The 2024 Oktoberfest brought in massive crowds and substantial business for local hotels. Global Review Index (GRI) data provides critical insights into how Munich hotels handled the increased demand. By examining the trends and performance metrics, hoteliers can identify areas of improvement and strategic actions that add value for guests. Here’s a breakdown of key findings with actionable insights for hoteliers.

Actionable takeaways

- Increase resources during high-demand events: Plan additional staff and temporary hires to maintain cleanliness standards.

- Invest in room comfort: Prioritise A/C installation where lacking and address noise issues through earplugs or soundproofing improvements.

- Enhance perceived value: Add complimentary perks like robes, slippers, or enhanced breakfast options to justify higher rates.

- Adjust review response strategies: Focus on platforms like Booking.com, Google, and Agoda for review management to address guest concerns effectively.

- Improve F&B offerings: Invest in training, menu enhancement, and consistent quality to improve food and beverage scores.

Brews, bites, and brilliance

This year, an astounding 6.7 million visitors filled Munich’s streets and downed 7 million litres of beer—about a litre per person! Food sales were up 9% from last year, with “Hendl,” the classic roast chicken, reigning supreme as the preferred beer companion. Additionally, the event was powered entirely by renewable energy, adding an eco-friendly touch to the celebrations.

Impact of rates and value perception on guest experience

Hotels saw a significant rise in occupancy and nightly rates, with prices up by 138% and occupancy peaking at 90% during busy weekends. This increase naturally heightened guest expectations, a factor that often leads to more critical reviews. Despite the surge, guest satisfaction only dipped slightly from 82.1% to 81.7%, showcasing hotels’ ability to maintain a positive overall experience even under high demand.

