were more than $1 million per key, the second most ever recorded in a first half, showing that while there was a shortage of deals, valuations for luxury assets remain high. The single-asset average price per key was $241,000.

Global portfolio volume fell 52% to a near historic low highlighting the challenges investors have underwriting high-dollar trades. As JLL noted, urban markets are driving liquidity while resorts fuel pricing. “Look for investors to continue targeting top urban gateway markets, particularly as the discount-to-replacement cost remains pronounced,” JLL wrote. Foreign capital and private equity will likely be the most acquisitive, with select-service and luxury most in favor.

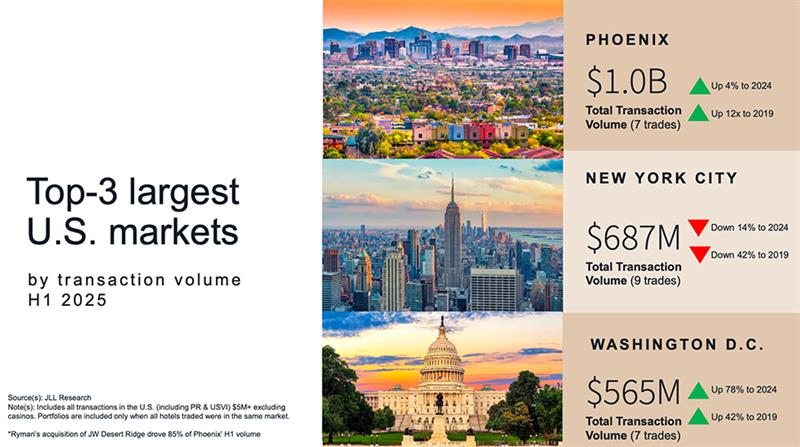

Just more than half of all hotel transactions were in the U.S. and while total deals were down 6.7% versus the same period in 2024, total transaction volume of $9.7 billion was up nearly 4% compared to H1 2024. It, however, remains well below historical averages as liquidity for larger transactions has been more subdued, JLL noted. Supply growth is expcted to continue to be muted as construction costs remain elevated and investors focus on acquiring existing assets, often at a discount to replacement cost. More brand and management company M&A is expected, as hotel companies seek to drive unit growth.

Global hotel supply is expected to grow 230 basis points less than its long-term average over the next four years as construction costs remain high. This should benefit existing hotels as well as spur hotel brands to use their balance sheets to fuel net unit growth, JLL noted.

Despite the weaker volume of global deals, JLL is optimistic that there could be a pickup in the second half of 2025, noting significant dry powder on the sidelines—especially from private quity and high-net-worth individuals—coupled with an increase in debt maturities.

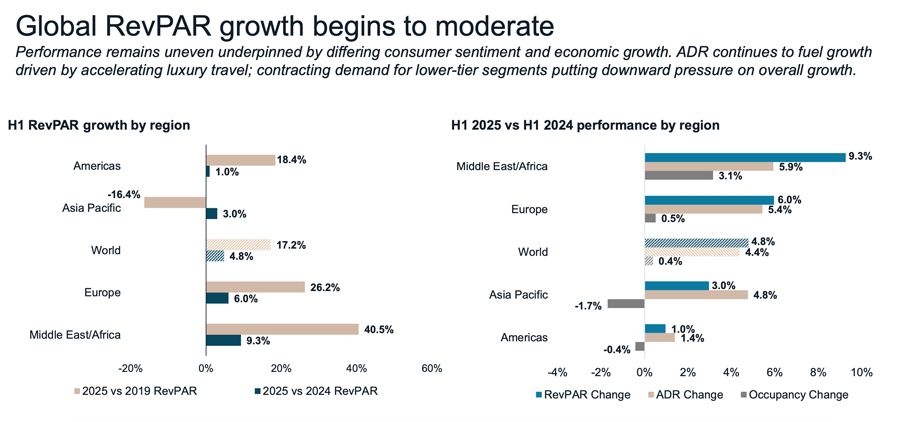

Global RevPAR is also showing retrenchment. JLL wrote that performance remains uneven underpinned by differing consumer sentiment and economic growth. ADR continues to fuel growth, driven by the luxury segment, but there is contracting demand for lower-tier segments, which put downward pressure on overall growth. Occupancy in the Americas contracted in the first half of 2025 comapred to the same period in 2024, according to the data, though overall RevPAR was up 1%.

The highest RevPAR growth region was Middle East/Africa, up 9.3% in H1 2025 v. H1 2024.

Meanwhile, JLL expects nternational travel to likely soften in the back half of 2025 driven by escalating trade wars and increased geopolitical volatility. “Look for outbound U.S. travel to contract, some of which should be mitigated by growing outbound Indian and Chinese travel,” it wrote.