Keeping up with the ever-expanding universe of consumer gen AI products is a dynamic, fast-moving job, whether we’re building time-saving new workflows, exploring real–world uses, or experimenting with new creative stacks. But amid the relentless onslaught of product launches, investment announcements, and hyped-up features, it’s worth asking: Which of these gen AI apps are people actually using? Which behaviors and categories are gaining traction among consumers? And which AI apps are people returning to, versus dabbling and dropping?

Welcome to the third installment of the Top 100 Gen AI Consumer Apps.

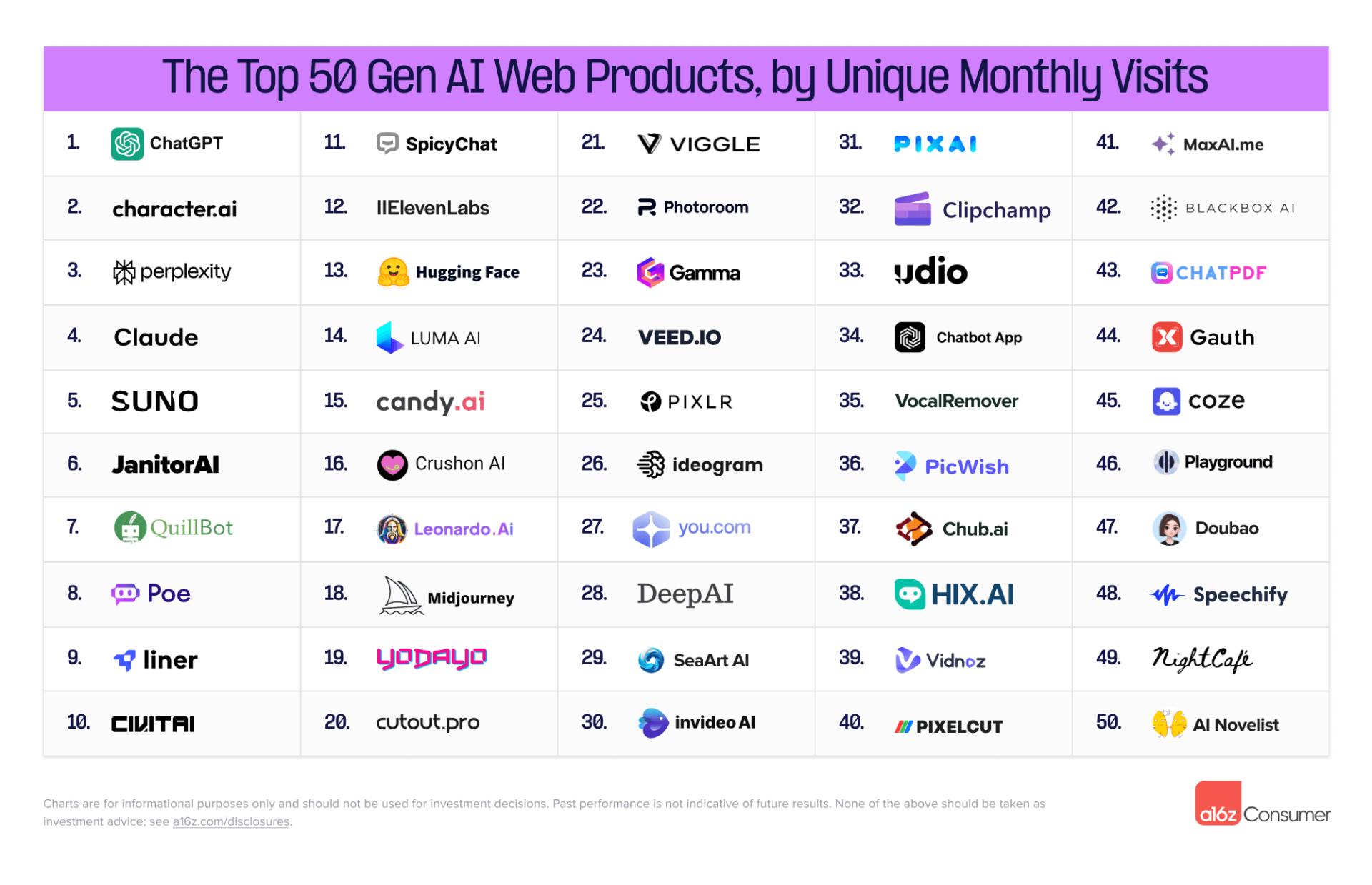

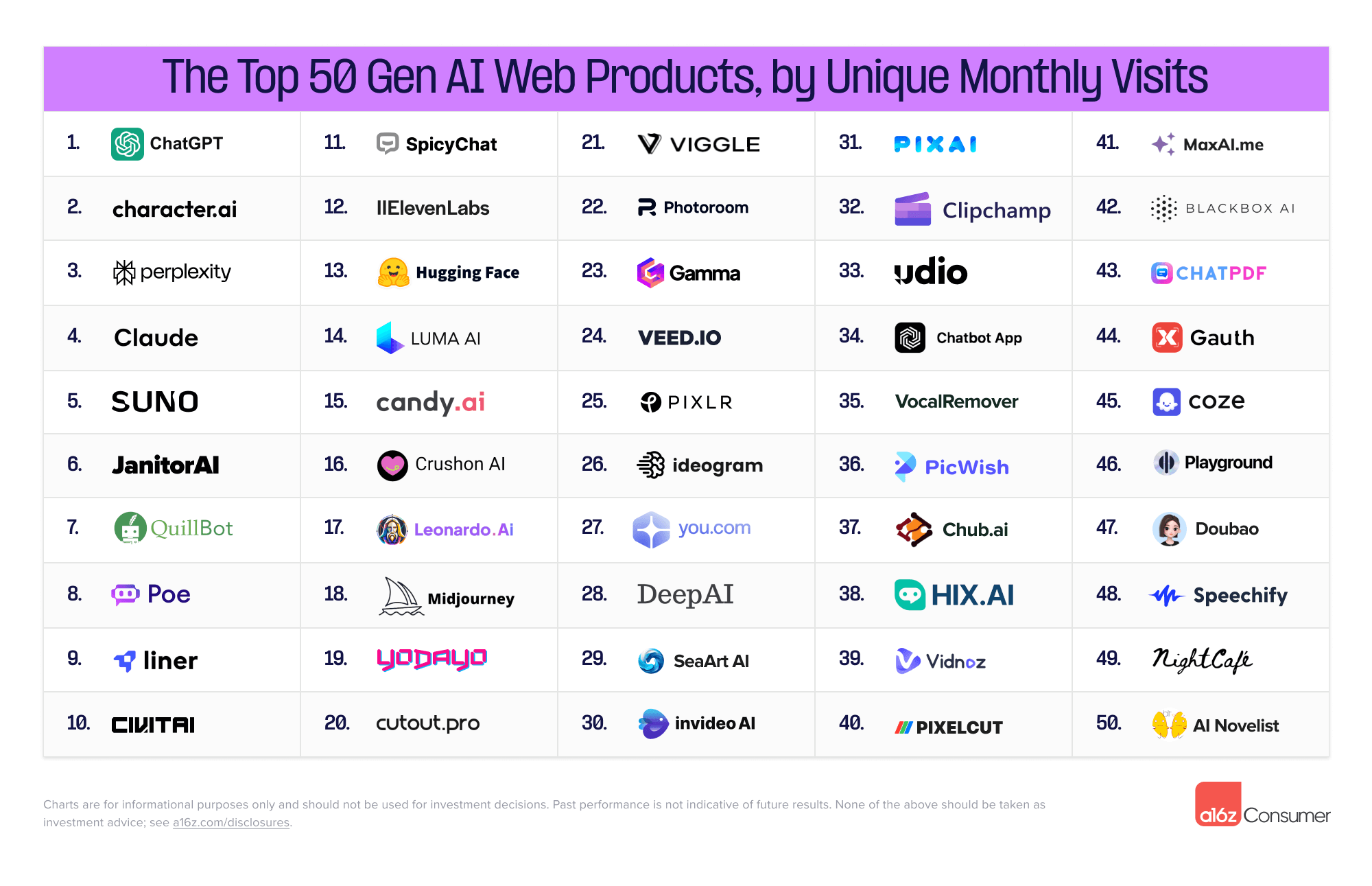

