At first glance, cruise ships and commercial airlines may seem worlds apart.

One evokes images of floating holiday resorts, slow travel, and buffet lines. The other? Jet engines, high-altitude flight, and sleek metal tubes defying gravity at 35,000 feet—arguably one of humankind’s most advanced technological achievements.

In this light, the cruise industry has often been perceived as somewhat outdated, trailing behind the rest of the travel sector in terms of technology and innovation.

But that perception is no longer accurate.

Over the past few years, cruise lines have quietly evolved into some of the most forward-thinking players in travel, particularly when it comes to customer engagement and onboard personalization.

In fact, some industry experts now argue that cruise ships are among the “most advanced smart cities in the world”—fully IoT-enabled, identity-based, and powered by real-time data to deliver deeply personalized passenger experiences.

Many of the technologies and strategies now being deployed at sea offer valuable inspiration for innovation on land and in the air.

And this evolution isn’t just impressive; it’s directly relevant.

Cruise companies and airlines share far more operational DNA than most realize. Both are high-volume, fixed-capacity businesses with razor-thin margins. Both operate complex logistics networks, rely heavily on ancillaries for profitability, and face mounting pressure to modernize legacy systems without compromising safety or service.

So in this new three-part analysis, we’ll take a closer look at the cruise industry’s digital evolution, and explore what the airline sector can learn from it.

To start, here are four reasons why cruises may hold the blueprint for the next wave of airline innovation.

1. The Comeback Story Airlines Should Be Studying

When COVID-19 brought global travel to a standstill, few segments were hit harder, or faced more public scrutiny, than the cruise industry.

While airlines grounded fleets and scrambled to issue refunds, cruise ships became headline-grabbing symbols of the crisis. Hundreds of thousands of passengers and crew were stranded at sea for weeks, sometimes months, as countries closed their ports and refused disembarkation. The optics were devastating. Some media outlets described cruise ships as “floating petri dishes,” and lawsuits stemming from those early pandemic days are still making their way through courts.

At the time, recovery forecasts were grim.

They couldn’t have been more wrong.

Not only did the cruise industry come back, it came roaring back.

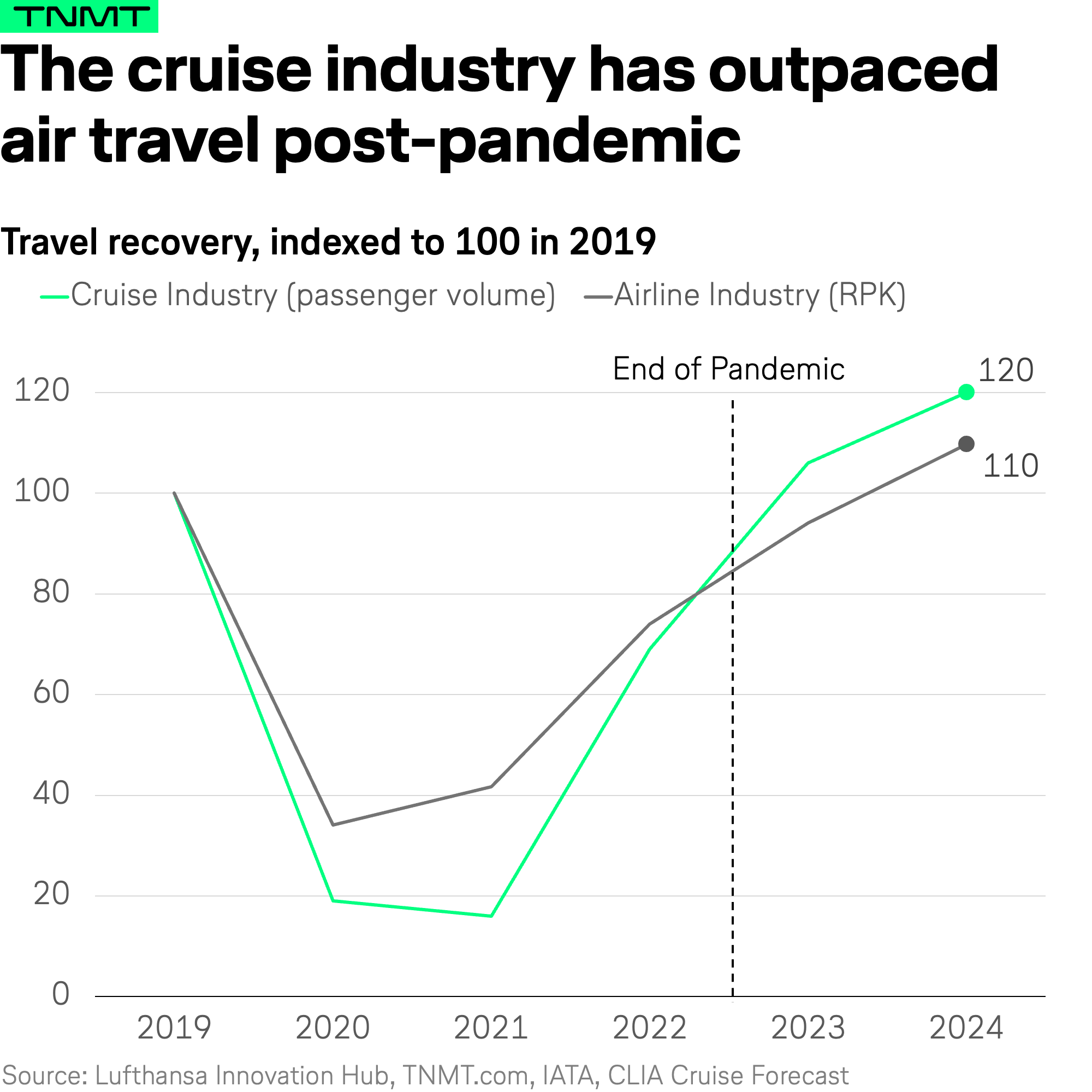

In fact, cruise lines have outpaced nearly every other travel segment in their post-pandemic recovery.

- The industry reached pre-COVID passenger volumes by as early as 2022.

- Major players like Royal Caribbean and Carnival have posted consecutive record-breaking financial quarters in both 2023 and 2024, with load factors at all-time highs and consumer demand surging.

This phenomenal rebound deserves attention, especially from airline leaders. Because while both industries faced existential challenges during the pandemic, only one has returned stronger, faster, and, most importantly, more profitable than before.

The natural question is: why?

What has the cruise industry done differently to fuel this comeback?

That brings us to the second reason airlines should take a much closer look at the cruise sector…

2. A Perfect Storm of Demand, Value, and Demographic Shift

The cruise industry’s comeback isn’t the result of one silver-bullet strategy. It’s the outcome of several reinforcing forces coming together at the right time.

First, demand never really disappeared.

