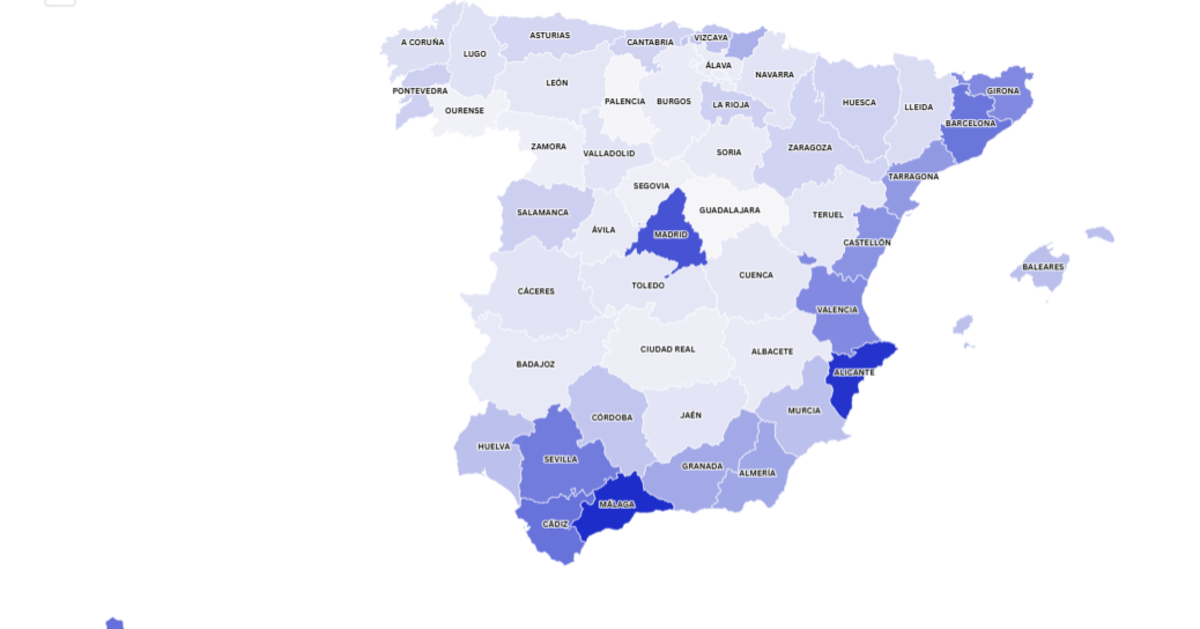

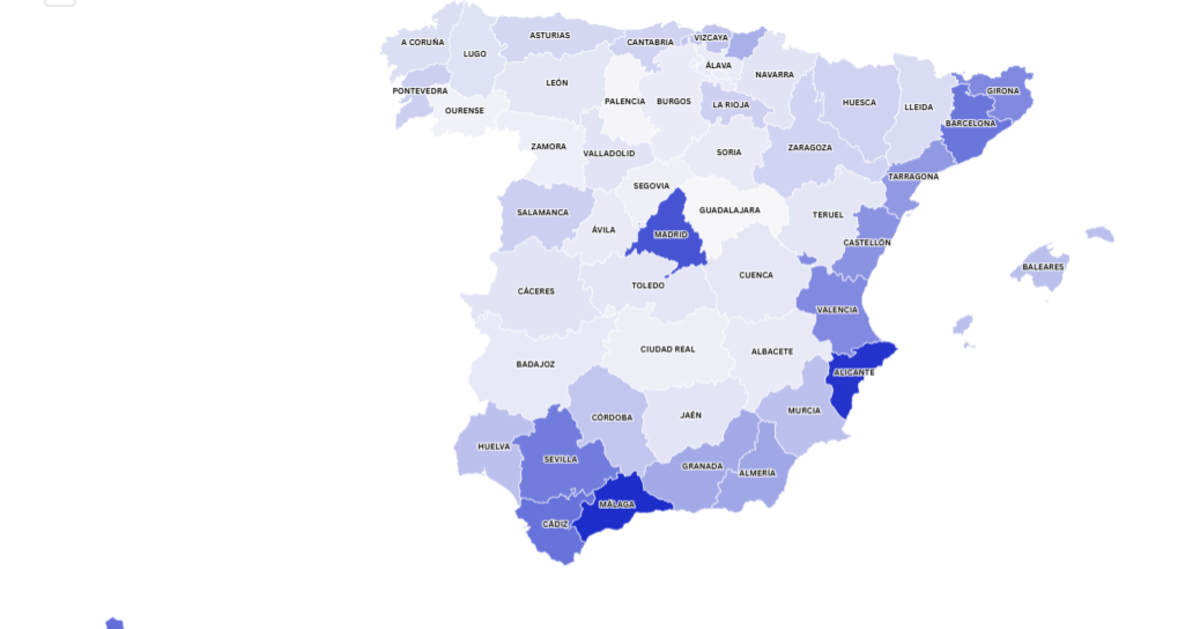

The territorial distribution of short-term rentals (STRs) properties per inhabited square kilometre in Spain decrease by -0.2 points over the past year, falling from an average of 6.8 to 6.6 properties per km².

