In a world where AI can generate almost anything, trust is what still sets things apart. Some of the threads in this edition look at where trust shows up, and why it’s becoming one of the few lasting advantages. I hope you enjoy it, and as always, thanks for trusting me with your inbox.

Special thanks to Propellic for sponsoring this edition of the newsletter:

While you’re still optimizing for keywords, Google’s AI is rewriting the rules of travel search. Our NavLog readers are ahead of the curve with Google’s AI search surfaces. Don’t get caught playing catch-up when your competitors are already adapting. Get the travel marketing intelligence that matters. → Join 1,500+ travel marketers.

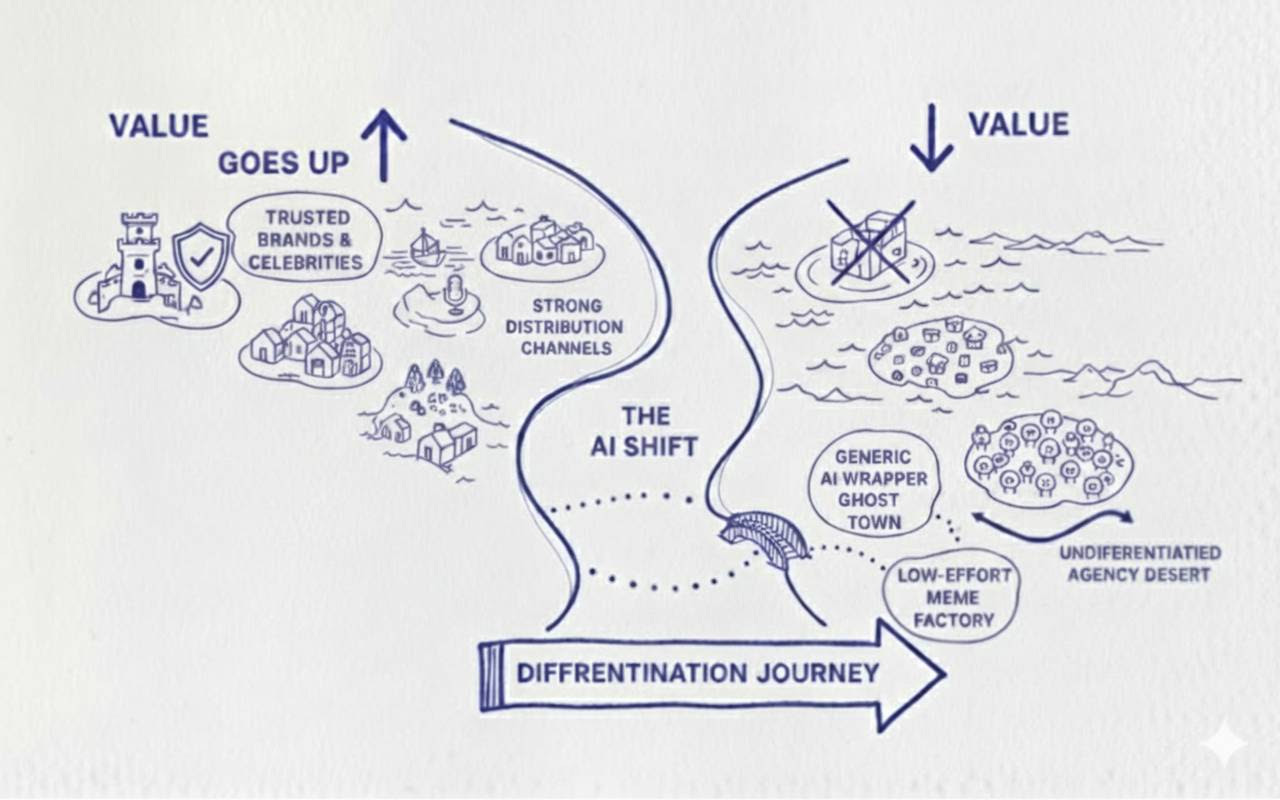

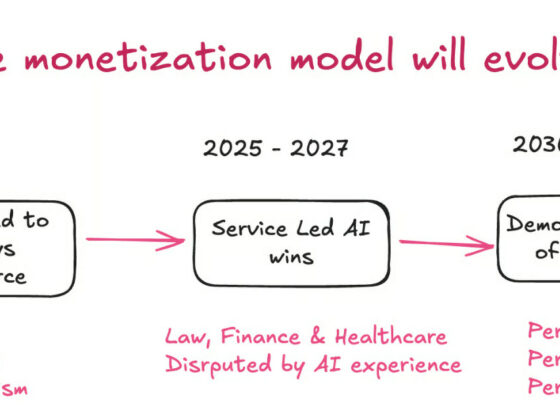

1. Where will value accrue and decline in an AI-generated world?

In his recent post, “The AI Slop Arbitrage,” Greg Isenberg argues that as AI makes creation abundant, the value shifts to what can’t be easily generated. He maps out where value will accrue and where it will decline in this new landscape.

