The cruise industry is poised to make revenue management waves.

It may seem hard to believe that an industry capable of serving up tens of millions of unforgettable passenger experiences every year—all without letting their guests see them sweat—has room to improve. But despite their innovative and sophisticated approach to guest technologies, sustainability, and other complex and challenging initiatives, cruise lines have been comparatively slow to adopt the shift in tools and philosophy needed to maximize revenue from their perishable inventory of cabin accommodations.

The result? A ruthlessly competitive environment with cruise lines willing to undervalue ticketing to ensure a ship full of passengers who’ll (hopefully) spend enough onboard to cover the difference and then some.

It’s a tough balancing act filled with missed revenue opportunities. And it’s one we believe can be fundamentally shifted toward a more profitable position through the use of similar, tried-and-true revenue science principles widely adopted across airlines and hotels.

The upper hand of unconstrained demand

At the root of the perishable inventory problem is an inability to effectively forecast demand. A cabin ticket obviously can’t be sold after sail away, which creates urgency for cruise lines to ensure they fill the ship. Without effective demand forecasting, cruises are left slashing fares or overbooking standard accommodations knowing they’ll need to offer free upgrades to premium accommodations to ensure everyone has a place.

But what if you knew ahead of time that there’s likely enough demand for premium cabins to fill them at full (or much closer to full) value? Or know well in advance that demand for premium cabins is looking soft? That information sets the stage for a sea change in how cruise lines approach pricing, promotions and more.

By assessing a host of complex factors, advanced revenue management solutions can help answer a critical question: How would you maximize revenue if you understood demand for each cabin category and had infinite capacity?

Once that is understood you can choose to accept the demand that best optimizes revenue using levers such as price, distribution channels, and qualified promotions. Recognizing that demand does not behave the same for each cabin-category, and treating the pricing decisions independently for each enables something closer to optimal ticketing revenue.

Better sailing through segmentation

Unlike their landlubber hotel counterparts, cruise lines often lack the luxury of well-defined market segments (e.g. corporate, leisure, contract, etc.) that share similar booking (and spending) behaviors. This certainly complicates granular, segment-based demand forecasting—but it’s not unsolvable.

There are a number of other parameters that can be applied, such as booking channel, source market, agency vs. direct, online vs. offline, and so on that can serve as key indicators for segmentation-based forecasting.

For instance, if your long-haul agency customers are booking ahead of pace against the previous year, you can assume they will fill more cabins than they did the previous year. If your domestic direct-booking passengers are booking slower than usual, you can assume they will not make up the volume they historically have—and in turn adjust your selling strategy to counter. If enough demand is forecast, promotional offers can be restricted.

The potential value of understanding these segment-based trends is likely coming into clear focus—with enough insight into segment-based demand, cruise lines can develop strategies that ultimately lead to getting the most valuable mix of passengers on board as possible. And as guest segmentation data practices improve, insights into onboard spending can then be factored into the revenue strategies used to drive an optimal mix of guest bookings.

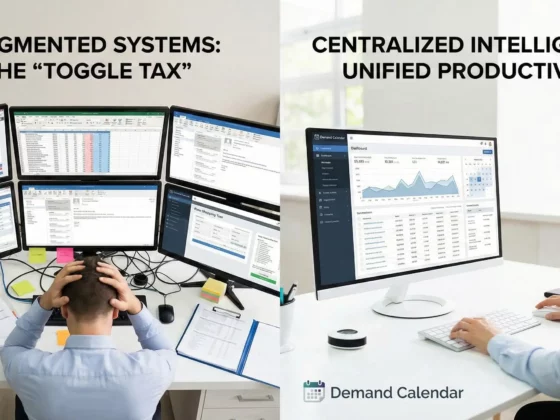

Weighing all this information—including publicly available competitor pricing—in concert can provide a powerful foundation for shaping an effective revenue strategy. But there’s just one problem—it takes a ton of time-consuming, error-prone work to make this happen manually. Particularly at the scale and frequency needed to respond effectively for an entire fleet of ships booking months or years in advance.

Making it happen with automation

To pull off the necessary data crunching and subsequent shifts in selling strategy implementation effectively, cruise lines need to enlist the power of advanced automated tools.

The good news is that this isn’t a problem to be solved internally starting from square one. Technology using machine learning (ML) and artificial intelligence (AI) has been tackling similar challenges for years, and recent enhancements have accelerated the pace at which they spur new features and improved performance.

By joining forces with a proven leader in advanced revenue management technology, cruise lines now have an ally that can take care of the critically important—but ultimately tedious—advanced forecasting calculations and tactical changes needed to implement a dynamic, demand-driven approach to revenue management.

These analytically driven, automated revenue management systems (RMS) don’t completely replace a revenue manager’s judgment. They do alleviate the manual processing of high volumes of data and respond quickly to shifts in demand patterns by changing prices and controls.

While it may make waves today, a revamped approach to automated demand forecasting and dynamic ticket pricing strategies is just the start. Cruise lines will undoubtedly continue to explore new avenues of data-driven revenue optimization as they chart a course for improved efficiency and profitability. That’s an exciting prospect for what’s coming over the horizon in the cruise industry—the question is: Are you ready to set sail with us?

IDeaS is ready to help your cruise line rethink its approach to revenue management—are you? Connect with us today to start exploring what’s possible.