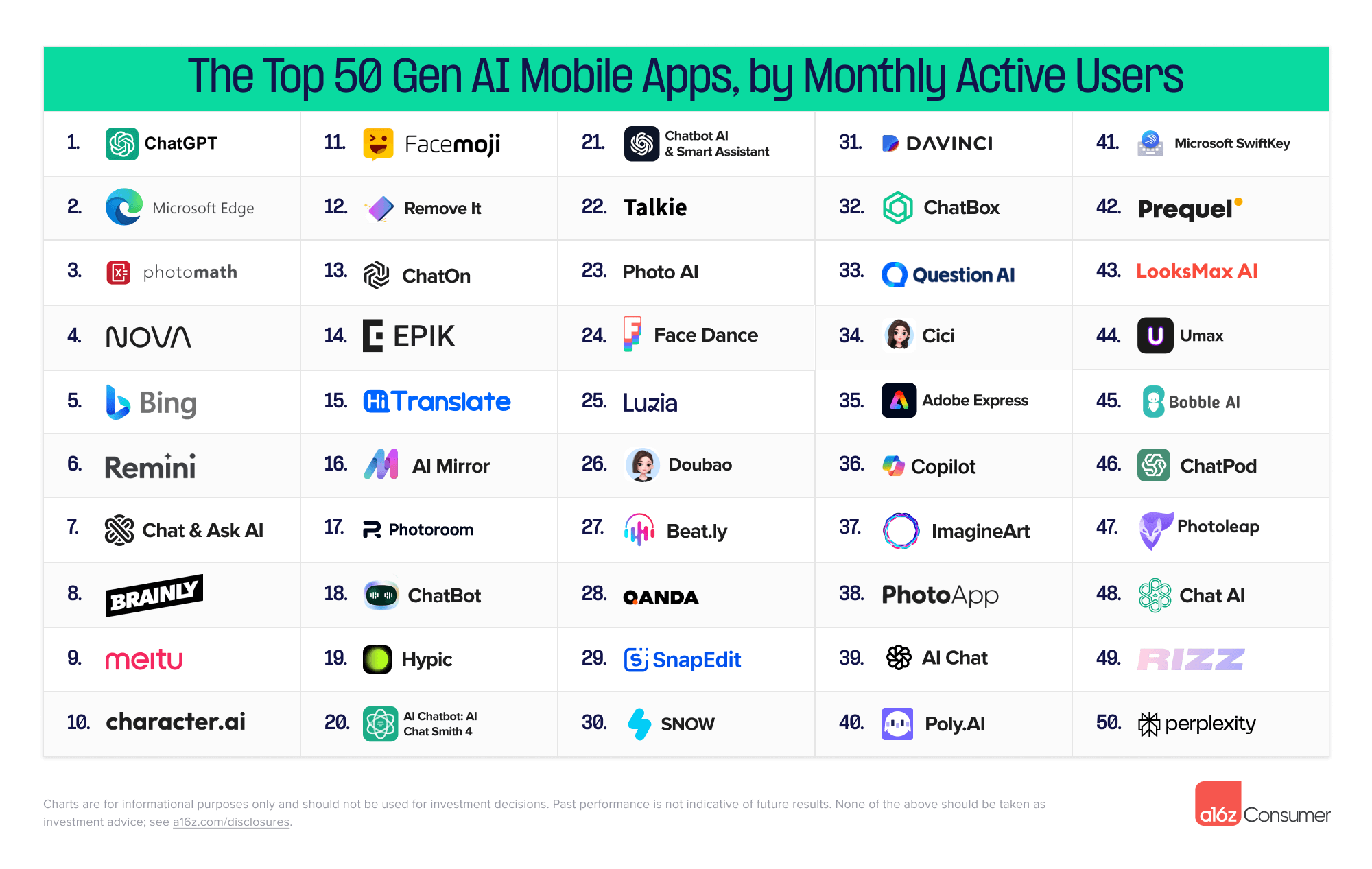

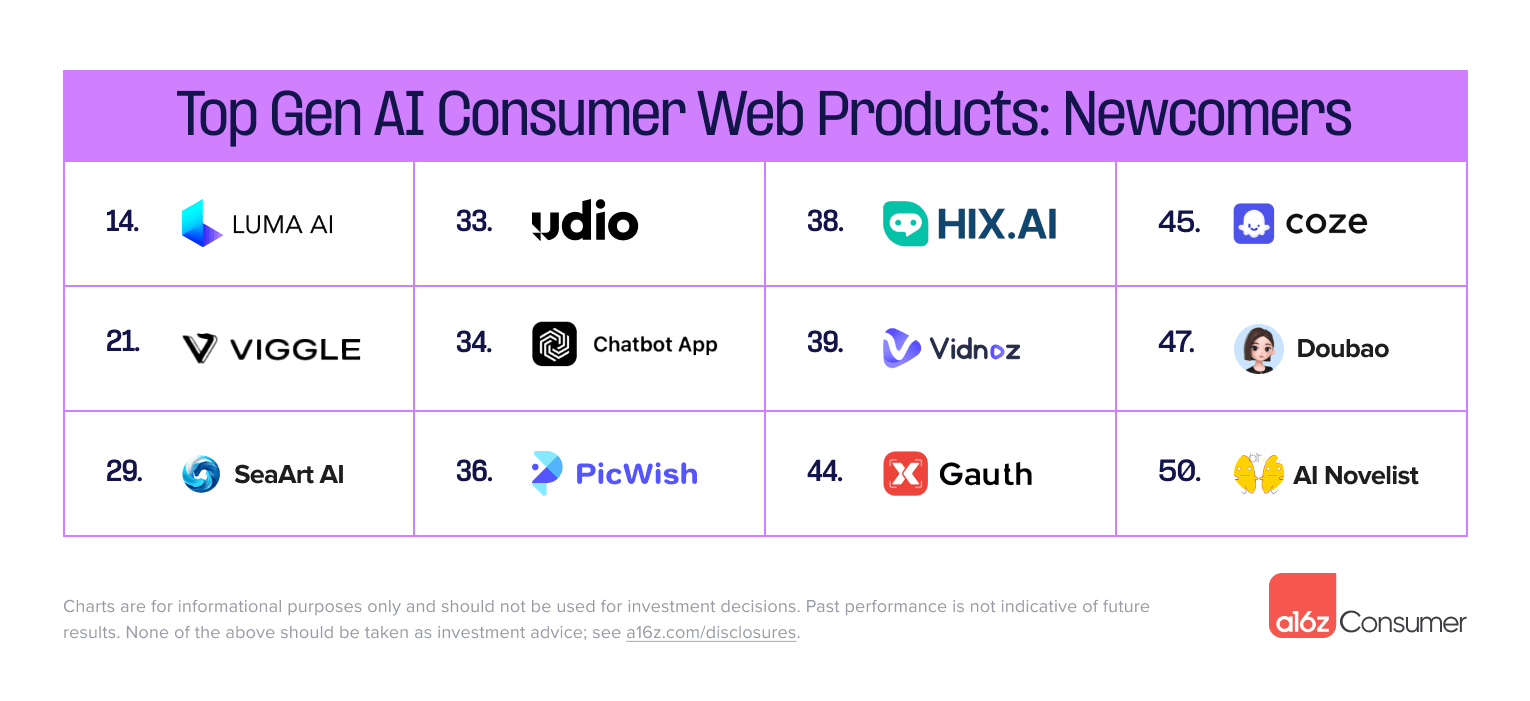

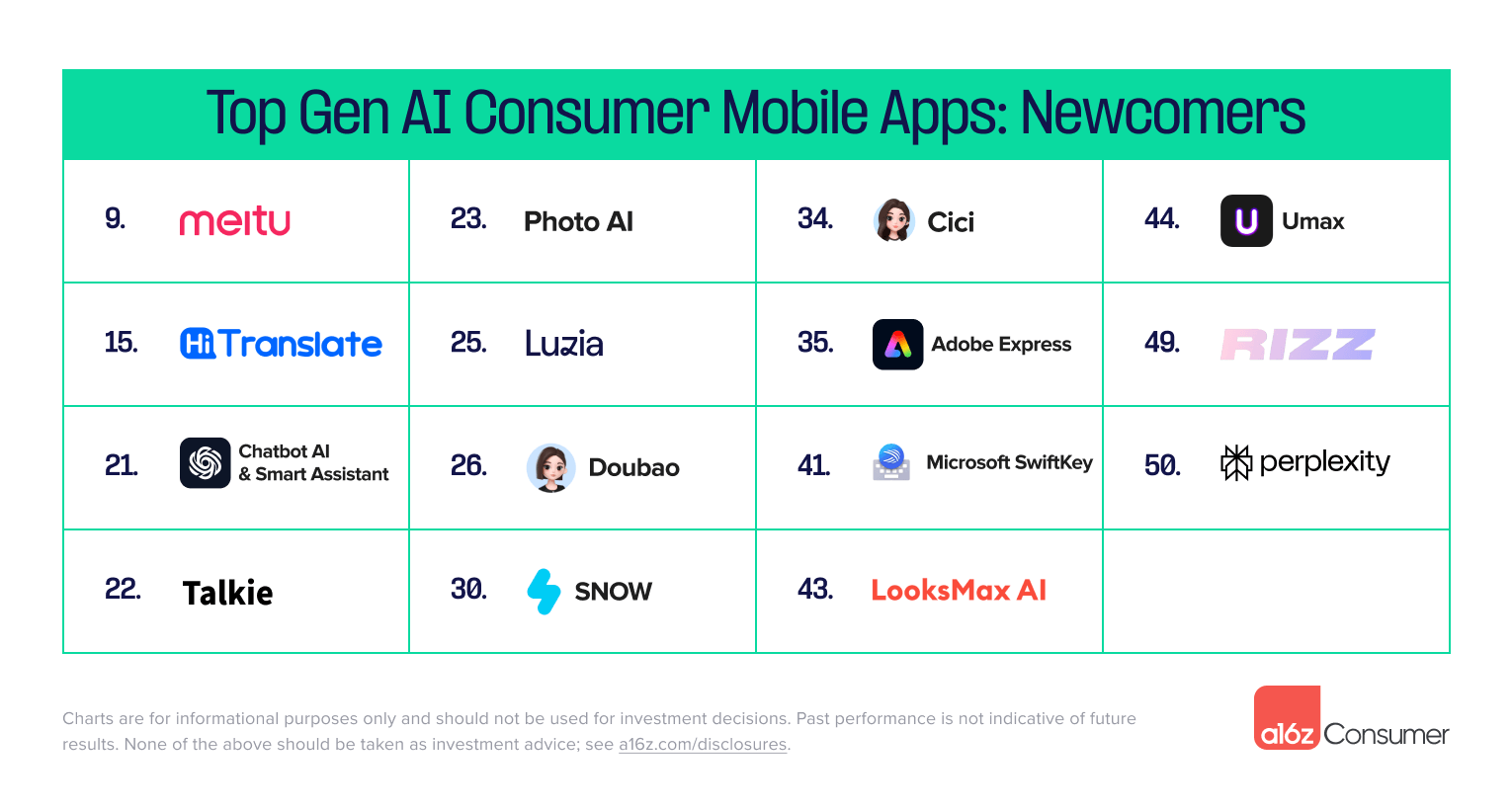

Every six months, we take a deeper dive into the data to rank the top 50 AI-first web products (by unique monthly visits) and top 50 AI-first mobile apps (by monthly active users). This time, nearly 30% of the companies were new, compared to our previous March 2024 report.

Beyond the logo-laden interest of these rankings, however, the data reveals some noteworthy trends around new and expanding categories, emerging competitors, and patterns of engagement.