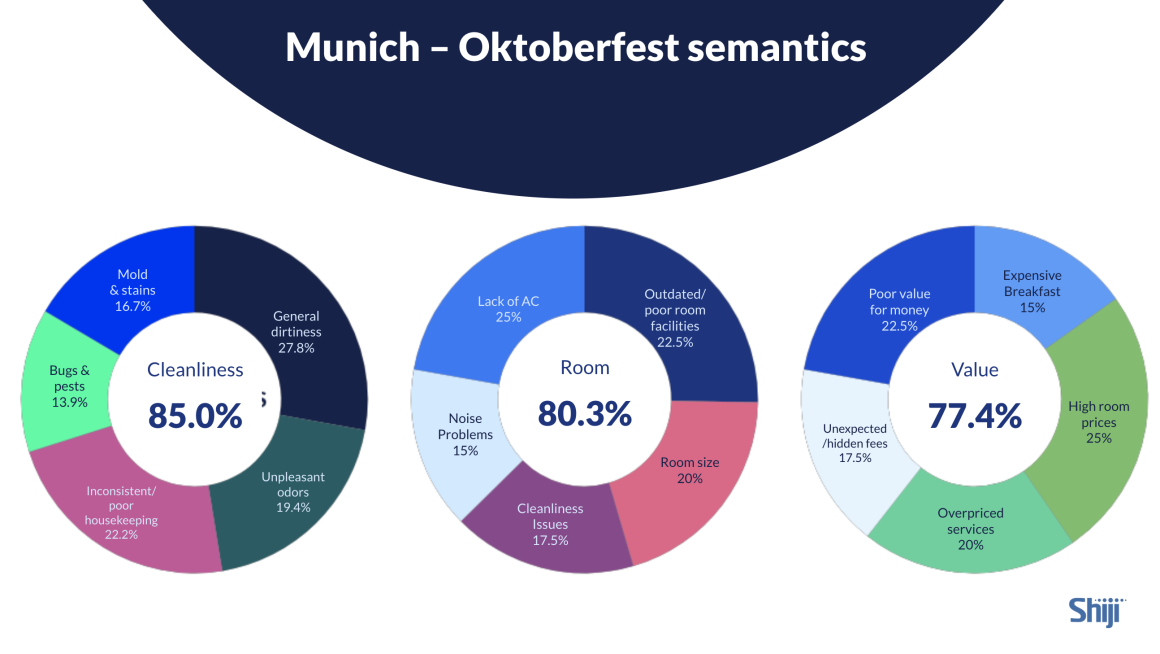

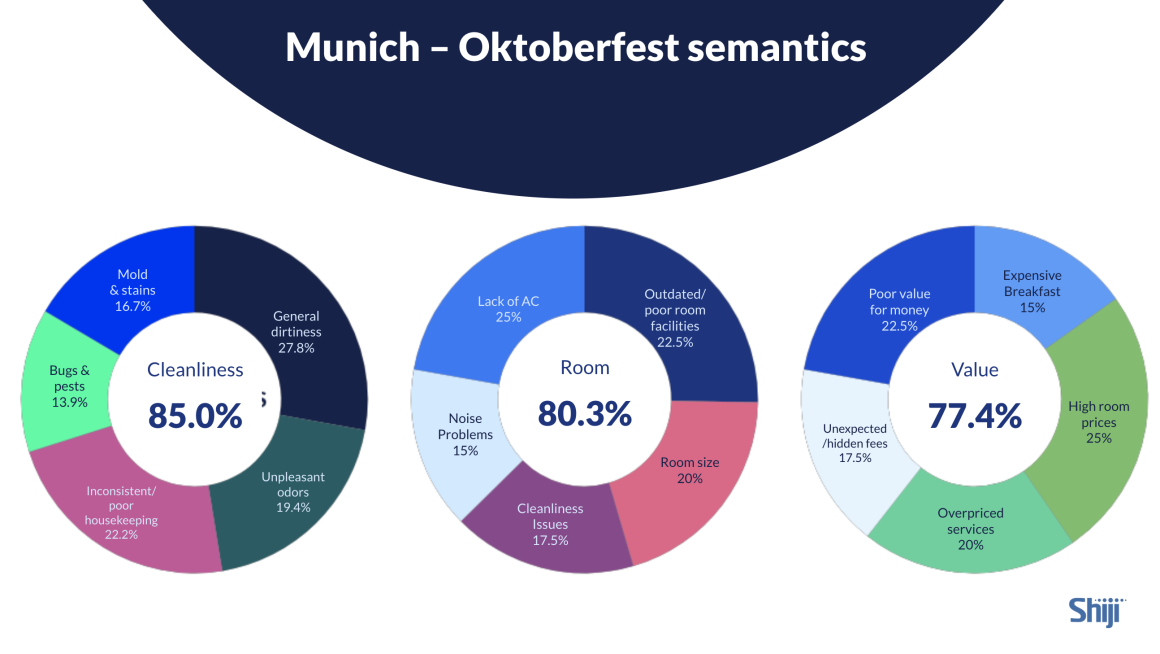

However, the perception of value for money scored lower at 77.4%, with guests raising concerns about high room prices, costly breakfast options, and unexpected fees. To align pricing with value perception, hotels might consider adding complimentary perks, such as robes, slippers, or upgraded breakfast selections, to reinforce the value guests receive for their money. Clear communication about additional costs also helps minimise dissatisfaction, creating a more favourable guest experience during peak times.

Hygiene standards: A recurring theme

A notable 85% of reviews highlighted concerns over hygiene standards, focusing on mould, stains, unpleasant odours, and inconsistent room upkeep. This indicates that many hotels were not fully prepared to handle the increased guest load.

The surge in occupancy likely stretched housekeeping teams thin, resulting in lower standards. Hotels can focus on a few key strategies to support these high-occupancy events. Increasing staff levels, scheduling deep-cleaning sessions on low-demand days, and exploring temporary hires can help maintain cleanliness standards and ensure positive customer feedback. Maintaining cleanliness is crucial, as negative feedback heavily impacts overall GRI scores.

Room quality and comfort

Room quality received an 80% rating during Oktoberfest, with many guests mentioning the lack of air conditioning as a significant issue. Oktoberfest coincides with warm weather in Bavaria; many guests found rooms uncomfortable. For hotels lacking air conditioning, investing in A/C should be considered in future CapEx budgets, especially given the climate trends and increasing guest expectations for comfort.

Noise complaints also contributed to dissatisfaction. High noise levels are expected during major events, but hotels could mitigate this by offering earplugs or considering soundproofing improvements. All of which could make a notable difference in review scores during peak times.

Trends in review sources

During Oktoberfest, reviews for hotels spiked, with 5.4% of the city’s annual review total captured in just two weeks. Booking.com remained the dominant review source, followed by Google and Expedia. A notable shift saw Agoda enter the top five sources for 2024, displacing TripAdvisor.

This trend indicates that guests are increasingly favouring certain platforms over others for feedback. Hoteliers should prioritise responses on these key platforms to ensure effective guest engagement and reputation management, especially on sites like Agoda, where reviews may be rising.