Unlike other travel sectors that faced prolonged lockdowns, the U.S. cruise market—the world’s largest by far—escaped further nationwide shutdowns from mid-2021 onward. This early reopening provided a critical head start. Bookings picked up steadily as pandemic fatigue set in and “revenge travel” took hold. In 2023, the U.S. market hit 16.9 million passengers–a 19% increase compared to 2019.

Second, pricing power played a major role.

While hotel rates and land-based vacation costs have skyrocketed in recent years, cruise lines maintained a compelling value proposition.

- A 2023 study by Truist found that cruise vacations often start as low as $186 per passenger per day—less than the price of a hotel room alone in many major cities or Caribbean destinations. And cruises include far more than just accommodation.

- Historically, cruises have been priced at a 15–20% discount compared to comparable land-based vacations. Since the pandemic, that discount widened to nearly 50%.

- Today, it has leveled out around 25–30%—still well above pre-COVID norms and an attractive proposition for value-conscious travelers.

This affordability has given cruise lines a strong competitive edge in a cost-sensitive travel market.

But perhaps the most overlooked force behind the industry’s revival is its changing customer base.

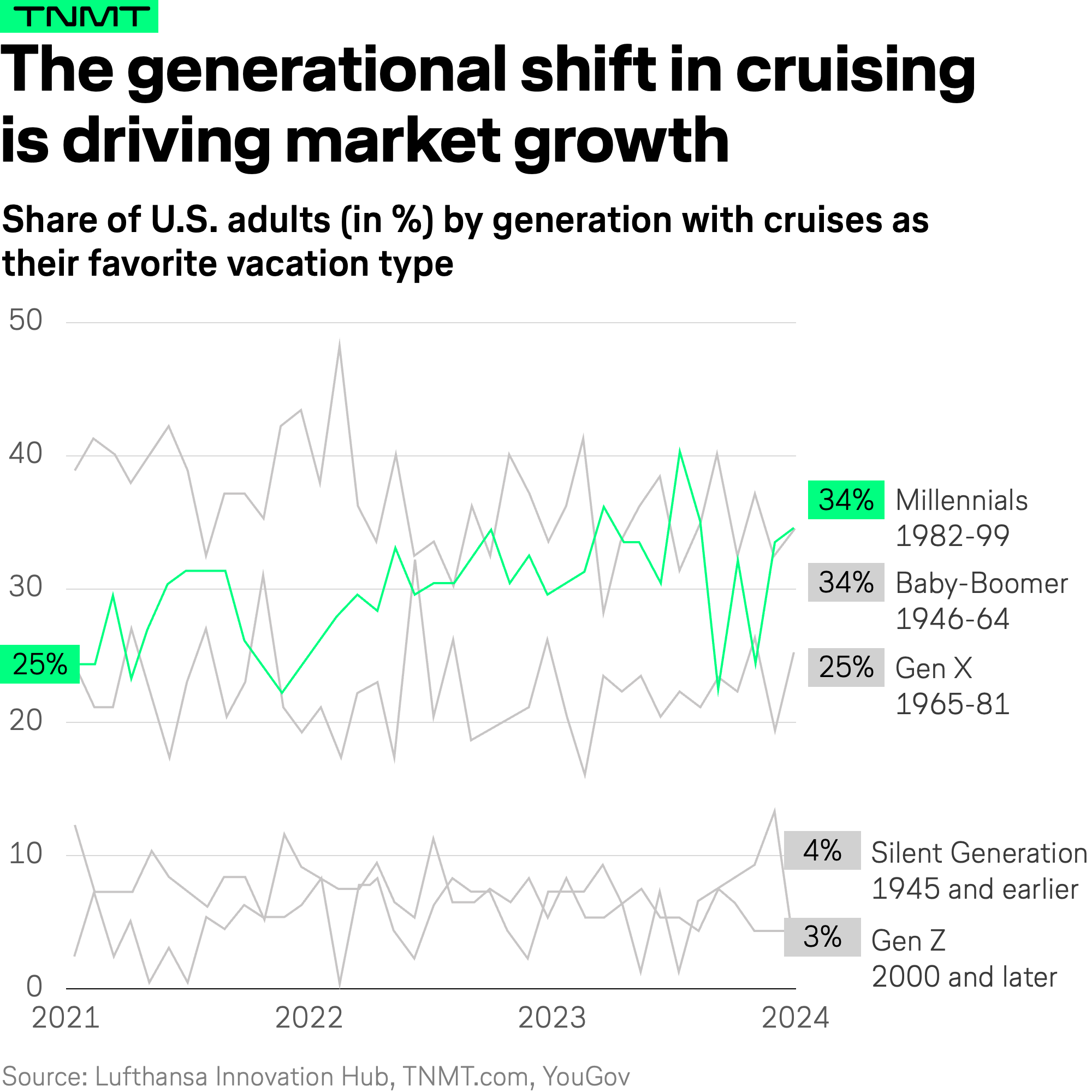

Cruises are no longer the domain of retirees and “silver surfers.”

In recent years, cruise lines have executed one of the most successful generational rebrands in the travel sector, quietly capturing the attention of younger travelers.

- In 2019, just 35% of cruise passengers were under 40.

- By 2024, that figure had climbed to roughly 42% of Millennials, Gen Z, and even Gen Alpha passengers stepping aboard.

- Millennials, in particular, (those now up to 43 years old) have emerged as particularly enthusiastic cruise-goers. CLIA data shows that of those Millennials who have previously cruised, 81% plan to sail again.

And this isn’t just a short-term shift.

According to recent survey data from YouGov, Millennials are now the most cruise-positive demographic for future trips—suggesting this generational momentum is likely to continue in the years to come.

This generational shift is a strategic turning point.

By appealing to younger audiences through targeted marketing, digital engagement, and experience-focused offerings, cruise lines are future-proofing their customer base in a way many other travel sectors (airlines included) have struggled to do.

And that brings us to the third, and perhaps most important, reason airlines should be paying attention: cruise lines are nailing the customer experience.

3. Cruise Lines Are Quietly Mastering the Customer Experience

Before we dive in, here is a quick but important disclaimer.

The cruise and airline experience aren’t perfectly comparable.

- Airlines are primarily in the business of transportation–getting passengers from point A to point B.

- Cruises, on the other hand, are, quite literally, the destination.

- They blend accommodation, entertainment, and transit into one all-inclusive product. In that sense, they’re more like floating resorts or package holidays than traditional modes of transport.

But that distinction makes the cruise industry’s performance in terms of customer satisfaction all the more impressive.

- If anything, the bar is higher for cruise lines.

- Their passengers spend days, sometimes weeks, on board, creating far more touchpoints, expectations, and opportunities for things to go wrong.

- And yet, they’re not just meeting expectations; they’re consistently exceeding them.

