A Summer marked by contrast

The summer season of 2025 confirms a clear divide. International clientele has returned in large numbers, supporting consumption, while French households, although present in volume, are forced to reduce their spending.

“Flows are more diffuse. Vacationers have made choices and perhaps opted for cheaper, less traditional destinations. Some areas, like the countryside and mountains, which didn’t benefit much from summer before, are seeing more visitors now,” – Vanguélis Panayotis.

International as the growth driver

Figures from Aéroports de Paris (ADP) confirm an increase in passenger traffic during July-August 2025, driven by transatlantic and long-haul flights. Air France reported strong summer results, citing sustained international demand for France and Southern Europe.

In the external accounts, revenue from the ‘travel’ line monitored by the Bank of France (based on customs and financial flow data) show a 12% increase in spring 2025, reflecting increased spending by non-residents in France.

These visitors contribute to filling hotels, restaurants, and cultural sites, further benefiting from the post-2024 Olympics effect. For them, the purchasing power differential remains favorable, making France attractive despite local inflation.

French tourists dparting but more constrained

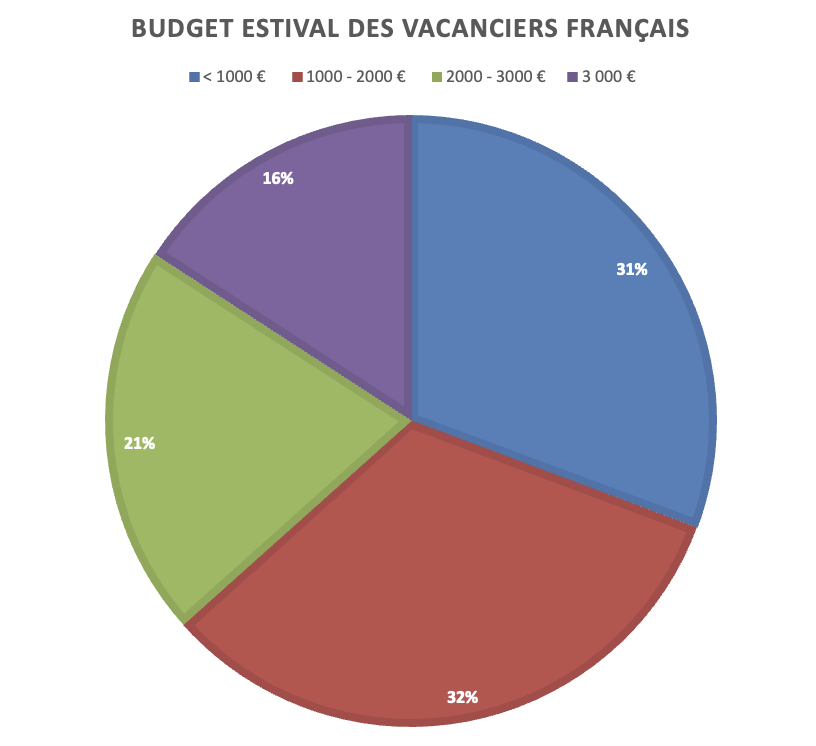

According to the Alliance France Tourisme / Ipsos barometer (April 2025), 77% of French people expressed a desire to take at least one week of vacation this summer. A strong desire for escape, supported by an average budget of €1,820, with significant disparities. In fact, 31% of vacationers planned to spend less than €1,000, 33% between €1,000 and €2,000, and only 16% over €3,000.

Additionally, 39% planned to reduce their vacation budget by cutting back on dining (53%), the length of stay (30%), or opting for cheaper accommodations (48%).

These choices translate into shorter stays, less on-site dining, and more stays with family or friends.

“The traditional black Saturdays, cross-country traffic, or ‘human transhumance’ are now a thing of the past. Vacation habits have evolved, driven by purchasing power but also by the desire not to waste two days stuck in traffic,” – Vanguélis Panayotis.

Social and generational divide

The upper-middle class made few trade-offs and continued frequenting traditional hotels and flagship destinations (French Riviera, Paris, Atlantic coast). Some even saw slight growth, fueled by foreign clientele.

On the other hand, the more fragile middle class significantly reduced its spending. Families remain constrained by school schedules and do not take advantage of off-peak seasons.

Young generations, less motorized (fewer driving licenses and fewer personal cars), tend to choose destinations accessible by train, coach, or carpooling.

What impact for the hospitality ?

While these changes in habits are having a somewhat disruptive effect on the French tourism sector, the picture is far from entirely bleak. In fact, international business is offsetting the domestic decline, boosting margins in iconic tourist areas. And foreign demand is also helping to lengthen the season.

However, new challenges arise for industry players. The traditionally dominant French clientele is becoming more demanding in terms of value for money, more volatile in their choices, and is reducing secondary consumption.

Hoteliers and tourism professionals must adapt to fragmented, price-sensitive demand. This challenge may even present an opportunity for previously less attractive destinations during the summer.

A sustainable transformation

According to Vinci Autoroutes, “black weekends” now account for only 20% of summer traffic, compared to 40% fifteen years ago. SNCF also reports a 10% increase in weekday travelers compared to 2019.

French people no longer leave on the same day at the same time: 30% now choose to depart during the week, and nearly half split their vacation into multiple stays rather than a single long period.

[embedded content]“Summer tourism is no longer about massive departures on fixed dates. It is now a mosaic of mobility, destinations, and timeframes. This transformation poses operational challenges for players, but also opens up opportunities to better distribute demand and reduce overtourism pressure. Summer 2025 confirms the end of mass departures and the rise of more flexible, diversified tourism. A shift that is likely to reshape the map of winning and losing destinations in the medium term,” – Vanguélis Panayotis.

![]()