ATLANTA—JLL Capital Markets announced on behalf of Woodvale Opportunity Fund I the closing of a $25 million acquisition of the Southaven Marriott Portfolio, and the $11 million acquisition of the Fairfield Inn & Suites Buford.

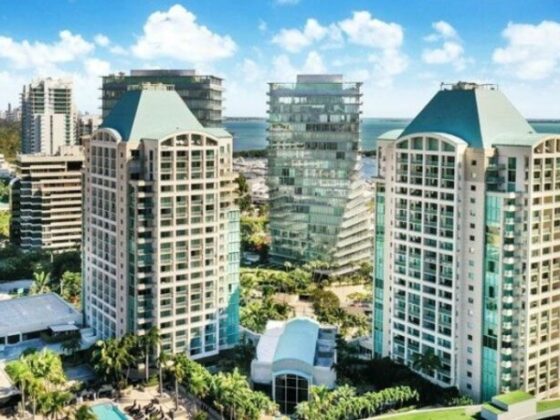

The Southaven Portfolio includes the Courtyard Memphis Southaven (85 keys) and the Residence Inn Southaven (78 keys), both located in Southaven, Mississippi, part of the greater Memphis metropolitan area. The Fairfield Inn & Suites Buford includes 94 suites and is located in a northern suburb of Atlanta.

JLL worked on behalf of the buyer, Woodvale Opportunity Fund I, who purchased the portfolio from Chartwell Hospitality.

Built in 2007 and 2006 respectively, these hotels offer amenities catering to both business and leisure travelers. The Residence Inn features all-suite accommodations with full kitchens, hot breakfast, and an outdoor pool. The Courtyard boasts The Bistro restaurant, 609 square feet of flexible meeting space, and an indoor pool. Both properties provide 24/7 fitness centers internet access, flat-screen televisions, and workspaces in their rooms.

The hotels’ location off I-55 offers access to attractions, including Memphis International Airport, Downtown Memphis, Baptist Memorial Hospital DeSoto, and retail destinations like Southaven Towne Center Mall and Tanger Outlets Southaven.

“Our acquisitions of the Southaven Marriott Portfolio and the Fairfield Inn Buford underscore our commitment to adding high-quality, strategically located assets to our portfolio,” said Bashir Mansour, vice president of investments for Woodvale. “We expect these assets to deliver strong returns for our investors while supporting the growth of their respective local hospitality segments.”

The JLL Capital Markets team was led by Managing Director C.J. Kelly and Senior Director Bobby Norwood.

“Both the Southaven Marriott Portfolio and the Fairfield Inn Buford align perfectly with Woodvale’s strategy, allowing them to secure well-positioned assets with strong in-place yield while still offering further upside potential,” said Kelly. “Woodvale’s all-cash acquisition strategy afforded them the opportunity to acquire assets at pricing superior to market standards.”