Key Takeaways

- Shift in Power: The travel industry is moving from price wars to transaction ownership, with banks leading the charge.

- Capital One’s Fortress: By integrating payment, inventory, and AI, Capital One is redefining travel tech.

- Paymentification: Banks are controlling the entire customer experience by becoming the “Merchant of Record.”

- Trust Advantage: Intimacy and physical presence give banks a psychological edge over OTAs and AI agents.

The travel industry has spent the last decade fighting the “Price Parity” war. Airlines fought Online Travel Agencies (OTAs), hotels fought wholesalers, and everyone fought Google.

While the industry was distracted by those skirmishes, a new combatant entered the field. Quietly, banks disrupting the travel industry have built a fortress that makes old alliances irrelevant. The next war isn’t about who has the lowest price. It is about who owns the transaction layer.

It is The Wallet vs. The Web. And right now, the Wallet is winning.

The Scale of the “Block”: Capital One’s Travel Strategy

Let’s be clear about the weight class we are dealing with. We aren’t talking about a scrappy fintech startup disrupting a Global Distribution System (GDS). We are talking about Capital One—a financial titan with nearly $470 billion in deposits and $660 billion in assets.

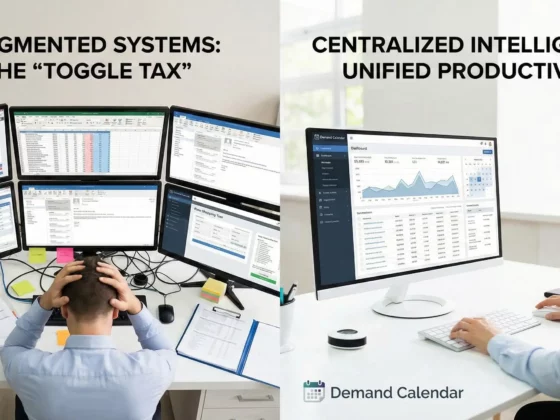

By moving to integrate deep travel software capabilities and engineering teams (like those from Hopper), they aren’t just buying a vendor; they are operationalizing a fortress. They are vertically integrating three critical components of the modern transaction into a single, proprietary block:

- Payment (Identity): They own the ledger. They know you spent $5,000 at a bridal shop last week. This allows them to predict your honeymoon travel intent before you even type a search query.

- Product (Inventory): By controlling the booking engine, they manage the inventory, sorting logic, and pricing. They aren’t renting the “shelves” from a third party; they own the store.

- AI (Risk Pricing): This is the glue. They use AI not just to “chat” with you, but to price the risk of your experience (e.g., automated disruption payouts).

This isn’t a partnership; it’s a sovereign state.

The “Paymentification” of B2C Travel

This move signals a broader macro-trend: the Paymentification of B2C. In retail, we’ve seen “Buy Now, Pay Later” firms try to own the shopping journey. Now, major banks are doing the same for services. They are moving upstream from being the “dumb pipe” that processes money to being the Merchant of Record that owns the experience.

Why is this happening? Because cash is dead. Global cash usage has plummeted to under 50% of transactions and is practically extinct in travel. The digital wallet is now the passport. By locking the travel booking inside the banking app, Capital One ensures that their card is the default currency. They are effectively taxing the entire trip before the traveler leaves the house.

The New Front: AI Search vs. The Content Crisis

Here is where the “Next Gen” travel war gets messy. The new battlefield is AI Search (ChatGPT, Perplexity, Google Gemini). These engines are hungry. They need vast amounts of real-time, reliable pricing and inventory data to function. However, travel data is notoriously messy, siloed, and expensive to access.

- The AI Problem: An AI agent can plan the perfect trip, but it can’t easily book it without a reliable “content aggregator” to handle payment and liability.

- The Bank Solution: The “Capital One Block” solves this. It provides a sanitized, bookable inventory feed wrapped in a financial layer. It becomes the “safe harbor” for the transaction.

While open AI browsers struggle with “hallucinating” flight prices or getting blocked by airline firewalls, the Bank’s walled garden offers a clean, coherent, and financially protected booking path.

The Google Factor: The Sleeping Giant

There is one player that still looms over the entire board: Google. They have the most complete stack in existence:

- Discovery: Search & YouTube (Intent).

- AI: Gemini (The Brain).

- Inventory: Google Flights/Hotels (The Meta-Layer).

- Identity: Gmail & Android (The Passport).

The only loose brick in their wall is Payments. Yes, they have Google Wallet, but they don’t hold the risk or the lending portfolio like a bank. They facilitate the pay, but they don’t earn the interest.

Watch this space. If Google decides to close that gap—perhaps by partnering deeply with a global issuer or launching a true “Google Travel Card”—they would be the only entity capable of challenging the Bank Block. For now, they seem content to be the toll road rather than the bank, but strategic shifts happen fast.

The Silent Relationship: Why the Card Wins the Customer

There is a psychological component to banks disrupting the travel industry that is often overlooked: Intimacy. Consider the relationship a consumer has with these entities:

- The OTA (Expedia/Booking): A transactional relationship. You visit their site perhaps 2-3 times a year. You don’t have their app on your home screen; you delete it to save space.

- The AI Agent (ChatGPT): A functional relationship. It’s a tool you query when you have a problem. It has no physical presence in your life.

- The Bank (Capital One/Amex): An intimate relationship. You carry their metal card in your pocket every day. It is a tangible status symbol.

The “Invisible” Loyalty Loop

Most consumers don’t consciously “connect the dots,” but the Bank Model weaponizes this intimacy. Every time you buy a coffee, pay an Uber, or tap for groceries, you are reinforcing the loop. You are “earning your way” to that vacation.

By the time you are ready to book a trip, you have already “paid” for it with 50,000 accumulated points. Consequently, you must book through the Bank’s portal to unlock that value. The OTA and the AI Agent never even get a chance to bid for your business because the currency you hold (Capital One Miles) is only legal tender in their store.

The Verdict on Banks Disrupting the Travel Industry

This isn’t just a technology stack; it is a behavioral lock-in. The Bank doesn’t need to win the search bar because they have already won the pocket.

In the war of relevance, the entity that holds the Liability (the money) and the Ledger (the data) holds the high ground. The OTA is fighting for your search. The Bank has already won your wallet. If Capital One can successfully close the loop between your spending history and your travel future, they won’t just disrupt the travel industry; they will privatize it.