Some examples of where value will increase:

-

The value of trusted brands, recognized experts, taste, and curation increases because reputation, credibility, and knowing what to ignore can’t be automated.

-

Unique insights and “un-Googleable” knowledge gain value, since AI can easily replicate what’s already online but can’t fake domain expertise earned over time.

-

Proprietary data and community-built products create moats because when everyone has access to the same public training data, the edge is in what nobody else can see.

-

Real-world distribution, retail shelves, and in-person relationships become key differentiators because they can’t be automated.

On the flip side, Isenberg suggests that some areas will see their value decline, such as:

-

Generic AI wrappers because simply wrapping ChatGPT in a UI is mostly decoration.

-

Average content because AI can now create it in abundance.

-

Audiences without trust because a million disengaged (or acquired) followers are worth less than a hundred loyal ones.

-

Faceless brands, because people buy from people, and when everything is generated, humanity becomes the premium.

In an AI-generated world, the most valuable things will be the hardest to automate or fake. Differentiation will come from authenticity, curation, real-world presence, and above all, trust and humanity.

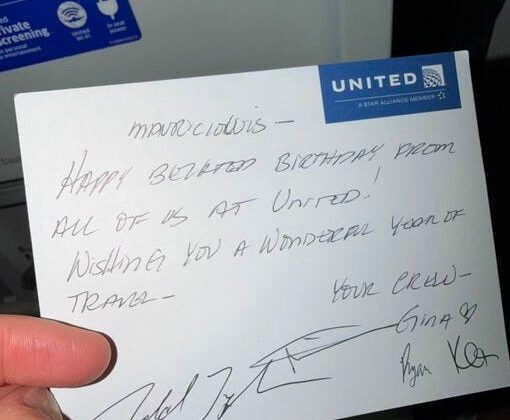

2. The shared language of delight

In my last newsletter, I wrote about Nesrine Changuel’s product framework for delight. Last week, she published a post that draws a connection between product design and hospitality, specifically, the story behind Will Guidara’s Unreasonable Hospitality and how Eleven Madison Park became the best restaurant in the world.

She advances nine shared principles between dining and digital products, from removing friction to exceeding expectations to energizing the teams behind the work. Read + When Hospitality Meets Product

Functionality creates trust, but it doesn’t create love. Whether it’s the way a waiter remembers your name or how Google Photos quietly curates your best memories into a story, connection comes from the human layer around functionality. Delight begins where functionality ends, when products and experiences start speaking to our emotions, not just our needs. — Nesrine Changuel

