The third quarter of 2024 continues to reveal significant trends in guest experience management for hoteliers. As we approach the year’s end, the Shiji Guest Experience Benchmark Report Q3 2024 offers a deep dive into the performance of hotels across regions, highlighting shifts in guest satisfaction, review volumes, and management practices. During this peak tourist season in the northern hemisphere, guest satisfaction grew while review volumes declined across major platforms. These insights are crucial for hoteliers and owners looking to optimise guest engagement strategies and stay competitive in an evolving landscape.

Key takeaways

Hoteliers should diversify their review management efforts, improve response times, and enhance value-for-money offerings.

Global GRI improved to 86.0%, with 3-star hotels seeing the largest growth.

Review volumes dropped by 4.4%; fake review crackdowns played a role.

Asia-Pacific leads globally in guest satisfaction, with Europe and North America also showing growth in certain areas.

Response times are improving globally, with the Middle East and Africa leading in response efficiency.

Global trends: Guest satisfaction and review volume

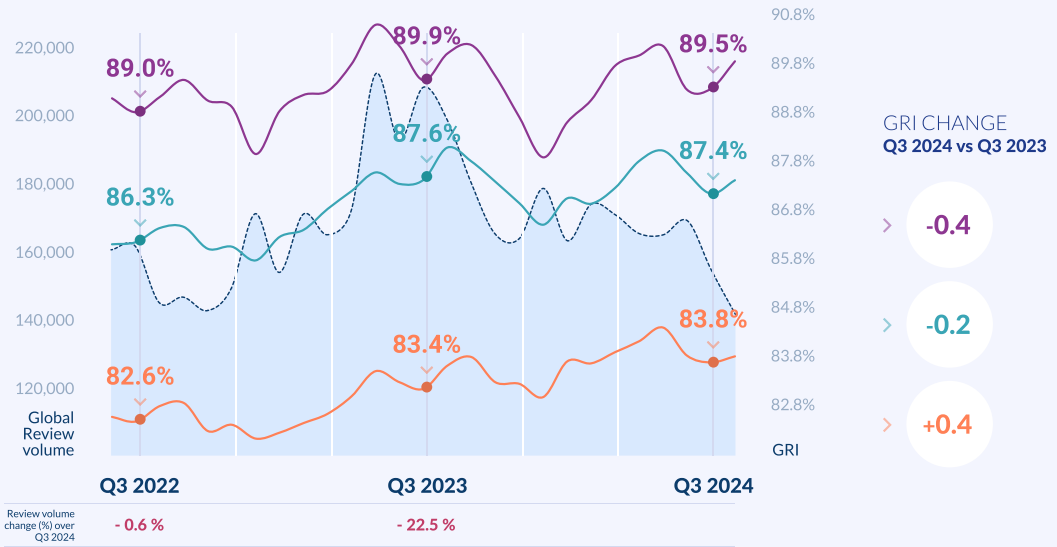

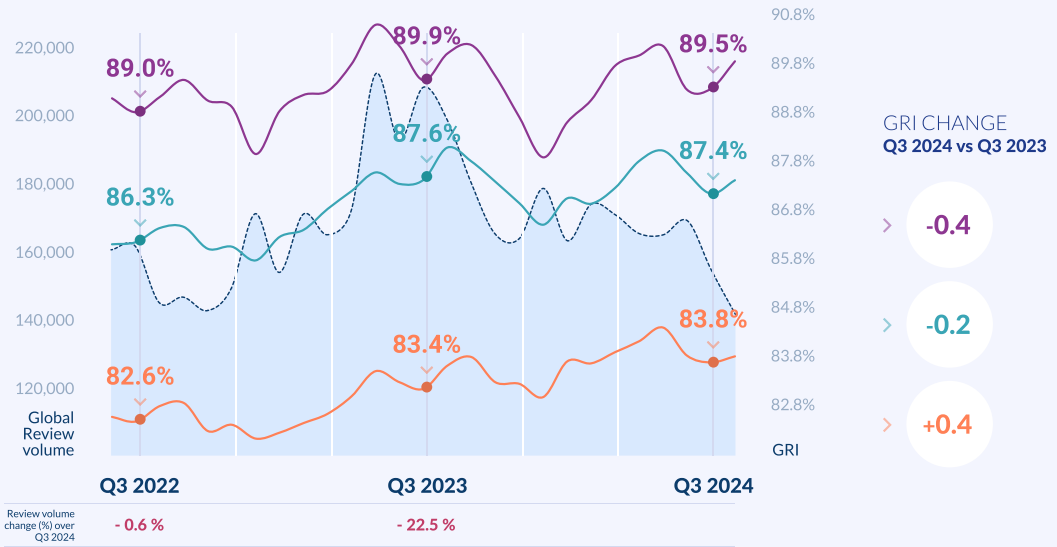

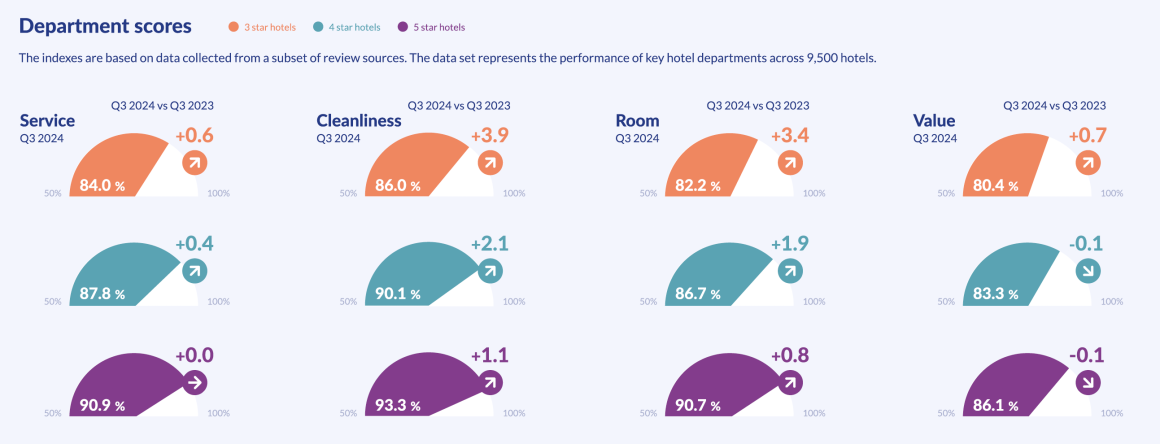

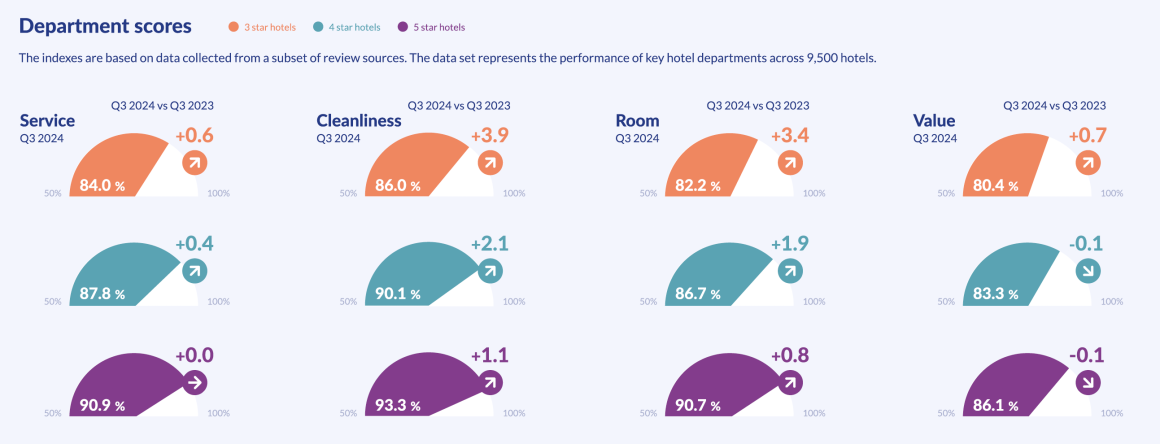

The Global Review Index (GRI) for Q3 2024 reached 86.0%, a 0.6-point increase from the same period in 2023. This marks a slower improvement compared to earlier quarters but remains a positive trend. The percentage of positive guest mentions also grew by 0.7 points. Notably, the three-star hotels showed the largest growth, rising by 0.8 points, while four-star and five-star hotels improved by 0.5 points each.

