The sample of branded full-service hotels in Edinburgh recorded a healthy increase in profit during the 12-month period ending in May 2025, relative to the same time last year. GOP per available room (GOP PAR) rose by 5.9%, driven by a 3.6% revenue increase and despite rising expenses (+1.9%).

OVERVIEW

- The sample of branded full-service hotels in Edinburgh recorded a healthy increase in profit during the 12-month period ending in May 2025, relative to the same time last year. GOP per available room (GOP PAR) rose by 5.9%, driven by a 3.6% revenue increase and despite rising expenses (+1.9%).

- Rooms revenue grew by 7.1%, resulting from a 3.8% rise in occupancy and a 3.2% increase in ADR to £220. In contrast, F&B revenue declined by 3.1%, dropping to £49 per occupied room (POR).

- Occupancy rates increased primarily in November, February, and June by +12.3%, +9.4%, and +6.9% respectively, compared to the same period last year.

- Total expenses increased only by 1.9%, driven by Payroll (+4.7%), followed by Other Expenses (+5.8%), while Cost of Sales and Utilities declined.

- The performance growth was supported by the constrained supply, which increased only by 244 rooms, representing 0.7% growth over the 12-month period.

- Overall, due to constrained expenses, 70.6% of additional revenue flowed through to the bottom line. As a result, the GOP margin increased from 43.1% to 44.1% and the nominal GOP increased by 5.9%, reaching £107 PAR.

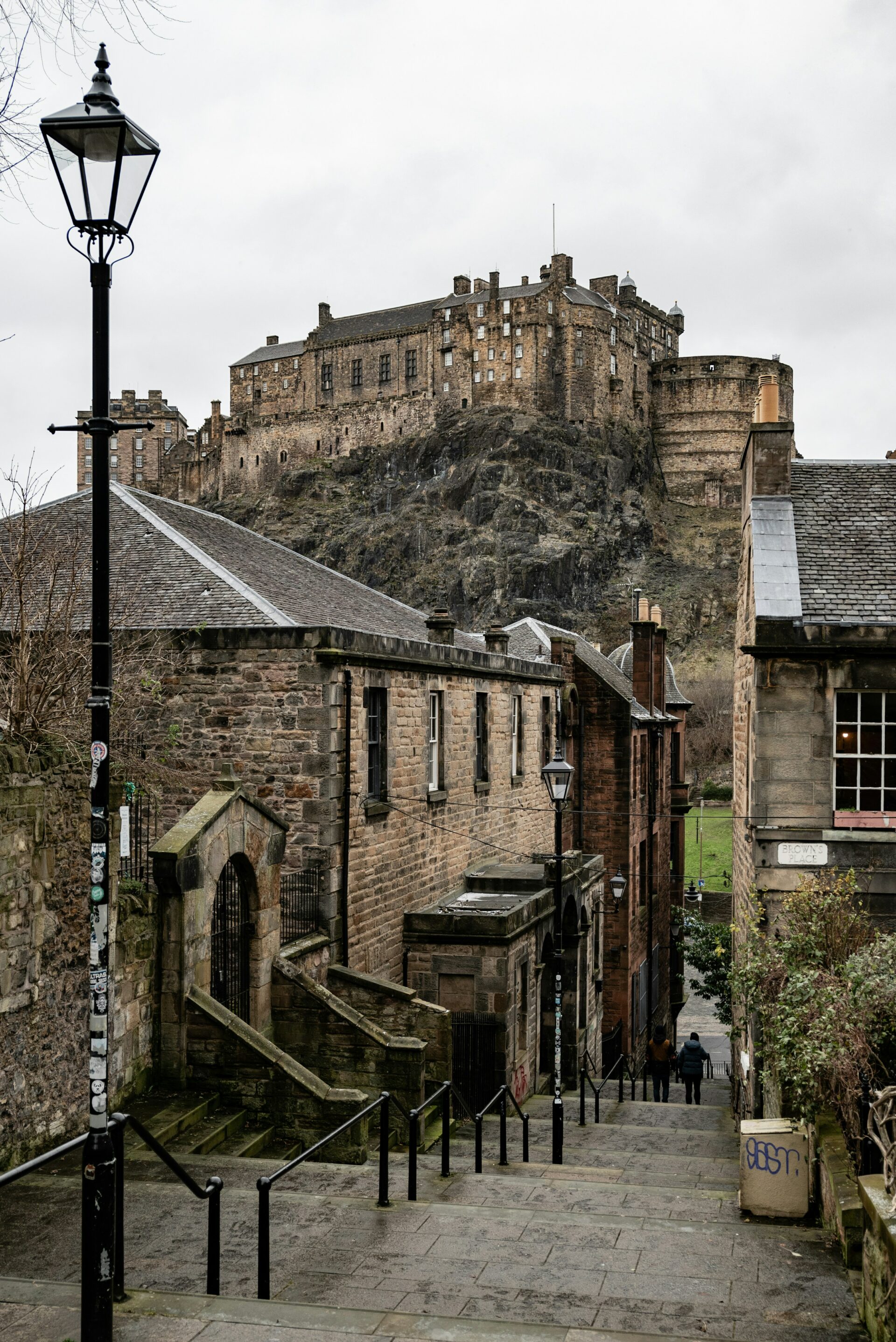

— Photo by Cushman & Wakefield

— Photo by Cushman & Wakefield

SUPPLY

- Over the last 12 months, four new hotels opened in the Edinburgh hotel market (244 rooms), resulting in a 0.7% increase in total supply (weighted by opening date)

- All new hotels opened in the city center and primarily within the Upper Upscale class (94.3%)

- Most of the new room supply was within branded properties (94.3%), with the remainder being two small independent luxury apartment-hotels. Overall, 32.8% of the new room supply was in the extended-stay sector.

- There was no notable hotel conversion during the YE May 2025 period, albeit IHG signed in March 2025 the rebranding of the Haymarket Hub hotel that opened in June 2025 as Garner Hotel by IHG. This property has 195 rooms and is located in Edinburgh’s vibrant West End.

- While no significant closures were announced during the last 12 months; some properties were undergoing renovations without closing during the period. Among the most notable properties is Hilton Edinburgh Carlton (211 rooms)

— Photo by Cushman & Wakefield

COST OF SALES

- Total COS decreased by £1.2 PAR (-4.8%), primarily driven by the Rooms department (-£0.9 PAR).

PAYROLL COSTS

- The labor expenses in the selected Edinburgh hotels increased during the last 12-months (YE May) by 4.7% (+£2.6 PAR), reaching £57 PAR. The A&G department led the increase, where payroll increased by 30.6% (+£1.6 PAR). The minimum wage increase (+6.7%) introduced in April 2025 had a significant impact so far, with the payroll cost rising by £3.0 POR (+4.5%) in the last two months (4-5/2025 vs 4-5/2024).

UTILITY COSTS

- Utility costs decreased by £1.2 PAR (-11.6%), driven by a reduction of electricity expenses (-£1.0 PAR).

OTHER EXPENSES (excl. Utilities)

- Other expenses increased by £2.4 (+5.8%) to £44 PAR, driven by higher other cost within S&M (+£2.0 PAR) and Rooms (+£0.7 PAR) departments. This was partially offset by a £0.6 PAR reduction in the A&G department.

— Photo by Cushman & Wakefield

— Photo by Cushman & Wakefield

— Photo by Cushman & Wakefield