In 2024, the fees a hotel owner paid to support their brand’s guest loyalty program continued to grow at a relatively strong rate. During the year, the annual growth of guest loyalty program fees exceeded the increases in brand royalty payments, as well as the brand marketing and reservation assessments. Further, the pace of growth for guest loyalty program fees was greater than the increases in both rooms occupied and rooms revenue, two factors that influence the guest loyalty program fees charged to hotels.

Fortunately for owners, hotel loyalty programs have continued to prove their value. Loyalty programs are growing their memberships and contributing increasingly more to the number of paid occupied room nights.

The Cost for Owners

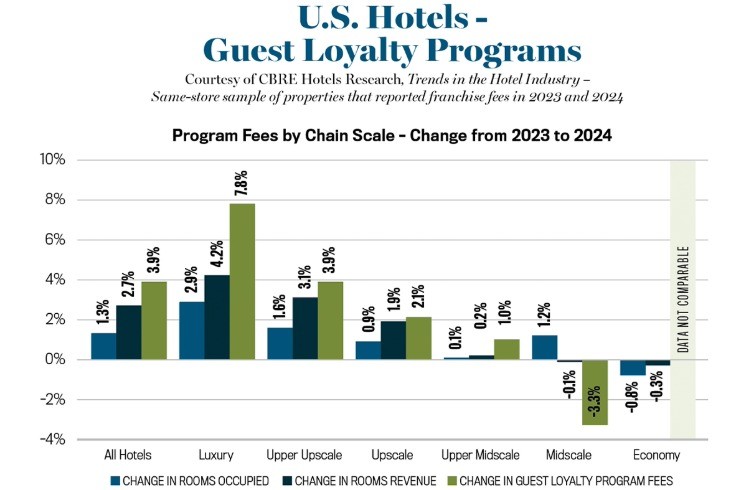

To understand how guest loyalty program fees moved in 2024, CBRE analyzed the loyalty program fee payments made by 4,187 U.S. hotels in its Trends in the Hotel Industry database from 2023 to 2024. In 2024, these hotels averaged 218 rooms and achieved a 70.2 percent occupancy with a $214.89 ADR.

For our Trends survey, CBRE captured three different franchise-related fees on a discrete basis:

• Royalty fees

• Marketing and reservation fees

• Guest loyalty program fees

From 2023 to 2024, the 3.9 percent increase in loyalty fees was the greatest among the three components. Further, the 3.9 percent growth rate was greater than the increases in rooms occupied (1.3 percent) and rooms revenue (2.7 percent). This pattern was consistent across the four highest-priced chain scales, the segments that benefit most from guest loyalty program members. Since guest loyalty program fees are partially based on the number of loyalty program members paying to stay at a hotel, fee growth that is greater than the rise in rooms occupied implies that loyalty program members made up a larger share of rooms occupied in 2024 compared to 2023.

In 2024, loyalty program fees averaged 2.2 percent of rooms revenue and were highest at upper-upscale hotels. Properties that operate in this segment capture both corporate and group travelers, two types of frequent travelers who appreciate the benefits of the loyalty programs. Conversely, the loyalty program fee-to-revenue ratio is lowest at midscale and economy hotels, where guests are less likely to be loyalty club members.

Guest loyalty program fees measured as a percentage of rooms revenue were greater at soft brand hotels compared to core brand hotels. This indicates that loyalty program members are comfortable booking rooms beyond the primary brands within the major chains. This is good news for owners who opt to affiliate with a soft brand rather than the core brands.

Benefits to Owners

Strong loyalty programs help hotel brands lower customer acquisition costs, increase direct-to-consumer access, and offset occupancy shortfalls during shoulder periods and weaker economic conditions. Analyzing available data for the loyalty programs of five public C-corporation hotel companies, CBRE found that total loyalty membership grew by 14.5 percent in 2024 to more than 676 million, outpacing room growth of 6.7 percent. Since 2014, members per available room have more than doubled, increasing from 62 to 137, and rising over 7 percent year over year in 2024 from 128.

Loyalty member contributions to occupancy have been on the rise since the pandemic. In 2024, the average member contribution to occupancy rose two percentage points to 52.8 percent year over year. Loyalty programs provided 12 percent more room nights in 2024 compared to 2023, although the average room nights per member declined by 4 percent to 1 from 1.1, still below the recent peak of 1.8 in 2016. This dynamic suggests that members are either inactive, participating in multiple loyalty programs, traveling infrequently, or accumulating points through credit card and affiliate partnerships instead of through frequent hotel stays.

With the proliferation of infrequent guests throughout the membership base, brands are tasked with turning one-time guests into more frequent, higher-value members. In an effort, in part, to engage the growing membership base, major brand families have doubled their brand portfolios since 2014 to an average of 24 brands each in 2024. Loyalty program membership has increased at a 15 percent compound annual growth rate over the same period. Newer brands have been added, including soft brand collections, as well as less conventional options like glamping and all-inclusive resorts. By enhancing their brand ecosystem, brand families hope to attract new customers and to provide their increasing membership base with less traditional options and experiences where they can redeem their points.

Based on 2024 data, members are using their points faster than they are earning them, with the loyalty point liability per member falling 5.3 percent year over year. Hotels should focus on maximizing redemptions that fill less popular shoulder seasons and drive ancillary revenue through incentives like food and beverage credits, spa perks, and exclusive experiences.

Loyalty Program Cost Transparency

Besides the guest loyalty program fees, hotel owners are also responsible for paying for the extra amenities and services provided to loyalty program members during their stays. Such costs may include complimentary food and beverage, upgraded rooms and housekeeping services, points provided as compensation for service failures, and access to an exclusive executive lounge.

To provide hotel owners and operators with greater insights into these costs, the 12th edition of USALI includes new loyalty program expense categories within the rooms, administrative and general, and sales and marketing departments. CBRE will begin to benchmark these additional costs in 2026 as the industry adopts the new USALI.