The story of the Indian group and its “Little Prince” of hotel distribution, Ritesh Agarwal, is a succession of twists and turns that would make even the most hardened partner break out in a cold sweat. A 3rd IPO attempt has just been blocked by its historical shareholder, SoftBank.

The group’s founder and still chairman, Ritesh Agarwar, who holds 30% of the capital against SoftBank’s 40%, saw the IPO as a way out of his personal financial difficulties. Sumer Juneja, a director on behalf of Softbank, told him that “it’s too soon” and that the company’s financial results were not attractive enough to make it worthwhile.

This is the 3rd aborted attempt, now postponed until 2026 at the earliest, while Oyo Hotels further proves its “remontada” since the Covid crisis that almost cost it its life. The first valuation, in 2021, based on pre-Covid activities, was close to $12 billion. This is the valuation level now being pursued by Softbank, which has backed the company through thick and thin, and intends to reap a fair profit from this long-term commitment. But we’re far from there.

It’s not looking too good for Ritesh Agarwal, who borrowed $2.2 billion to hold 30% of his company and retain operational control, together with his steadfast shareholder Softbank. The first repayment instalment on this loan, personally guaranteed by SoftBank founder Masayoshi Son, is due before the end of the year, and the founder currently lacks the means to meet it without selling part of his stake on the stock market.

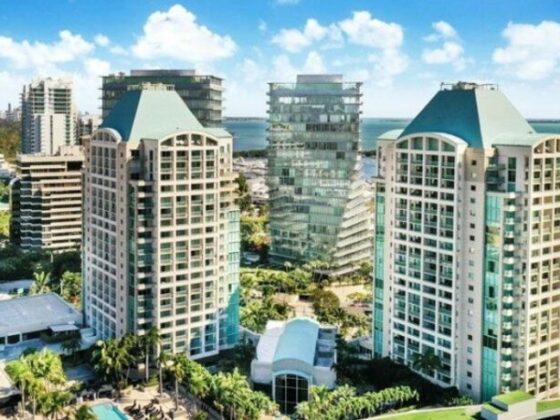

It’s all the more galling for the CEO that the company is doing better, much better. It has gone back to conquering its domination of the budget and very budget hotel market by acquiring the American G6 and its Motel 6 and Budget 6 brands. Sales for the 1st quarter of the current financial year jumped by 60%, bringing in $250 million in royalties, and net profit is forecast to reach $100 million by the end of the year, or even double that figure by 2026.

But this progress is still not enough to convince the markets to invest in the group’s capital to the extent SoftBank had hoped. Ritesh Agarwal will have to wait and see, depending on the goodwill of his partner, who has apparently agreed to extend the loan repayment deadline in exchange for the CEO’s patience.

![]()