According to CoStar, there were 1,264 properties with a combined total of 151,129 guestrooms under construction in the United States as of November 2024, which represents approximately 2.6 percent of the existing inventory of U.S. hotel rooms. For perspective, the average monthly ratio of rooms under construction to total inventory since 2019 is 2.9 percent. Further, the 151,129 rooms under construction is the lowest figure since August 2022, which marked the end of the build-out of projects that began prior to the pandemic. High interest rates for construction loans, combined with the relatively high costs for construction labor and materials, has suppressed development activity.

To analyze current trends in hotel development activity, CBRE analyzed construction data provided by CoStar. In addition, comparisons were made to the intentions expressed by hotel investors in CBRE’s May 2024 U.S. Hotel Investor Intentions Survey. This provided the opportunity to compare where hoteliers are showing preferences to build versus buy.

What Is Being Built?

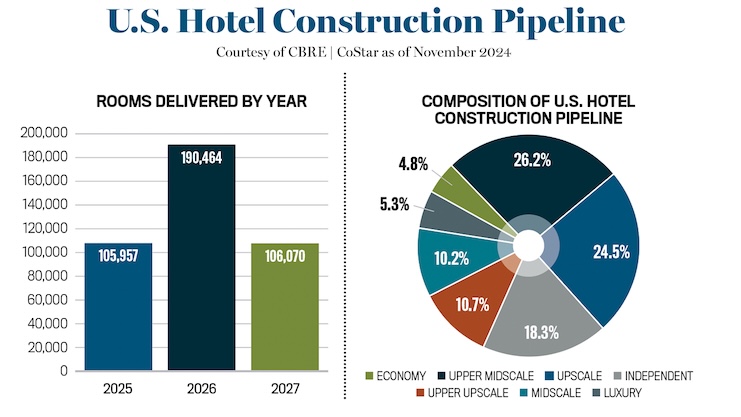

As of November 2024, hotels operating in the upper-midscale and upscale chain-scale categories dominate the list of properties under construction in the United States. Combined, these two categories represent 50.7 percent of the total rooms being built. Hotels operating in these two segments typically offer a limited number of public spaces and amenities, and therefore the costs of operation and construction are less than properties operating in the luxury and upper-upscale segments. Most of the select-service, boutique, lifestyle, and extended-stay brands that are popular with consumers are categorized as either upper-midscale or upscale.

Because of their extensive facilities and services, upper-upscale and luxury hotels are typically more expensive to build and require a bigger footprint. These factors equate to higher construction costs, and therefore require average daily rates that are challenging to achieve in today’s operating environment. Upper-upscale hotels represent 10.7 percent of the total rooms under construction, while luxury hotels comprise just 5.3 percent of the total.

Approximately 18.3 percent of the hotel rooms currently under construction are slated for properties that will be operated independent of a brand. As the costs associated with licensing a brand increase, hotel owners are beginning to question the value of a brand. Technology has greatly assisted the marketing capabilities of hotels and enabled them to develop their own loyalty programs and reservation systems, so for certain types of hotels that have their own identity or are in remote destinations, affiliation with a brand is no longer considered necessary.

Historically, developers have not sought to build new hotels in the economy and midscale segments. Growth in these two categories has been limited to older properties that have lived out most of their useful life and moved down chain-scale categories to operate in these two segments. Recently, however, new moderate-priced extended-stay brands have been created because of the recent success of these types of hotels. Consequently, the new brands have created some interest in building new midscale and economy extended-stay properties. Combined, midscale and economy projects make up 15 percent of the hotel rooms currently under construction in the United States.

Emblematic of the preference for smaller, more modest-priced properties is the decline in the average size of hotels in the development pipeline. The average size of a hotel under construction dropped from 132 rooms in 2019 to 118 in 2024.

Where and When?

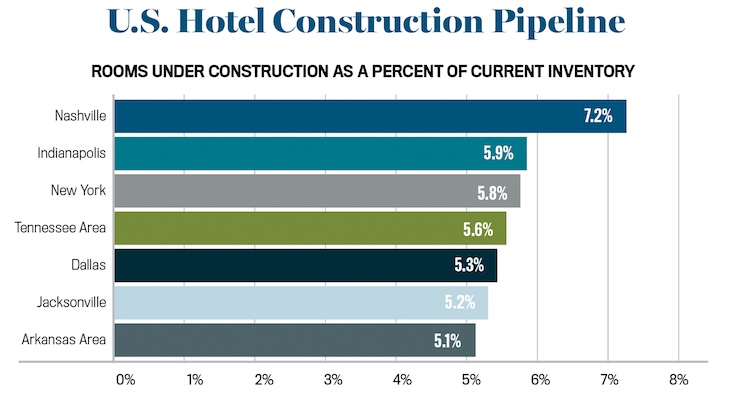

Nashville will be the most impacted market in the United States, as the current construction pipeline represents 7.2 percent of the market’s existing supply. For the past 15 to 20 years, this ratio in Nashville has remained above the national average, yet market performance, for the most part, has been sustained.

Other markets with construction ratios above 5 percent are Indianapolis, New York, Tennessee Area, Dallas, Jacksonville, Arkansas Area, and Phoenix. New York stands out as the sole high-density urban market within the group, as recent restrictions to short-term rental development, as well as the conversion of hotels to other forms of commercial real estate, has attracted hotel developers that can afford to build a hotel in this market. Most other markets in this group are in the Sunbelt and have relatively low development costs and lower barriers to entry.

On the other end of the spectrum, hotel rooms under construction in the San Francisco/San Mateo area represent just .3 percent of the existing inventory. Not only is this an expensive market for development, but operating performance has been, and is expected to remain, depressed.

Most of the impact of new hotel rooms will not be felt for another two years. In 2026, 190,464 of the rooms currently under construction are scheduled to open. This is greater than the 105,957 rooms scheduled to open in 2025, and the 106,070 rooms slated to open in 2027.

Building vs. Buying

Each year, CBRE surveys hotel investors in the United States to determine their current appetite for hotel investment. Questions in the survey address the desired types of hotels to be purchased, favored market areas, and the reasons behind these decisions.

In May 2024, the investors surveyed by CBRE expressed a bias toward purchasing hotels in the upper-upscale category, which is consistent with the relatively low new construction activity in this segment. The cost of building and financing a new big-box property is most likely the primary influence steering investors toward pursuing the purchase of these types of hotels, as opposed to building a new hotel.

A difference between the appetite to build or buy in a market is also evident when comparing the current construction pipeline to investor intentions. In general, larger markets such as San Francisco, Miami, Boston, and Chicago are preferred targets for purchases, as opposed to new construction.

The exception is New York City, which developers are eyeing for both investment and new construction. However, recent legislation will make new hotel construction in New York City more challenging in the future after the current projects in the pipeline open, as the new law gives hotel unions leverage to block the development of non-union properties.

Forecasts call for financing and construction costs to remain high, and therefore the impact of new hotel openings is expected to be minimal for the next two to three years. However, hoteliers must understand the conditions in the chain-scale segment and market, as investment and development decisions in Nashville are different than assessments being made for the San Francisco market.