Notable decreases are observed in Alicante, Santa Cruz de Tenerife, and Pontevedra, while increases occur in Malaga, Seville, and Girona.

This trend is highlighted in a study carried out by Mabrian, the global travel intelligence and destination strategy partner, which analyses the year-on-year evolution of the Short-Term Rentals Concentration in Spain.

To assess whether regional and autonomous regulations, along with the implementation of The National Registry for Tourist and Seasonal Rentals, have contributed to reducing the concentration of short-term rentals in Spain, Mabrian examined the year-on-year evolution of the Short-Term Rentals Concentration in Spain.

The study calculates the number of STR properties available in August 2025 per inhabited square kilometre, excluding areas without population or accommodation facilities (such as natural parks), across all 50 Spanish provinces.

Carlos Cendra, partner and director of marketing and communication at Mabrian, said: “Although, nationwide, the average decrease in short-term rentals territorial concentration is modest, the behaviour of this indicator across the Spanish provinces reflects the impact of recently implemented regulations as well as the resources allocated by all administrations to monitor and regularise this market.”

Mabrian’s study reveals that, since August 2024, Alicante (-1.2 points), Santa Cruz de Tenerife, and Pontevedra (-0.8 points in both cases) are the provinces that reduce the most STR territorial concentration per square kilometre.

In Alicante, the second-highest province in Spain in terms of tourist homes per inhabited square kilometre, the indicator fell from 20 to 18.80 in one year; in Santa Cruz de Tenerife, from 14.38 to 13.57; and in Pontevedra, from 6.14 to 5.32.

Other provinces where highly demanded summer destinations are located, such as Valencia, Tarragona, Murcia, Cantabria, and A Coruña, also saw decreases in the ratio of STR properties per populated square kilometre.

On average, by August 2025, Valencia has 11.34 tourist homes per square kilometre; Murcia, 6.58; Cantabria, 5.05; and A Coruña, 4.02.

The provinces of Castellón (-0.6 points, with a ratio of 10.55) and Cádiz (-0.5 points, with a ratio of 13.36) have likewise reduced their STR territorial concentration per inhabited square kilometre. In addition, Guipúzcoa, the Balearic Islands, and Asturias each dropped -0.4 points from last year, with respective ratios of 8.07, 6.71, and 4.67 homes.

Nationwide, the STR territorial concentration per populated square kilometre decreased year over year by -0.2 points, a similar reduction as in other provinces such as Las Palmas, Navarra, Huesca, and Lugo.

“The implementation of the national registry for short-term rentals in July, combined with the cooperation of platforms such as Airbnb in enforcing it, turned this month into pivotal milestone for the provinces where the concentration of holiday rentals has declined,” said a Mabrian spokesperson, part of The Data Appeal Company – Almawave Group.

He added that this “suggests a scenario in which the market is getting reorganised following the introduction of the National Registry for Tourist and Seasonal Rentals,” particularly among provinces showing significant decreases.

This is the case for Alicante, Las Palmas, Santa Cruz de Tenerife, Castellón, and Murcia, that registered the largest drops in this indicator precisely between July and August of this year.

In other regions, the downward trend is more gradual, as seen in Cádiz, Valencia, Tarragona, Guipúzcoa, and the Balearic Islands, “highlighting the combined effect of regional and local policies together with the regulatory framework established by the national registry.”

Among the ten provinces with the highest proportion of STRs per inhabited square kilometre by August 2025, only Malaga (+0.4 points), Seville (+0.5), and Girona (+0.1) recorded year-on-year increases in this indicator.

Malaga, the province with the highest concentration of holiday rentals in Spain, reaches 19.31 tourist rentals per square kilometre; Seville, 12.49; and Girona, 11.40.

Other provinces show slight increases, such as Granada, Vizcaya, and Córdoba (+0.2 year-on-year), while some remain stable, including Madrid and Barcelona, with 16.04 and 13.04 homes per inhabited square kilometre, respectively.

In a few destinations, the concentration of STRs rises only marginally (+0.1 points), such as Girona, Almería, Huelva, and La Rioja.

“Our data intelligence highlights how short-term rentals decisively shape the territorial concentration of accommodation in many destinations, which is why exhaustive monitoring is essential,” said Cendra.

“The fluctuations we see in this indicator for short-term rentals are not mirrored in the hotel sector, which remains much more stable”

“Leveraging technology and data intelligence as a strategic tool for administrations and local communities to achieve a sustainable balance between economic activity and citizens’ quality of life.”