Beyond Luxury

Last week, Hermès and Nike caught the spotlight for different reasons. Hermès defied industry struggles, reporting impressive results, while Nike launched a new campaign that brought the brand back into the spotlight. What connects these two brands? Heritage. Brand heritage. Isn’t heritage the foundation of one of luxury’s most powerful pillars?

In today’s experience focused world, brands are facing big challenges in staying connected with their customers while staying true to their core values. Leaders in the luxury industry are dealing with problems like short-term thinking, financial instability, fake products, changes in leadership, shifting generational behaviors, environmental issues, and fast-moving technology. These challenges are made worse by business models that resist innovation and lack long-term strategies that remain true to the brand’s essence.

In Luxury Unlocked: The Key to Mastering Luxury Brands in a Disrupted Age, Susanna Nicoletti, author and columnist, discusses her vision on one of the industry’s missteps: “Luxury lost the personal relationship with its customers. They became targets. They were studied with a quantitative approach, their habits categorized into segments: Millennials, Baby Boomers, Gen Z, and so on.” In this context, what does the future hold for brands trying to move forward?

2024 was undeniably a tough year for the luxury industry. Kering itself described it as an annus horribilis, with shares plummeting by 41%, which brought its market value down to €30 billion. LVMH, despite being a dominant force in the sector, didn’t fare much better, reporting a mere 1% revenue growth, reaching €84.7 billion. However, while many struggled, some brands managed to weather the storm more successfully.

At Beyond Luxury Group, we value Susanna Nicoletti’s mindset of long-term brand growth. It’s not about chasing quick wins, it’s about having a clear vision, a strong mission, and the flexibility to adapt while staying true to the essence of the business. But how many luxury brands today are truly embracing this approach?

The latest earnings calls and industry news show that while many brands are still trying to find their way in a fast-paced world, some are not only staying positive but also focused on a promising future. This gives us hope in the power of brand-building in the luxury industry. In this week’s article, we share some of these brands for you to keep on your radar.

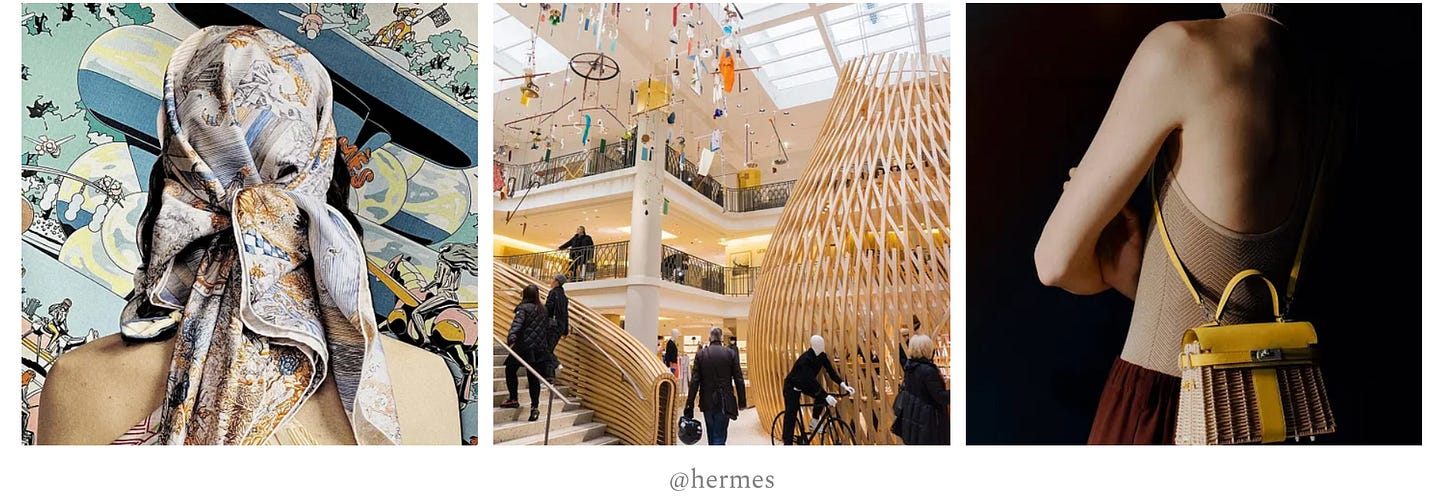

Hermès: Heritage and Craftsmanship Driving Long-Term Success

In 2024, Hermès reported exceptional results, with €15.2 billion in revenue, reflecting a 15% increase at constant exchange rates, and a net profit of €4.6 billion. Despite a slowdown in the luxury sector, the brand exceeded expectations, driven by strong sales in leather goods, ready-to-wear, and beauty, particularly in the Americas. CEO Axel Dumas attributes Hermès’ success to its commitment to quality, creativity, and craftsmanship, even amidst geopolitical uncertainty.