Beyond the logo-laden interest of these rankings, however, the data reveals some noteworthy trends around new and expanding categories, emerging competitors, and patterns of engagement.

Here are some of our top takeaways:

The magic of creative tools continues to draw in consumers. Fifty-two percent of the companies on the web list are focused on content generation or editing, across modalities — image, video, music, speech, and more. Of the 12 new entrants, 58% are in the creative tool space.

This included four of the top five first-time listmakers by rank: Luma (#14), Viggle (#21), SeaArt (#29), and Udio (#33). And the biggest leap in the past six months was music generator Suno, which rose from #36 to #5.  In our prior lists, the majority of content generation tools focused on image. Over the last six months, other modalities have gained steam: image gen only represents 41% of the top content gen sites. And of the five generation tools that made the list for the first time, only one, SeaArt, is in image. Video saw three new entrants (Luma, Viggle, and Vidnoz) and music saw one (Udio) — both modalities have seen massive leaps forward in output quality over the past year.

In our prior lists, the majority of content generation tools focused on image. Over the last six months, other modalities have gained steam: image gen only represents 41% of the top content gen sites. And of the five generation tools that made the list for the first time, only one, SeaArt, is in image. Video saw three new entrants (Luma, Viggle, and Vidnoz) and music saw one (Udio) — both modalities have seen massive leaps forward in output quality over the past year.

What about on mobile? Content editing for image and video is the most common use. At 22% of the listmakers, it’s the second largest product category of the mobile ranks — users are eager to edit the content on their phones. While startups are emerging here as well, many of the highest-ranking new entrants to the list are legacy creative tools that have pivoted to become generative AI-first, like Meitu (#9), SNOW (#30), and Adobe Express (#35).

