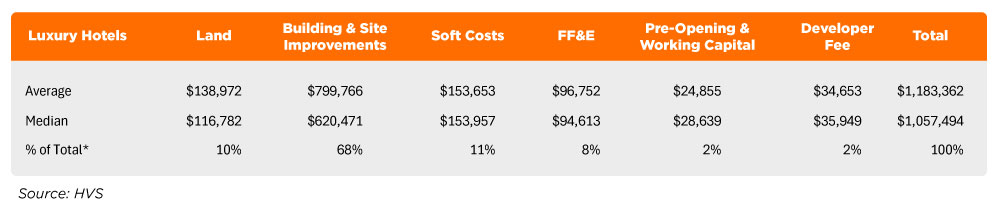

It’s easy to enjoy a luxury hotel. Building them is hard. According to the HVS U.S. Hotel Development Cost Survey 2025, the average cost to develop luxury hotels was recorded at more than $1 million per key. It’s no surprise that this category of hotel reflected the lowest number of developments, considering the arithmetic of making luxury projects feasible, given the high development costs.

About that cost. Luigi Major, managing director, advisory of HVS Americas, uses napkin math to explain how a luxury hotel can pencil out for a developer. It’s not scientific, he said, but it basically holds true. Namely, for a luxury hotel that runs around 65% occupancy, if it’s going to cost $1 million per room to build it, then an average daily rate of $1,000 is needed to make it work. Essentially, 1,000 times the rate.

Data from CoStar show that luxury average daily rates have increased since their COVID lows, but $1,000 per night they are not. Year-to-date June 2025 shows luxury ADRs in the U.S. at $398. In Major’s estimation, luxury projects that can creep closer to that $1,000 ADR are resorts that attract leisure travelers who are more willing to pay higher rates in contrast to urban luxury hotels that typically have a higher concentration of business travelers and a rate cap. The dual-located Montage and Pendry in La Quinta, Calif., that is currently under development after being stalled due to COVID, is the type of project, Major cited, as being able to succeed on a higher ADR.

Notable in HVS’ survey was the number of luxury developments where all-in costs exceeded $2 million per room. This has been exacerbated by higher interest rates that make financing these projects even more onerous.

“It’s very difficult to make luxury work,” said Major, his assertion backed also by the finance community. Peter Berk, president of PMZ Realty, a New York-based firm that focuses on hotel debt and equity financing, has worked on myriad deals and financed more than $10 billion of commercial real estate over the years. In the current cycle, he is seeing limited luxury deals get done, and it goes beyond just higher interest rates and cost of construction, he said. “The labor, insurance and other operating costs just to operate a hotel at that level requires a RevPAR that does not align with those development costs. Even in major cities, such as New York or L.A., few hotels justify that type of cost, and those that are currently under construction were planned pre-pandemic and have already committed to that course. Very few new ones at that level are planned.”

Mixed Feelings

It doesn’t mean luxury development is not happening, especially mixed-use projects that contain residential components; just ask Marriott, which, in conjunction with Related Group and BH Group, recently announced W Pompano Beach Hotel & Residences, a co-located property that blends residential and hotel, with condominium residences and condo-hotel suites designed by Meyer Davis. Staying in Florida, Marriott opened The St. Regis Longboat Key Resort last fall, a new-build development with 168 guestrooms and 28 suites, along with 69 branded residences.

Sixty-nine percent of Marriott’s luxury residential pipeline is co-located to a hotel, Jacobsohn said.

According to a recent report put out by Savills on branded residences, there are some 740 completed branded-residential developments with another 790 expected to be delivered by 2031.

It’s multi-use projects like these that are keeping Marriott’s luxury pipeline full, said Dana Jacobsohn, CDO of North America luxury brands and global mixed-use for Marriott International. “We have seen expanding opportunities with mixed-use developments. Many developers have found that mixed-use projects with branded residences can provide added benefits while helping to diversify their portfolios,” she said.

