HotelHub, a hotel technology solution provider for travel management companies and their corporate customers, has released its HotelHub Index for Q3 2024.

The analysis of over 1.8 million hotel bookings made between July and September, highlighed significant downturn in reservations for business travel over the summer months in Europe.

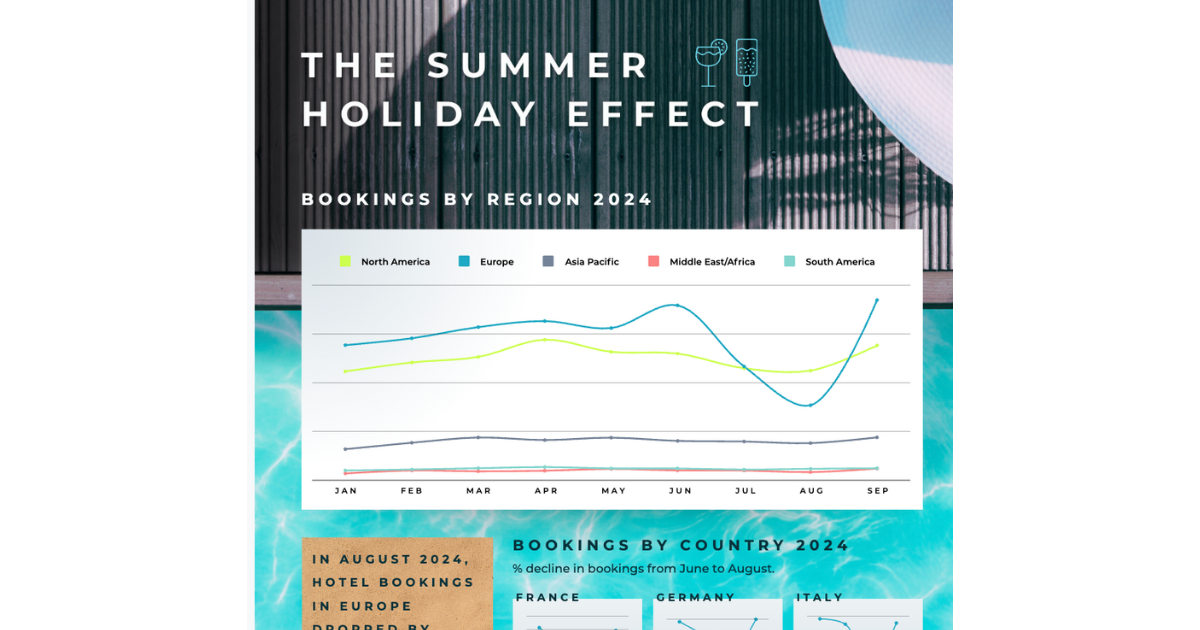

While booking volumes for other regions have remained fairly consistent across the year, the latest HotelHub stats have shown a stark contrast in the booking data for Europe, with August 2024 transaction volumes down 57% compared to June 2024.

In some key business destinations, this August decline was even more pronounced, with bookings down by more than 70% in Italy (-72%), Spain (-77%) and France (-79%) compared to June.

Surprisingly, despite expectations that the leisure market would keep rates high throughout the summer, the data shows average European nightly rates were down by 11% in August, compared to their year-to-date peak in June. In Germany, rates shrank significantly from an average of USD 174 in June to USD 138 in August — a 21% decrease.

Even popular tourist destinations such as Spain and Italy saw reduced rates in August, dropping 13% and 15% respectively, compared to June.

In contrast to the rest of Europe, Nordic countries saw their lowest booking volumes in July; however, similar trends were observed with notable hotel reservation decreases compared to June in Denmark (-69%), Norway (-69%), Finland (-77%) and Sweden (-79%).

Rates in these countries also dropped by between 7 – 15% in the same period.

Despite the European summer hiatus, HotelHub’s figures have revealed a rapid and robust September bounceback, with global booking volumes at their highest monthly total all year and up 9% compared to September 2023.

This includes a swift recovery in European bookings; to date, September has proved to be the busiest month of the year in the region for HotelHub travellers, with transactions up 3% on June, the second highest month.

Along with booking numbers, rates also increased sharply in September, reaching a global average of USD 198 per night, the highest monthly average so far in 2024 and 4% up on the same month in 2023.

However, overall, the latest HotelHub data continues to reflect a decrease in inflation, with the average global rate per night up just 1.85% compared to the same period last year ($183 USD per night in Q3 2024 vs USD 180 in Q3 2023).

While this does mean rates are continuing to rise, it is at a much slower pace than earlier in the year where the average rate increases compared to the same period the previous year were at 7.92% in Q1 and at 3.63% in Q2.

Other insights from the report include a 6.81% increase in booking lead times in Q3 2024 compared to the same period in 2023, with reservations being made an average of 16.21 days prior to check-in.

Paul Raymond, director of business development of HotelHub, remarked: “Having worked in the travel industry for 30+ years, it has always been accepted that there is a ‘summer drop-off’ in commercial travel activity; however, I have never seen such stark data to back up this supposition.

“This report clearly demonstrates the impact of cultural differences across travel markets and will hopefully assist travel managers and TMCs in planning for seasonal variations.”