After a few years of political and economic instability that delayed the path toward post-pandemic recovery, 2024 is quickly becoming a stellar year for hoteliers in South America. For the period January through August, and benchmarked against Central America and the Caribbean, South America achieved the greatest year-over year expansion in total revenue per available room (TRevPAR) at 12.1%. The region also exhibited the most significant gross operating profit per available room (GOPPAR) growth out of the three at 12.5% and was the only one to avoid GOP margin erosion.

Though year-on-year comparisons have been positive for all months of 2024 so far, it was in the second quarter that the region really took off. While TRevPAR and GOPPAR increased by 5.2% and 3.6%, respectively, in Q1, South America moved into double digit territory in Q2 with increases of 16.9% in the top line and 19.0% in the bottom line. And even though results for Q3 are not finalized yet, the combined July and August numbers continue to show the region’s strength, as TRevPAR placed 16.2% above 2023 and GOPPAR did so by 19.5%.

COUNTRY MOVES

The key markets driving this phenomenon are Peru and Chile. In the case of Peru, the years 2022 and 2023 were marred by political and social unrest, violent demonstrations and airport closures, a mix that wreaked havoc on the country’s tourism industry. With a more stabilized environment in 2024, Peruvian hoteliers are finding their way toward recovery. In the current financial year (January through August), TRevPAR and GOPPAR in the country have grown 42.2% and 80.5%, respectively, year-on-year. Chile has also seen its share of political and economic instability in the years after COVID, and just like Peru, it’s beating its softer 2023 comps by a wide margin, with TRevPAR up 21.2% and GOPPAR up 38.6% year to date. Though at a more mature stage of its post-pandemic recovery than Peru and Chile, Brazil is another major force behind the South American upswing, also achieving growth in both TRevPAR (up 10.8%) and GOPPAR (up 9.0%).

PROFIT MATTERS

South America also stands out as a flow-through leader in 2024. Flow-through essentially measures how much of each incremental dollar of revenue turns into additional profits. Flow-through provides a clear signal of the trajectory profit margins will follow in the future because it highlights the profitability of new revenue streams. In the first eight months of the year, South America achieved a 38% flow through, meaning that it added 38 cents of profit for every dollar of revenue added from the previous year. At 32%, the Caribbean was a close second. However, the picture was completely different for Central America, which struggled with a -49% result. This negative percentage means that for each dollar of year-on-year top-line increase, Central America saw a 49-cent profit decline. South America retains its leadership status even in comparison to Canada and the United States, as flow-through was 27% and 6%, respectively, in the northern countries.

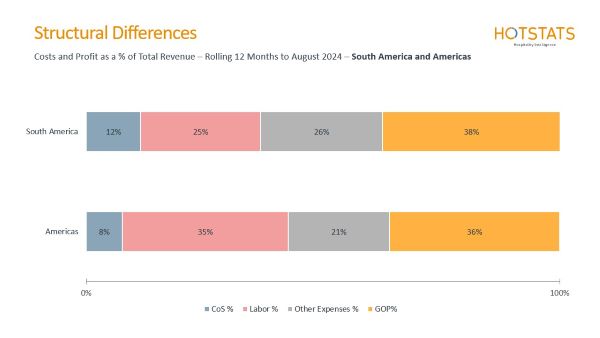

To understand the stabilized cost and profit structure in South America as compared to the Americas average, we use the rolling 12 months through August 2024. The results are reported in Figure 2 below.

South American hotels operate at a 2-percentage-point higher profit margin than the average for the Americas. This is achieved strictly because of a much lighter labor cost percentage, as cost of sales and other expenses account for greater portions of total revenue.

Most of the 4-point cost of sales negative difference is explained by food costs, which are 3 percentage points higher in South America than its wider region. The remaining point comes from higher commissions and reservation fees in the Rooms department. Undistributed expenses are behind the bulk of the other expenses differential, particularly due to higher energy costs that increase the weight of utilities. Conversely, it’s in the operated departments that we see the greatest savings in South America, splitting the 10-point favorable difference almost equally between the non-management salaries and wages in the Rooms and F&B departments.

Despite the rocky years after the COVID pandemic, South America is coming back in full force in 2024, so it’s no surprise that brands and investors are showing great appetite for the region. Looking at the last part of 2024 and into 2025, we expect results to remain positive though on a more reduced scale, as we move past the softer comp years and into a more normalized pattern.

Story contributed by Laura Resco, director of hotel intelligence – Americas, HotStats.