In other cases, developers are adding residences to an existing hotel, like at The Ritz-Carlton, South Beach, where 30 branded residences in a standalone 15-story tower on the sand are being added. The famed Morris Lapidus-designed beachfront hotel reopened in 2020 after a multiyear, $90-million renovation following damage from Hurricane Irma.

At the same time, Ritz-Carlton will soon open standalone residences atop South Station Tower in Boston, a 51-story glass spire rising behind the railroad station. Recent standalone luxury residences to open include Mandarin Oriental Residences Madrid, SLS Madrid Infantas and Banyan Tree Padilla Madrid Residences. “We’re seeing strong interest from buyers who appreciate the reliability and prestige that come with international hospitality brands,” said Richie Fernandez, in-house sales & marketing associate for Persepolis, the developer behind SLS Madrid Infantas and Banyan Tree Padilla Madrid Residences.

Oftentimes, it’s the branded residential component that allows a luxury development to pencil out since, as Jacobsohn conceded, the financing environment “remains challenging,” especially for new-build luxury hotels and resorts, where high interest rates, availability of funds and bloated labor costs are challenges facing developers.

In the case of W Pompano, sales for the residences, which reportedly start at $3 million, began in January 2025 and it’s the residential sales that dictate when construction of the project begins. Right now, 2027 has been given as a potential start date

A north star in luxury delivery is Four Seasons Hotels and Resorts, which, unlike some of its peers, has resisted any urge to add new brand extensions either above or below it; it remains singular, which gives it gravitas. But even a preeminent luxury brand like Four Seasons isn’t immune to macroeconomic pressure. Similarly, said Sheila Farahpour, SVP of development, Americas at Four Seasons Hotels and Resorts, and because of financing troubles, many luxury projects are only able to get off the ground if there is a residential component affixed. She also cited the growth opportunity in standalone residences, “particularly in markets where a hotel may not be feasible or where residential demand outpaces hospitality.” Four Seasons has a pipeline of standalone residences in the U.S., in Lake Austin, Texas, Coconut Grove in Miami and Las Vegas.

Four Seasons currently has a pipeline of more 60 projects and by 2033 aims to operate 180 properties. One of its anticipated projects is the reopening of Four Seasons Resort The Biltmore Santa Barbara later this year. It comes on the heels of the reopening of Four Seasons Hotel New York. Farther out are properties in Deer Valley, Utah, and Jacksonville, Fla., which Four Seasons is building with Shahid Khan, owner of the Jacksonville Jaguars.

Other recent luxury announcements include Rosewood Hotels & Resorts’ entry into Dubai with a hotel and residences slated for an opening in 2029. Mandarin Oriental recently announced the expected opening of Mandarin Oriental, Xi’an in 2029, marking the group’s first urban resort in Northwestern China.

Rooms Reduced

Data suggest that the headwinds to U.S. luxury construction have not stunted the pipeline by projects, but the scope of those projects have become smaller by room count. According to Lodging Econometrics, a firm that charts hotel development globally, the total luxury new construction pipeline in the U.S. in Q2 2020, at the outset of the global pandemic, stood at 88 projects and 25,666 rooms. By Q2 2025, the total luxury new construction pipeline was 92 projects and 21,119 rooms. “The pipeline has remained pretty constant through the pandemic, but the size of the projects has continued to consistently decline,” said Bruce Ford, SVP and director of global business development at Lodging Econometrics.

He’s not wrong. Around the same number of luxury properties open each year in the U.S.: 17 in 2024, 16 slated for this year and 16 and 13 scheduled to open in 2026 and 2027, respectively. However, according to the numbers, the room counts almost halve when comparing 2024 to 2027.