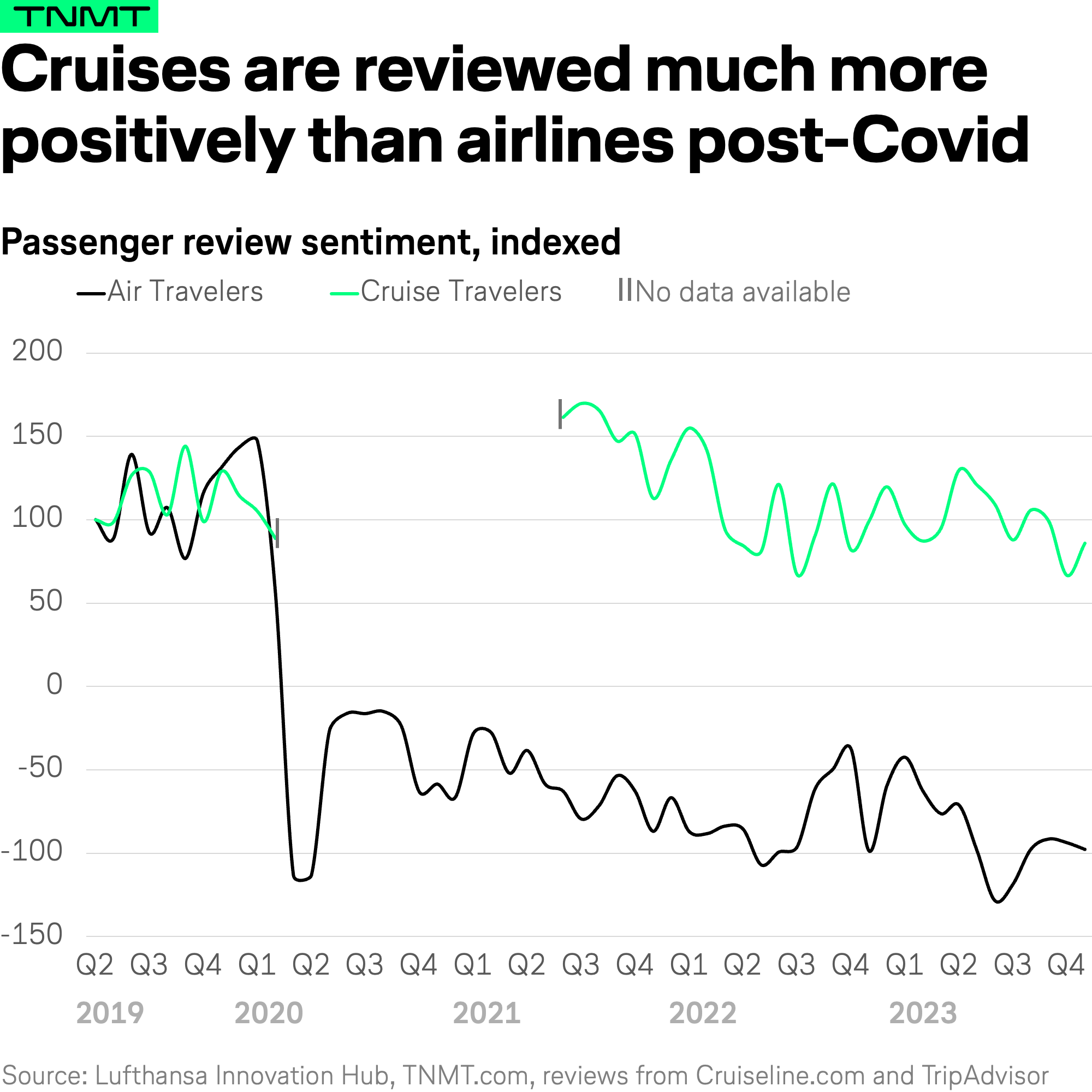

To benchmark customer satisfaction, we turned to the same method we used in our TNMT airline review analysis: mining thousands of verified customer reviews.

We analyzed over 4,500 reviews from Cruiseline.com across ships from Carnival and Princess Cruises, Crystal Cruises, Norwegian, Royal Caribbean, and Virgin Voyages to measure post-pandemic sentiment.

What we found is striking.

- Passenger sentiment in the cruise sector not only recovered quickly, it exceeded pre-pandemic levels as early as summer 2021.

- While there have been minor dips along the way (likely driven by overcrowding in peak months and popular destinations as travel fully reopened), overall satisfaction has remained impressively stable and consistently strong.

That stands in stark contrast to the airline sector, where satisfaction metrics have fallen below pre-COVID levels, dragged down by staffing shortages, flight disruptions, and a lack of service improvements.

So, what’s driving this sustained cruise satisfaction?

How are cruise lines keeping passengers happy across so many channels—food, entertainment, accommodations, excursions, and more?

The answer lies in a single strategic shift: an obsessive, system-wide focus on delivering better customer experiences.

But this isn’t just about friendly service or more buffet options.

It’s about long-term investment—building smarter systems, deploying new technology, and committing to innovation at a scale that most other travel segments, including aviation, have simply failed to match.

Which brings us to one more reason the airline industry should pay close attention to what’s happening at sea.