Looking ahead, Hermès remains focused on long-term growth, with plans to enter haute couture by 2026-2027. This year’s first Couture shows have blended nostalgia, chaos, sensuality, and resilience, celebrating human emotion and creativity while embracing the role of technology in crafting timeless, provocative fashion. It’s an exciting time to imagine what Hermès will bring to this new creative frontier.

This strategic move will diversify its portfolio and help maintain the brand’s exclusivity. By continuing to emphasize craftsmanship and authenticity, Hermès has been able to expand into new markets while ensuring that demand consistently exceeds supply. As the luxury sector faces challenges, Hermès remains committed to preserving its identity and positioning itself at the top of the market.

Prada & Miu Miu: Embracing Culture and Experience in a Changing Luxury Landscape

Prada has continued to thrive amidst the market slowdown in 2024, with Miu Miu leading the way. Miu Miu’s blend of designs and cultural engagement has allowed it to stay relevant, hosting literary talks, pop-up bookshops, and artist collaborations at events like Art Basel Paris. Meanwhile, Prada’s flagship brand has experienced growth, though at a slower pace, despite price hikes. CEO Andrea Guerra, who took the reins in 2023, is focused on aligning the brand with consumer expectations and enhancing the in-store experience.

Both Prada and Miu Miu have positioned themselves as brands offering more than just products, but cultural experiences. Prada supports the Luna Rossa sailing team and runs its own Fondazione Prada museum, further cementing its cultural integration. The brand’s stores, including the Prada Café, serve as immersive spaces that embody its philosophy. In a luxury sector increasingly focused on experiences over products, Prada’s commitment to cultural collaborations and unique store activations is a solid example of how brands are evolving. Despite the challenges, Guerra remains optimistic about Prada’s future, according to McKinsey’s State of Luxury Report interview, believing that the key to success lies in staying true to the brand’s core values while meeting consumer desires.

Richemont: Innovation and Cultural Legacy with Cartier

Cartier, as part of Richemont, continues to drive long-term growth and innovation through both its leadership and its involvement in experimental luxury. The Financial Times recently reported that Richemont exceeded expectations in the final quarter of 2024, with strong demand in the U.S. for its Cartier and Van Cleef & Arpels brands.

Cartier’s focus on leadership is clear with the promotion of Louis Ferla (CEO of Cartier) and Catherine Renier (CEO of Van Cleef & Arpels) to Richemont’s senior executive committee. This highlights a strategic focus on elevating talent from within the company, particularly from its key jewellery brands, and highlights Richemont’s long-term succession planning.

In terms of experimental luxury, Cartier is making significant contributions to the art world. The Victoria & Albert Museum in London will host a major Cartier exhibition from April 12 to November 16, 2025. This exhibition will feature over 350 pieces, including royal jewels, rare prototypes, and historic watches, marking the first major Cartier showcase in the UK in nearly 30 years.

Moreover, Cartier is expanding its cultural footprint with the Fondation Cartier’s new building set to open in late 2025. Designed by Jean Nouvel, the new 90,000-square-foot museum will sit opposite the Louvre in Paris. The innovative space will feature 70,000 square feet of exhibition areas, highlighting Cartier’s commitment to contemporary art and its role in fostering creative expression.

Moncler: Resilience in the Face of Challenges

Moncler Group achieved strong results in 2024, surpassing €3.1 billion in revenues, a 4% increase from the previous year. This growth was driven by a solid performance in all markets, including a return to double-digit growth in China, and a significant boost from its direct-to-consumer (DTC) channels for both Moncler and Stone Island. The group also maintained an operating profit margin of nearly 30% and ended the year with a net profit of €639.6 million, reflecting resilience in a complex environment.

Moncler’s success was particularly notable in Asia, where revenues rose 7%, driven by a strong performance in mainland China. The brand’s events, such as Moncler Grenoble in Saint Moritz and Moncler Genius in Shanghai, were important in increasing brand visibility and engagement. While Stone Island saw a slight revenue dip of 2%, it experienced a 10% increase in Q4, with strong results in the DTC channel and improvements in the wholesale channel.