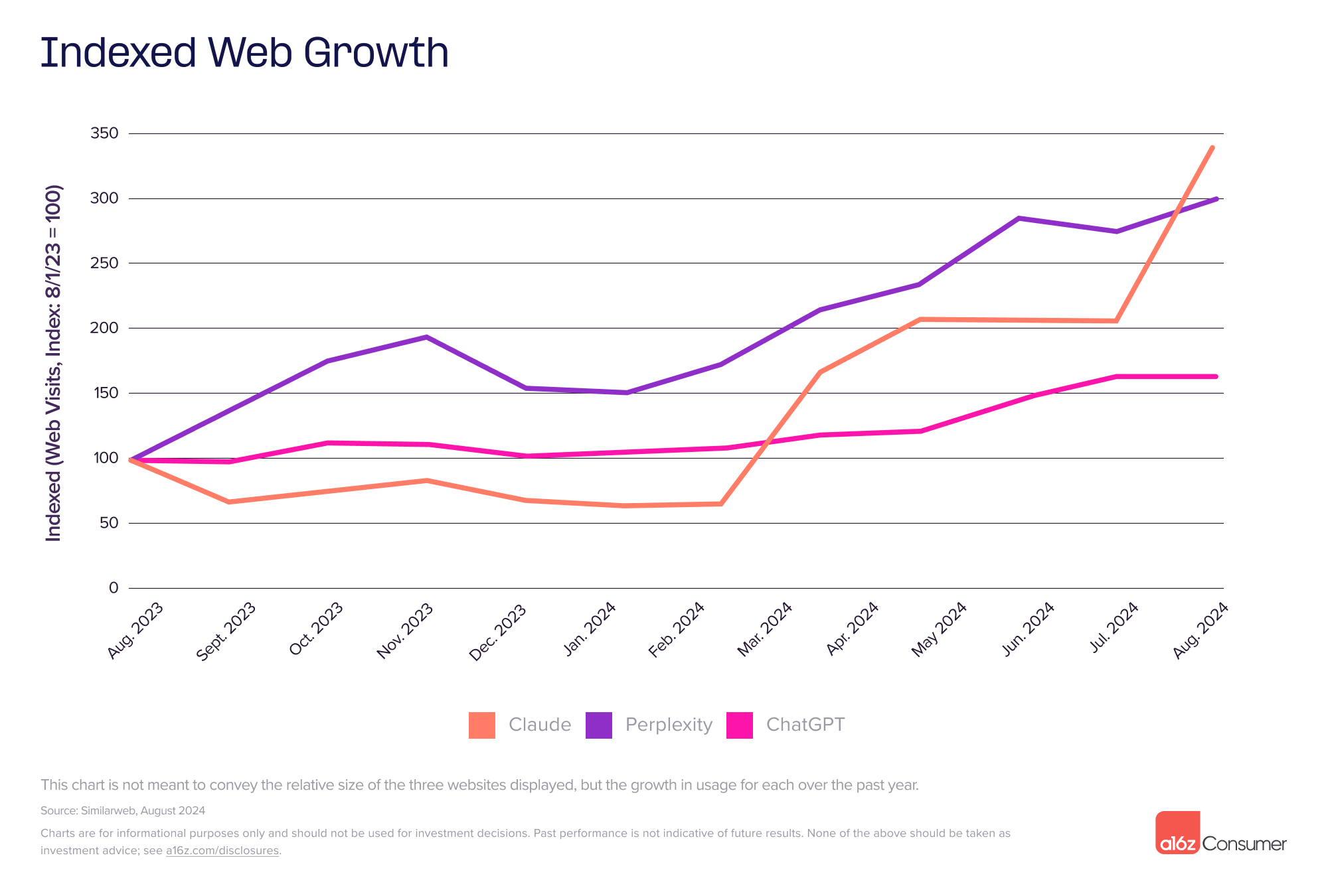

For the third time, ChatGPT is the #1 product on web and mobile by a large margin. But the competition to be the best consumer assistant is heating up.

Perplexity is now #3 on web — the AI-powered search engine focuses on delivering concise, real-time, and accurate answers to queries, with cited sources. Perplexity slightly edges out ChatGPT in visit duration (at over seven minutes) according to Similarweb data, suggesting that users are deeply engaged. Perplexity also made the top 50 mobile list for the first time.

Perplexity is now #3 on web — the AI-powered search engine focuses on delivering concise, real-time, and accurate answers to queries, with cited sources. Perplexity slightly edges out ChatGPT in visit duration (at over seven minutes) according to Similarweb data, suggesting that users are deeply engaged. Perplexity also made the top 50 mobile list for the first time.

Anthropic’s Claude, arguably even more of a direct ChatGPT competitor, entered the top five on web at #4, up from #10 in the prior ranking. The company recently launched Artifacts, which goes head-to-head with ChatGPT’s GPTs.

On mobile, AI assistant Luzia debuted at #25 — the company claims 45 million users worldwide, primarily Spanish speakers. Luzia initially launched as a WhatsApp-based chatbot, but debuted a standalone mobile app in December 2023.