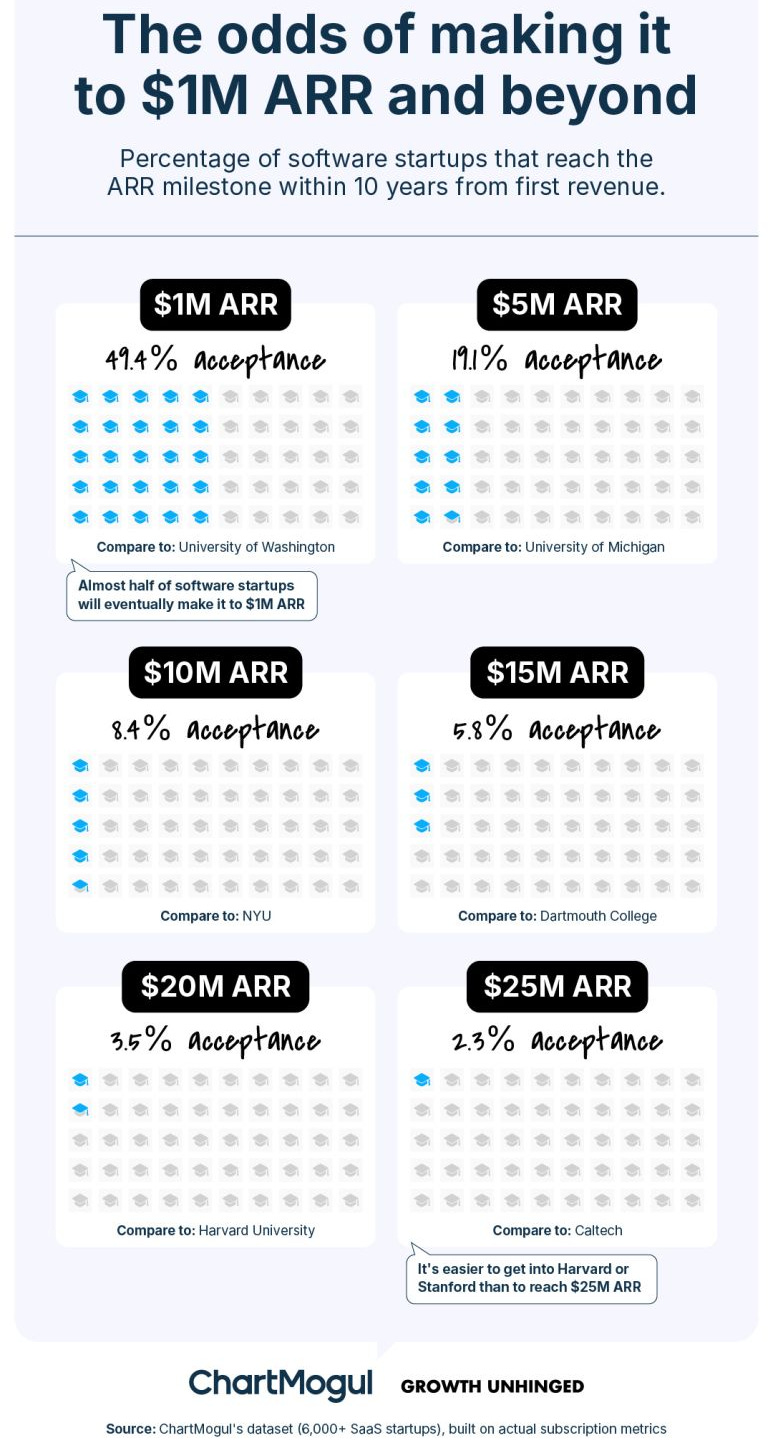

3. What the data says about reaching $1M ARR (and beyond)

Kyle Poyar teamed up with ChartMogul to analyze growth data from 6,500+ SaaS companies. Just 2% of these startups reach $25 million in ARR within 10 years. Even hitting $1 million ARR takes longer than most founders might expect: 2 to 5 years after monetization. Only 3% get there in under a year.

The piece includes useful benchmarks but is honest about the caveats. These are companies serious enough to track SaaS metrics, which likely skew the data a bit more optimistically. And the dataset starts with first revenue, not founding… so it doesn’t capture the quiet years before launch or the startups that shut down early.

AI-native startups are 3x more likely to reach $1 million ARR in 6 months, and 8x more likely to reach $10 million ARR within a year. Vertical SaaS and enterprise startups grow more slowly: only about 1.2–1.7% reach $1M ARR in 6 months, and fewer than 0.1% make it to $10M ARR in a year.

The data also shows geography still matters, but less than it used to. Bay Area startups are about 70% more likely to hit $1M ARR within three years, yet companies in locations like France, Canada, or New York often show more staying power. Read + The Odds of Making It.

4. Simulating demand

New research shared by Ethan Mollick shows that you can replicate real purchase intent with 90% accuracy by prompting an off-the-shelf LLM to act like a customer with a demographic profile. Show it a product image, ask for a free-text reaction, and compare the response to reference statements on a 1–5 scale using semantic similarity. The researchers tested three methods and found that this semantic approach was the most accurate, required no fine-tuning, and outperformed classic machine learning models.

This could make early demand testing much faster and cheaper. Still, real conversations remain essential for understanding nuance, emotion, and context. AI is a valuable complement, but not a substitute for that kind of learning.

