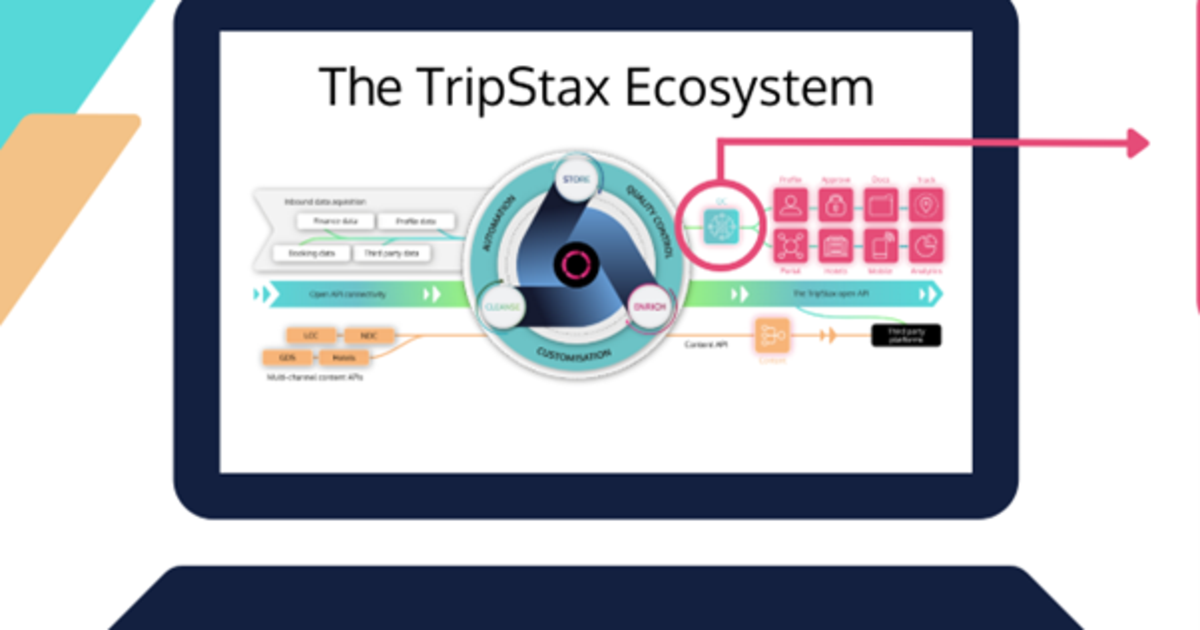

Business travel data management specialist TripStax has revealed that the volume of non-GDS ‘passive segments’ ingested by its TripStax Core data-processing engine is set to surpass one million for the first time.

This figure, at an average segment-to-trip ratio of two and at an average trip value of £500, is the equivalent of the entire annual trading of a £250 million turnover travel management company (TMC).

According to TripStax, the milestone, which comes three years after the tech provider launched the TripStax Core and interconnected stack of travel management modules, is a clear barometer of the health of the travel industry’s processes.

It represents a core indicator of the volume of bookings that TMCs are making outside of the primary GDS channels, something that TripStax monitors closely as part of several significant projects currently underway with key customers and partners.

The travel industry has long relied on passive segments to enable bookings made outside of the GDS to be processed through an agency’s internal systems.

Agents must input flight numbers, dates, times, and other details of such bookings into the GDS PNR to ensure that all bookings are properly documented and tracked for itineraries, accounting, reporting, and record-keeping purposes.

As part of the requirement of many agencies to feed their mid, back office and other downstream systems via the GDS, TripStax believes that the presence and use of passive segment points towards not only the volume of content split in and out of the GDS, but also potential operational efficiencies and commercial risk for TMCs.

Noting the significance of the milestone, David Chappell, Chief Product Officer at TripStax said: “Thanks to the increasing adoption of NDC, as airlines and content providers look to distribute directly to agents and consumers, the growing reliance on the GDS to continue to enable TMCs’ downstream systems via the humble passive segment intensifies.

“Once a go-to solution for an agency, the ‘passive’ is rising up the agenda due to TMCs’ commercial pressures and the quest for operational efficiency.

“If TripStax’s database was an agency and we were charged £2 per passive segment, this could represent a threat of as much as £2M to the bottom line of the agency, plus additional costs and potential lost GDS segment revenue of a further £2M.