The data diverge on a global scale. According to Lodging Econometrics, 140 hotels totaling 26,114 rooms opened in 2024. This year, the number of openings is forecasted to be 255 properties representing 46,674 rooms; next year, the numbers are approximate to 2025. There’s a reason for this contrast, said Ford. “When we talk luxury growth, a significant portion is in Asia, mainly China. This is one of the few places in the world where they are still building a hotel supply of western brands.”

PMZ’s Berk, noting the dearth of ground-up U.S. luxury development, is more confident on luxury deals in Asia Pacific and in the Middle East, where, he said, labor and operating costs are significantly less. “It makes sense.”

IHG Hotels & Resorts is no stranger to luxury and is driving development through its eponymous InterContinental brand, along with the ultra-high-end Six Senses and Regent Hotels, a venerable brand IHG acquired a 51% majority stake in in 2018 and which it has the right to acquire the remaining 49% in a phased manner starting in 2026. One of its most recent openings was Regent Bali Canggu, which opened in February 2025, and includes 150 suites and villas. The opening came on the heels of the opening of Regent Santa Monica, a conversion of the former Loews Santa Monica Beach Hotel that marked the return of the Regent brand to the U.S.

The opening of Regent Bali Canggu is part of a concerted effort by IHG to nurture and grow luxury products in the Asia-Pacific region, said Leanne Harwood, SVP, managing director, luxury & lifestyle Americas for IHG. She pointed to Regent Shanghai on the Bund, one of two Regent properties in Shanghai, as testament. The bulk of the Regent portfolio is in Asia.

IHG’s luxury and lifestyle brands, which also include the likes of Kimpton, Indigo and Vignette Collection, represent 20% of its global pipeline, nearly double what it was five years ago, and it’s an area that the company—known the world over for the iconic Holiday Inn brand—is steadfastly focused on growing. “We see ourselves as being a market leader in this segment,” Harwood said.

While the eco-conscious and wellness-centric Six Senses, a brand which IHG acquired the management rights to in 2019, has traditionally cropped up in almost secluded resort destinations, there has been a push by IHG to push it into the light of the city. Six Senses Rome opened in 2023, the brand’s first true urban location, with further deliveries in London, Milan and Dubai through 2026.

Harwood said that IHG isn’t unwilling to use its balance sheet to secure deals, but employing key money to chase deals is not the strategy. “We have to be very balanced in our approach and make sure that it’s not about simply bringing a deal over the finish line,” she said. “It’s one thing to throw money up front, but once the doors open, you’ve got to actually deliver.”

Beyond Brand

Smaller luxury groups, having eschewed the siren call of the big brands to go at it alone, are also in the market opening hotels. Elias Barbosa has been involved in the real estate sector for more than 25 years with such companies as Hyatt Hotels and Iberostar. A few years ago, he launched TROBBU, a vertically integrated luxury boutique hotel group. It opened its first property in Tulum in February. Future openings in Mexico include San Miguel de Allende, Mérida Yucatán, Mahahual Riviera Maya and Los Cabos, with Madrid also slated for opening within the next few years.

Barbosa said that while capital markets have made development tougher, against a backdrop of stiff competition, he said that TROBBU’s edge is differentiation: In resort areas, like Tulum, where rates start at around $1,000 per night, it’s an all-inclusive product, while urban locations will be a more standard luxury offering. “The current and future appetite for luxury development globally is increasing,” Barbosa said. “The quality of the experience is the most important factor for guests.”

New may be better, but sometimes it’s cost prohibitive, one important reason why many brands and investors have focused more to date on conversions—wherein an asset is acquired, typically given a PIP, or property improvement plan, and flipped to a new brand or taken independent. Instead of waiting several years for a hotel to open, with conversions, the revenue spigot stays in the on position. Consider IHG: Its total global conversion signings nearly doubled between 2023 and 2024. Other lodging companies have introduced conversion brands to nurture the trend.

“The best deals from a typical return on investment, or things really penciling out, are the conversion deals, because you don’t have to build the structure brand new,” said HVS’ Major. “A lot of savings goes into that.”