4. Cruise Lines Are Doubling Down on Innovation—Even When Times Are Tough

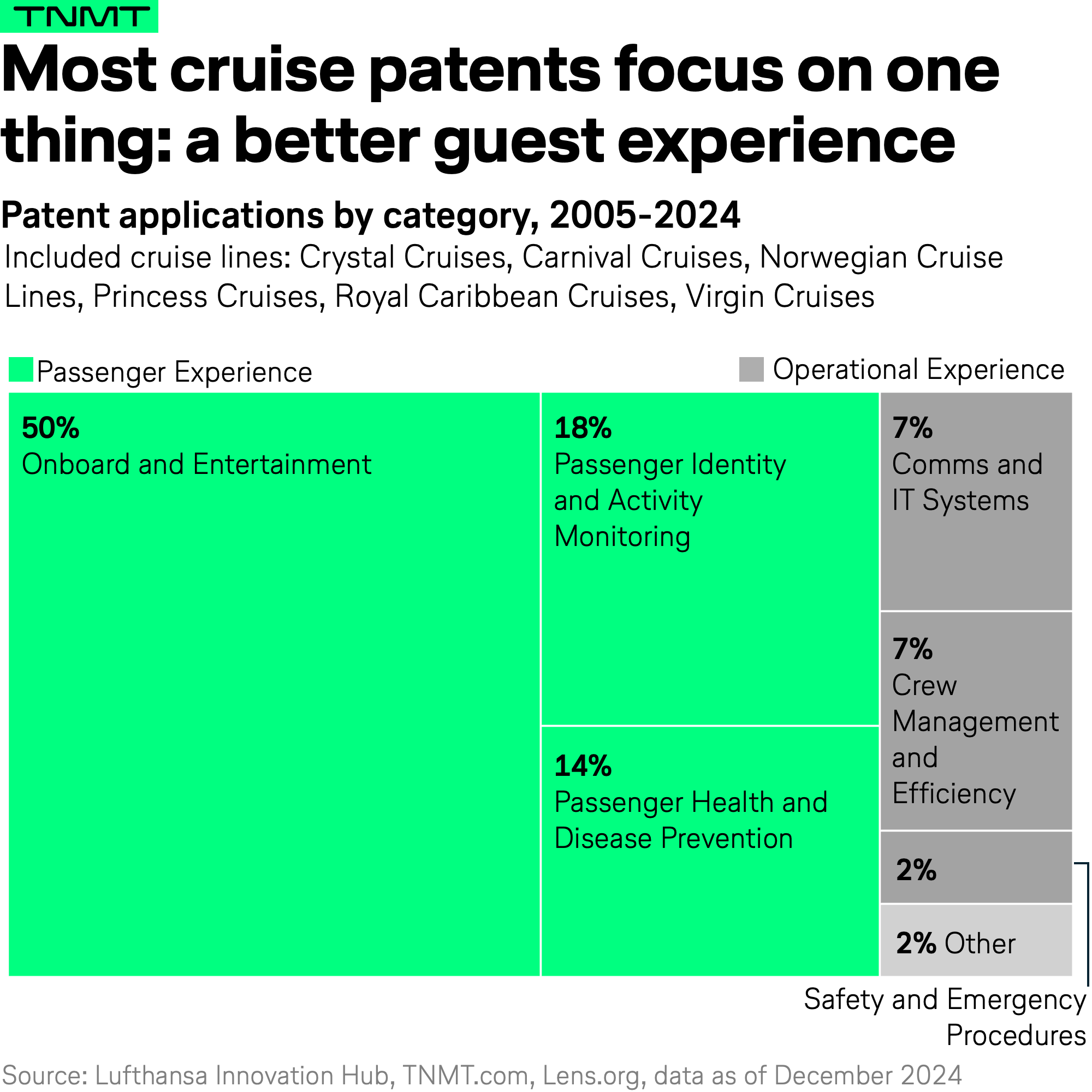

To better understand the innovation momentum powering the cruise industry’s comeback, and to uncover where traveler fascination may truly be rooted, we took a closer look at how cruise lines are investing in R&D.

And to do that, we turned to a familiar metric: patent activity.

- Just like in our previous TNMT analysis of airline patent pipelines, we used annual patent filings as a proxy for innovation intensity.

- While patents aren’t a perfect measurement, they’re one of the most concrete signals of where an industry is placing its bets, especially in high-capex, tech-driven sectors like cruise shipping.

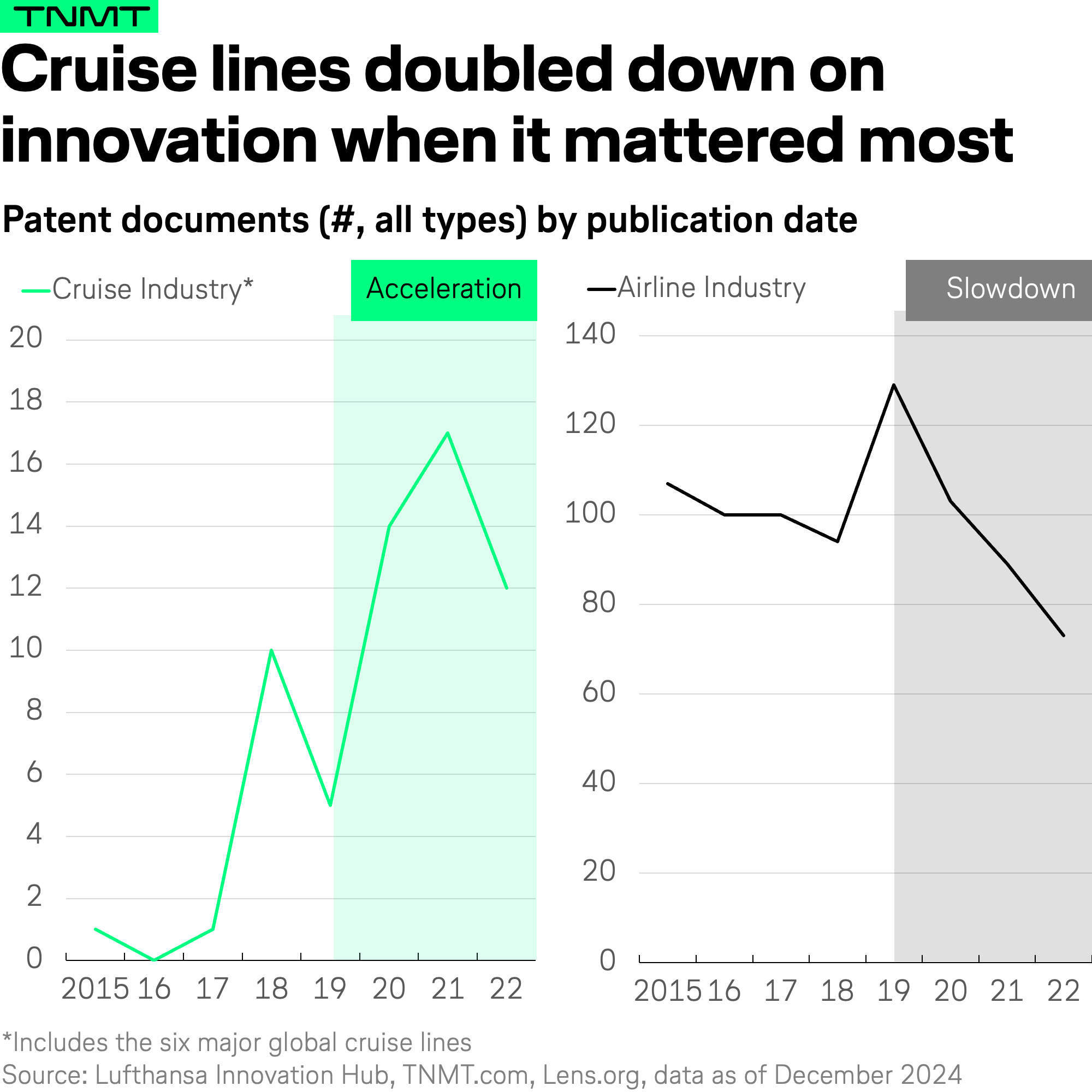

And the data speaks volumes.

- Historically, cruise operators haven’t been major patent powerhouses. But starting around 2018, and accelerating sharply during the pandemic, something changed.

- Annual patent filings by major cruise lines increased significantly, reaching unprecedented levels post-2020.

What’s remarkable is the timing.

- While the cruise industry was experiencing its darkest chapter, think ships docked, operations frozen, public trust damaged, these companies did something counterintuitive: they ramped up innovation efforts.

- Rather than pulling back on R&D activity, they doubled down. The very moment when business-as-usual was no longer possible became the moment for reinvention.