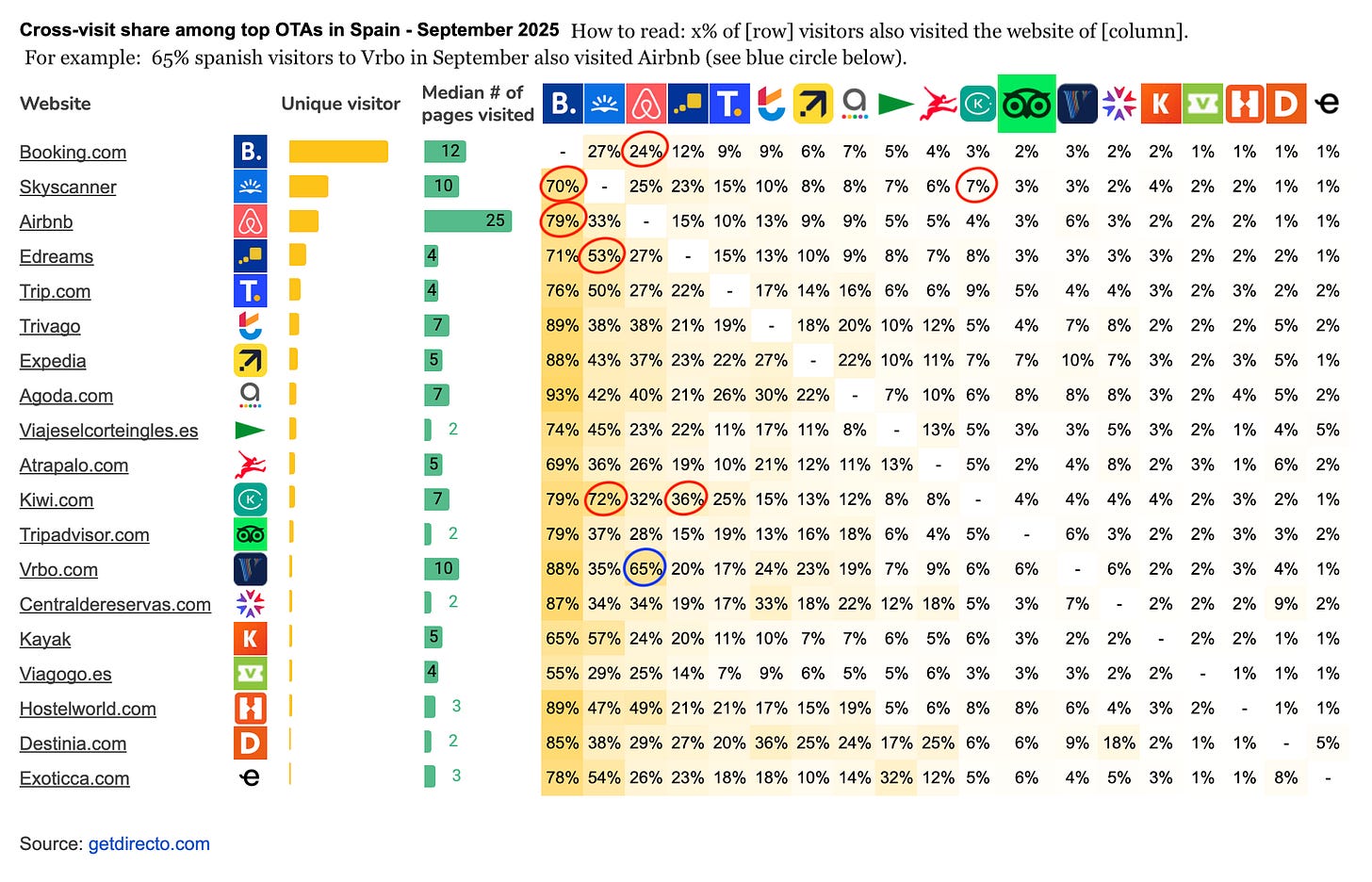

5. Visitor dynamics among Spain’s top travel players

This data comes from a special partnership between Travel Tech Essentialist and Directo, one of the most-installed browser extensions in the global travel category. Directo uses AI to help travel brands capture demand and convert browsing intent into bookings.

A few highlights from the dataset (each stat is circled in the chart for quick reference)

-

Booking vs Airbnb: 79% of Airbnb visitors in September also visited Booking.com, while only 24% of Booking.com visitors also visited Airbnb in September.

-

eDreams vs Skyscanner: 53% of eDreams visitors also visited Skyscanner, but only 23% of Skyscanner visitors visited eDreams.

-

72% of Kiwi visitors also visited Skyscanner…the highest cross-visit share to Skyscanner of any player. But only 7% of Skyscanner users visited Kiwi.

