Introducing The Economad Index

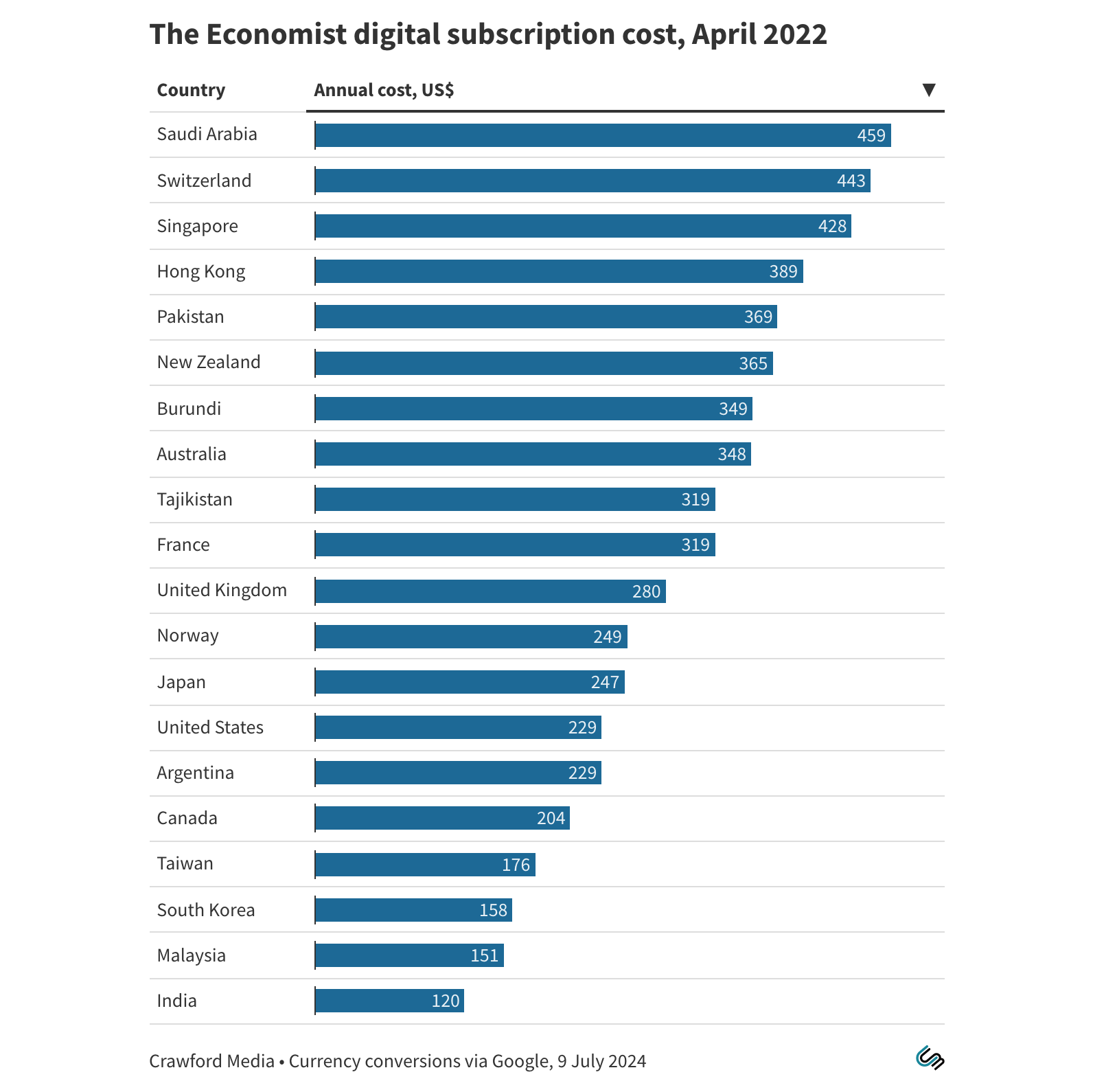

Two years ago I looked into The Economist’s global subscription pricing structure and found a labyrinthine mess that seemed irrational and unfair. For exactly the same digital content, delivered over the internet, prices varied by over 300% depending on the subscriber’s nationality. Subscribers in poor nations like Pakistan and Burundi were paying double the rate of rich nations like Canada and South Korea.

This inversion was not systematic. Indians had the cheapest subscription, while a Pakistani next door would have to pay around three times as much. New Zealand was the second-most expensive subscription in the world, after Saudi Arabia and the other Gulf states.

I’ve revisited the data in 2024, and the shemozzle continues.

I have selected the 20 nations in the graph above from among the 206 given on The Economist’s website. All 206 are included in my Economad Index data sheet, which you can download here as a CSV file. The prices are either converted from the local currency to US dollars, or are set in US dollars. There are 19 local currency versions of The Economist globally.

In 2024 the rip off for Australian and New Zealand subscribers continues, but has been moderated by weak local currencies. Price hikes for most markets have been steep: one of the cheapest subscriptions, Canada, copped a 28% increase. Subscriptions in North and South America (minus Canada) were increased by 21%.

A clutch of countries in the Asian region with local currency editions went backwards in US dollar prices because of tanking local currencies.

The Economad Index

You may have heard of The Economist’s Big Mac Index. This uses the price of a Big Mac hamburger in the local market as a standard by which to judge the valuation of a currency. The Economist says that “in the long run, exchange rates should adjust to equal the price of a basket of goods and services in different countries.”

The basket they are talking about with the Big Mac Index is the Big Mac alone. The Economist says the index roughly measures whether a currency is over or under-valued.

I have done the same thing using an Economist subscription as the singular item in the basket, rather than a hamburger. What picture of the world emerges and how does it compare to the Big Mac index?

The first thing you’ll notice is that The Economist’s pricing indicates a world economy far crazier than the one depicted in the Big Mac Index, stretching from 93 percent overvalued to 48% undervalued (compared to 44%/-58%). Most world currencies appear overvalued according to Economad, whereas the Big Mac Index has most currencies undervalued. There is some common ground between the two indexes: the Swiss Franc is overpriced in both, while India, Malaysia, South Korea and Taiwan’s currencies are undervalued in both.

In general the Economad numbers verify what we already knew: The Economist’s digital pricing is totally out of whack.

Know thyself

While the eagles at The Economist are ripping irrationality apart in global markets, they seem unaware of their own indefensible pricing. They are stinging the rich petro states the hardest – hurrah – but they are also giving wealthy countries like the US, Canada, South Korea, Taiwan, and Japan a big discount compared to swathes of Africa and Asia. Even if you viewed the UK as “ground zero” of Economist pricing (as opposed to the US), the picture remains horrible: what is the justification for charging a Cook Islander 31% more than a Brit for exactly the same content delivered at near-zero marginal cost?

Maybe someone at The Economist will cast some light here. The discrepancies are big, easy to discover, and feel grossly unfair. My yearly subscription is now more than A$500. If I happened to have a Canadian credit card, I’d get the same content for A$220. I love reading and listening to what the Economist editors idiosyncratically describe as “this newspaper”, but I have ended my subscription.

Have a great week,

Hal