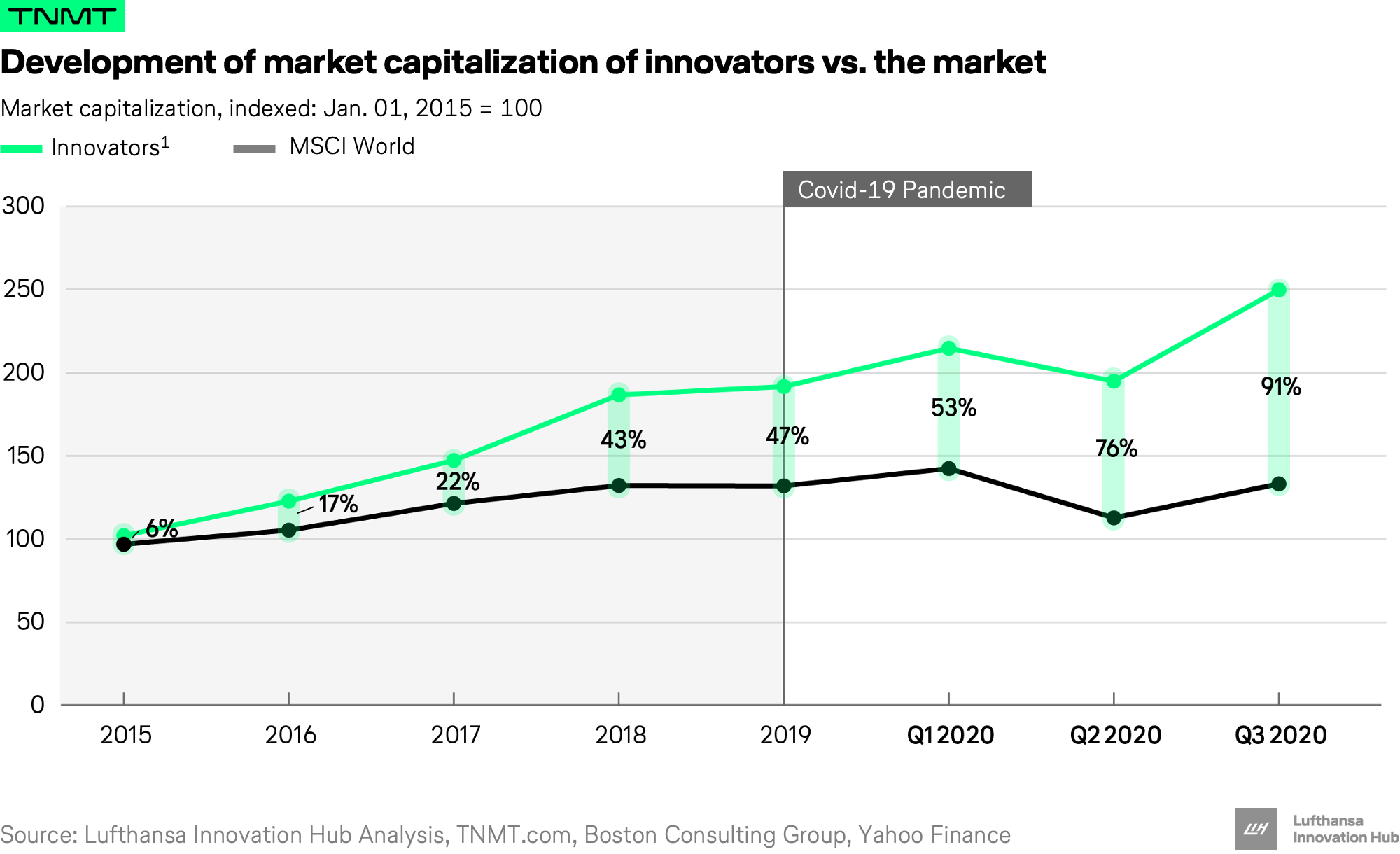

That’s the opposite of what we’ve seen in the airline sector, where patent activity has mostly stalled since 2020, with many carriers shifting into pure survival mode.

The cruise industry, by contrast, followed the playbook management literature has long praised but few companies actually follow: investing in innovation during downturns.

Studies from McKinsey, BCG, and others all point to the same conclusion—companies that prioritize innovation in times of crisis tend to outperform their peers during recovery.

And in this case, the cruise industry is the textbook example.

Even more telling is the type of innovation being prioritized.

A deeper look into these patents reveals that the vast majority focus on enhancing the passenger experience—from onboard services and entertainment to identity management and personalized offerings.

That’s where things get especially relevant for airlines.

Because many of these innovations, while designed for ships, could be adapted to air travel.

How Wearables Are Reshaping the Cruise Journey

One of the most promising areas where cruise innovation could inspire real change in air travel?

Wearable technology.

