While the post-pandemic rebound has smoothed out some bumps in the road, it’s clearer than ever that there’s still rust under the hood.

As guest behavior shifts and economic uncertainty prevails, how hotels price their rooms — and how that pricing stacks up against the competition — has never mattered more. For revenue professionals, that means doubling down on our understanding of price elasticity, booking windows, and, most importantly, how guests perceive the value we offer.

One trend, however, is throwing a wrench in the system: reverse yielding.

What is reverse yielding?

Reverse yielding refers to the practice of setting high rates far in advance, only to drop them as the arrival date nears. It’s essentially the opposite of traditional yield management, which starts with lower rates that climb as demand increases.

But here’s the thing — reverse yielding isn’t a strategy. It’s usually a sign of something deeper: poor forecasting, low confidence in pricing decisions, or internal misalignment.

To better understand how this plays out in practice, let’s take a look at one of our key markets: Las Vegas.

Viva Las Vegas: A closer look

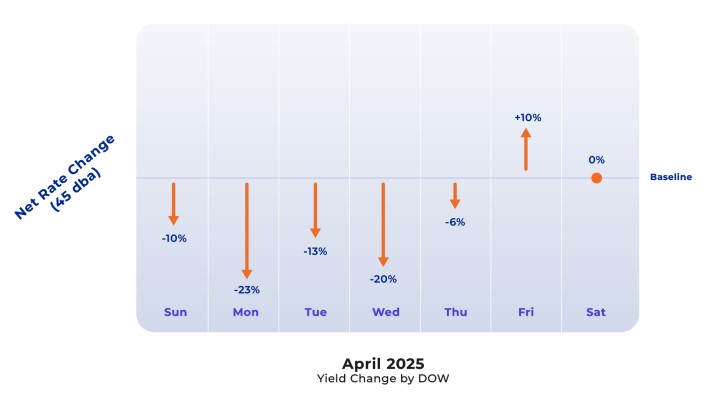

Let’s zoom in on Las Vegas in April 2025.

Specifically, we compared rates set 45 days out from the stay date with the actual final rates at night audit (the day of arrival).

Why 45 days?

Because that’s roughly the average booking window for transient guests in the market.

In this first chart, we see a general decline in prices — a clear indication of reverse yielding at play. But since this chart averages out all properties, it masks how extreme the drops were for some individual hotels.

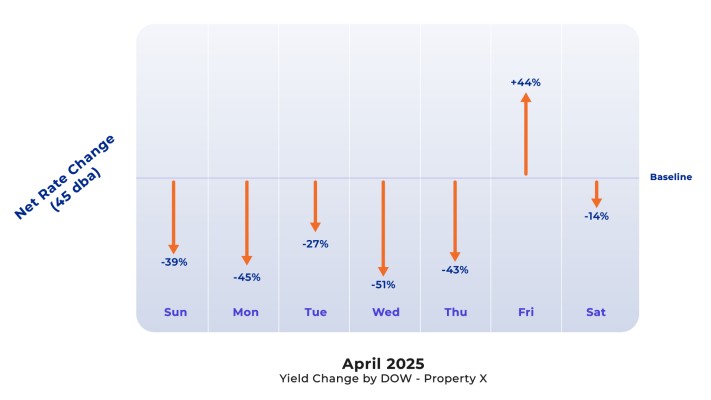

That’s where the second chart comes in. Here, we will zoom in on a single property — a resort on the Strip with strong market presence.

Its rate behavior is a textbook example: guests who booked early paid significantly more than those who booked closer to arrival.

Why does it happen

Several factors contribute to this trend — and most of them are rooted in deeper issues than just price.

That’s where the second chart comes in. Here, we will zoom in on a single property — a resort on the Strip with strong market presence.

1. Competitive pressure

This is the one that worries me most.

In dense markets like Vegas, it only takes one or two major players using reverse yielding to spark a chain reaction. Suddenly, even data-driven revenue managers feel pressured to follow suit.

Here’s a common scenario: A budget resort posts a $499 rate 50 days out. A luxury property across the street is faced with a dilemma — do they match the high rate to protect their premium image, or price more realistically at $299 and risk being perceived as “less than”? Many end up pricing too high early on, only to slash rates later when reality hits.

2. Lack of confidence in forecasting

Some properties don’t have a revenue management system (RMS) at all — but most major resorts on the Strip do. These tools are built to forecast demand and recommend rates based on real-time data.

But here’s the problem: if the team doesn’t trust the system — which is often the case with several RMS’ in our space — they end up overriding its recommendations or using it just to push out rates. When that happens, the platform loses its strategic value, and forecasting becomes far less effective.

3. Uncertainty

Sometimes, properties bet on hype rather than data.

A real-world example? The inaugural Las Vegas F1 event. Many resorts set sky-high rates months in advance with the expectation of a massive boom. But when that demand didn’t materialize as expected, hotels had to cut prices drastically at the last minute. That one day was probably (one of) the most extreme examples of reverse yielding we’ve ever seen.

4. Leadership misalignment

Another root cause is internal — and surprisingly common.

Not every organization gives revenue leaders a seat at the executive table. That can lead to misalignment between departments and a lack of understanding of revenue strategy at the top.

Here’s what that looks like: A VP of Operations may push to keep early rates high, fearing that lower rates will attract less desirable guests. But if demand doesn’t come through, the hotel ends up slashing prices last-minute to fill rooms when the top line is in danger.

So… where do we go from here?

Reverse yielding isn’t just a pricing misstep. It’s a reflection of deeper challenges in culture, systems, and decision-making.

But it’s not irreversible. Here’s what needs to happen:

- Give revenue leaders a voice. Empower them with decision-making authority and a seat at the executive table.

- Collaborate across departments. When revenue, marketing, and operations are aligned, pricing decisions become smarter and more stable.

- Have an RMS you trust. Choose a system that not only supports your pricing strategy but also delivers reliable forecasting. When your team trusts the RMS to predict demand accurately and guide rate decisions, they’re far less likely to override recommendations or default to reactive pricing.

- Read demand signals honestly. Don’t get swept up in hype — use historical trends and real-time data to make informed choices.

At its best, revenue management is proactive, not reactive. So let’s stop chasing the market, and start leading it.