It’s easy to be impressed by rising revenues: a full lobby, strong ADR, or a healthy RevPAR line can make any market look like it’s thriving.

But when you zoom in on what really matters — profit — the story often changes.

That’s why leading investors, operators, and asset managers are shifting focus: from top-line performance to true profitability intelligence.

At HotStats, our Market Insights reports go beyond surface metrics like RevPAR and ADR. These uncover how markets actually perform at the profit and cost level — providing a profitability lens that turns data into smarter investment, asset, and operational decisions.

Today, we’ll explore some of the key metrics from our Market Insights report that reveal whether top-line growth is translating into real bottom-line results.

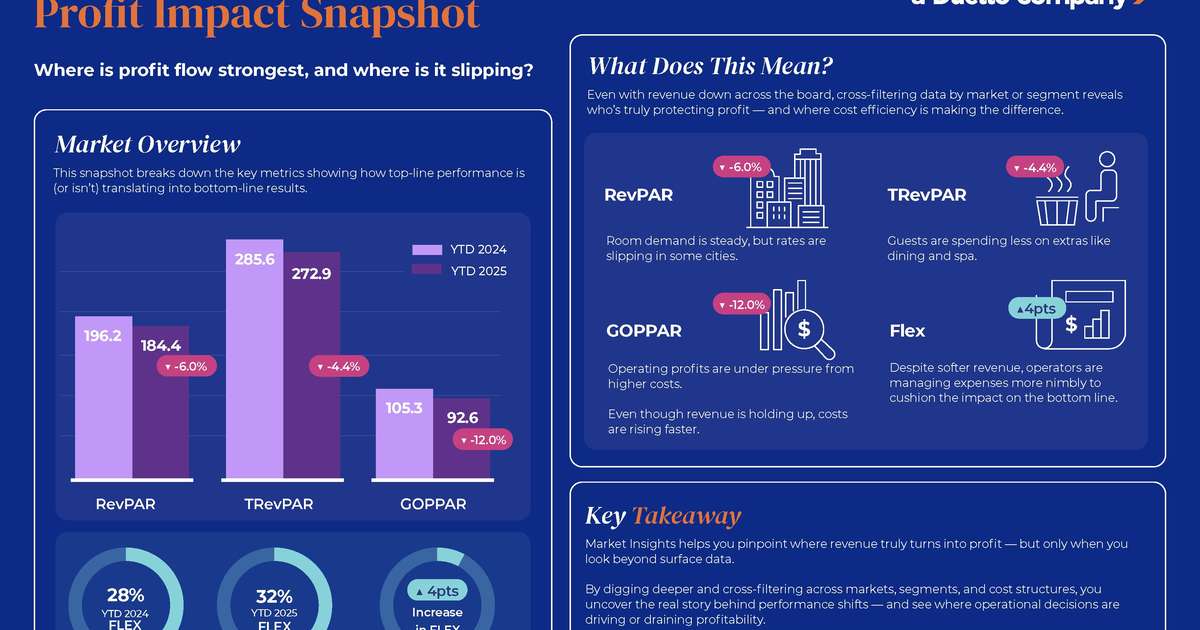

The figures below are from a hypothetical Profit Impact Snapshot, modeled after our Market Insights reports, to illustrate how these insights can guide you. Tap the image to take a closer look.

1. RevPAR: The Room Revenue That Starts the Story

Revenue per Available Room (RevPAR) is one of the most watched indicators of hotel health.

At first glance, a 6% RevPAR dip with stable occupancy might seem manageable. But in reality, this points to rate resistance across competitive urban markets. Guests are returning, but price elasticity is back.

When RevPAR looks stable but costs are rising faster than rates, profit quickly erodes.

Takeaway for investors:

RevPAR trends alone can’t justify market optimism. Track how ADR growth compares to operating cost inflation to avoid overvaluing rate-driven markets with thin margins.

2. TRevPAR: The Total Revenue Picture

Total Revenue per Available Room (TRevPAR) captures all guest spend, from food and beverage to spa and parking.

Our example shows a 4% TRevPAR decline despite steady room demand — a red flag that ancillary revenue streams are softening. Travelers might still book, but they’re cutting back on F&B, spa, and on-property extras.

Takeaway for operators:

When TRevPAR slows, it’s time to re-evaluate how every square foot generates return. Consider F&B mix optimisation, service model adjustments, or repositioning high-cost amenities to protect profit contribution.

3. GOPPAR: When Costs Start to Bite

Gross Operating Profit per Available Room (GOPPAR) is the measure of what’s left after operating expenses, showing you where things get tough.

This one dropped 12% in our snapshot. Labor inflation, maintenance, and energy costs are eroding gains faster than revenue can keep up.

Strategic takeaway:

Even when RevPAR looks steady, GOPPAR tells a different story. Profitability data exposes how rising costs and operational inefficiencies quietly compress margins — insights revenue metrics alone can’t reveal.

Those investors relying on revenue-only metrics risk underestimating operational drag; especially in high-cost or labor-tight markets.

4. Flex: Following the Money Trail

Profit efficiency tells the real story. With RevPAR down 6%, TRevPAR down 4.4%, and GOPPAR falling 12%, revenues are clearly softening. In this environment, the key metric to watch is Flex — how well operators can adjust costs when revenue declines.

In our snapshot, Flex improved slightly from 28% to 32%, signaling smarter cost control despite softer top-line performance. This suggests that while profits have narrowed, operators are managing expenses more nimbly to cushion the impact on the bottom line.

Analyst perspective:

Markets with strong Flex ratios are better positioned for volatility. Tracking Flex across markets helps investors allocate capital toward operators demonstrating adaptability and operational discipline, even in challenging conditions.

The Real Takeaway: Don’t Just Track Revenue, Track Profit Flow

Top-line growth doesn’t guarantee bottom-line success.

Profit-focused data helps hotel investors and asset managers gain a clearer view of where returns are truly being made, or lost.

That’s where Market Insights comes in. By visualizing how RevPAR, TRevPAR, GOPPAR, and Flex move together, it helps leaders:

- Identify markets with strong profit conversion and efficient cost structures.

- Spot early warning signs of margin compression.

- Model acquisitions and underwriting with real operating data to maximise ROI.

That’s the power of HotStats Market Insights: turning data into action, and performance into strategy.

The figures in this snapshot are illustrative, but the insights are very real.

A Market Insights report gives you market-level intelligence drawn from live operating data, enabling:

- Asset managers to validate performance with owners and investors.

- Investors and analysts to guide acquisitions and underwrite decisions with true NOI and GOP trends.

- Operators and management companies to optimise brand and segment positioning

- Consultants and advisors to inform client strategies and recommendations.

- Lenders to assess loan risk and asset stability.

See how profitability trends are shifting, and act before the market does.

About HotStats

HotStats, a Duetto company, is a global data benchmarking company offering specialized performance analysis and a benchmarking tool that helps analyze financial and operational data from a diverse range of hotels globally. This provides hotel owners, operators, and investors with valuable insights into the financial performance of their properties against their competition – an invaluable resource for weighing options and evaluating investment opportunities. For a quick demo, email us at [email protected] or visit www.hotstats.com.