The latest figures from Lodging Econometrics’ Q4 2024 analysis indicate Europe’s hotel construction pipeline encompasses 1,661 projects totaling 244,464 rooms. Though this represents a slight year-over-year cooling, these figures reflect sustained development activity for the continent’s hospitality sector.

Europe’s Q4 hotel construction pipeline breaks down across three stages: 736 projects with 112,904 rooms (44% of projects, 46% of rooms) under construction, 415 projects with 59,719 rooms (25% of projects, 24% of rooms) scheduled to start anytime within the next 12 months and 510 projects with 71,841 rooms (31% of projects, 29% of rooms) in early planning. This shows construction activity leading the pipeline, with early planning and near-term starts maintaining a steady development flow.

Europe’s hotel pipeline continues to show lingering effects from its 2021 development surge when 169 hotels with 24,472 rooms opened in Q2 2021 alone to accommodate overall European demand in anticipation of the Olympics. This concentrated burst of openings, particularly during the Olympic lead-up, has contributed to today’s more measured pipeline numbers, as the market gradually rebuilds its development momentum from that significant opening period. However, new project announcements reached a yearly high in Q4, with 146 projects/18,416 rooms, a sign of future hotel development to come.

BY SECTOR

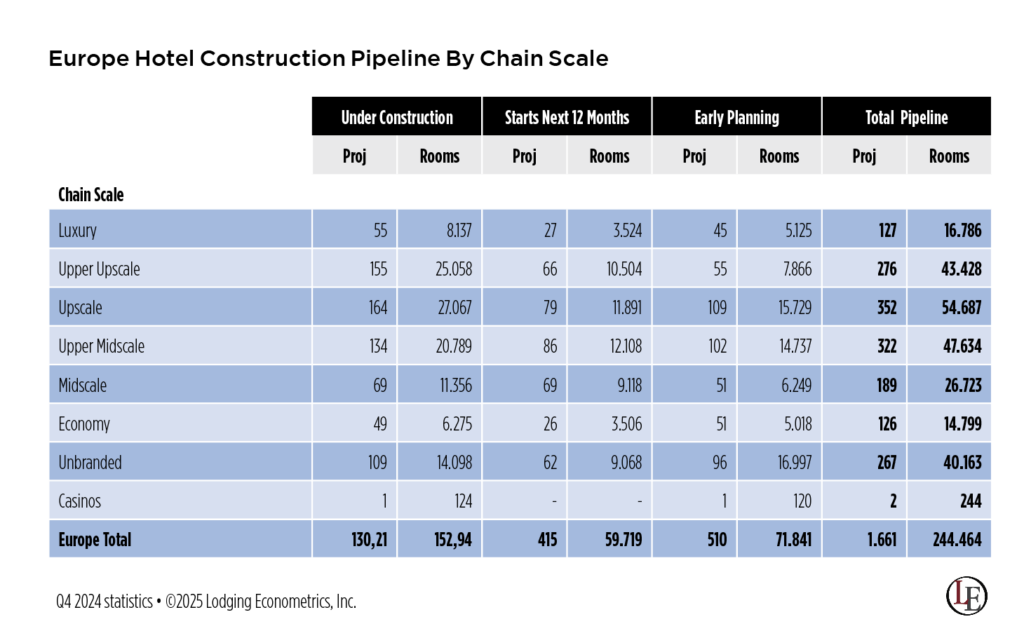

Chain-scale segmentation across Europe’s hotel construction pipeline highlights three dominant tiers, with upscale projects leading at 352 projects/54,687 rooms, followed by upper-midscale (322 projects/47,634 rooms) and upper upscale (276 projects/43,428 rooms). These three chain scales dominate the pipeline, representing 57% of projects and 60% of total rooms. Q4 2024 shows notable growth in midscale development, reaching 189 projects with 26,723 rooms. Luxury development has rebounded to its strongest level since Q4 2019, with 127 projects totaling 16,786 rooms.

Property conversions have emerged as a significant trend, with 520 projects (61,550 rooms) marking a substantial 26% increase in projects and a 13% rise in rooms year-over-year. When combined with renovation activity, property updates total 667 projects and 84,289 rooms, highlighting the industry’s focus on asset optimization and brand repositioning strategies.

COUNTRY COUNT

Five countries dominate Europe’s hotel development landscape, led by the United Kingdom with 286 projects (40,305 rooms) and followed by Germany’s 161 projects (26,461 rooms). Turkey has reached record development levels with 130 projects (19,038 rooms), while France and Portugal round out the top five with 119 and 113 projects respectively. Together, these nations represent 49% of Europe’s total pipeline projects and 46% of rooms. Georgia emerges as a unique case, with fewer projects but comparable room counts due to several large-scale developments in its pipeline.

“What’s particularly interesting in our Q4 analysis is the growing diversification of development across Europe,” said JP Ford, SVP and director of global business development, Lodging Econometrics. “While established countries like the UK and Germany continue to lead, we’re seeing remarkable momentum in countries like Turkey, which has reached record development levels, and Georgia, where several large-scale projects are reshaping the hospitality landscape.”

The cities with the largest pipelines are London with 77 projects/14,820 rooms, Istanbul with 49 projects/7,903 rooms, Lisbon with 35 projects/3,976 rooms, Dublin with 24 projects/4,285 rooms, and Tashkent, Uzbekistan with 24 projects/4,091 rooms.

Europe’s hotel pipeline showcases several landmark developments, headlined by the ambitious Hard Rock Hotel Athens Riviera, currently under construction in the upper upscale segment. The 1,000-room property, scheduled to open in 2027, represents a significant expansion of Athens’ luxury hospitality offerings.

In London’s Vauxhall district, plans are advancing for an 872-room upper midscale hotel, slated to begin construction within the next 12 months. Meanwhile, Georgia is emerging as a development hotspot with two major properties: Wyndham Grand Residences Aqua, already under construction with 755 rooms, and slated to open in 2025, and the Ramada Residences by Wyndham Batumi, a 696-room project in early-planning stages, which, upon completion, would significantly boost Georgia’s lodging capacity.

Europe’s hotel openings maintained steady momentum in Q4 2024, with 59 new properties adding 7,368 rooms and bringing the year’s total to 289 hotels with 38,681 rooms. Looking ahead, 2025 is set to welcome 342 new hotels (48,564 rooms), including the 720-room Hotel Costa Papagayo in Spain’s Canary Islands and the 670-room Social Hub Florence, Italy. Further growth is projected for 2026, with 399 hotels (51,964 rooms) scheduled to open. Georgia will see two major additions that year: the 546-room Pontus Rotana Resort & Spa Gonio and the 500-room Radisson Blu Resort & Residences Batumi Gonio.

“Looking ahead, we see several encouraging indicators for European hotel development,” said Ford. “With nearly 350 hotels slated to open in 2025 and about 400 in 2026, including several landmark properties across both established and emerging markets, we’re seeing a healthy progression of projects moving through the pipeline. This measured but steady growth reflects a region that has successfully recalibrated after the 2021 surge and is now positioned for sustainable long-term expansion.”

Story contributed by Lodging Econometrics.