According to WWD and the company report, Moncler’s CEO, Remo Ruffini, expressed confidence in navigating future market dynamics, emphasizing creativity and uniqueness as key drivers of long-term growth. Despite the ongoing global uncertainties, the group remains focused on the development of its two core brands and is optimistic about future prospects, particularly with the strong performance of its DTC channels.

Ferrari: Product Excellence and Formula 1 Spotlight

Ferrari posted impressive financial results for 2024, with net profit rising to €1.526 billion and operating profit increasing by 16.7%. The company attributed its success to a strong product mix and rising demand for vehicle customizations, which allowed Ferrari to focus on quality over volume.

CEO Benedetto Vigna highlighted the company’s teamwork, innovative product developments, and advancements in research, including the launch of the Ferrari F80 supercar and the establishment of an E-Cells Lab to enhance its electrochemical capabilities. Ferrari expects continued growth in 2025, with strong potential to exceed its 2026 profitability targets. Following the announcement, Ferrari’s stock saw a 4.79% increase.

In terms of expectations, Ferrari’s presence in Formula 1 is also in the spotlight with Lewis Hamilton’s debut this season, which can not only reinforce the brand’s excellence in product customization but also serve as a thrilling experience for F1 fans, further enhancing Ferrari’s global appeal and solidifying its position as a leader in both luxury and motorsport.

Nike: A Parallel Case of Brand Reinvigoration

This month, Nike reminded everyone who they are at Nike’s Super Bowl comeback with an all-female cast “So win” ad. Yet since 2020, the brand had underinvested in brand-building, distanced itself from sports and big-name athletes, alienated key retail partners with its direct-to-consumer (DTC) strategy, and generally lost its marketing direction.

All of that changed with the arrival of Elliott Hill last September. Nike’s new CEO had been a lifelong company executive until retiring in 2020, when he was passed over for the top job. However, when the time came, Hill returned, seemingly reenergized with Nike’s DNA running through his veins. Nike’s share price, which had lost a quarter of its value in 2024, surged 6% in a single day following Hill’s appointment. His mantra was a simple yet powerful one: “Let Nike be Nike again.”

Building on this renewed energy, Nike announced this week a collaboration with Skims, Kim Kardashian’s brand, which led to a 6.2% rise in the company’s stock price and boosted its market value to $6.7 billion. The NikeSkims partnership will offer a new collection of training apparel, footwear, and accessories, set for release in 2025. This move appears to be strategically aimed at addressing the growing competition from female-focused brands like Lululemon and Alo Yoga.

Skims, co-founded by Kim Kardashian and Jens Grede in 2019, has established itself with high-profile collaborations, such as those with Dolce & Gabbana and Fendi. In the sports sector, Skims has created collections for the Tokyo 2020, Beijing 2022, and Paris 2024 Olympics, and partnered with the WNBA for athletic wear. With Kim Kardashian’s 358 million Instagram followers, the brand was valued at $4 billion in 2023.

With Hill’s leadership and strategic moves like this, could this be the beginning of a new era for Nike, one where it embraces its heritage and reconnects with its audience in the most authentic way possible?

ON: Innovation And the “Oniverse” Ecosystem

As recently pointed out in The Sociology of Business by Ana Andjelic, On reported a 32% sales increase compared to the previous year and is expected to exceed $2.6 billion in sales. The brand has made significant progress through partnerships with celebrities like Zendaya and Roger Federer, as well as recent campaigns such as On’s Super Bowl ad and its sponsorship of young athletes like 18-year-old tennis player João Fonseca. These moves have raised important questions about the future of the brand: Is On becoming more than just a sports brand? Could it actually be creating an ‘Oniverse’ ecosystem?

On’s secret sauce lies in its innovation, sustainable edge, long-term collaborations, and team-focused corporate culture that emphasizes playing the long game. While it may be too early to fully predict the future of On, the brand’s connection to Roger Federer gives it a sense of heritage rooted in his past. This, along with its growing presence in the sports community and embrace of new talent, makes it a brand worth keeping on our radar.

Why It Matters?