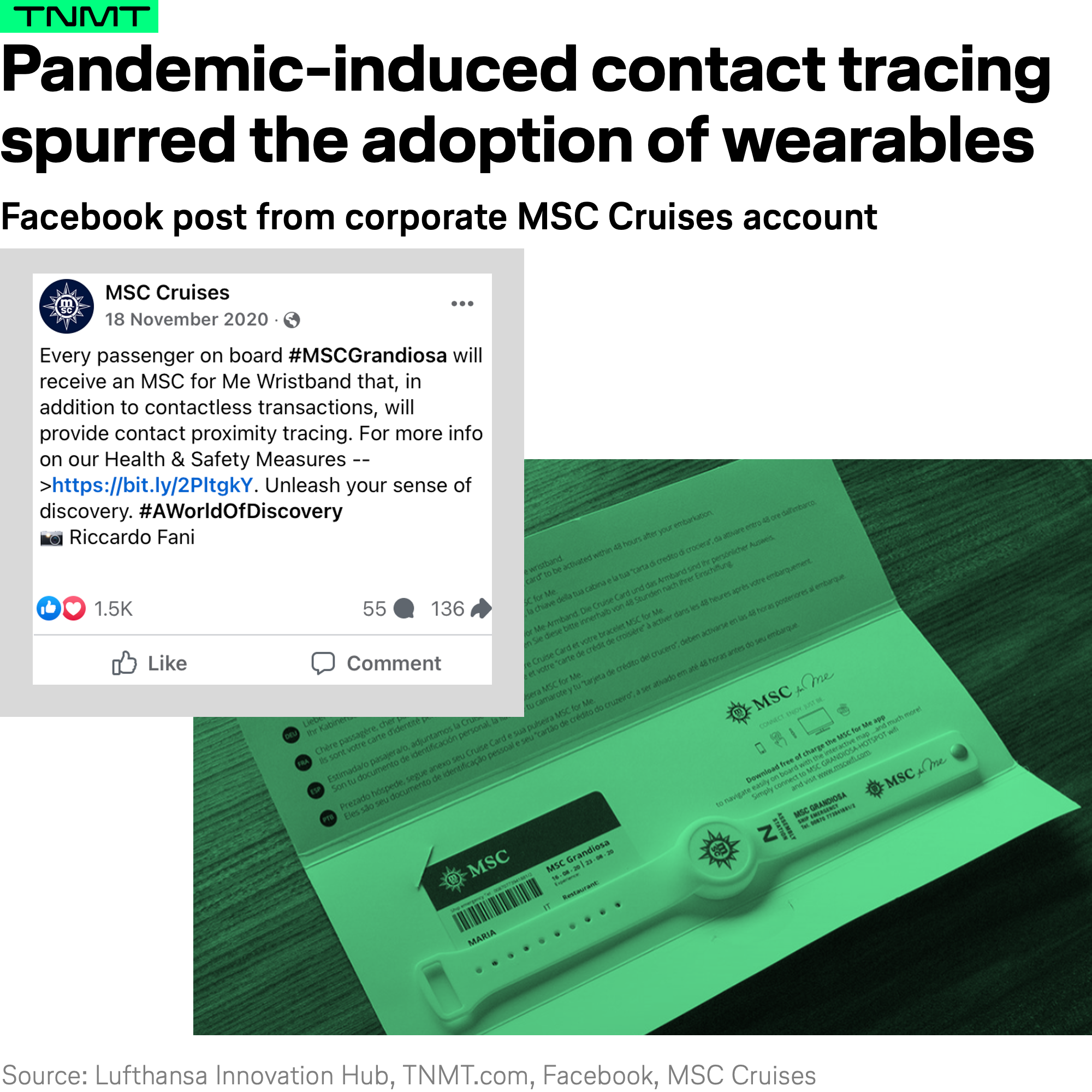

Over the past few years, major cruise lines have turned basic wristbands into powerful digital keys that unlock a completely new level of customer experience. And it all started with something far less glamorous: contact tracing.

When COVID-19 brought cruising to a halt, the U.S. Centers for Disease Control’s “Conditional Sail Order” required cruise operators to track passenger movements on board to control potential outbreaks. As a result, wearable devices, which had been in early testing phases at a few cruise lines, suddenly became mission-critical.

- Between January and December 2020, Princess Cruises rolled out its OceanMedallion as a mandatory wristband across the majority of its ships.

- Shortly after, Royal Caribbean launched the Tracelet, a required device designed specifically for contact tracing.

But what began as a health measure quickly turned into a catalyst for innovation.

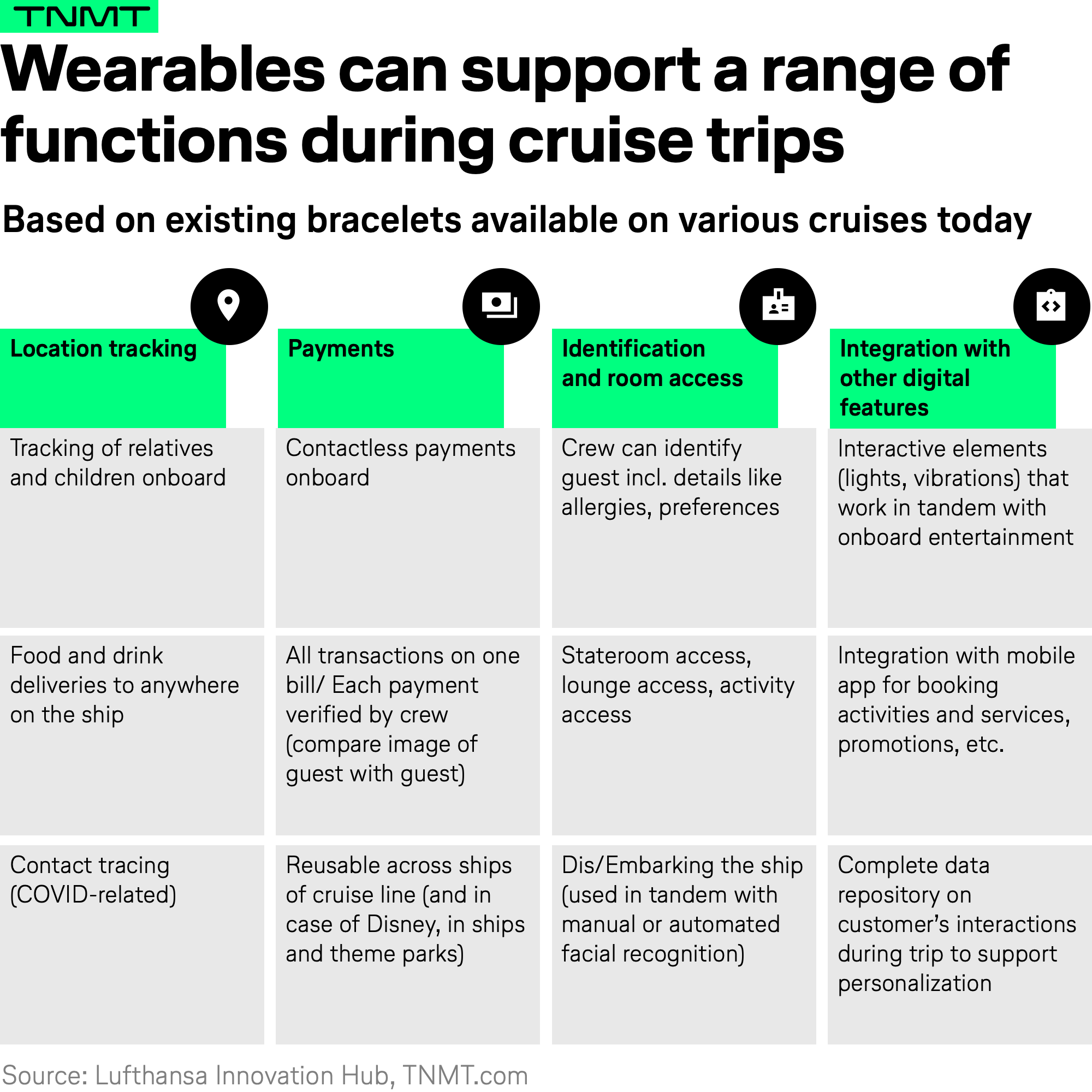

Cruise lines doubled down, transforming these wearables into full-fledged customer experience tools, offering everything from location tracking and room access to seamless payments and personalized services.

Today, major cruise lines offer their own take on connected wristbands. While they vary in design, functionality, and scope, they all aim to achieve the same thing: reduce friction, improve personalization, and give passengers more control over their journey.

Here’s a breakdown of the leading wearable offerings from the cruise industry’s major players:

- Princess Cruises – OceanMedallion: First piloted in 2018 and expanded during the pandemic, this bracelet enables touchless boarding, keyless stateroom entry, onboard purchases, and even real-time location tracking for families and friends. One standout feature: guests can order food and drinks to wherever they are on the ship.

- MSC Cruises – MSC for Me Wristband: Originally launched in 2017 as an NFC-enabled alternative to cruise cards, the device became mandatory during the pandemic. It’s part of the broader “MSC for Me” ecosystem that connects to a mobile app and voice-activated cabin assistant.

