Betting big on Japan’s real estate, Brookfield has invested $1.6 billion in two transformative projects, in a move that highlights the Canadian asset manager’s confidence in the country’s long-term growth potential. The deals include the acquisition of a strategic stake in Gajoen, a premier mixed-use complex in central Tokyo which includes a luxury hotel, as well as a logistics development project in Greater Nagoya.

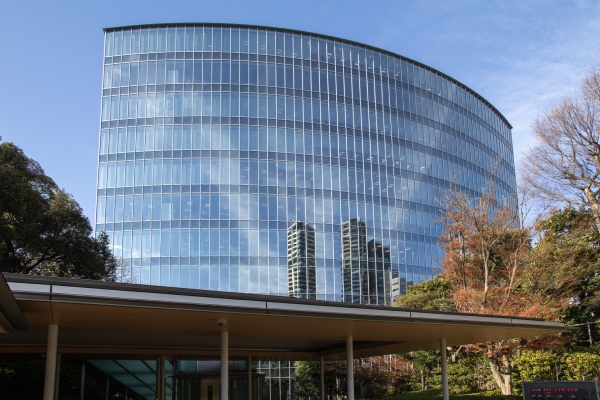

Gajoen, located in Meguro, Tokyo, is a Grade-A property featuring a luxury hotel, two office towers (Arco Tower and Arco Tower Annex) and retail spaces, spanning 1.5 million square feet of gross floor area. According to a report by Bloomberg, Gajoen is owned by China Investment Corp. and LaSalle Investment Management, which they acquired from Mori Trust in 2015.

The complex is situated near major transportation routes and key business and entertainment hubs. Brookfield plans to manage and reposition the property through extensive renovations and active asset management. Brookfield did not disclose the size of its stake in Gajoen.

In Greater Nagoya, Brookfield has acquired a 1 million-square-foot land plot in Anpachi, strategically situated near the Meishin Expressway, a major connection for cities in mid-west Japan.

The site will be developed into a 2.4 million-square-foot premium-grade, multi-tenant warehouse. Construction is scheduled to begin in the first half of 2025, with completion expected by early 2027.

Brookfield acquired the stake in Gajoen on its balance sheet, while plot in Nagoya was purchased through the asset manager’s global opportunistic strategy, the Bloomberg report added.

The two deals represent the opportunities Brookfield will be exploring this year in Japan, as the company aims to invest significant capital into the country’s real estate, particularly in logistics and high-quality office, said Ankur Gupta, Brookfield’s head of Asia Pacific and Middle East Real Estate.

“We have unparalleled global expertise in these sectors and a differentiated approach to working with partners to create value for our investors.”

These investments reflect Brookfield’s growing focus on Japan as a key market for real estate opportunities in logistics and office sectors.

“Leveraging Brookfield’s operational expertise in placemaking and managing large mixed-use assets, we see strong potential to grow Gajoen. Additionally, tight vacancy rates in Greater Nagoya will drive demand for logistics facilities, giving us an advantage when leasing the Anpachi Logistics Development,” said Ikushin Tsuchida, senior vice president of Brookfield Real Estate.

Japan has been attracting significant amounts of foreign investment in the real estate market over the past year, driven by the ultra-low interest rates (which has resulted in the Japanese yen falling to its lowest levels against the U.S. dollar in over 30 years), booming tourism industry and favorable rental yields, according to a study by Savills. Cities such as Tokyo, Osaka and Niseko will benefit from accessibility, well-developed public infrastructure and the highest share of tourism in the country, the study added.