The review volume, however, declined by 4.4% globally. Major review platforms, including Booking.com, Google, and Tripadvisor, saw significant drops in review volumes. Google’s effort to crack down on fake reviews played a key role in this decrease. You can read more about Google’s actions here: The Verge, Mashable, and Money Control.

Although Google’s volume dropped, other platforms saw significant growth. Expedia and Hotels.com both experienced a more than 40% rise in review volumes. Agoda also grew by pushing its global review market share with a 1.3-point increase over 2023. However, Booking.com’s global market share shrank by 4 points in Q3 2023.

Because of the decline in the overall review volume, response times improved. Positive reviews now receive responses within 3.1 days on average, down from 4.7 days in Q3 2023. Negative reviews are addressed in 3.9 days, compared to 6.3 days last year. Review response rates saw a 4.1-point increase over Q3 2023.

Regional performance

Asia-Pacific: Leading in guest satisfaction

Asia-Pacific led the global market with a GRI of 88.0%, showing a slight increase over the same quarter last year. The region’s five-star hotels reached a GRI of 91.1%. However, this growth has slowed compared to earlier in the year.

Review response times in Asia-Pacific improved by 0.8 days compared to the same quarter last year, now averaging 3.8 days. The review response rate also increased this quarter by 2.9 points. This marks the third-best performance globally, following the Middle East and Africa. The review response rate increased by 2.9 points over the previous year. Agoda gained significant ground in the region, raising its market share by 3.1 points, placing it third behind Booking.com and Google.

Europe: Decline in review volume despite leading in tourism

Europe remains the leader in the global tourism market, as seen in this Statista report. However, review volume during Q3 2024 dropped by 4.7% compared to last year’s peak season. Major platforms like Booking.com, Tripadvisor, and Google all saw declines in review volumes.

On the other hand, Expedia, Hotels.com, and Agoda reported substantial increases in reviews. HolidayCheck and Trip.com also saw significant growth, with review volumes rising.

Europe also saw improved review response times. Positive reviews are now addressed in 3.7 days, while negative reviews take 4.6 days, compared to 6.2 and 8.1 days on same quarter of last year. Room satisfaction levels, however, saw a slight decline. The GRI for five-star hotel rooms dipped by 0.7 points.

Latin America: Significant drop in review volume but stable satisfaction

Latin America saw a 22.5% decline in review volume this quarter, following a decrease in the second quarter. Despite this, the region’s GRI remained steady at 86.4%. The GRI for five-star hotels dropped slightly, while three-star hotels showed a modest improvement of 0.4 points.

Unfortunately, positive mentions in the region dropped by 1.7 points. Latin America was the only region where positive mentions did not increase during the quarter. This drop may be linked to Google’s crackdown on fake reviews, which led to a 5.6-point increase in Google’s negative mentions in the region.

Response times improved, with positive reviews addressed in 4.2 days and negative reviews in 3.9 days. This is a significant improvement from last year’s average of 7 days. However, the value index for 4- and 5-star hotels declined slightly compared to Q3 2023.

Africa: Steady growth in satisfaction and response rates

Africa saw its GRI grow by 0.9 points, while review volumes dipped slightly by 0.1%. The region’s five-star hotels led the way, up 1.2 points compared to the same quarter last year. HolidayCheck achieved the highest satisfaction index among primary review sources in Africa, with a score of 86.9%. Booking.com, on the other hand, scored the lowest at 82.6%.

Africa also saw improvement in review response times. Positive reviews are now addressed within 3.3 days, and negative reviews within 4.6 days. This is a significant improvement from last year’s average of over 5 and 6 days.

Middle East: Best in response rates

The Middle East continues outperforming other regions in review response rates, achieving an 82.8% response rate, the highest globally. The region’s 5-star hotels recorded a GRI of 91.3%, making it the best-performing region for guest satisfaction in this category.

