Will the three segments of the Premium, Midscale, and Economy division grow at the same pace?

Overall, we continue to reinforce the leadership position of our midscale and economy brands while expanding our premium brands to further extend their networks. The premium segment is a strong growth area for us, and our premium brands – including Pullman, Swissôtel, Mövenpick, and Grand Mercure – represent 17% of our PM&E division, with a 5% global market share.

Since 2019, our premium hotel signings have increased impressively by +150%, and we now have more than 500 premium hotels worldwide. With a pipeline of over 250 upcoming premium hotel openings, representing more than 53,000 additional rooms, we are eager to capitalize on our momentum.

The brand portfolio has been enriched through acquisitions. Doesn’t this richness pose a risk of unclear positioning for each brand?

In reality, Accor’s strength lies in its ability to allow each of our brands to express an authentic and reliable brand experience throughout the customer journey, while leveraging the advantages and strengths of the Accor group as well as our ALL Accor loyalty program. Our most well-known and appreciated brands – such as ibis, Novotel, and Pullman – attract owners in markets where strong brand recognition is an asset.

However, each of these brands offers distinct customer experiences and varying levels of segmentation – from the ibis family of brands, with over 2,500 hotels worldwide, to the incredible and evolving story of Pullman that brings people, cultures, and ideas together, to Novotel and its balanced lifestyle, flexible workspaces, and inviting restaurants for family or social meetings. On the other hand, we have our flagship conversion brands that offer more specialized and customizable styles, inviting existing hotel owners to easily join us, such as Mercure, ibis Styles, and Mövenpick.

Is there the same level of interest from investors for “historic” brands like Novotel, Mercure, Pullman, or ibis?

The heritage and iconic brands of Accor, along with its well-known hotels, offer trusted hospitality experiences that transcend generations, broaden horizons, and help create memorable travel experiences. For investors, these brands provide a sense of solidity, a global network of ALL Accor loyalty program members, and a reliable and efficient path to achieving a return on investment.

For example, Pullman, Accor’s flagship premium brand and one of the oldest hotel brands in the world (1859), has not only remained relevant through the generations but has seen its popularity grow. Pullman will increase its network by 50% over the next four years. Half of these projects are located in high-growth markets such as China, India, and Indonesia. The ibis brand family is another excellent example – with the highest recognition in its category and a solid reputation as the preferred hotel brand in France.

Given the current economic climate and the state of new building constructions, hotel conversions are indeed at a record level, and Accor is a leader in this area.

What critical size objective, if any, have you set for the “young” brands?

TRIBE, one of Accor’s newest brands, with over 20 hotels in operation and more than 40 in development, defines the standards for modern, design-focused hospitality. The brand’s flexible development model and efficient operating costs make it an ideal option for conversions and new builds in key city centers.

Meanwhile, the Handwritten Collection, launched in 2023, already has a global footprint with over 60 hotels open and in development. We have primarily developed the brand by converting existing independent hotels that celebrate their owners’ vision for the property, ensuring that each address is unique.

Is there still a future for budget offerings within the Accor group?

Accor is very proud of its commitment to diversity in all its forms. By introducing a brand like ibis many decades ago, Accor was a pioneer in democratizing travel experiences and making hotel stays accessible to a broader range of travelers. We anticipate continued and strong demand in the midscale and economy segments.

Given the current climate, is development still primarily driven by new constructions with new offerings, or is it mostly driven by conversions?

With the current economic climate and the situation regarding new construction, hotel conversions are indeed at a record level, and Accor is a leader in this field. Whether a conversion or a new build, our commitment is to create value and exceptional performance by aligning the right brand with each project, then leveraging our solutions to increase revenues and optimize costs.

In the PM&E division, do you feel competition from other forms of commercial accommodation?

Concepts like Airbnb have helped open up new categories of hospitality, which we welcome positively; innovation allows the tourism industry to continuously progress and thrive across all segments and demographic categories. Rather than feeling competition, we see these offerings as complementary to the traditional hotel industry.

Much of the demand for these rentals has been driven by the emergence of “bleisure” – a trend that continues to influence the industry. This has strengthened the appeal of our extended-stay properties and apartment-style accommodations. Our response has been to offer more multifaceted hotel experiences in the premium and midscale segments, supported by our expertise as one of the largest global operators of extended-stay properties and serviced apartments. It may not be widely known, but Accor owns over 300 extended-stay properties worldwide, under various brands, from economy to luxury, including the market’s historical leader, Adagio.

At the same time, we continuously explore markets that can offer size, growth, and high potential profitability, such as India, Southeast Asia, Japan, Mexico, the Caribbean, and Latin America.

Which geographic markets do you see as having the greatest potential for your brands?

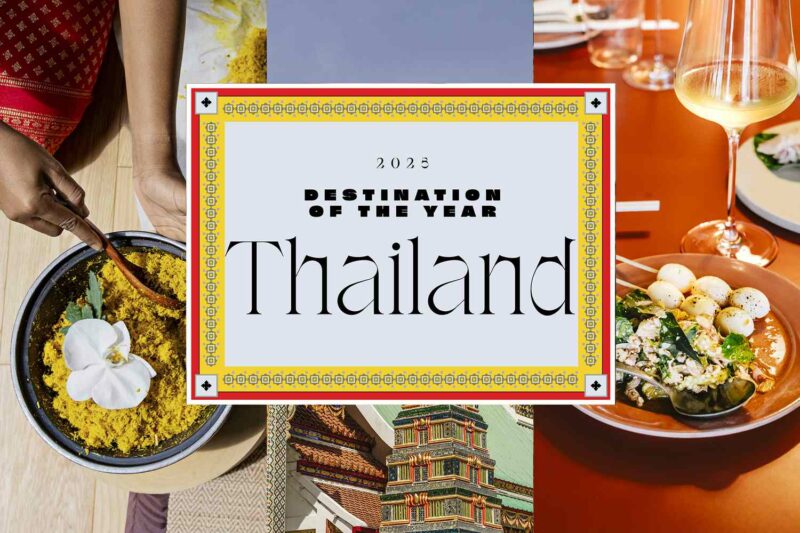

Among our strong markets, Accor aims to reinforce its leadership position with our midscale and economy brands while further expanding our premium networks. At the same time, we continuously explore markets that can offer size, growth, and high potential profitability, such as India, Southeast Asia, Japan, Mexico, the Caribbean, and Latin America.

In India, Accor has signed a new brand partnership with InterGlobe to strengthen Accor’s presence in India, with 300 hotels under Accor brands by 2030. In Mexico, we have recently acquired 17 management contracts from the Royal Holiday Group, including 11 hotel complexes and city hotels in Mexico, Argentina, Puerto Rico, and the United States, which will be renovated and rebranded as Swissôtel, Mercure, Mercure Living, or ibis Styles.

Less populated leisure destinations that can offer a pristine and positive hotel environment are a development focus for expanding our beach resorts, such as ibis Styles Resort Maragogi in Brazil, in the Alagoas region, and Marival Distinct Residences & Spa – Handwritten Collection in Riviera Nayarit, Mexico.

Is there a pause in more mature markets (Americas and Europe)?

As a historical leader in hospitality in Europe, with over 3,100 hotels in the region, we have no intention of resting on our laurels. We will continue to be leaders in Europe while also pursuing our ambitious exploration of growth and development opportunities globally, including targeted growth and development opportunities in the Americas.

The growing middle class worldwide and its travel aspirations will have a tremendous impact on the growth of hospitality, both in established markets and emerging markets. We are confident that these travelers will be eager to explore the Americas and Europe.

![]()