- Virgin Voyages – The Band: Introduced in early 2020, The Band serves as a room key, payment tool, and access pass for events. It’s stylish, non-reusable, and included as an alternative to traditional cruise cards.

- Royal Caribbean – WOW Band: Launched in 2023, this RFID-enabled band allows guests to unlock rooms, make purchases, and access activities, essentially a tech-enhanced replacement for the plastic key card. It builds on the functionality of the earlier Tracelet.

- Disney Cruise Line – DisneyBand+: Rolled out in 2023, DisneyBand+ offers a unified guest experience across Disney’s cruise ships, theme parks, and resorts. It enables seamless payments, room access, and even lights up and vibrates in sync with entertainment experiences.

The evolution is clear: what started as a tool for safety has now become a platform for convenience, personalization, and operational efficiency. In other words: wearables have become an infrastructure layer for a smarter customer journey.

Why Airlines Should Pay Attention: Wearables Aren’t Just for the Seas

At first glance, the cruise industry’s wearable revolution might seem like a sector-specific innovation movement, more relevant for vacationers ordering piña coladas poolside than for high-stress, high-speed air travel.

But that would be a missed opportunity.

While the environments and use cases may differ, the underlying logic behind cruise wearables is absolutely transferrable to air travel for both airlines and airports.

Of course, we’re not suggesting airlines start handing out custom wristbands at the gate. That model works well at sea, where passengers spend multiple days onboard and have limited internet access on their own devices, but it’s unlikely to scale in the sky.

However, the core experience-enhancing features these devices enable, such as location tracking, contactless payments, and identity-based personalization, could very well be integrated into consumer wearables already on passengers’ wrists, such as the Apple Watch, Samsung Galaxy Watch, or Google Pixel Watch.

And yet, today, most airlines barely leverage the potential of these platforms. Aside from basic boarding-pass wallet integrations, most airlines don’t leverage the full potential of the wearable ecosystem.

That’s beginning to change.

In the following sections, we explore three emerging use cases where wearables are slowly starting to reshape parts of the airline experience and where much more potential remains to be unlocked.

Use Case #1: Smarter Luggage Tracking, Right From Your Wrist

Lost luggage remains one of the most frustrating pain points in the passenger journey, and it’s not going away anytime soon. In fact, our latest passenger review analysis confirms that baggage issues consistently rank among the top three complaints cited by air travelers.

This should make luggage transparency a strategic priority for airlines, and wearables may offer a meaningful way forward.

We’re now seeing early signs of this shift, driven by one familiar device: the Apple AirTag.

- Travelers increasingly place AirTags in their checked bags, using Apple’s “Find My” feature to monitor real-time location updates, often with greater accuracy than the airline’s own tracking system.

Recognizing the opportunity, several airlines have begun embracing this behavior.

- United Airlines, our parent company Lufthansa Group, KLM, and many more carriers now support Apple’s “Share Item Location” feature, allowing passengers to track their luggage via iPhone or Apple Watch throughout their journey.

- Qantas has also announced plans to roll out similar integrations.

This functionality could, in theory, go far beyond luggage.

Any item that supports Apple’s location-tracking network, from phones to laptops to noise-cancelling headphones, can now be monitored via wearable devices. For forgetful travelers (and overstretched cabin crews), that’s a potential game-changer.

Use Case #2: Paying by Watch, No Wallet, No Worries

If you’ve ever fumbled for your wallet while crammed into an airplane seat or dashed through an airport food court with one eye on the departure board, you know: payments while traveling aren’t always seamless.

But they could be.

Thanks to the growing adoption of contactless technology, and the rising popularity of smartwatches, travelers are increasingly leaving their wallets (and even phones) in their pockets.

Globally, contactless payments have become the new normal.

- In some countries, more than 90% of consumers use tap-to-pay methods as their primary mode of payment.

- And wearables are playing an increasing role, because in 2024, around 16% of contactless payment users preferred their smartwatch, up from 14% in 2022.

This share is expected to keep rising. The reason is simple: convenience.

Smartwatches are always on-hand (literally), require no extra authentication once configured, and dramatically reduce friction, especially in time-sensitive or high-density environments like airports and airplanes.

Imagine this:

- You’re in a rush to catch your flight, but you breeze through a self-checkout at the terminal newsstand with a flick of your wrist.

- You’re mid-air and decide to order a snack—no need to dig through your bag for a credit card. One tap on your smartwatch and it’s paid.

- You land and head straight for the city center. Instead of fumbling for a ticket, you simply tap your watch at the train turnstile.

This isn’t theoretical. The first real-world airline travel use cases are already rolling out:

- Airlines like Lufthansa, Finnair, and Ryanair accept contactless payments onboard on many flights.

- Wizz Air has announced a full transition to cashless in-flight payments starting April 2025.

- United Airlines rolled out support for standard tap-to-pay in late 2024, removing the previous requirement of linking a credit card to their app.

- Delta Air Lines, following Alaska Airlines’ lead, now lets flight attendants accept payments directly via iPhone-based tap-to-pay, thereby streamlining the entire in-flight purchase flow.

- Munich Airport was Europe’s first to introduce tap-to-pay at-the-shelf checkout in its Terminal 2 “Corner Shop.”

All these developments may seem small in isolation, but collectively, they reflect a major shift in how travelers interact with their environment. Airlines and airports now have a clear opportunity to meet passengers where they are: on their wrists.

Use Case #3: Real-Time Journey Updates Right on Your Wrist

Ask any traveler what stresses them most at the airport, and you’ll likely get the same answers: long lines, last-minute gate changes, and the constant worry of missing a connection.

For years, airlines and airports have tried to address these friction points through mobile apps.

But let’s face it: pulling out your phone every five minutes, unlocking it, navigating to the right app, and refreshing a screen isn’t exactly seamless.

Enter the smartwatch.

By pairing wearables with real-time data from airline and airport apps, the travel journey becomes much more intuitive. Flight changes, gate updates, baggage details, and even estimated security wait times can now live where they’re most useful: on your wrist, in real-time, when you need them most.

United Airlines is already leading the way.

- In 2023, the carrier introduced “Live Activities” for its mobile app, and in 2024, extended this feature to the Apple Watch.

- Now, United fliers can view a countdown to boarding, updated gate info, seat assignments, and baggage carousel locations—all via subtle wrist notifications that update throughout the journey.

Amsterdam Schiphol Airport has taken a systems-wide approach.

- The airport has deployed thousands of motion sensors across terminals, which feed into self-learning algorithms to better predict passenger flow and waiting times.

- That data is pushed to passengers in real-time, on their phones and now on their smartwatches, offering alerts about security delays and how long it’ll take to reach their gate.

- According to Schiphol’s Product Owner, David de Vries, the ultimate goal is ambitious: to make the entire journey, from “home to holiday destination and back again, transparent and predictable.”