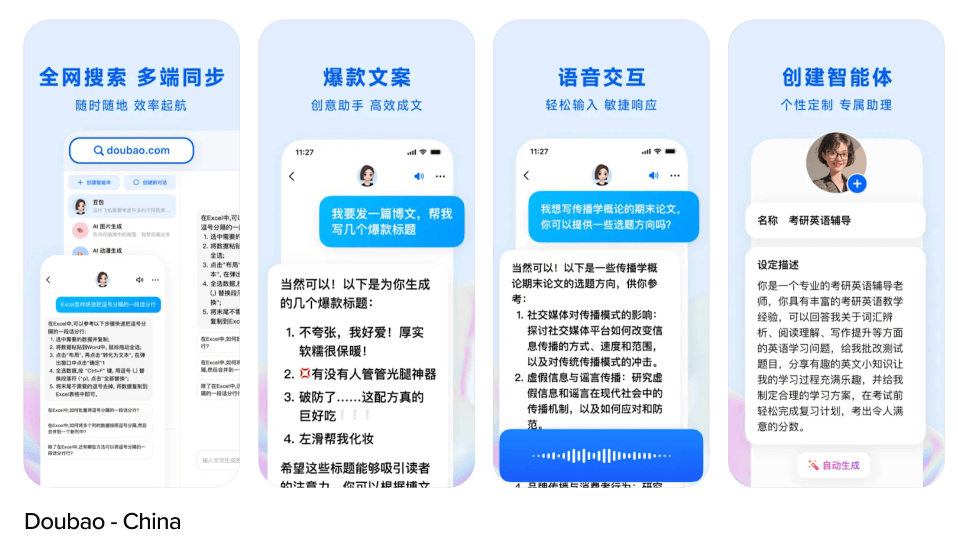

TikTok’s parent company, Bytedance, is making a push into web-based AI products. Three of its apps debut on our list: edtech platform Gauth (#44), bot builder Coze (#45), and general assistant Doubao (#47). Doubao also made the mobile list for the first time, at #26.

Alongside Doubao, the photo and video editor Hypic (#19) and assistant Cici (#34) are also Bytedance products, totaling six spots across both lists. This includes apps targeted at different geographic markets; on mobile, Cici is an English-language version of Doubao in Chinese.

Why the flood of new entrants? Bytedance launched an R&D division, Flow, focused on generative AI applications in late 2023, and has been debuting new AI applications in the U.S. (and abroad) under other corporate names since early 2024.

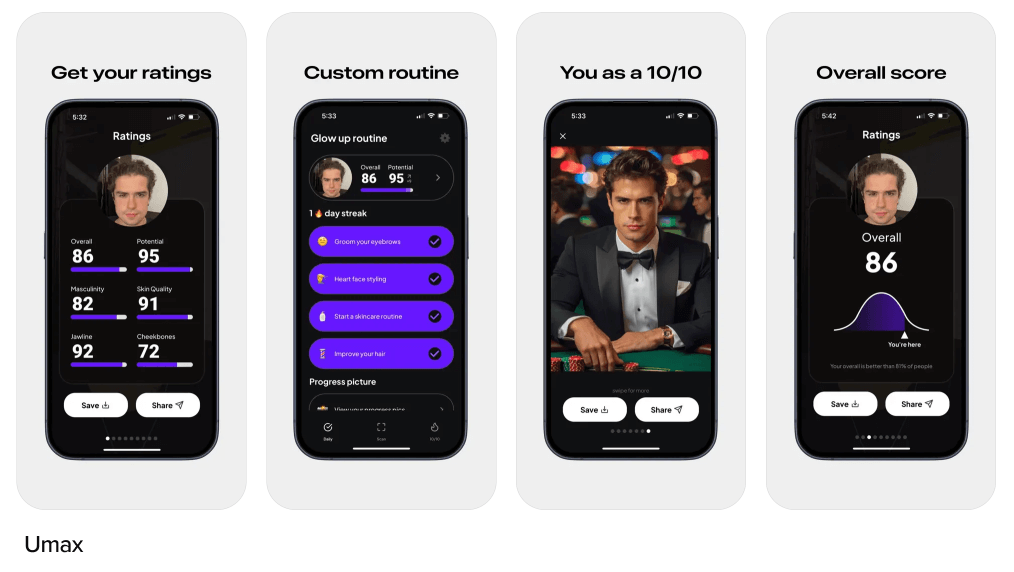

Across both web and mobile, there was only one new category: aesthetics and dating. This encompasses three new entrants: LooksMax AI (#43), Umax (#44), and RIZZ (#49), all ranked on the mobile list.

LooksMax and Umax ingest photos of the user, rate them, and give “tips” to become more attractive. Umax also generates pictures of what the user would look like as a 10/10, while LooksMax analyzes the user’s voice for attractiveness. In their app onboarding screens, LooksMax claims more than 2 million users, while Umax claims 1 million.

Both apps monetize via subscription to unlock results: Umax costs $4.99 per week (or invitations to three friends), and LooksMax is $3.99 per week.

RIZZ, on the other hand, focuses on upleveling dating app messages. Users can upload a conversation screenshot or profile and get suggestions on what to say. Messages can be copied directly from RIZZ into dating apps.