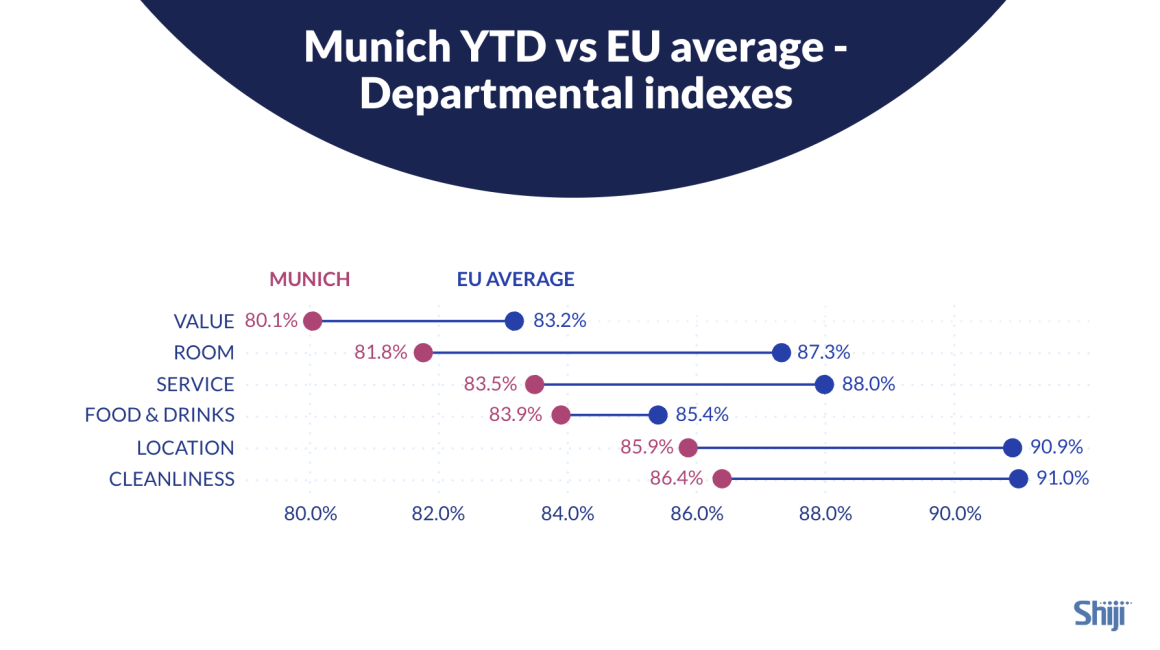

Departmental ratings

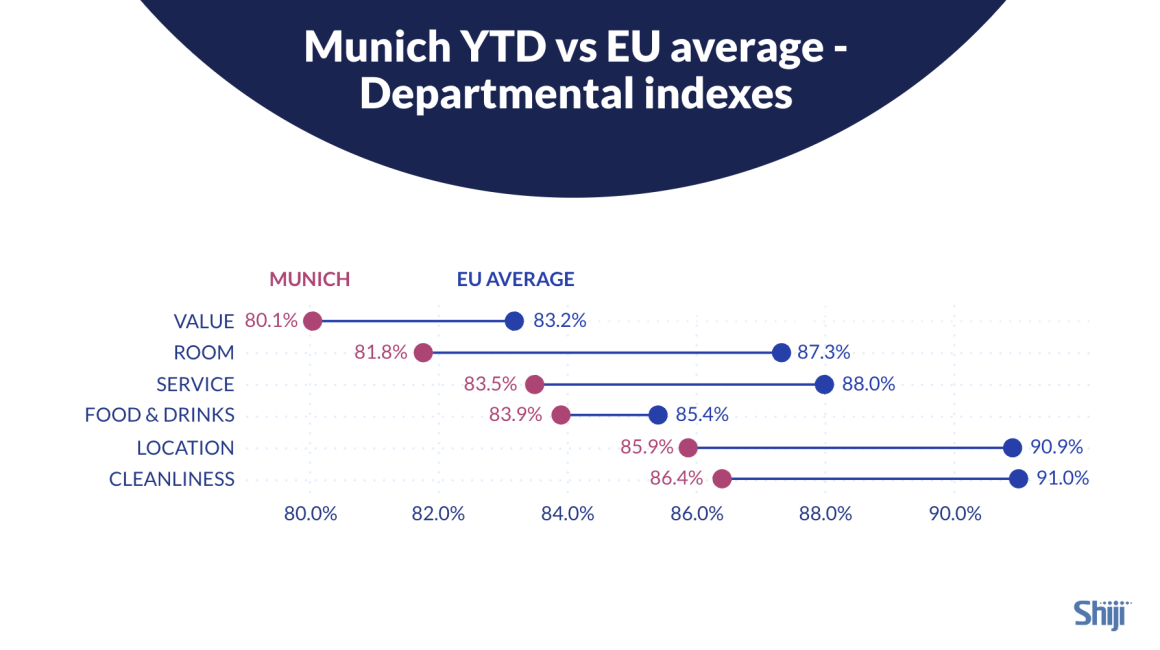

When we compare Munich to the EU average, there are opportunities for improvement, particularly in value, cleanliness, and food and beverage experiences, with current scores at 80.1% versus the EU average of 83.2%. While cleanliness has been identified as an area needing attention, enhancing the quality of food and beverages also presents a chance for improvement that could elevate the city’s overall appeal.

Enhanced training for F&B staff, improved menu options, and consistent quality can help boost these scores. Additionally, focusing on providing good value for money—even at higher price points—is essential to improving the perceived quality of the overall guest satisfaction.

Conclusion

Munich’s hotel performance during Oktoberfest 2024 demonstrates impressive resilience in guest experience amidst high demand. To build on this success, hotels should focus on enhancing hygiene standards, room quality, value perception, and strategic response management. By proactively addressing these areas, hotels can meet and exceed guest expectations during future high-demand events, strengthening their reputation and competitive standing in the market.

Watch the video here:

[embedded content]