Global research firm for experiences sector Arival has unveiled its largest-ever research study, and third edition of The Global Operator Landscape: The State of Experiences.

Based on a survey of more than 7,000 operators of day tour, activity, attraction and experience businesses worldwide, this landmark report provides a comprehensive view of the industry’s state and structure, covering key trends in operator performance and outlook, sales and distribution, technology adoption, and more.

One key takeaway is the significant role played by small businesses. Nearly 80% of tour operators fall into the small or medium-sized category, serving a maximum of 10,000 guests annually.

This highlights the entrepreneurial spirit and diverse offerings within the sector and yet, attractions emerge as the major drivers of demand, with nearly half of them serving at least 50,000 guests each year.

The research was conducted in partnership with online travel experiences marketplace GetYourGuide, as well as the Catalan Tourism Board, booking system providers Expian, Rezgo and TripWorks, and online marketplace Viator.

The report revealed despite the growing prominence of online sales channels, a significant portion of operators still need to adopt modern booking and ticketing systems; almost 2 in 5 operators globally still do not have a reservation system.

This indicates a potential gap in technology adoption that could hinder the sector’s growth and efficiency.

“The experiences industry is dynamic and diverse, with a mix of small businesses and large attractions driving its growth,” said Douglas Quinby, CEO and co-founder of Arival.

“However, while online channels continue to grow and adoption of technology has increased, many operators still lack modern booking and ticketing systems and are not using AI.

“The sector’s entrepreneurial spirit and passion-driven nature are evident, but there’s a need to balance this with a focus on sustainable growth and strategic technology adoption to remain competitive.”

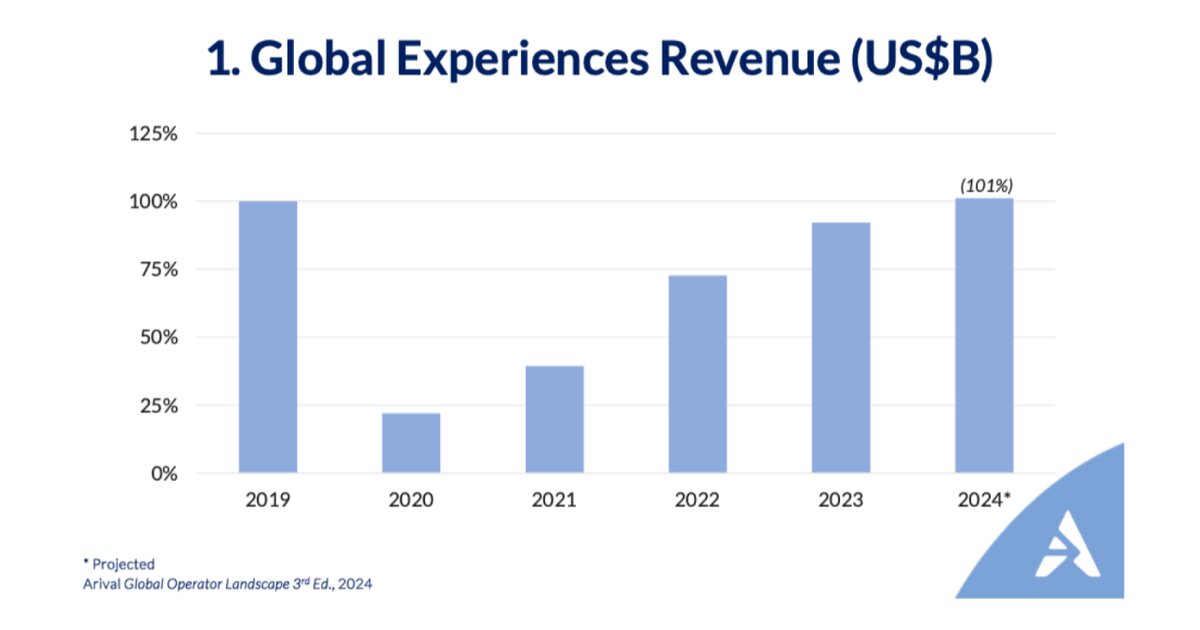

Key findings from the report found that globally, operator revenue is poised to finally exceed the pre-pandemic peak this year, but the recovery has been very uneven.

After a period of robust travel recovery from 2021-2023, growth has slowed, especially in 2024.

Online sales channels continue to strengthen, with online travel agencies (OTAs) now accounting for nearly 1 in 3 bookings for tour and activity operators.

While only 12% of operators actively use AI in their operations, with most still experimenting or not using it at all.

The operator landscape is highly fragmented, with a mix of large and mostly small businesses. Nearly 4 in 5 tour operators are small or medium-sized businesses, serving up to 10,000 guests per year.

Visitor attractions are the largest draw for destinations, with nearly 50% serving at least 50,000 guests annually, compared to just 9% of tour and activity operators.

The experiences sector is ripe with entrepreneurship, with nearly 60% of tour operators and 40% of activity businesses founded in the past decade.

Even amid the toughest years of the pandemic in 2020-2021, entrepreneurs launched new businesses. The number of startups has picked up as the pandemic receded.

Finally, most operators (3 in 4) are not focused on aggressive growth, prioritizing passion and lifestyle over rapid expansion.

The report shed light on the diverse and dynamic landscape of the tours, activities, and attractions sector, highlighting the dominance of small businesses, the crucial role of online sales channels, and the uneven recovery from the pandemic’s impact.

It also underscored the need for increased technology adoption and strategic planning to navigate the evolving travel landscape.