Even smaller airports are getting in on the action. Ireland’s Shannon Airport, for example, now offers smartwatch integration with its mobile app, providing live updates on check-in times, boarding gate changes, flight delays, and baggage collection; all from a single glance at your wrist.

The vision is clear: shift from reactive to predictive travel.

And the smartwatch, with its glanceable format and push-notification power, is emerging as the perfect companion for just that.

The Vision: Toward a Truly Seamless Travel Journey

The three use cases we just explored offer a glimpse into how wearable tech can enhance the passenger experience in air travel.

But let’s be clear: they’re just the beginning.

To unlock the full potential we’ve seen in the cruise industry, wearables in air travel need to evolve from functional accessories into true digital identity carriers.

Because that’s the real game-changer.

When wearables become the key to verifying who you are, not just what you booked or how you pay, they can transform the entire journey into a seamlessly connected experience.

Picture this:

- You arrive at the airport. Your smartwatch tells you to head to security checkpoint 3 because wait times are the shortest there right now.

- You check in your luggage and pay for an extra bag with a tap of your wrist.

- You breeze through security with your digital boarding pass and verified identity, all from your watch.

- You’re notified of a gate change en route, and your smartwatch guides you turn-by-turn through the terminal.

- In the retail area, you get a personalized offer from your favorite beauty brand, pay instantly at the shelf with a tap.

- You go through immigration with no passport in hand, just a verified digital ID on your watch.

- Onboard, you pay for your meal with one tap.

- After landing, your smartwatch tells you where to pick up your luggage and how long it will take.

- You exit the terminal and tap your watch to access public transport.

- You arrive at your hotel, head straight to your room–your watch is the key.

- The same device gets you into museums, rental cars, even serves as your driver’s license.

- No wallet. No passport. No phone fumbling. No paper tickets.

- Just one connected, secure, verified device guiding your entire journey from start to finish.

Sounds like a fantasy?

It’s not. However, the only major puzzle piece missing is fully accepted digital identity integration, but we’re getting there.

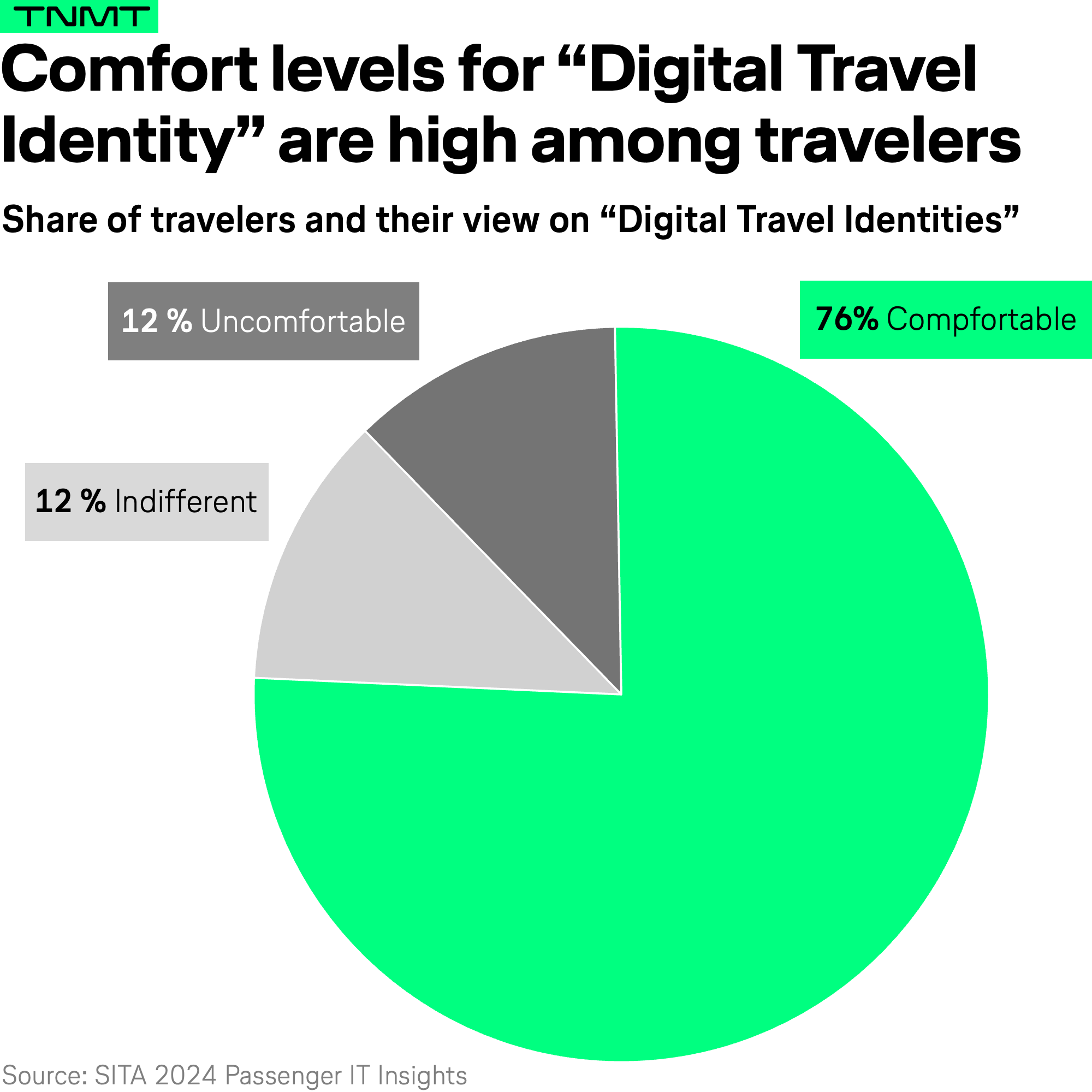

Critics often claim that travelers won’t be comfortable with sharing digital ID credentials, especially across devices like wearables.

But the data tells a different story.

- According to a recent SITA survey, nearly three out of four travelers say they would feel comfortable having a digital passport on their phone, or smartwatch.

- In other words, the barrier isn’t user readiness. It’s infrastructure.

Fortunately, momentum is building:

- In the U.S., TSA checkpoints in 11 states now accept digital ID via Apple Wallet at select airports.

- Google Wallet is preparing to support digital versions of U.S. passports, taking things a step further.

- Delta Air Lines has expanded its Digital ID initiative to more airports for TSA PreCheck travelers, making biometric, device-linked identity a mainstream experience for frequent flyers.

This is the direction the industry is heading, and it’s good news.

Because once digital identity becomes standard, wearables can evolve into the ultimate travel companion.

The future of seamless travel isn’t just mobile-first. It’s wearable-enabled.

And the airlines that start designing for this reality now?

They’ll be the ones shaping the future travel experience, maybe before the next cruise line beats them to it again.

This being said, wearables aren’t the only frontier. There’s another surprisingly promising field where cruise lines are outpacing airlines.

We’ll explore it next time in part two of our TNMT cruise series. Stay tuned.