-

eDreams and Skyscanner are the only major players where fewer than 75% of users also visited Booking.com. Still high, at 71% and 70%, but lower than others.

-

Vrbo (65%) and Hostelworld (49%) have the highest share of users also visiting Airbnb.

-

36% of Kiwi users visited eDreams; the highest share for any competitor. But only 8% of eDreams users went to Kiwi.

Data limitations: i) The dataset is primarily desktop-based, since Directo operates via browser extension. Mobile behavior is thus underrepresented. ii) These insights reflect the behavior of Directo’s user base, which may not fully represent all traveler segments.

6. Revolut integrates travel into the core product

Revolut just acquired Swifty, a Lufthansa Innovation Hub spinout that built a conversational AI travel agent. The product handles the whole booking process, from search to invoicing, through a chat interface. The team is joining Revolut to help expand its loyalty and lifestyle products by combining financial guidance with automated action across spending, travel, and rewards.

In my last newsletter, I pointed to Revolut’s eSIM as a clear example of how delight comes from anticipating real pain. Swifty brings that same approach, but across the whole booking stack. It’s also another signal that fintechs with high user engagement are moving into lifestyle automation and shifting from helpful content to helpful action. Capital One’s work with Hopper is another good example of integrating travel directly into the credit card experience. These companies already own the payment moment, and they’re coming for everything around it.

7. Showing traction before you have it

In this LinkedIn post, Andrew Chen discusses a catch-22 many startups face: needing traction to raise money, but needing money to gain traction. He highlights tactics like launch videos, waitlists, and “building in public” that can help demonstrate momentum before achieving “real” metrics like revenue. The key is finding creative ways to validate interest and bridge the gap to more substantive traction. While not as solid as revenue, these tactics can generate buzz, engage potential customers, and prove to investors that you’re on the right track.

8. The ultra-rich are giving up on luxury assets

The ultra-wealthy are losing interest in traditional luxury assets, according to this article in The Economist. Prices for Bordeaux first growths have dropped 20%, and second-hand Rolexes are down 30%. Even prime real estate in global cities is stagnating. But as The Economist reports, the cost of ultra-luxury services keeps rising. A table at a three-star Michelin restaurant, a room at an iconic hotel like Paris’s Le Bristol, courtside seats at the Super Bowl, and front row at Wimbledon are all becoming more exclusive and expensive.

The dynamics driving this shift align with Thorstein Veblen’s theory of luxury: scarcity and rivalrousness are what make something truly luxurious. In an era of abundance, it’s the unique, unrepeatable experiences that are most valued.

9. Travel tech voices worth following

Quick ask: Who are the individuals you follow/trust on LinkedIn or X for travel tech insights? Not media brands, just people. Founders, execs, operators, analysts, researchers. People who consistently share useful ideas or help you think more clearly about where travel is headed.

Please answer directly (and anonymously) on this Google Form. If you’ve already voted from my LinkedIn or Twitter post, I have your votes, no need to vote again. And please, no voting for yourself 🙂

Would love to know who’s on your radar. I’ll include the results in a future edition so others can follow and learn from them too.

10. A small test that reveals a lot in hiring

Trent Innes, former MD at Xero and now CGO at SiteMinder, uses a simple rule in interviews: if a candidate doesn’t take their coffee cup back to the kitchen, they don’t get hired, regardless of their credentials. Read +

These small behaviors speak volumes. They signal a specific mindset, respect, and cultural awareness. Often more powerfully than a résumé.

Travel Tech Essentialist Job Board

→ Explore all 1501 open roles on the Travel Tech Essentialist Job Board now.

-

Expedia | Director Global Markets – Mexico | Mexico City

-

TravelPerk | Product Design Manager | London

-

Airbnb | Data Scientist – CRM | USA | $194k – $240k / year + Equity

-

WeRoad | Head of Sales and Customer Experience | Milan

📩 For monthly updates on the latest roles, subscribe to the Travel Tech Jobs newsletter

Raising a round?

If you are a startup looking to raise a round (from pre-seed to Series D), I can help (for free). Travel Investor Network is a private platform where I recommend innovative travel startups to investors and innovators. If you’re interested, please start by completing this form.

If you like Travel Tech Essentialist, please consider sharing it with your friends or colleagues. If you’re not yet subscribed, join us here:

And, as always, thanks for trusting me with your inbox.

Mauricio Prieto