Hotel distribution has always been a core concern for operators, though often difficult to master. Business success no longer relies solely on the quality of service and guest experience — although this remains a fundamental pillar — but equally on the ability to market the offer at the right price while maintaining full control over the distribution chain.

In the latest issue of Hospitality-ON, a complete report is reviewing the whole ecosystem of hotel distribution: state of the art, the challenges, the software solutions, the big players and the implication at all levels of Artificial Intelligence. Details only available to H-ON subscribers (abonnés).

Since the rise of online travel agencies (OTAs), this control has weakened. Regaining ownership of direct sales is now a priority for hotel groups and independent properties alike. It is a complex challenge requiring strategic decisions.

While these debates are not new, today’s landscape is changing fast — with the introduction of artificial intelligence (AI) reshaping the rules and opening new opportunities.

By exploring all facets of the hotel distribution ecosystem, this analysis aims to clarify current challenges, shifts in power dynamics, and emerging trends — ultimately supporting hotel entrepreneurs in making informed decisions.

These challenges are driven by evolving guest expectations, technological advances, and competitive pressure. They encompass both the choice of technological tools and the management of relationships with distribution partners. We have structured them into key chapters for a comprehensive overview.

Technology infrastructure: platform versus best-of-breed models

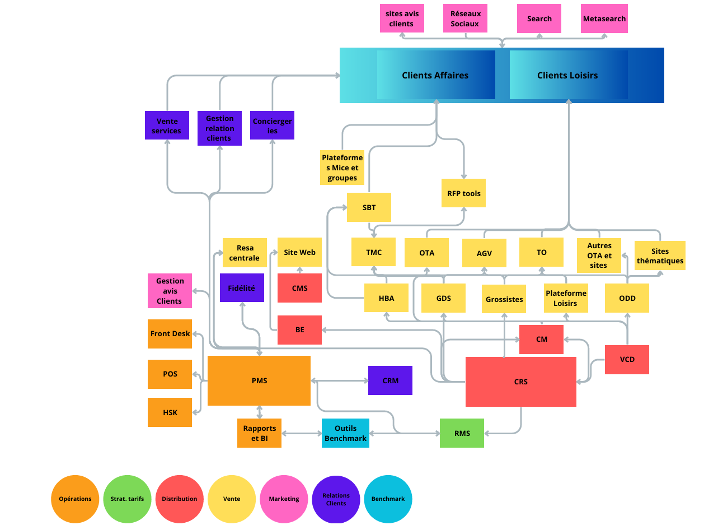

A significant strategic debate now divides the industry. On one side: fully integrated platforms combining property management systems (PMS), central reservation systems (CRS), customer relationship management (CRM), revenue management systems (RMS), and sometimes payment solutions and data analytics.

On the other: a best-of-breed approach — selecting top-performing, interoperable tools and connecting them via open APIs.

Each model presents critical implications:

- Guest experience: integrated platforms offer seamless journeys, while specialized tools provide advanced features.

- Interoperability: modular approaches depend on robust software communication; open APIs and native integrations are key selection criteria.

- Return on investment: chains favor standardization to control maintenance costs, while multi-brand operators invest in scalable, tailored solutions.

- Cybersecurity and compliance: centralized data management may ease regulatory compliance (e.g., GDPR) but also increases vulnerability in case of cyberattacks.

Managing channel fragmentation

Choosing the right tools is crucial to balancing direct bookings, OTAs, GDS, metasearch engines, and wholesalers — each with distinct pricing structures, commission models, and data transparency levels.

Revenue management strategies must adapt to increasingly complex distribution models and the shift toward AI-driven dynamic pricing, requiring agile, real-time responses.

Countering OTA dominance

Despite criticism, OTA dependency remains high. Platforms like Booking.com and Expedia capture significant market share while charging substantial commissions.

Google’s growing influence in metasearch further complicates direct booking strategies, forcing hoteliers to balance paid visibility and organic search optimization.

Efforts to boost direct bookings (via Brand.com) are increasing but require major investments in digital marketing, loyalty programs, and personalized experiences.

Balancing personalization and data privacy

Guests now expect highly personalized experiences, yet data protection regulations and the end of third-party cookies complicate data collection and usage.

Ethical considerations, beyond sustainability, are gaining importance. Guests are drawn to platforms that align with these values, sometimes favoring smaller, more responsible players.

Facing the rise of AI and automation

AI-driven chatbots, virtual assistants, and automated booking engines are redefining the guest journey. The question remains: will AI further strengthen OTA algorithms, driving hyper-dynamic pricing, or will it create new direct visibility opportunities via personal assistants?

Hotels must prepare by leveraging AI to personalize and differentiate their offerings — without compromising rate integrity.

Navigating the distribution paradox

The solution lies in flexibility and intelligent data utilization. Hotels that optimize their channel mix, technological integration, personalization, and sustainability will gain a competitive edge — while reducing reliance on costly third-party platforms.

Complete report only on subscribtion