According to McKinsey State of Luxury Report, the global luxury market is expected to experience slower growth from 2024 to 2027, with projected annual growth rates between 1% and 3%. In this challenging environment, it is more important than ever for luxury brands to stay true to their heritage while adapting to cultural shifts.

In the book “Beyond Luxury: The Promise of Emotion”, Carlota Rodben emphasizes that luxury’s success relies on balancing tradition with innovation to remain relevant. The demand for experiential luxury, particularly among high-net-worth individuals (HNWIs), is growing, and brands must cater to this shift by offering tailored, immersive experiences that go beyond material goods, especially as younger generations become less engaged with traditional luxury advocacy.

Insights from this year’s UBS Global Wealth Report highlights the expansion of the luxury market is not just about wealth concentration but the entry of new consumers driven by generational wealth transfer. Additionally, McKinsey also shows that 80% of HNWIs are prioritizing experiences over products, seeking deeper emotional connections with brands.

In this context, luxury brands must create personalized, purpose-driven experiences that resonate with consumers’ evolving desires, making emotional engagement and brand storytelling more crucial than ever.

So, What Now?

The future of luxury is not about quick wins or chasing fleeting trends, it requires staying rooted in your brand’s essence and story while embracing transformation. Look at Hermès and Nike for example. These brands are defying the odds not by abandoning their heritage but by using it as a foundation for innovation. Hermès, with its relentless commitment to craftsmanship, and Nike’s re-invigoration of its identity under Elliott Hill show us that understanding who you are and staying true to your brand’s core values is what leads to lasting success. In a world where everything is shifting, from generational behaviors to economic pressures, brands that continue to honor their legacy while adapting to the new demands of experience-driven consumers are the ones leading the way.

This is a call to all luxury brands. Now is the time to evolve without losing your identity. As consumers increasingly seek experiences over products, those who can blend authenticity with innovation will stand out. It is about creating memories, connections, and stories that resonate. As we see with Cartier’s cultural expansions, Prada’s cultural experiences, and Nike’s return to its roots, there is a powerful reminder. Heritage is not just a static element of the past but a living part of a brand’s future. So, let this be your guiding light. Build your future, but never forget where you came from.

Season 3 is now LIVE! For today’s reading, we suggest you listen to Part 2 of Carlota Rodben’s episode, where she shares her journey to becoming the founder of Beyond Luxury Group.

Note, that this is an opinion piece by Carolina Soares, Head of Content and Business Intelligence, with the guidance and endorsement of Carlota Rodben, Founder & CEO.

Carolina Soares is the Lead Editor & Insights Manager at Beyond Luxury, a Beauty & Fashion Brand Consultant, and a former Googler. A native Brazilian with a deep passion for cultural fusion and languages, she grew up speaking English and Italian. Carolina spent 11 years at Google, focusing on data analysis within the beauty, wellness, and fashion sectors. Her role allowed her to work with global teams and in France, and she also spoke at industry events and served as a media spokesperson. This experience enriched her understanding of luxury and innovation

Raised in a nature-centric culture, Carolina views health as the ultimate luxury. After leaving Google, she recognized the need for a neutral voice to bridge the gap between the beauty industry and consumers. Today, she collaborates with brands and shares her insights through platforms and podcasts, working to redefine luxury and beauty.

Carlota Rodben is an author, entrepreneur, advisor, and podcaster specializing in futures and innovation in the luxury industry.

She is the CEO and Founder of Beyond Luxury Group, Co-Founder and COO of Memora, a stealth-mode startup at the crossroads of luxury, tech, and impact, and the host of the Beyond Luxury podcast, a Top 25 podcast worldwide in its category. She is also the author of two industry best-selling books, Beyond Luxury: The Promise of Emotion and Beauty As It Is.

Carlota began her career at CHANEL, where she created and led the Open Innovation Team in Europe. She later transitioned to the Global Open Innovation Team at the brand’s headquarters in London, where she managed New Concepts.

Known for advancing the conversation about the future of luxury through the lenses of technology, and sustainability, and experience. Carlota’s books ‘Beauty As It Is’ and ‘Beyond Luxury: The Promise of Emotion,’ along with the Beyond Luxury podcast, are essential guides for navigating the luxury industry today.

She also serves as an advisor and consultant for institutions and multinationals, including Henkel, Beiersdorf, Muraaba, and Lufthansa Group, helping them build more desirable futures through Beyond Luxury Group.

The Beyond Luxury Substack in a proud partner of Submarine.ai, from David Klingbeil.