A contrasting market: luxury on the rise, budget under pressure

The last few years have profoundly reshaped the geography of performance. The economy and super-economy hotel sectors are suffering, largely due to the slowdown in construction projects and the decline in the working-class clientele that has historically driven the segment. Conversely, the upscale hotel sector is posting excellent results, fuelled by international clientele.

Paris remains very dynamic, particularly in the luxury segment, while the Île-de-France region outside Paris continues to be penalised by the difficulties of certain local businesses. In the regions, demand remains high, confirming the resilience of large cities and the emergence of significant potential in towns with 150,000 to 300,000 inhabitants.

Over ten years, RevPAR has increased and costs have also risen, but at a slower pace. Value creation therefore remains possible, provided that the structural levers are controlled.

The five strategic challenges transforming the hotel industry

Process transformation: AI as a driver of productivity and service

Process evolution is one of the most transformative areas of work. According to Sylvie Bergeret, hotel productivity has remained stable over a long period, but the arrival of AI could change the game.

The challenge is twofold: optimising operations while preserving the relational essence of the business.

In the luxury sector, AI should enable teams to refocus on personalised service, while in the budget hotel sector, it can help reduce staffing requirements and increase margins.

The question of the impact on employment remains central: the hotel industry is a hospitality business, and the challenge will be to strike a balance between operational efficiency and the quality of the customer experience.

Fragmentation: an increasingly polarised market

Performance shows significant structural disparities. Certain destinations, such as Paris, Brittany and the French Riviera, are consistently outperforming, while other areas continue to struggle.

The trend towards decentralisation of professional events, which are increasingly being organised in the regions, is also contributing to this rebalancing, as is the development of home office and remote meetings.

The rise of medium-sized cities is playing a key role: long overlooked, they now offer significant potential, as they can cater to a wide range of customers, both business and leisure.

Prices in Europe remain attractive for high-end international customers, reinforcing the appetite for less obvious destinations, where luxury establishments are now appearing.

Modernisation: renovating, moving upmarket and creating value

The best hotel performances today are recorded in recent or renovated establishments. Modernisation is emerging as a direct lever for value creation.

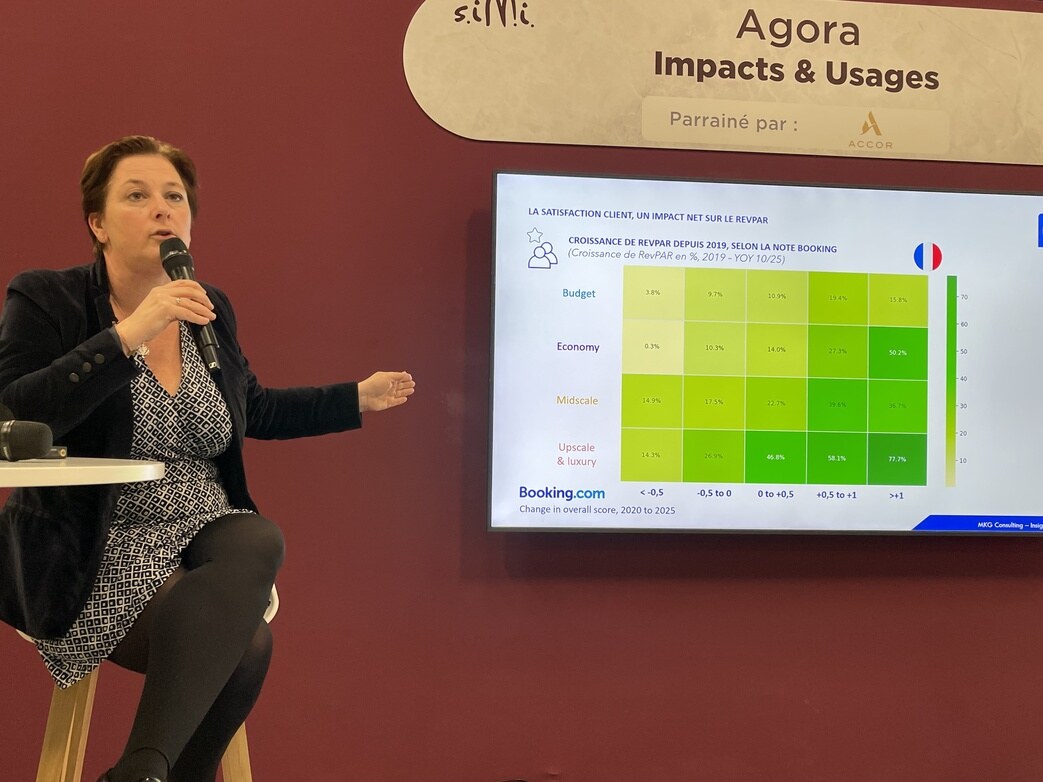

MKG data is clear: +1 point on the Booking rating = +16% RevPAR.

Moving upmarket, even at the cost of reduced capacity, can significantly improve profitability. Grouping together small establishments (as Korner and Encore Mieux have done) also adds value by centralising what can be centralised.

Many assets now go beyond their original purpose: some add furnished tourist accommodation or serviced residences to capture other segments. However, the evolution of the stock is limited by very slow growth in hotel supply in France, constrained by permits and the stronger dynamism of alternative accommodation.

Modularity and mixed use: optimising every square metre

Flexibility is becoming a prerequisite for sustainable performance. Operators are adapting their spaces to maximise occupancy and meet increasingly diverse expectations.

Hybrid catering, family rooms and premium dormitories are examples of this diversification.

The conversion of offices into hotels is another important issue, but it is not always economically viable: conversion costs can sometimes be close to the cost of new construction, which limits truly viable opportunities.

CSR mobilisation: an expectation of customers, employees and banks

CSR is now an imperative across the board. Customers, employees and financiers place it at the heart of their requirements.

Energy savings have become essential in operational management. On a social level, mobilisation relies on the ability to unite teams around a meaningful project.

The benefits are immediate, but also long-term. Banks are increasingly interested in financing green assets, which has a direct impact on financing conditions, asset valuation and liquidity.

In a constrained market where hotel supply is growing slowly, CSR is becoming a real differentiator.

Sylvie Bergeret’s presentation confirms that the European hotel industry is entering a period of restructuring, where performance depends as much on market fundamentals as on the ability of operators and investors to anticipate change.

The five challenges (process transformation, market fragmentation, asset modernisation, modularity and mixed use, CSR mobilisation) are redefining the levers of value creation. In a constrained environment, strategy can no longer be limited to capturing demand: it must rethink the product, processes, use of space and societal commitment in order to build a resilient and competitive model.

![]()