It happened overnight. On March 29, 1984, the NFL’s Baltimore Colts packed up Mayflower moving trucks in Owings Mill, Md., and moved to Indianapolis. It was a dramatic, unpublicized exit.

Less theatrical, but shocking still among the hospitality ranks, early in the morning of November 10, Marriott International issued a press release announcing the termination of its licensing agreement with Sonder due to default. Sonder bills itself as a tech-enabled, apartment-style accommodations platform. Unlike Airbnb, which operates a marketplace, Sonder leases and and operates its own properties.

Marriott said that it now expects its full-year net rooms growth to be 4.5% due to the termination.

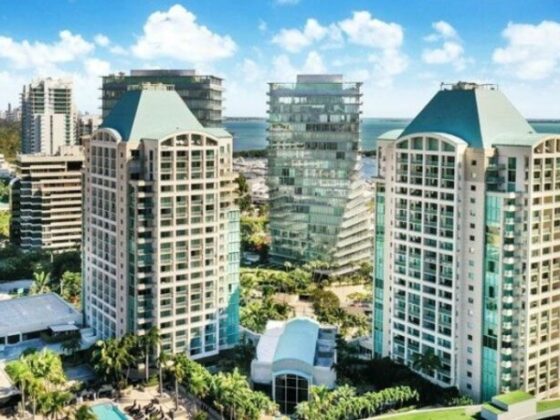

In August 2024, Sonder entered into a long-term strategic licensing agreement with Marriott International and completed full integration with Marriott in Q2 2025, making the accommodations availabkle for booking on all Marriott digital channels and allowing Marriott Bonvoy members the ability to earn and burn points. The relationship appeared harmonious: it gave Marriott access to a new traveler cohort and added rooms without buying or building; for Sonder, it gave them credibility and access to a global booking platform and the more than 200 million Bonvoy members.

Marriott’s curt announcement only added that its “immediate priority” was assisting guests currently staying at Sonder properties and those with upcoming reservations.

A day later, Sonder issued a press release of its own, announcing that it was winding down operations immediately and expected to initiate a Chapter 7 liquidation of its U.S. business. It was an abrupt and stunning admission for a company that went public via a SPAC merger with Gores Metropoulos II in January 2022 at a $1.9 billion valuation.

“We are devastated to reach a point where a liquidation is the only viable path forward,” said Janice Sears, interim CEO of Sonder, who, according to Sonder’s Form 10-Q was drawing a monthly salary of $60,000 since her June 2025 appointment. “Unfortunately, our integration with Marriott International was substantially delayed due to unexpected challenges in aligning our technology frameworks, resulting in significant, unanticipated integration costs, as well as a sharp decline in revenue arising from Sonder’s participation in Marriott’s Bonvoy reservation system. These issues persisted and contributed to a substantial and material loss in working capital. We explored all viable alternatives to avoid this outcome, but we are left with no choice other than to proceed with an immediate wind-down of our operations and liquidation of our assets.”

In the release, Sonder noted that it faced what it referred to as “severe financial constraints” that it claimed came from prolonged challenges connected to its Marriott integration. Sonder also said that in order to stave off insolvency it made efforts to evaluate all financing and other strategic alternatives, including a sale of its business.

At the time of the agreement, Marriott provided $15 million in key money to further help Sonder bring its rooms into the Marriott system. Sonder pledged to make cost cuts to the business. But the numbers were foreboding. Sonder listed a net loss of more than $224 million in its 10-K ending December 31, 2024, with 9,900 units, 3,000 less than it recorded the year prior. It recorded a net loss of $44.5 million in its Q2 2025 earnings report.

In Sonder’s statement, Sears seems to blames a sharp decline in revenue due to Sonder’s participation in Marriott’s Bonvoy reservation system, which, one would lead to believe, should have been a revenue generator. A spokesperson for Marriott told HOTELS Magazine: “Marriott is aware of Sonder’s intention of a U.S. bankruptcy filing. We have worked tirelessly to remain informed about Sonder’s financial situation and develop action plans so that we can work to meet the needs of our guests, which remains our priority. Sonder operates its properties and has made independent business decisions. Marriott does not agree with the characterizations expressed in Sonder’s release.”

Marriott and Sonder both lose here, but it’s the guest that, ultimately, feels the brunt of it. “When someone books a hotel, they’re putting real trust in the brand they choose. I think our industry’s desire to ‘platform’ and grow at all costs can blur who’s actually responsible for the stay; and when something breaks, it’s the guest who feels it hardest,” said Curtis Crimmins, founder & CEO of Roomza. “For Marriott to make such a swift and public break shows how serious the internal situation must have been. For me, the lesson here is clear: The guest must be able to count on you when they arrive, growth be damned.”