The bad news: Expectations are that consumers’ seasonal spending will decline this upcoming holiday season on average by 5% from 2024—the first notable drop since 2020, according to PwC’s 2025 Holiday Outlook survey. Eight-four percent expect to cut back over the next six months, citing rising prices, new tariffs and a higher cost of living. The good news: travel plans this holiday season won’t be as negatively impacted.

Gen Z respondents, those aged 17 to 28, are expected to be the one cohort to reduce their spend dramatically, with an expected reduction of holiday budgets by 23%, citing major life transitions, smaller savings and a precarious job market. By contrast, millennials, Gen X and baby boomers expect to maintain or even increase their holiday spending, according to the study.

PwC surveyed 4,000 consumers in the U.S. between June 26 and July 9, 2025, with 1,000 respondents each from the Gen Z, millennial, Gen X and baby boomer segments.

The anticipated dip in holiday spend is anomaly according to PwC, which compared holiday shopping to a “well-rehearsed melody”: steady and familiar. This year, it wrote it feels more like jazz: “improvisational and less predictable, with shifting consumer behavior, smarter spending and a younger generation leading the key change.”

Consumers are approaching holiday purchases more deliberately, deciding what matters most, where to scale back and what feels worth the splurge, PwC wrote. Brands that recognize these nuances, and meet shoppers where they are, have an opportunity to build loyalty that lasts beyond December.

Though spending habits on whole are anticipated to be lower this holiday season, travel spending is expected to be steady: Though the biggest adjustment is in gift spending, which is down 11% to an average of $721 compared with $814 in 2024, travel and entertainment are holding steady with 1% increases.

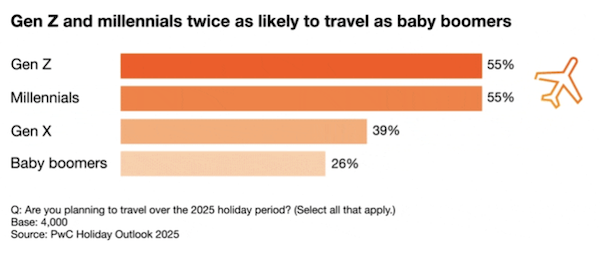

Travel plans remain steady overall compared to last year, the report noted, with 44% of U.S. consumers expecting to hit the road this holiday season. The overall stability reflects a shift from pandemic-era hesitation to a new normal shaped largely by cost, PwC wrote. Visiting family and friends, according to 48% of travelers, is the main motivation to travel. Younger generations are more likely to hit the road this holiday season, the study concluded, likely staying with family over hotels or STRs, as a way to save money and reconnect at the same time. Of all the cohorts surveyed, Gen Z is pulling back the most: 55% plan to travel in 2025, down from 61% last year. For those not traveling, about half (49%) said they prefer to celebrate at home and 43% cite cost concerns. This rises to 50% for Gen Z respondents who say they’re not traveling.

“Despite what looks to be an overall dip in consumer spending sentiment this year, travel is holding its ground,” said Jonathan Kletzel, travel and transportation leader at PwC US. “Nearly half of consumers (46%) still plan to take a trip this holiday season, virtually unchanged from last year. The biggest generational shift comes from Gen Z, with travel intent down; millennials, by contrast, are maintaining steady holiday budgets overall, while Gen X and boomers are tightening theirs. At the same time, travel stress is easing, with fewer consumers worried about cancellations or rising costs. Even as wallets tighten, travel demand remains remarkably resilient.”

PwC called holiday travel “a real-time read on consumer sentiment,” noting that the fact that travel plans are holding steady despite cost pressures is a signal of resilience in spending. Further, choosing family stays over hotels, driving instead of flying and trimming trip extras reveals a budget-conscious mindset shaping non-discretionary experiences. PwC instructed that hospitality and adjacent categories should lean into affordability without compromising meaning.

“Even though consumer sentiment is down according to the University of Michigan, and overall spending is expected to dip based on our Holiday Outlook survey, we believe people will continue to prioritize holiday rituals and meaningful experiences,” PwC wrote. “Our survey shows that many are still planning to travel, host celebrations and exchange gifts, even if it strains budgets and means adjusting elsewhere. And based on historical data, holiday spending typically rises year over year. For many people, the holiday season is the time for a bit of retail therapy—using purchases to lift spirits and preserve traditions. This behavior signals a pattern: Spending may shift but the intent to maintain a sense of normalcy holds firm. ”

Technology is powering holiday spend, as consumers use it to hunt for value. Seventy-six percent of millennials say they’re likely to use AI for travel recommendations. Overall, 68% say they’re likely to use AI for comparing flights, while 57% say they’d be likely to use it for booking travel. The finding, PwC said, is a signal that AI-enabled recommendations are becoming a larger part of how consumers discover products and plan, but using AI for purchases could be further away.

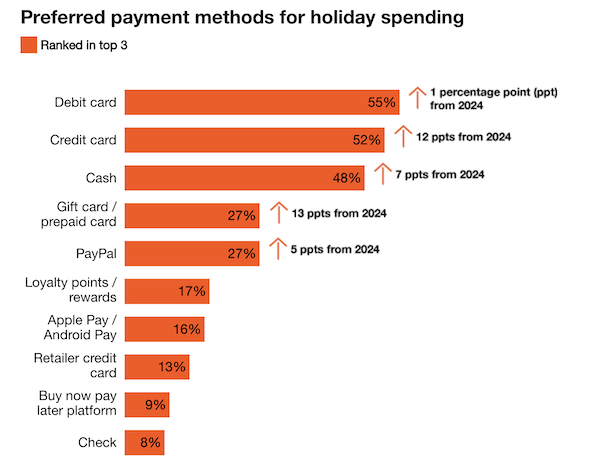

The method people are using to pay for trips is changing, too. Credit card use has climbed sharply, with 52% saying it’s among their top three payment methods (up from 40% last year). Cash has surged to 48%, potentially to avoid fees or stick to budgets (up from 41% in 2024.) Gift cards and prepaid cards are also gaining traction, with 27% of shoppers saying these cards are a preferred payment method, up 14% from last year. Among digital payment options, PayPal has grown steadily, now ranking in the top three for 27% of shoppers (up from 22% in 2024), while a smaller share (9%) opts for buy now, pay later (BNPL) platforms.