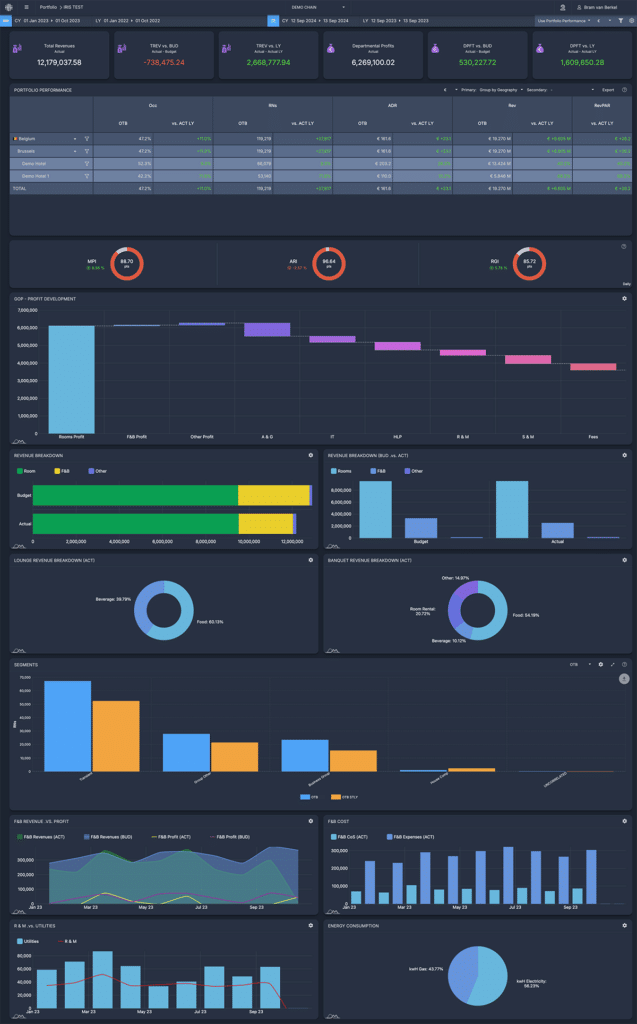

In today’s complex and competitive hospitality environment, complacency is not an option. Data-driven decision-making is essential for the success of your business.

In most organizations commercial analytics are the domain of sales, marketing and particularly revenue management. Financial data is leveraged by Accounting and Finance teams focusing on costs, profitability and overall financial health.

In this article you’ll learn why and how these types of data should be leveraged together by both Finance and Commercial teams create an integrated approach to using data to maximize top-line revenue growth and bottom-line profitability.

Combining Commercial and Finance Analytics Explained

Let’s start by sketching what these terms refer to.

Commercial analytics data comes from systems at the core of a hotel’s commercial operations including the PMS, RMS, benchmarking and rate-shopping tools, and others. Commercial analytics refers to data and data visualizations related to the commercial performance of the business, including information on how the business is built up.

For example:

- Breakdowns such as segmentation, channels, rate codes, room types, room occupancy

- Behavioral data including leadtime, length-of-stay, day-of-week patterns of production

- Statistics on loyalty-contribution, average booking value, free upgrade-%, etcetera

- All of the above are related to each other and to specific stay and/or book periods

Finance Analytics takes data from the accounting system, or ERP, of the business and focuses on providing insights on costs, profitability and investment.

Relevant information includes:

- Profit and Loss statements (P&L’s)

- Breakdowns of expenses by department, cost type, etcetera

- Profitability across the hotel, and by outlet

By bringing together of these two types of analytics, currently separated in most organisations, hotels can get a clearer picture of how commercial activities and decisions affect the financial health of the business and vice versa. Also the use of commercial data to provide context to financial data and the other way around helps business users answer the most important follow-up question in data and analytics: “Why?”.

For instance: commercial breakdowns on segmentation and channel can give context on why profitability is comparatively high or low for the Rooms department.

The Benefits of Marrying Commercial and Finance Analytics?

- Holistic business view. Having commercial and finance analytics sit together in one place, even in one dashboard, means users from both sides of the business are getting a holistic business view and are using the same source of truth for the same data. This enables a deeper understanding of how operational decisions in either department impact financial outcomes. This is crucial for cross-departmental alignment and ensuring that decisions made in one area don’t negatively affect performance in another.

- Improved forecasting and budgeting. Commercial analytics are often focused on real-time trends, but when linked with financial analytics, hotels can make better, more informed forecasts. For example, instead of focusing solely on revenue, you can factor in associated costs to understand the true profitability of a certain segment or channel. This, in turn, enhances budgeting decisions and resource allocation.

