123Compare.me, the company behind the World Parity Monitor, has revealed the results from the World Parity Monitor report for July, 2024.

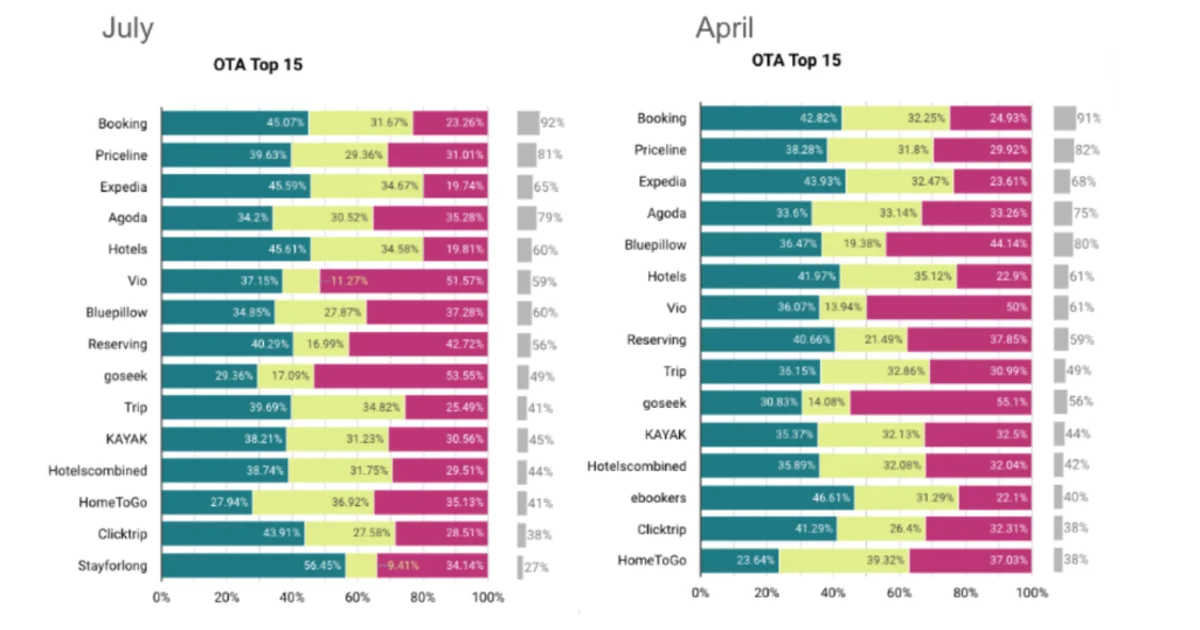

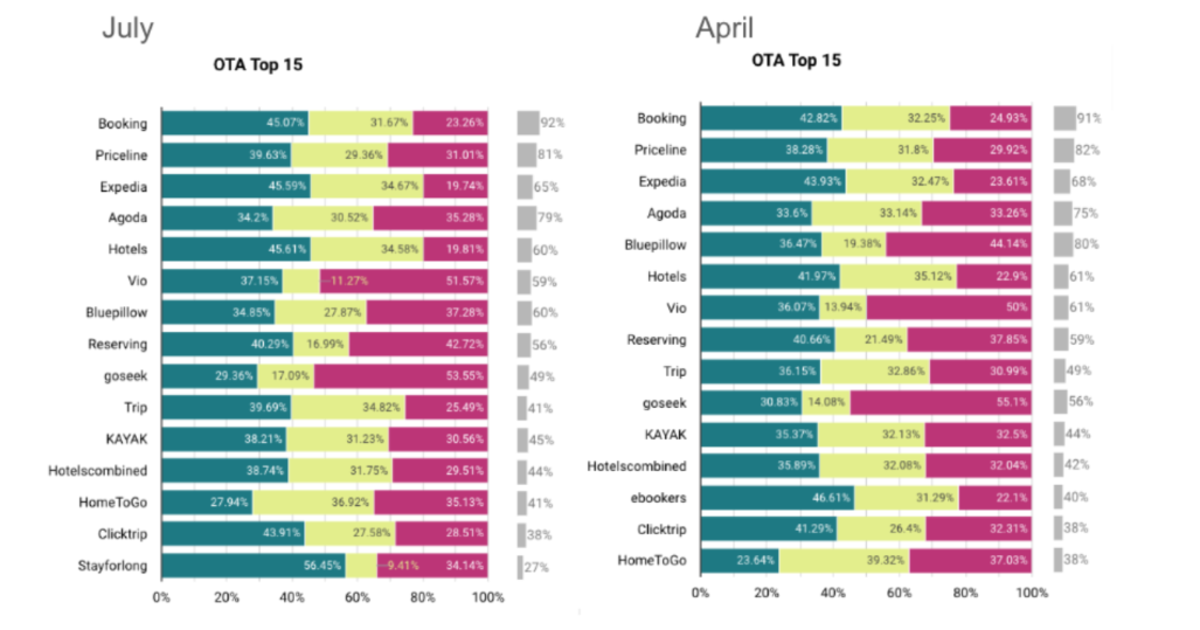

It found that there was improved parity for Major OTAs with many, including Expedia Group and Booking.com, have maintained stable or improved direct price parity with properties.

Still, some minor OTA such as Reserving, have seen a 5-point increase in price disparities compared to the previous waves.

This increase is due to more cases where prices match the hotels’ direct rates (Meet) rather than being lower (Beat).

The data showed there was a slight improvement with 1.5% of total disparity cases shifting to ‘Beat’ cases.

This positive trend was also observed in the previous wave of June, where there was an overall increase of 4 points towards positive parity performance.

The Lead time trend remains stable with no significant movement in price disparity. However, there are minor shifts between ‘Meet’ and ‘Lose’ categories.

Long-term bookings are performing better in the ‘Beat’ category. The autumn-winter strategy is not yet fully implemented, as current demand is focused on summer, with winter trips not yet prominent on users’ horizons.

The performance in Destinations shows slight changes, mostly between ‘Meet’ and ‘Lose’ categories.

Notably, Palma de Mallorca and Frankfurt am Main are improving their ‘Beat’ performance by reducing ‘Lose’ cases.

Palma de Mallorca gained 10 points in the ‘Beat’ category by effectively managing price distribution, which led to a reduction in ‘Lose’ cases.

Frankfurt am Main saw a 12 point increase in ‘Beat’ cases by also decreasing ‘Lose’ instances.

Overall, compared to the June analysis, destination performance remains stable with minimal changes observed.