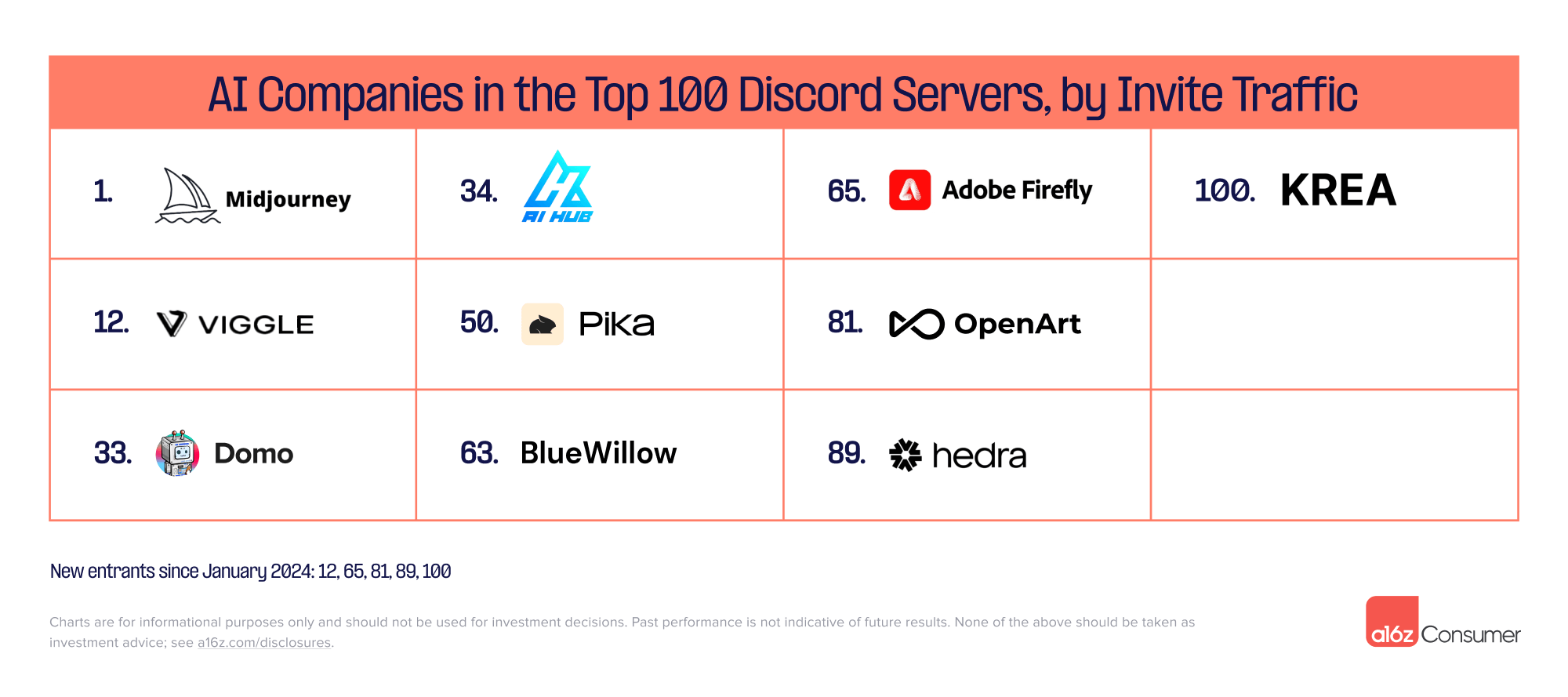

In many cases, Discord traffic is a leading indicator for apps that will climb the web and mobile ranks, especially in content generation.

Some products launch on Discord to “sandbox” and test the product while building a community, but then launch a website and largely migrate off of Discord. These products “graduate” from the Discord top ranks (one prime example is Suno, which was #31 in Discord traffic on our last list, but did not appear in Discord’s top 100 servers this time).

Other companies maintain significant Discord usage even after launching a standalone product. Midjourney, for example, retained the #1 spot in invite traffic across all Discord servers.

As of July, there were 10 AI companies that ranked in the top 100 of all Discord servers by invite traffic. Half of these were new entrants, compared to January:

Half of the top 10 Discord servers allow users to actually generate content within Discord, often via paid subscription, while the other half use Discord for community building, customer support, and resource sharing.

Half of the top 10 Discord servers allow users to actually generate content within Discord, often via paid subscription, while the other half use Discord for community building, customer support, and resource sharing.

* * *

It’s clear that a new generation of AI-native products and companies are growing faster and engaging users more deeply than ever before. We believe that over the coming decade, AI will underpin category-defining companies.

Read more about the a16z consumer AI thesis.