Wyndham Hotels & Resorts grew its system-wide rooms by 4% year-over-year in the third quarter, increased its development pipeline by 4% YOY to a record 257,000 rooms, but RevPAR fell 5% in the quarter versus the same time last year, more pronounced in the U.S. than internationally. At the same time, it updated its full-year RevPAR outlook to down 2% to 3%, which included a range of down 4% to 7% in the fourth quarter, noting softening RevPAR trends in Q3.

Wyndham’s RevPAR headwinds are similar to Hilton, though more pronounced, which follows the broader trend in the bifurcation of travel demand, where upscale and luxury hotels have performed better, while economy and midscale hotels, segments where most of Wyndham’s stock resides, have suffered as less-affluent consumers pull back on travel spend due in part to the macro-economic environment.

During a Q3 Q&A with analysts, Geoff Ballotti, president and CEO of Wyndham Hotels & Resorts, was asked if there was something structurally wrong with the economy segment, to which he opposed. “We are seeing nothing structural that concerns us,” he said, adding that Wyndham’s booking lead times are up 2% versus the prior year and our lengths of stay are consistent with last year.

Wyndham, he said, is getting questions about structural challenges and argued that occupancy is down across all chain scales with the divergence of RevPAR being driven by average daily rate, with the upscale segments taking rate. Occupancy, he noted, is still not back to pre-COVID levels across all chain scales and argued that there is nothing structurally broken, and any short-term hemorrhaging due to “persistent inflation, consumer uncertainty and immigration,” Ballotti said.

ADR for the economy segment, he noted, is up 11% compared to 2019 compared to up 29% in the luxury segment. “Luxury is the only segment that’s been able to outpace inflation growth, which is very good news for the economy and midscale segments from a long-term pricing power standpoint,” he said.

Approximately 70% of Wyndham’s pipeline is in the midscale and above segments, which grew 4% YOY. Approximately 17% of the pipeline is in the extended-stay segment, 58% of the pipeline is international and around 75% of the pipeline is new construction with approximately 36% of these projects having broken ground. Rooms under construction grew 3% YOY.

“We need RevPAR to get back, but we’re feeling very good about our net rooms growth outlook accelerating in our higher-fee segments,” Ballotti said.

Wyndham has been laser focused on technology, both as a lever for driving development and engaging guests. On the former, Ballotti touted continued investment by the likes of Amazon in data centers. “We’ve identified over 150 planned data centers and the Wyndham hotels in those markets. Hotels within those radiuses are seeing improvement in Q3 market share, which gives us a lot of optimism compared to the other sites and markets outside of those radiuses that are under pressure for all the reasons we mentioned.”

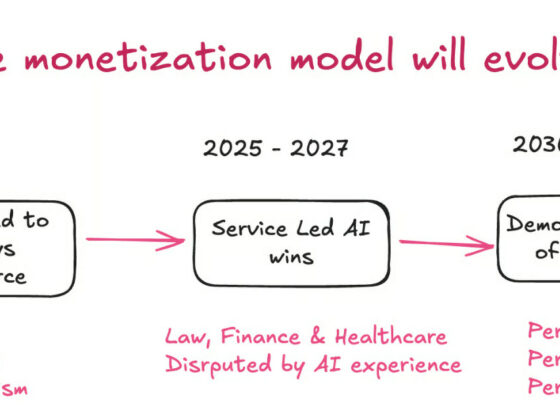

At the same time, Wyndham is making large investments and paying much attention to artificial intelligence and its impact. Wyndham Connect, which was rolled out in North America last year, is a guest engagement platform that uses AI to enhance the guest and staff experience. On the call, Ballotti mentioned the over 230 AI agents “with encyclopedic knowledge” on each of Wyndham’s 8,300 hotels that have begun leveraging the power of Salesforce, Oracle and Canary Technologies to generate and modify direct bookings while also answering questions and providing tailored travel recommendations.

Agentic AI voice assistants, Ballotti said, are delivering natural language conversations, while also handling live messaging through SMS. “To date, Wyndham AI has already handled more than half a million customer interactions, delivering faster service, higher booking conversion and a 25% reduction in average handle time, all contributing to nearly 300 basis points of improvement in direct contribution for hotels,” Ballotti said.

Moreover, LLMs are improving the direct bookings, which are much more profitable than ones made through intermediaries. “LLMs reduce dependency on OTAs,” Ballotti said, adding that these LLMs are able to plug directly into Wyndham’s inventory.

Earlier this week, Wyndham debuted a $95 travel subscription called Wyndham Rewards Insider, which unlocks a slew of perks for customers including automatic Gold-level status, concierge services, the ability to double-dip on points with select partners and savings on hotels, flights, car rentals, cruises and more.