Predicting future demand for the U.S. lodging industry is challenging even in stable economic times. The factors that drive hotel demand are varied and sometimes unpredictable. This challenge becomes even more significant when faced with unexpected governmental policy decisions, especially when the nature and severity of these policies seem to be a moving target.

Beyond the direct impact of federal government workforce cuts on lodging demand, there is the broader uncertainty created in the economy. Generally speaking, uncertainty leads to restraint. This restraint extends to nearly all economic segments, not just room night demand or rate sensitivity. Large corporations begin monitoring their spending and limiting travel, while consumers do the same with purchases of durable goods, homes, cars, and entertainment. The federal government layoffs, or even the threat of them, create a cascading effect throughout the general economy.

The actual and potential tariffs on goods imported into the United States will also negatively affect both hotel performance and the broader U.S. economy. In the short term, the uncertain and constantly changing tariff levels make their impact on lodging demand unclear. Again, the unknown effect of increased costs for both travel and imported goods creates hesitation for corporate and leisure travelers alike.

Government Travel Decline

At Kalibri, we track bookings by rate category and know that nationally, just over 3 percent of lodging demand comes from government rate bookings. Additionally, a significant percentage of room night demand related to government travel is booked through other rates, including corporate rates and promotions, and loyalty member rates. This makes the impact of federal government layoffs and cuts on the lodging industry much more substantial than the 3 percent booking directly with government rate programs. Furthermore, the impact of these cuts varies widely by market and submarket, with some areas critically dependent on government-related travel.

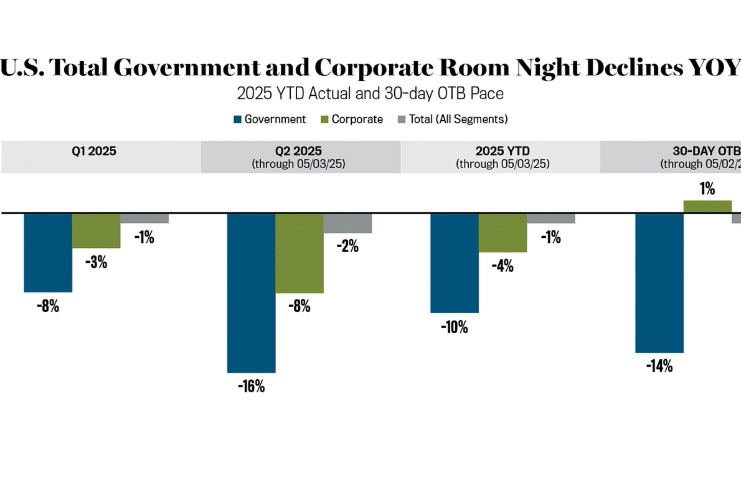

The charts included present actualized room night demand and future bookings 30 days ahead for three categories: government travel, corporate travel, and total U.S. lodging demand. The data is current through May 3, 2025. As shown, government travel declined substantially in Q1 and even more so in Q2. Additionally, forward bookings 30 days out from May 3 are down 14 percent compared to the same period in 2024. Corporate demand has also declined so far in 2025, though not to the same degree as government travel.

Not surprisingly, the decline in government-related travel has been felt most keenly in the top 50 U.S. markets due to the high concentration of government business in cities like Washington, D.C. The 30-day outlook for government demand in these markets remains soft.

Leisure Travel Resiliency

Looking at factors that might mitigate the long-term effects of these “shocks to the system,” two truisms about American travelers will ultimately sustain leisure travel over the long term. First, as a society, we tend to have very short attention spans. Whether this is due to the ubiquity of social media and constant news feeds or if it has always been part of our culture is debatable. Nonetheless, the uncertainty around policy changes will likely fade as it becomes less prominent in daily conversations.

Second, a large portion of the American public considers travel a birthright, meaning they fully expect to vacation where and when they want. The strength of this desire was evident in how vigorously Americans embraced travel once pandemic-era restrictions were lifted. When the current economic uncertainty subsides, we can expect leisure travel to grow again and maintain its position as the dominant U.S. lodging demand driver.