Hotels in the Middle East significantly improved their response times. Positive reviews are now answered within 3.2 days, and negative reviews within 3.9 days. This represents a major improvement from Q3 2023 when response times averaged 5.2 days for positive reviews and 7.2 days for negative reviews.

North America: Recovery in review volumes and guest satisfaction

North America saw a reversal of the downward trend experienced earlier in 2024. Review volumes grew 5.8% over Q3 2023, making it the region with the most vigorous volume growth. Guest satisfaction also increased, with the region’s GRI rising by 0.9 points.

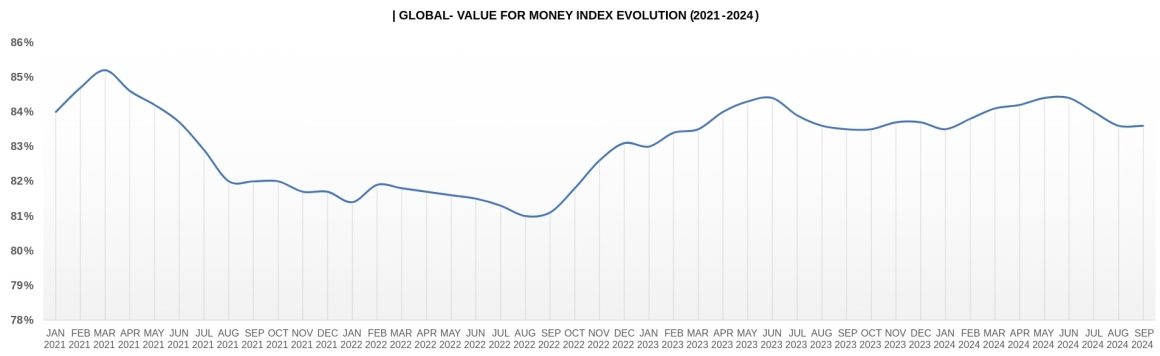

Expedia drove much of this growth, with a 39.9% increase in review volumes. Booking.com also maintained a strong market share, with 29% of reviews coming from the platform. However, North America still struggles with value-for-money perceptions, especially in 5-star hotels. The value index for these properties did not grow compared to Q3 2023. The 3-star hotels, however, saw a 0.9-point increase in value-for-money perception.

Actionable insights for Hoteliers

Based on the Shiji Guest Experience Benchmark Report Q3 2024, here are some key actions for hoteliers:

- Diversify review management efforts: Expedia, Hotels.com, and Agoda gained review volumes; hoteliers should focus on more than just Booking.com and Google.

- Improve response times: Hotels should aim to reduce response times further, particularly in regions like North America, where slower response times can negatively affect guest satisfaction.

- Enhance value-for-money offerings: Hotels, especially in North America, need to focus on delivering experiences that provide better value for guests.

- Focus on 3-star hotels: Guest satisfaction at 3-star properties increased significantly. Hotels in this segment should capitalise on this trend by improving service and room quality.

- Combat fake reviews: Google’s crackdown on fake reviews reshapes the review landscape. Hoteliers should invest in tools and strategies to maintain authentic feedback across all platforms.

Conclusion

The Shiji Guest Experience Benchmark Report Q3 2024 highlights critical shifts in the hotel industry. These insights provide clear actions for hotel operators. While global guest satisfaction rises, review volumes have dropped due to efforts to combat fake reviews. Hoteliers should use this period to enhance guest engagement and encourage authentic feedback.

Improving response times is essential. Faster responses to reviews demonstrate a hotel’s commitment to guest satisfaction. Hotels should aim to meet the high standards of regions like the Middle East and Africa. This will boost guest trust and improve overall reputation.

Diversifying review management is also key. Focusing on platforms like Expedia, Hotels.com, and Agoda can provide a broader perspective. Limiting efforts to Google and Booking.com might mean missing valuable insights from other growing platforms.

Additionally, hotels need to address value-for-money concerns. Improving guest perceptions without raising costs should be a priority in regions like North America. Adding personalised experiences or small, meaningful amenities can significantly enhance the guest experience.

Hoteliers can stay competitive by focusing on faster responses, reviewing diversification, and improving value for money. These strategies will help meet evolving guest expectations and boost performance in an ever-changing marketplace.