- Better profitability. While revenue growth is important, it must be accompanied by effective cost management. Merging these analytics allows hotels to identify where they may be sacrificing profitability while chasing revenue, such as higher acquisition costs that don’t translate to more profitable bookings.

Having a clear understanding of the full cost and revenue dynamics of different distribution channels means hotels can choose pricing models and channel management strategies that maximize profit. - Enhanced decision-making. In an integrated environment, when making decisions on for example marketing investments, pricing strategies, and resource allocation, they are made with a financial lens ensuring the decisions contribute to the overall profitability and sustainability of the hotel.

How to Bring Finance and Commercial Analytics Together

It will come as no surprise that technology is the answer to the challenge posed here as the most effective solution.

Step 1: Data Integration

Start by breaking down the literal data silos. Both financial and commercial data need to be available and shareable across departments. While this can be done manually, it’s through a Business Intelligence tool that you will be able to effectively bring the data together in a meaningful way and consume the data in the many different ways that the data can bring value. This also eliminates the cost and time needed to invest in a manual process to extract and structure the data in a way that becomes valuable.

Step 2: Define Key Metrics

The success of this marriage depends on identifying the right metrics and making them available in the right locations. For commercial analytics, focus on revenue drivers like RevPAR, ADR, and occupancy rates. On the financial side, integrate costs, profitability per segment, and distribution cost metrics. Merging these key metrics allows hotels to monitor the actual performance and profitability of every operational decision.

Step 3: Collaborate

An understanding between the teams doesn’t always come naturally. Aligned KPI’s and regular cross-functional meetings help ensure that both sides understand the impact of their decisions on the other.

Step 4: Automate and Customize

When you’ve come to this step, you will realize that a manual process for bringing together the data is not going to bring you the efficiency you need to execute effectively. Because each business is different and each business user has different personal preferences on how to consume analytics, hotels need flexible tools that allow the building of customizable dashboards in which they can combine data and visualizations from both the Commercial and the Financial domains and sources. Automation will reduce manual work and errors and ensure consistency.

Step 5: Regular Analysis and Adjustment

A constant feedback loop is critical. Reviewing the integrated analytics regularly and having each party validate the accuracy and conclusions of the other makes sure that trends can be spotted faster, inefficiencies are uncovered, and data-driven adjustments are made where necessary. Whether it’s reallocating budget, revisiting pricing strategies, or adjusting marketing efforts, the marriage of commercial and financial data ensures these changes are grounded in both operational performance and financial health.

Some Examples of How Holistic Data Can Help a Hotel Business

- Forecasting: When commercial analytics are combined with financial analytics, hotels can forecast not just revenue but also profitability. This leads to more realistic, actionable forecasts that reflect the true financial performance of the hotel. Hotels will learn to anticipate how operational costs and overheads will impact overall financial outcomes.

- Enhanced budget precision: By aligning future revenue forecasts with cost data, hotels can better allocate resources. For example, if a marketing campaign historically generated strong occupancy but low profitability due to high distribution costs, hotels can choose to either adjust their performance forecast more accurately, leverage more profitable channels for the campaign, or put restrictions on the booking conditions to limit displacement of more profitable bookings.

- Scenario analysis: Hotels can model how various commercial strategies (pricing adjustments, distribution mix changes, etc.) will affect both revenues and costs. This predictive capability helps management anticipate and plan for different market conditions.

- Risk management: Long-term forecasting becomes more reliable when it is able to include financial risks that come along with commercial decisions. By integrating financial analytics such as break-even points and true fixed and variable costs hotels can see potential risks tied to their commercial strategies. This helps avoid or limit negative financial results by enabling more conservative or aggressive financial planning.

- Better capital allocation. Hotels can strategically allocate capital to the most profitable initiatives. This could mean investing in marketing campaigns, expanding services or refurbishing facilities. Understanding both revenue potential and cost implications ensures that capital is allocated where it will drive the highest return in the long term.

Aligning Commercial and Financial Analytics for Hotel Success

The bringing together of commercial and financial analytics is no longer a luxury but a necessity for hotels looking to push the boundaries of their performance. Hotels that are able to align their commercial activities better with their financial objectives are better positioned to optimize profitability, improve decision-making and sustain long-term growth.

By combining insights from both worlds, hotels can ensure that every booking, marketing campaign, and investment leads to stronger financial outcomes and a sustainable future.

Free Checklist: Start Using Data in Your Hotel’s Decision-Making

Using data to power insights and decisions at your Hotel can position you for commercial success, help increase guest satisfaction, and reduce costs. This checklist provides a starting point for hoteliers new to data analytics in the hotel industry.

Click here to download the checklist “Start Using Data in Your Hotel’s Decision-Making“.